Automated Cell Block System Market Outlook:

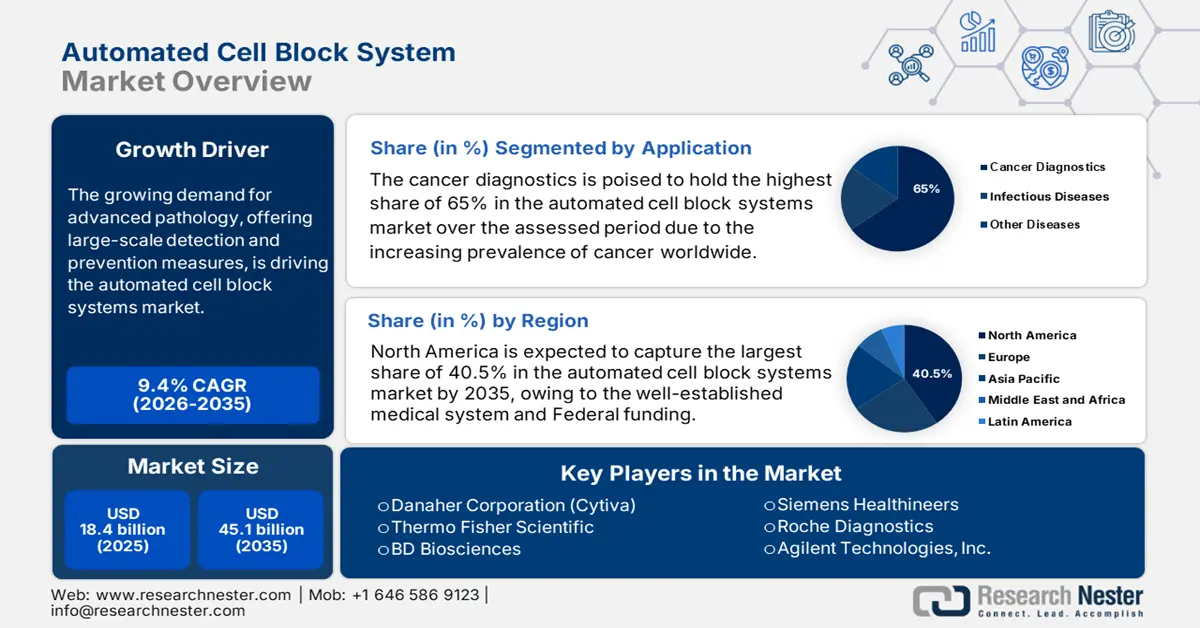

Automated Cell Block System Market size was valued at USD 18.4 billion in 2025 and is projected to reach USD 45.1 billion by the end of 2035, rising at a CAGR of 9.4% during the forecast period 2026-2035. In 2026, the industry size of automated cell block system is evaluated at USD 20.1 billion.

A rapid surge for advanced diagnostic solutions is observed all across the world, which is majorly driven by the increasing prevalence of chronic illnesses, such as cancers. As evidence of the continuously growing patient population, the WHO in February 2025 projected that the volume of deaths due to cancer was registered as 10 million worldwide. On the other hand, a report from the National Cancer Institute (NCI) data in May 2025 also testified to this by predicting that the total cancer population in the U.S. is 2,041,910. This is pushing global healthcare authorities to opt for more efficient and scalable pathology solutions to improve public access to advanced diagnostic solutions. Moreover, the growing demand for large-scale detection and prevention measures is driving the automated cell block system market.

Investment in research, development, and deployment (RDD) is mainly made by the public and private sectors to improve diagnostic accuracy and laboratory productivity. In the U.S. National Institutes of Health (NIH), the funding for the research and development of cancer-related diagnostics has experienced steady investment, driving innovation in pre-analytical sample preparation. From the trade perspective, importation and exportation of completed automated systems and their supplies are substantial. The United States International Trade Commission statistics indicate active trade of medical devices under harmonized system codes, including 9018 for instruments and appliances used in medical sciences. Countries with a strong manufacturing base lead the market. The OEC 2023 data depicts that the global trade of medical instruments reached USD 167 billion, highlighting the market growth.

