Atomic Magnetometer Market Outlook:

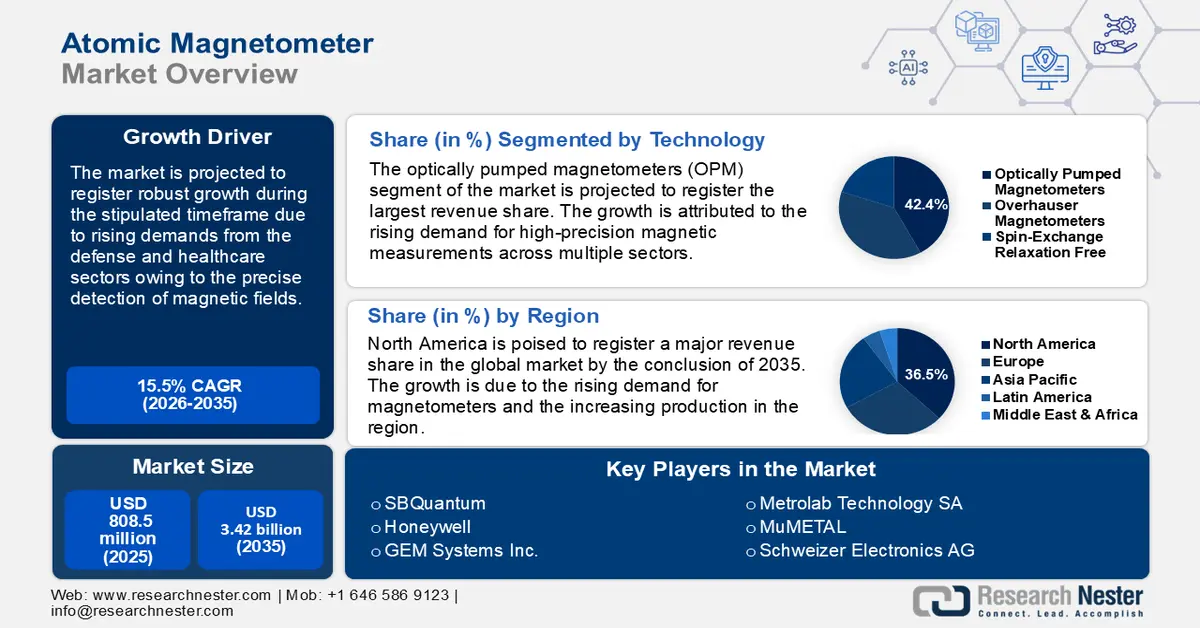

Atomic Magnetometer Market size was over USD 808.5 million in 2025 and is poised to exceed USD 3.42 billion by 2035, growing at over 15.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of atomic magnetometer is estimated at USD 921.29 million.

A key factor boosting atomic magnetometer market’s growth is its rising adoption of atomic magnetometers across diverse industries such as healthcare, defense, geophysics, etc. Atomic magnetometer devices are in demand owing to their precision in magnetic field detection. Furthermore, rapid advancements in quantum technology have bolstered the features of these devices assisting in the sector’s expansion. Additionally, the scope of applications of the devices has widened, with use cases in magnetic anomaly detection in geophysical surveys to advanced medical imaging techniques such as magnetoencephalography (MEG). The table below highlights ongoing major geophysical surveys and investments in such surveys, where atomic magnetometer devices are in demand.

Details on Geophysical Surveys

|

Date of Announcement |

Details of the Survey |

|

October 2024 |

USGS invested USD 4.8 million in the Bipartisan Infrastructure Law funding for five airborne electromagnetic surveys across the U.S. |

|

October 2024 |

Westport announced the commencement of the next round of geophysical surveys to gather information about Cockburn Sound. |

|

September 2024 |

TGS announced the successful completion of an ultra-high-resolution geophysical survey for community offshore wind in the New York Bight. |

|

August 2024 |

Argentina Lithium & Energy Corporation announced the completion of its geophysical survey as a part of the Rincon West lithium project. A total of 15.04 line-miles of Transient Electromagnetic (TEM) sounding surveys were completed as per the announcement. |

|

June 2024 |

Inflection Resources Ltd. launched a major geophysical survey in collaboration with Fleet Space Technologies. |

