Audiology Devices Market Outlook:

Audiology Devices Market size was valued at USD 11.54 Billion in 2025 and is expected to reach USD 20.86 Billion by 2035, expanding at around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of audiology devices is evaluated at USD 12.17 Billion.

The growth of the market can be attributed to the rising prevalence of hearing disabilities across the globe. As Hearing threshold of 20dB or more in both ears is said to have hearing loss. The World Health Organization has stated that 430 million people have hearing loss throughout the world and require hearing rehabilitation and the number is projected to surge to 700 by 2050. Moreover, the significant growth in the aging population across the globe is also predicted to augment the market size further in the years to come.

In addition to these, factors that are believed to fuel the market growth of audiology devices include the worldwide rise in cases of hearing loss. For instance, by the year 2050, around 2 billion people are estimated to have some level of hearing loss while almost 34 million children are living with hearing disabilities. Additionally, the growing number of government awareness campaigns on hearing screening among aged adults and newborns is predicted to present the potential for audiology devices market expansion over the projected period. In addition to this, the surge in technological advancements, along with the elevated adoption of AI in auditory products, and the rising trend of wireless hearing aids which are capable to link users with devices such as televisions and smartphones is estimated to boost the market growth further throughout the projected time frame.

Key Audiology Devices Market Insights Summary:

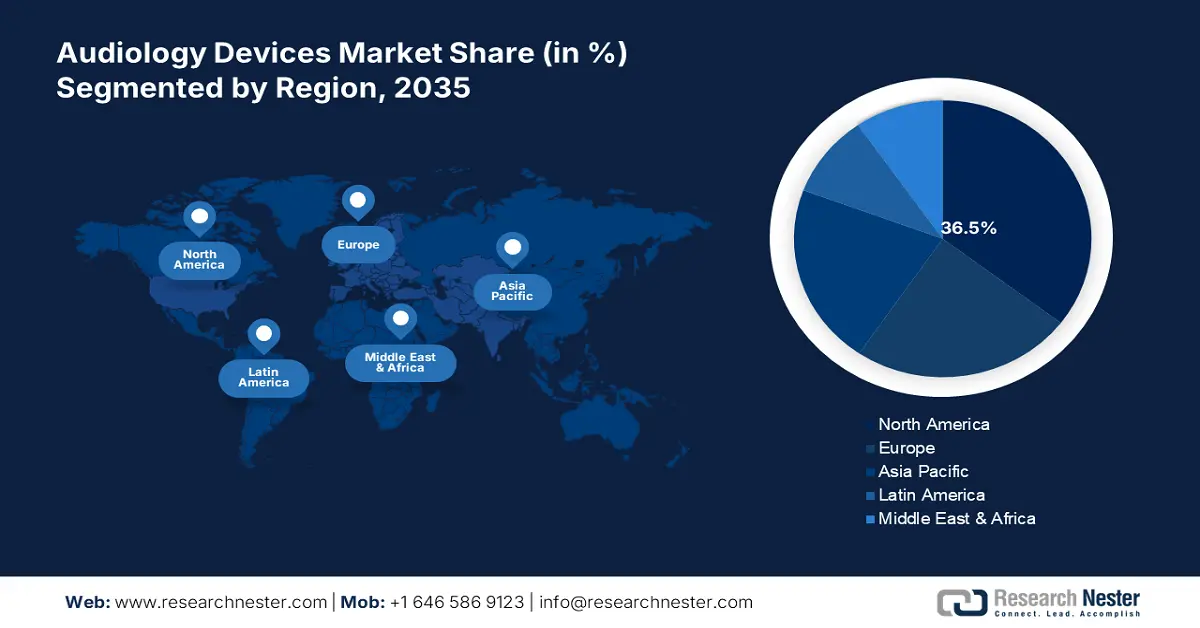

Regional Highlights:

- North America’s audiology devices market will hold around 36.7% share by 2035, fueled by the higher prevalence of hearing impairment and a rising geriatric population, along with advancements in audiology systems.

- Asia Pacific market will exhibit notable growth during the forecast timeline, attributed to the increasing ratio of age-related hearing issues and growing healthcare expenditure in the region.

Segment Insights:

- The hearing aids segment in the audiology devices market will command a significant 48.73% share, propelled by technological advancements and increased preference for discreet hearing aids, forecast year 2035.

- The analog (technology) segment in the audiology devices market is anticipated to experience a notable CAGR through 2035, driven by affordable, high-clarity analog devices enhanced with configurable microchips.

Key Growth Trends:

- Rising Geriatric Population Across the Globe

- Increasing Prevalence of Acute Otitis Media

Major Challenges:

- Rising Geriatric Population Across the Globe

- Increasing Prevalence of Acute Otitis Media

Key Players: Inventis S.r.l., Demant A/S, Oticon Medical A/S, GN Store Nord A/S, MAICO Diagnostics GmbH, Sonova AG, WS Audiology A/S, Audina Hearing Instruments, Inc., Cochlear Limited, MED-EL Elektromedizinische Geräte Gesellschaft m.b.H.

Global Audiology Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.54 Billion

- 2026 Market Size: USD 12.17 Billion

- Projected Market Size: USD 20.86 Billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 9 September, 2025

Audiology Devices Market Growth Drivers and Challenges:

Growth Drivers

- Rising Geriatric Population Across the Globe - According to the data provided by the World Bank, the global population of people aged 60 and over is expected to grow from 1 billion in 2020 to 1.4 billion by 2030. By 2050, the world's population of people aged 60 and over is proposed to double to 2.1 billion. The hearing disability rate is very high in people of age 65 and above. It is a natural procedure to lose hearing abilities over time. Hearing disabilities occur in elder people owing to the change in the nerve pathway from the brain to the ear.