Key Automated Cell Block System Market Insights Summary:

Regional Highlights:

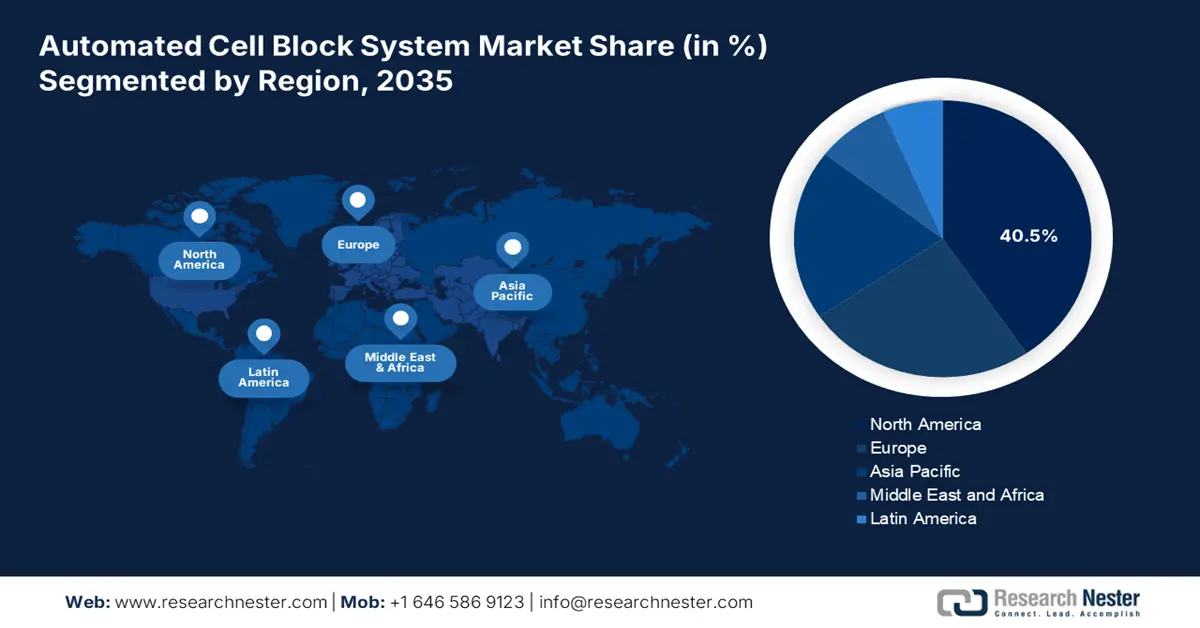

- North America is projected to hold a 40.5% share in the automated cell block system market by 2035, driven by high cancer prevalence, a well-established healthcare system, and federal funding supporting advanced diagnostic technologies.

- Asia-Pacific is expected to register the highest growth during the assessed period, fueled by a large affected population, government investment in healthcare infrastructure, and the surge in precision oncology and cell therapy clinical trials.

Segment Insights:

- In the application segment, cancer diagnostics is forecast to capture the highest share of 65% during the assessed period, reinforced by the importance of early detection and intervention in improving patient outcomes.

- Within the product segment, instruments and systems are set to hold a considerable share by 2035, propelled by high capital costs and the shift towards integrated, high-throughput diagnostic platforms.

Key Growth Trends:

- Financial and promotional support from governments

- Increasing research and tech-based advances

Major Challenges:

- Concerns about the liability of data-driven assessment

- Limited reimbursement policies

Key Players: Thermo Fisher Scientific Inc., Danaher Corporation (Leica Biosystems), Roche Diagnostics, Sakura Finetek Co. Ltd., Agilent Technologies Inc., Becton Dickinson and Company (BD), Siemens Healthineers, Sysmex Corporation, BioMerieux SA, Abbott Laboratories, Intelsint S.r.l., Medite Medical GmbH, Milestone Medical, Jokoh Co. Ltd., Amos Scientific Pty Ltd, Trivitron Healthcare, Tokyo Electron Limited, A&T Corporation, Japan Electron Optics Laboratory (JEOL) Ltd., Sakura Finetek Japan Co. Ltd.