The advent of major geophysical surveys coupled with large-scale investments creates a burgeoning atomic magnetometer market to supply atomic magnetometer devices for real-time magnetic field sensing solutions. Additionally, the strategic integration of atomic magnetometers into critical applications such as national security and resource exploration underlines the potential for expansion of the atomic magnetometer market. With major and emerging economies across the world bolstering marine defense investments, manufacturers of atomic magnetometer devices are poised to leverage lucrative contracts to supply applications for submarine detection. For instance, in November 2024, the U.S. Department of Defense (DoD) launched the industry-Government Maritime (MARSEC) Consortium to bolster maritime security across Southeast Asia.

Key Atomic Magnetometer Market Insights Summary:

Regional Insights:

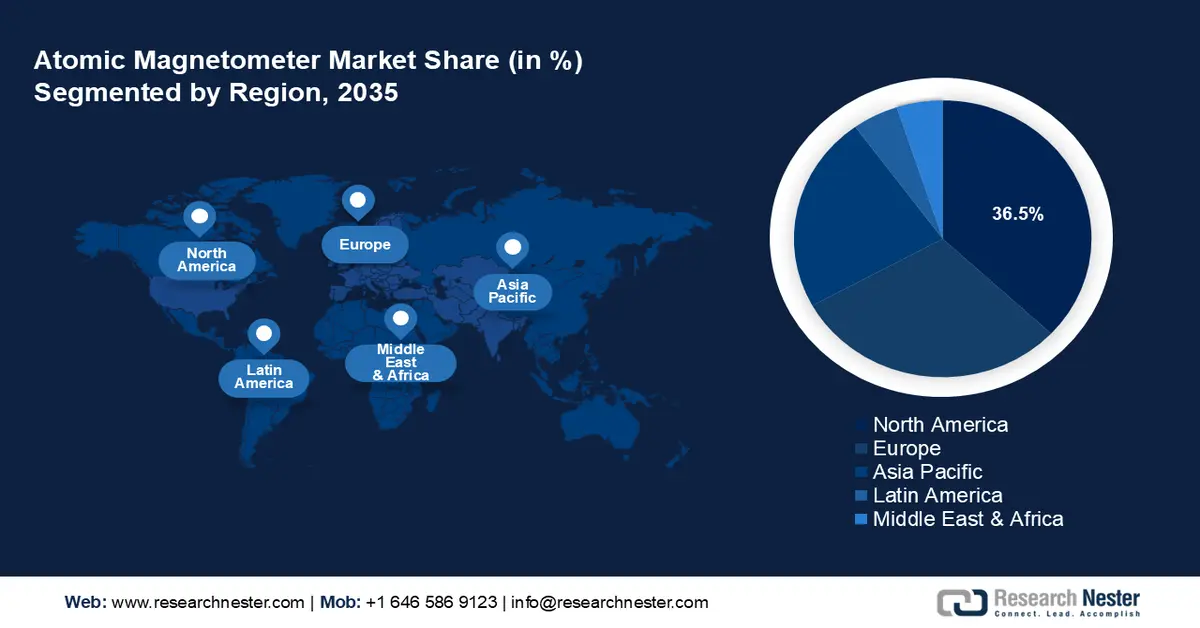

- By 2035, the North America atomic magnetometer market is projected to secure over 36.5% revenue share, supported by intensifying adoption of magnetometer devices across geophysical, medical imaging, and defense programs.

- Europe is anticipated to widen its market presence by 2035 as advancements to sustain technological leadership accelerate demand for atomic magnetometers in non-invasive neural monitoring.

Segment Insights:

- The optically pumped magnetometers (OPM) segment in the atomic magnetometer market is expected to command about 42.4% share by 2035, bolstered by escalating requirements for high-precision magnetic measurement across diverse industries.

- The geophysical exploration segment is set to elevate its revenue share through 2026–2035, stimulated by the growing reliance on atomic magnetometers to map subsurface magnetic anomalies.

