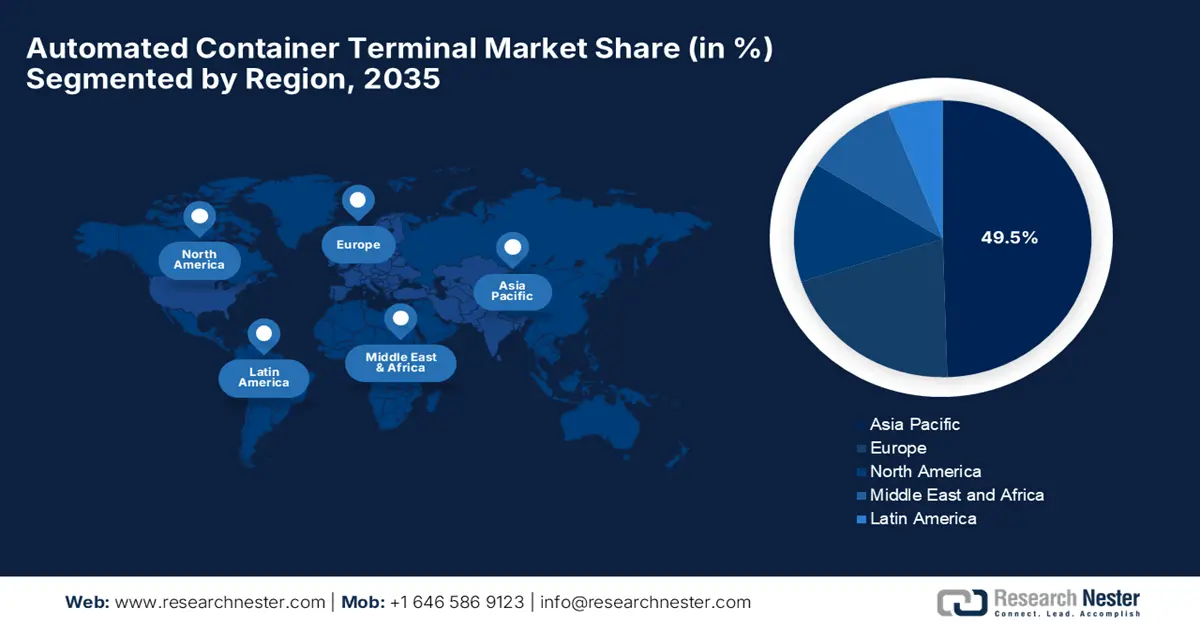

Automated Container Terminal Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the automated container terminal market is predicted to account for the largest share of 49.5% by the end of 2035. This rapid upliftment is increasingly propelled by high-volume ports and strong government support for port digitalization. The region remains a global hub for automated terminal development, wherein most of the brownfield projects incorporate advanced robotics, automated vehicles, and integrated terminal operating systems. In this regard, MPA Singapore notes that Tuas Port, which was officially inaugurated in 2022, is Singapore’s next-generation smart and green mega-port, set to handle 65 million TEUs by the 2040s with 66 berths across 1,337 hectares. The report also mentioned that its development spans four phases, featuring extensive land reclamation, advanced automation such as AI-enabled vessel management, 5G-powered AGVs, and remote-operated cranes. Furthermore, the aims for net-zero emissions by the end of 2050 through electrified equipment, smart-grid systems, and green buildings, hence placing a positive impact on automated container terminal market growth.

China is recognized as the global leader in the automated container terminal market, efficiently driven by several large ports which are operating fully automated facilities, which are built for high throughput as well as continuous operations. In the meantime, the state-backed initiatives are readily promoting the use of smart port technologies, artificial intelligence, and autonomous handling equipment, allowing a steady revenue stream in the country’s market. In October 2025 People’s Republic of China reported that the country is currently leading global smart port development with 60 automated container terminals and rapidly expanding smart waterways covering over 10,000 km. It also stated that from January to August 2025, the nation recorded strong growth in waterway freight (6.56 billion tonnes), port cargo throughput (12 billion tonnes), and container volume (230 million TEUs), hence solidifying China’s position in the global dynamics.

India is also expanding gradually in the automated container terminal market on account of the modernization of ports to support growing export activity and infrastructure development. Operators in the country are opting for remote management and energy-efficient equipment to enhance performance, whereas the public–private partnerships are laying the groundwork for broader adoption. For instance, in November 2025, Camco Technologies announced that it is partnering with Adani Vizhinjam Port to automate India’s first mega transshipment container terminal, strategically located just 10 nautical miles from major international shipping lanes. The project includes advanced gate automation, STS-crane OCR using Camco’s patented BoxCatcher system, and bay-load verification to ensure accurate stowage data. Furthermore, with real-time equipment tracking and the unified Bridge software interface, the terminal is set to achieve high operational efficiency.