Global Automated Cell Block System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest region: North America (40.5% share by 2035)

- Fastest growing region: Asia-Pacific

- Dominating countries: United States, Germany, Japan, United Kingdom, France

- Emerging countries: China, India, South Korea, Brazil, Australia

Last updated on : 29 September, 2025

Automated Cell Block System Market - Growth Drivers and Challenges

Growth Drivers

- Financial and promotional support from governments: Considering the rising mortality and severity of associated illnesses, several authorized investors are allocating funds to the market to combat and prevent this widespread. For instance, the ADLM report in January 2025 states that Medicare Part B spending on genetic testing, which includes advanced diagnostics for cancer, surged 29% in 2023 to about USD 1.8 billion. Furthermore, initiatives commenced by governing bodies are promoting the benefits and efficiency of modernized pathology, influencing both MedTech companies and patients to invest in this category. This ultimately secures a gradual magnification of business flow in this sector.

- Increasing research and tech-based advances: Robust amplification of R&D investments from both public and private organizations is revolutionizing the efficacy of products available in the automated cell block system market. For instance, the University Hospitals report in December 2024 states that NIH continuously funds multiple AI-based projects and research initiatives in biomedical fields, which include cancer and imaging, such as a USD 2.78 million grant for AI use in rectal cancer treatment. Similar funding in disease-related research projects also fosters lucrative opportunities for this sector.

- Rising incidence of cancer cases: The increasing global cancer burden directly expands the patient pool requiring advanced diagnostic procedures. According to an article published by NLM in February 2024, the National Center for Health Statistics has stated that in the U.S., nearly 611,720 deaths from cancer were registered. Though the death via cancer has decreased since 2021, there is always a threat on the rise in the increasing incidence of cancer impacting the market growth. This rise demands enhanced oncology treatments, preventive measures, and diagnostic solutions.

Trade Flow of Medical Instruments in 2023

|

Country |

Import (USD) |

Export (USD) |

|

Germany |

13.1 billion |

18.4 billion |

|

U.S. |

37.7 billion |

34.8 billion |

|

China |

10.6 billion |

12.3 billion |

|

Japan |

6.47 billion |

7.21 billion |

|

India |

2.47 billion |

1.46 billion |

Source: OEC 2023

Challenges

- Concerns about the liability of data-driven assessment: Consumers often become skeptical about the long-term efficacy and reliability of the products from the automated cell block system market for critical medical decision-making. The social stigma and stringent regulations regarding data security raise questions about the liability of diagnostic outputs among payers. This may foster a serious issue for wide adoption in this sector. Additionally, the lack of sufficient clinical proof to establish the effectiveness of ACBS may slow its uptake in developing regions. It also creates hesitation among insurers to subsidize these technologies, limiting patient accessibility and hence the sector's expansion.

- Limited reimbursement policies: The U.S. Medicaid programs in 2023 provided a considerable amount of funding for automated cell block procedures, providing a significant obstacle to adoption in low-income populations. This problem generates a disparity in the equitable access to advanced diagnostic technologies. To address this issue, companies and advocacy groups are aggressively advocating state-specific efforts to expand Medicaid coverage, with an emphasis on standardizing reimbursement practices and enhancing patient access to breakthrough diagnostic procedures across states.

Automated Cell Block System Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.4% |

|

Base Year Market Size (2025) |

USD 18.4 billion |

|

Forecast Year Market Size (2035) |

USD 45.1 billion |

|

Regional Scope |

|

Automated Cell Block System Market Segmentation:

Application Segment Analysis

The cancer diagnostics segment is poised to hold the highest share of 65% in the market over the assessed period. Cancer is the leading cause of death and the NLM report in January 2023 depicts that approximately 19.3 million new diagnoses and 10 million deaths are registered globally. As more clinical studies establish the importance of early detection and intervention in cancer care to get a better patient response and minimal financial exhaustion, investments from this segment are magnifying. In this regard, in 2022, a study from the National Cancer Institute highlighted the contribution of ACBS in enhancing accuracy and specificity in precision oncology.