Key Growth Trends:

- Rising trend towards miniaturization and portability

- Advancements in quantum technology

Major Challenges:

- Susceptibility to environmental interference

- Sensitivity constraints in miniature designs

Key Players: SBQuantum, Quantum Design Inc., Honeywell, GEM Systems Inc., Scintrex Ltd., Allegro MicroSystems Inc.

Global Atomic Magnetometer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 808.5 million

- 2026 Market Size: USD 921.29 million

- Projected Market Size: USD 3.42 billion by 2035

- Growth Forecasts: 15.5%

Key Regional Dynamics:

- Largest Region: North America (36.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: – United States, China, Germany, Japan, United Kingdom

- Emerging Countries: – India, South Korea, Canada, France, Australia

Last updated on : 2 December, 2025

Atomic Magnetometer Market - Growth Drivers and Challenges

Growth Drivers

- Rising trend towards miniaturization and portability: The trends towards miniaturization have bolstered the growth of the atomic magnetometer market. More compact and energy-efficient devices boost greater adoption rates. Furthermore, portable magnetometers are suitable for fieldwork and wearable technology. For instance, lightweight, battery-operated devices are applied in research settings to provide accessible solutions for researchers and students. A recent successful use case was reported in October 2024 by the Institute of Photonic Sciences, where the research team used optically pumped magnetometers (OPMs) to enable real-time detection of the fields produced by hyperpolarized molecules.

Additionally, manufacturers of atomic magnetometers can refer to new advancements reported by the American Institute of Physics (AIP) which highlights trends that can bolster further adoption of these devices. In September 2024, AIP reported an all-optical magnetometer which is enhanced by a machine learning model and uses a dual probing beam setup to detect spin projections simultaneously in both directions. With advancements in artificial neural networks, magnetometers with ML capabilities are expected to experience heightened adoption. - Advancements in quantum technology: The rapid rate of progress in quantum mechanics is a major driver in the growth of the atomic magnetometer market. Research in atomic physics and quantum coherence bolsters the development of precise devices that are capable of detecting minute variations in magnetic fields. The advancements expand their applications and the scope of end use in multiple industries. Emerging demand from the automotive sector for use in autonomous vehicles in the navigation systems bodes well for manufacturers operating in the sector. For instance, in March 2023, Embention announced the release of Veronte Max, i.e., a magnetometer sensor with I/O expansion capabilities to ease the reduction of wires in autonomous vehicles.

- Growing demand from the healthcare sector and DoD applications: A major factor in the profitable expansion of the atomic magnetometer market is the rising demand from the healthcare sector. The devices have impacted the landscape of medical imaging and diagnostics with their sensitivity to weak magnetic fields. Applications such as magnetocardiography (MCG) and magnetoencephalography (MEG) drive demand for magnetometers. These devices offer non-invasive and precise insights into brain and cardiac activity. Furthermore, the advancements in healthcare infrastructure globally have created burgeoning trends for the adoption of atomic magnetometer devices.

Additionally, the growth of application in DoD applications leads to consistent revenue streams for manufacturers. The table below highlights recent advancements in healthcare and DoD applications.

Recent Advancements in Atomic Magnetometers

|

Date of Announcement |

Details |

|

December 2023 |

Neuranics announced the launch of a magnetic sensor development kit that can record the heart’s magnetic activity and transfer it over bluetooth for 24/7 recording. |

|

June 2023 |

SRI-led team demonstrated a magnetic sensor that can detect biomagnetic signals. The Atomic Magnetometer for Biological Imaging in Earth’s Native Terrain (AMBIIENT) analyzes signals that can diagnose some medical conditions. |

|

July 2023 |

National Institute of Standards and Technology (NIST) announced patent- licensing opportunity for the Atomic Magnetometer and method of sensing of magnetic fields technology with potential applications in healthcare, navigation, defense, and medicine. |

Challenges

- Susceptibility to environmental interference: Atomic magnetometers are sensitive to external magnetic noise and environmental factors such as temperature fluctuations, and electromagnetic interference. External factors can disrupt a device’s performance leading to constraints in use cases. The challenge creates the need for extensive shielding and calibration. Additionally, susceptibility to environmental interference can limit the scope of applications which can adversely affect the sector’s growth.