Europe Market Insights

Europe has a strong scope to revolutionize the international automated container terminal market, propelled by the long-standing utilization of automated stacking cranes and AGVs. Ports in this region are extremely focused on modernization, operational reliability, and compliance with environmental regulations, which is encouraging investments in this field. In July 2025, Hamburg announced that its Waltershofer Hafen is all set for major modernization, including widening its turning circle to 600 metres, expanding terminal yards, and creating new berths to boost efficiency and safety for the world’s largest vessels. This was backed by public funding and Eurogate’s €700 million (USD 824.5 million) investment, and the project will enable a shift toward fully automated, electrified terminal operations, supporting Hamburg’s climate-neutral goals. Furthermore, the upgrade strengthens the port’s long-term competitiveness and its role as a key logistics hub for global trade.

Germany is the major hub of innovation in the automated container terminal market, which is integrating highly advanced automated yard systems and AGV-based horizontal transport. Simultaneously, collaborations between port operators and technology providers continue to accelerate automation adoption. In May 2024, HHLA stated that its container terminal Burchardkai in Hamburg has undergone a major transformation, replacing diesel-powered straddle carriers with ABB’s all-electric, automated stacking cranes to increase yard capacity, speed, and safety. The company also underscored that the phased implementation across 19 container blocks, supported by renewable electricity, has boosted productivity, improved flexibility, and reduced emissions. Hence, these transformation activities coupled with decarbonization initiatives are prompting a favourable business environment in the country.

The U.K. is showcasing notable growth in the regional automated container terminal market, which is efficiently driven by the need to enhance port competitiveness, particularly amid evolving trade patterns and capacity constraints. Meanwhile, the ongoing investments target remotely controlled equipment, digital optimization tools, and energy-efficient handling systems, in turn boosting the pace of progress in this field. Also, ports in the country are adopting automation to strengthen operational resilience and support long-term sustainability goals. Furthermore, major ports such as Felixstowe, Southampton, and London Gateway are leading the adoption of automated quay cranes, automated guided vehicles, and smart yard management systems. Hence, these initiatives are helping ports to handle larger vessels more efficiently by reducing carbon emissions.

North America Market Insights

North America also represents one of the largest landscapes of the automated container terminal market, successfully backed by a collective goal to handle growing trade volumes and address labor shortages. There has been an increased adoption of automated stacking cranes, remote-controlled equipment, and digital yard systems to improve efficiency and reduce congestion. The U.S. Customs and Border Protection in June 2025 disclosed that the U.S. and Morocco have signed a new Container Security Initiative agreement with a collective goal to enhance cargo security and streamline trade between the two countries, with a key focus on ports such as Casablanca and Tanger Med. The article further underscored that the initiative uses risk-based targeting, pre-screening, and intelligence-sharing to identify high-risk maritime cargo before it reaches ports in the U.S. Hence, this partnership strengthens global supply chain security while supporting Morocco’s ports.

In the U.S., the automated container terminal market is gaining enhanced traction as ports are with aging infrastructure, high operational costs, and the need to enhance vessel turnaround times. The West Coast ports in the country are at the forefront of the exploration of automation as a strategy to remain competitive with the terminals that are already operating with higher productivity levels. Simultaneously, the regulatory scrutiny, coupled with labor considerations, shape the pace of adoption, but large terminals continue to integrate automated systems in phases. In addition, ports such as the Port of Los Angeles, Long Beach, and Savannah are leading the adoption of automated stacking cranes, automated guided vehicles, and advanced terminal operating systems, encouraging more players to make investments in this field. Hence, these are helping U.S. ports increase throughput and maintain competitiveness in global supply chains.

Canada is also reaping advantages from the automated container terminal market owing to the expansion programs at major Pacific and Atlantic gateways, which are adopting automation to improve reliability and accommodate rising container flows. In October 2023, the Country’s government announced a USD 150 million investment under the National Trade Corridors Fund to build a new container terminal at the Port of Montréal in Contrecoeur, Québec, by increasing the port’s capacity by around 55%. It also stated that the project includes a 675-metre dock, container handling yard, rail and road connections, and operational facilities to improve cargo flow and connectivity to worldwide automated container terminal markets. Furthermore, this expansion aims to strengthen Canada’s supply chain, boost trade efficiency, and support long-term economic growth across the country’s vast geography, thereby encouraging the adoption of automated terminals.