Product Segment Analysis

Instruments and systems lead the market and hold a considerable share in 2035. The segment is dominated to the high capital costs and the transformation towards integrated and high-throughput platforms. As per the CMS report in August 2025, nearly 320,000 clinical laboratories are certified under the Clinical Laboratory Improvement Amendments in the U.S., ensuring high standard in testing quality and accuracy. This creates a recurring revenue model for manufacturers via initial sales of system and long-term service contracts.

End user Segment Analysis

The hospitals & diagnostic labs segment is anticipated to dominate the automated cell block system market throughout the forecasted timeframe. The worldwide trend of modernizing healthcare infrastructure and workflow is a primary driver in the segment's leadership. Additionally, the continuously surging volume of patient admissions and registrations in these organizations garners a greater consumer base and higher revenue for this sector, making it a major distribution channel for global leaders. Moreover, the accumulative investments from government and private companies in hospitals to enhance accessibility ensures a lucrative economic and functional turnaround in this category.

Our in-depth analysis of the global automated cell block system market includes the following segments:

|

Segments |

Subsegments |

|

Product

|

|

|

Technology

|

|

|

Application |

|

|

End user

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automated Cell Block System Market - Regional Analysis

North America Market Insights

North America is the dominating region in the market and is projected to hold the market share of 40.5% by the end of 2035. The region's high cancer prevalence, well-established healthcare system, and federal funding are the main drivers fueling the market. In 2025, nearly 148 AI-enabled medical devices have received FDA approval, highlighting the region's leadership in integrating advanced diagnostic technologies into healthcare to improve accessibility, accuracy, and efficiency for both patients and providers.

The U.S. augmentation in the automated cell block system market is significantly attributed to the recent expansion of reimbursement territories. The NIH awarded large grants to advance cancer diagnostic technologies. According to the July 2024 Breast Cancer report, AI has decreased false positives for breast cancer in the United States by 6%. A key trend is the strategic shift towards value-based care, incentivized by CMS reimbursement policies that favor highly accurate and efficient diagnostic methods like automated cell blocks.

The market in Canada is driven by the federal and provincial investment and a focus on cancer care. The primary trend of the market is the push for centralized, automated pathology services within the public healthcare systems. Mainly in Ontario and British Columbia. As per the Canadian Medical Association report in 2025, the total healthcare budget reached USD 344 billion in 2023, a part of which is used to strengthen diagnostic capacity toward laboratory automation and advanced oncology services.

FDA Approvals for AI-Driven Medical Devices

|

Year |

Number of FDA approvals for AI/ML-enabled medical devices |

Licensed for children (percentage relative to total FDA approvals %) |

|

2015 |

5 |

1 (20.0) |

|

2016 |

19 |

0 (0.0) |

|

2017 |

26 |

1 (3.8) |

|

2018 |

63 |

7 (11.1) |

|

2019 |

76 |

4 (5.3) |

|

2020 |

108 |

13 (12.0) |

|

2021 |

123 |

10 (8.1) |

|

2022 |

139 |

24 (17.3) |

|

2023 |

108 |

9 (8.3) |

Source: NLM, October 2024

APAC Market Insights

The Asia Pacific market is predicted to register the highest pace of growth during the discussed tenure. The region consists of a large afflicted population, across emerging countries with few of the highest mortality rates. This is pushing governments to accommodate sufficient resources to improve the quality and scalability of healthcare delivery for associated ailments. The recent advances and surge in precision oncology are also propelling the region's pace of progress. APAC has taken the lead in cell therapy clinical trials, and holds the largest share globally in the first half of 2022. As per the 2023 DIA-CoRE Singapore Annual Meeting, by June 2022 there are over 2,000 ongoing trials, and 32 US FDA-approved cell, tissue, and gene therapy products.