- Sensitivity constraints in miniature designs: Despite the rising demands for portable atomic magnetometers, the production can face challenges in maintaining efficiency. Achieving high sensitivity in miniaturized forms can pose technical challenges. Manufacturers must invest to maintain performance while reducing the size of components, and the added layer of complexity can lengthen product development cycles and increase the time-to- atomic magnetometer market.

Atomic Magnetometer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.5% |

|

Base Year Market Size (2025) |

USD 808.5 million |

|

Forecast Year Market Size (2035) |

USD 3.42 billion |

|

Regional Scope |

|

Atomic Magnetometer Market Segmentation:

Technology Segment Analysis

By technology, the optically pumped magnetometers (OPM) segment is expected to capture around 42.4% atomic magnetometer market share by the end of 2035. The rising demand for high-precision magnetic measurements across multiple sectors is a major factor of the segment's growth. The heightened demand from various sectors expands the scope of application of OPMs, creating lucrative opportunities for the manufacturers. An example of a use case is from the healthcare sector where OPMs are in demand for measuring small magnetic fields generated by bodily movements, to aid in comprehensive diagnosing of neuromuscular diseases.

Furthermore, the growing investments to further research in brain imaging and communication reception are poised to assist the segment’s growth. For instance, in April 2022, researchers from the University of Colorado released a system consisting of OPM to sense a modulated magnetic field to sense a modulated magnetic field wherein the modulated magnetic field includes encoded information. Moreover, in May 2021, researchers at the Fralin Biomedical Research Institute at VTC received a USD 2.4 million grant from the National Institute of Biomedical Imaging and Bioengineering, to measure the brain’s magnetic signals and expand the application of OPM devices as wearable, lightweight headsets to measure the brain’s activity. The research bodes well for the commercial application of OPMs ensuring consistent market expansion of the segment.

Application Segment Analysis

By application, the geophysical exploration segment of the atomic magnetometer market is forecasted to expand its revenue share during the stipulated timeline of the sector’s analysis. Atomic magnetometer devices have been positioned as vital tools to detect and map subsurface magnetic anomalies in geophysical exploration. The high sensitivity allows the detection of minute variations in the earth’s magnetic field, providing detailed insights into subsurface formations. Two recent announcements in the field of geophysical exploration highlights the heightened demand for atomic magnetometer devices.

For instance, in April 2024, the Cultural Resource Analysts Inc., announced the acquisition of a push cart with five magnetometer sensors from SENSYS which will be equipped with a RTK DGPS, to allow geo referenced measurements of the survey area. Furthermore, in July 2024, Myriad Uranium Corporation announced the initiation of a geophysical survey at the copper mountain uranium project in the U.S, which is expected to create a sustained demand for atomic magnetometer devices.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Application |

|

|

Form Factor |

|

|

Sensitivity |

|

|

Output |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Atomic Magnetometer Market - Regional Analysis

North America Market Insights

North America in atomic magnetometer market is anticipated to hold more than 36.5% revenue share by 2035. The market’s dominance is attributed to the rising demand for atomic magnetometer devices in geophysical exploration, medical imaging, and defense initiatives within the region. The U.S. accounts for a major share in North America followed by Canada. A key facet of the North America atomic magnetometer market is the growing advent of lucrative contracts to develop magnetometers catering to various use cases.

For instance, in December 2024, NASA and the National Oceanic and Atmospheric Administration (NOAA) awarded a contract worth USD 26 million to the Southwest Research Institute to develop magnetometers for NOAA’s Space Weather Next (SW Next) program for two missions set to be launched in 2029 and 2032 respectively. Such contracts within North America bode well for the atomic magnetometer market’s expansion during the forecast period.