- Increasing Prevalence of Acute Otitis Media - Otitis media is a kind of ear infection or inflammation that occurs in the middle ear. It occurs as a result of a sore throat, cold or respiratory infection and can later lead to hearing issues or hearing loss. Otitis media can affect children as well as adults. Therefore, the surge in otitis media cases is also estimated to accelerate the growth of the audiology devices market in the projected time frame. For instance, around 52% of all kids throughout the world are predicted to experience an ear infection by the time they turn two.

- Significant Prevalence of Unsafe Listening Practices - Approximately 2 billion young adults across the globe are projected to be at constant risk of permanent risk of hearing loss on account of unsafe listening practices.

- Increasing Investment in Hearing Rehabilitation – For instance, the annual rate of investment needed per person is expected to be nearly USD 1 to provide hearing care services worldwide.

- Growing Success Rate of Hearing Aids - For instance, the success rate of hearing aids is estimated to be nearly 65% which is further expected to grow Y-O-Y.

Challenges

- Disrupted Supply Chain as of COVID-19 - It is noticed that not every country manufactures audiology devices and in certain countries, the devices are imported from other nations. But as a result of COVID-19, the supply chain was broken down and the key manufacturer was at a loss. Hence, this factor is estimated to deter the growth of the market in coming years.

- Requirement of High Initial Investment

- Lack of Awareness About New Innovative Devices

Audiology Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 11.54 Billion |

|

Forecast Year Market Size (2035) |

USD 20.86 Billion |

|

Regional Scope |

|

Audiology Devices Market Segmentation:

Product Segment Analysis

The global audiology devices market is segmented and analyzed for demand and supply by product into hearing aids, diagnostic devices, BAHA/BAHS, and cochlear implants. Out of these four types of segments, the hearing aids segment is estimated to gain the largest market share at 48.73%. The growth of the segment can be attributed to the increasing enhancement in people’s lives, along with technological advancement, and ease of comfort. For instance, Starkey Laboratories, Inc.’s Livio AI, which was launched in 2018, is the first to incorporate integrated sensors and artificial intelligence, allowing the user to monitor physical activity and cognitive performance as measured by hearing aid use. Furthermore, escalating demand for complete-in-canal hearing aids and invisible-in-canal hearing aids is another major factor that is estimated to propel the segment growth further throughout the forecast period.

Technology Segment Analysis

The global audiology devices market is also segmented and analyzed for demand and supply by technology into analog and digital. Amongst these two segments, the digital segment is expected to garner a significant share. The growth of the segment can be attributed to the proliferating digitalization and automation of hearing aids which is raising the demand for advanced digital hearing aid devices. On the other hand, the analog segment is projected to witness notable CAGR during the forecast period, owing to the use of a technologically enhanced microphone that creates intensifying sound. In addition to this, some analog hearing aids are configurable, using a microchip that allows a person to manage settings for different listening circumstances. Such analog devices are favored over digital technologies since they offer clear sound at a competitive price.

Our in-depth analysis of the global market includes the following segments:

|

By Technology |

|

|

By Product |

|

|

By Age Group |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Audiology Devices Market Regional Analysis:

North American Market Insights

North America region is likely to hold over 36.7% market share by 2035. The growth of the market can be attributed majorly to the higher prevalence of hearing impairment backed by the rising geriatric population. According to the National Institute of Deafness and Other Communication Disorders, it is noticed that 2 to 3 out of 1000 children are born with hearing loss in one and both ears in the USA. Moreover, the prevalence is also very up-scaled in the adults of the region. As per the data published by the same source, it is stated that 37.5 (15%) million Americans aged between 18 and above have reported troubled hearing. In addition to this, the growing count of audiologists, along with the surge in the advancement of audiology systems are also estimated to boost the market size during the forecast period in the region. Moreover, the launching of modern smart hearing aids by the existing players is another significant factor that is anticipated to push the market growth further throughout the forecast period in the region.

APAC Market Insights

Further, the Asia Pacific audiology devices market is projected to display notable growth over the forecast period. The growth of the market can be attributed majorly to the dynamically increasing ratio of age-related hearing issues backed by the surging geriatric population. Additionally, increasing healthcare expenditure is also estimated to drive market growth during the projected time frame. For instance, East Asia and Pacific healthcare spending in 2019 expanded to approximately USD 752, an increase of around 4.38% from 2018. Moreover, frequently rising healthcare infrastructure is also projected to further accelerate the market growth over the forecast period in the region.

Audiology Devices Market Players:

- Inventis S.r.l.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Demant A/S

- Oticon Medical A/S

- GN Store Nord A/S

- MAICO Diagnostics GmbH

- Sonova AG

- WS Audiology A/S

- Audina Hearing Instruments, Inc.

- Cochlear Limited

- MED-EL Elektromedizinische Geräte Gesellschaft m.b.H.

Recent Developments

-

GN Store Nord A/S to introduce Jabra Enhance Plus, a wireless earbud with the hearing experience of 3-in-1 upgrades for people living with unaddressed hearing disabilities. The company has launched this product and showed its support based on the Over-the-Counter Hearing Aids regulation released by the U.S. Food & Drug Administration.

-

WS Audiology A/S to receive iF Design award for its brand, Signia. Signia won the award owing to its Insio Charge & Go AX hearing aids for the third time. It is known for contactless charging, direct streaming from Android and iOS along with comfort and discreet form.

- Report ID: 4303

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Audiology Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.