Japan is emerging as the hub of innovation for the automated cell block system market with its significant contribution in establishing AI as a crucial and mainstream asset in the healthcare industry. The country also has an expanding patient pool, driven by rapid aging and cancer occurrence, which is pushing the government to prioritize this category. For example, a significant amount was invested to improve the national efficiency in cancer diagnostics and pathology by the Ministry of Health, Labour and Welfare (MHLW) in 2024.

China dominates the APAC region due to the large screening programs, advancing healthcare technologies and rapid hospital expansion, which yield high specimen throughput, favoring automated cell block adoption. The NLM report in September 2024 depicts that the country has got approvals for 59 AI medical devices, shaping the medical device and cell diagnosis gradually. Government initiative to modern hospitals and pathology networks aid capex procurement. Further, national cancer screening pilots and county-level hospital upgrades have driven diagnostics investment.

Europe Market Insights

Europe’s market is driven by a high cancer burden, strong government support for innovative diagnostics, and advanced healthcare infrastructure. The standardization of cancer diagnostics under EU guidelines, the combination of digital pathology and AI-based analytics, and rising investments in precision medicine are some of the major motivators. The NLM article in March 2025 depicts that the number of cancer cases registered in Europe was 4,471,422 in 2022, highlighting the demand for the market. Further, the adoption of the latest diagnostic technologies in the healthcare sector, such as automated cell block systems, surges the cross-border collaboration.

UK leads the Europe region and is expanding steadily due to the rising investments by the NHS in diagnostic infrastructure. Rising cancer cases is the primary driver of the country, and the House of Commons Library in December 2024 states that nearly 346,217 new cases of cancer were diagnosed. This rising number of cases surges the adoption of ACBS to enhance pathology workflows. The UK position on advanced diagnostic technologies is further driven by the NHS-backed automation pilots and the integration of digital pathology across hospitals.

Germany is projected to hold the highest revenue share in Europe's automated cell block system market. The market is fueled by the strong base for manufacturing medical technology, robust government support for digital health, and rising healthcare expenditure. As per the Federal Ministry of Health, Germany’s Digital Healthcare Act has surged the adoption of AI-integrated diagnostic systems to enhance the outcome by providing the accurate results, with funding for digital pathology. The country’s highly decentralized laboratory system, with numerous large private and university hospitals, creates sustained demand for automated, high-throughput solutions.

Key Automated Cell Block System Market Players:

- Thermo Fisher Scientific Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Danaher Corporation (Leica Biosystems)

- Roche Diagnostics

- Sakura Finetek Co., Ltd.

- Agilent Technologies, Inc.

- Becton, Dickinson and Company (BD)

- Siemens Healthineers

- Sysmex Corporation

- BioMerieux SA

- Abbott Laboratories

- Intelsint S.r.l.

- Medite Medical GmbH

- Milestone Medical

- Jokoh Co., Ltd.

- Amos Scientific Pty Ltd

- Trivitron Healthcare

- Tokyo Electron Limited

- A&T Corporation

- Japan Electron Optics Laboratory (JEOL) Ltd.

- Sakura Finetek Japan Co., Ltd. (Parent Co.)

The presence of giant manufacturers and MedTech pioneers makes the automated cell block system market a highly competitive merchandise. The strategic commercial activities of key players in this sector shape the progress and revenue generation of this sector. In the current dynamics, Thermo Fisher Scientific and Merck KGaA stand at the forefront of the global landscape due to their exceptional manufacturing capacity. This leadership is further followed by the excellence of GE Healthcare and Siemens Healthineers in AI-integrated innovations.

Below is the list of some prominent players operating in the market:

Recent Developments

- In August 2025, Sartorius Stedim Biotech and Nanotein Technologies join together to advance the cell therapy manufacturing and provide new solutions for cell and gene therapy markets.

- In December 2024, Merck has acquired the HUB Organoids Holding B.V., advancing next generation biology portfolio. This acquisition is mainly done to enhance the cell culture portfolio with internationally recognized pioneer in organoid development.

- Report ID: 1099

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automated Cell Block System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.