The U.S. market is positioned to exhibit robust growth during the forecast period and hold a major share in North America. The substantial investments in research and development is a major factor in the growth of the domestic market. The U.S. is at the forefront of defense investments, creating a favorable atomic magnetometer market for the adoption of atomic magnetometers and for manufacturers to leverage lucrative defense contracts. For instance, in December 2024, SBQuantum announced the pioneering of quantum magnetometry for defense, aerospace, and minerals exploration with recent developments including major contracts with space agencies in the U.S. and collaboration with Silicon Microgravity for minerals exploration.

Additionally, the advancements in satellite-based magnetometers to monitor magnetic storms bolsters the sector’s growth by expanding the scope of application. Moreover, in May 2024, the U.S. Defense Innovation Unit launched a new tech portfolio with quantum sensors initiative with magnetometers as a focus area which bodes well for the market’s growth.

The Canada atomic magnetometer market is projected to expand during the estimated timeline. The rising advent of geophysical exploration in Canada is poised to create sustained demand for atomic magnetometer devices. Furthermore, Canada’s investment in space exploration is poised to create lucrative contracts for manufacturers. For instance, the Canadian Space Agency selected SBQuantum for its magnetometer as a part of the STRATOS Program. Furthermore, the advent of new seismic surveys in Canada is poised to create sustained opportunities for the atomic magnetometer market. For instance, in January 2025, TGS announced the launch of the Dawson Phase III 3D multi-client seismic survey in the Western Canadian Sedimentary Basin.

Europe Market Insights

The Europe atomic magnetometer market is poised to expand during the forecast period. A key driver is the rising advancements to maintain Europe’s position as a technological leader globally. Major applications will be in the healthcare sector of Europe owing to the rising demand for non-invasive neural activity monitoring. In November 2024, the European Space Agency and Open Cosmos announced the finalization of a contract worth USD 36.7 million to advance magnetic field monitoring. Such projects are expected to drive the demand for atomic magnetometer devices in the region. Furthermore, the European Quantum Flagship initiative is poised to assist in the advancements in magnetometer devices ensuring a steady growth of the sector.

The Germany atomic magnetometer market is projected to expand during the stipulated timeframe. Germany’s position as a central hub for atomic magnetometer research in Europe assists the market’s growth. Additionally, leading institutions in Germany such as Max Planck Institute and Fraunhofer-Gesellschaft are spearheading advancements in magnetometer research.

The France atomic magnetometer market is predicted to grow during the stipulated timeframe. The advent of advanced magnetometers for applications in MCG and MEG is poised to assist the sector’s growth. Additionally, programs supported by the EU such as the Horizon Europe program ensures sustained funding and collaboration for quantum research programs.

Atomic Magnetometer Market Players:

- SBQuantum

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Quantum Design Inc.

- Honeywell

- GEM Systems Inc.

- Scintrex Ltd.

- Allegro MicroSystems Inc.

- QuSpin Inc.

- Anertai Instruments Co., Ltd.

- Schweizer Electronics AG

- GWR Instruments, Inc.

- Metrolab Technology SA

- Bartington Instruments Ltd.

- MuMETAL

- Stinger Ghaffarian Technologies

The atomic magnetometer market is forecasted to expand during the forecast period. The competitive market is witnessing key players investing and R&D activities to bolster revenue shares. Companies are seeking to improve the efficiency of their magnetometer offerings to cater to growing demand across industries. Additionally, strategic collaborations are expected to help key players to strengthen their footprints in the expanding atomic magnetometer markets. Quantum Corporation, a major player in the market, reported revenue worth USD 311.6 million in its fiscal year 2024 financial summary, while the annual recurring revenue was reported to be USD 145 million.

Here are some key players in the atomic magnetometer market:

Recent Developments

- The Indian Space Researchq Organization (ISRO) announced the successful deployment of magnetometer boom on Aditya-L1 in Halo orbit. The magnetometer boom will be used to measure the low-intensity interplanetary magnetic field in space.

- In August 2024, SandboxAQ announced collaboration with Mayo Clinic on novel cardiac diagnostics. The collaboration is poised to explore the use of advanced, AI-powered magnetocardiography (MCG) technology with the goal of improving cardiac diagnostics.

- Report ID: 7015

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Atomic Magnetometer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.