Assisted Reproductive Technology Market Outlook:

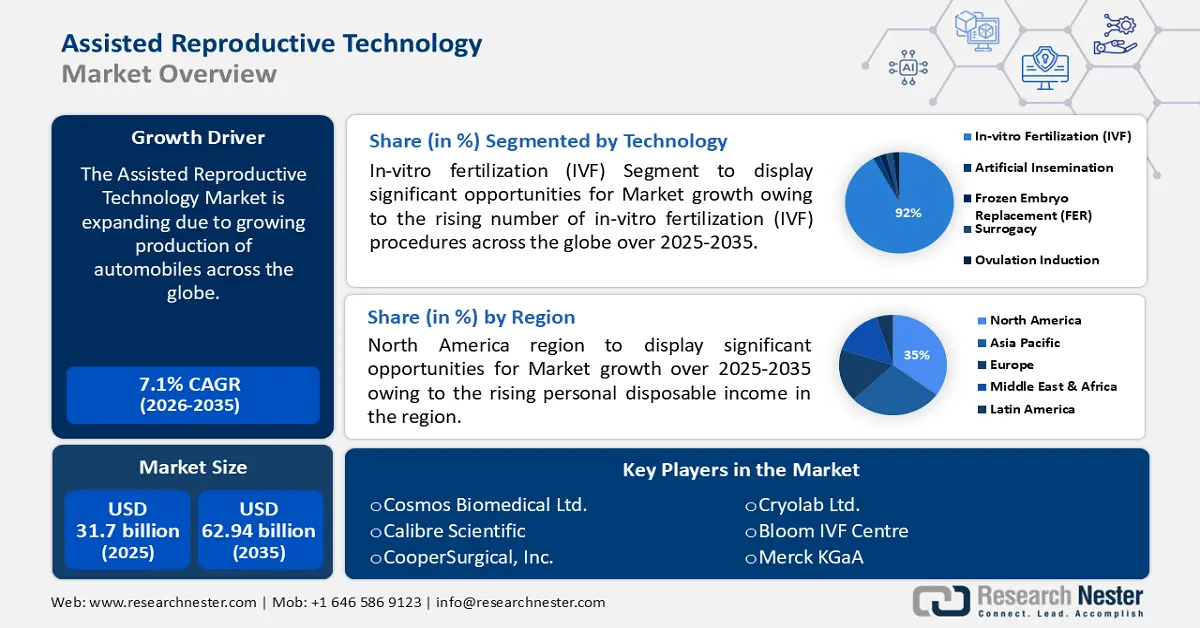

Assisted Reproductive Technology Market size was over USD 31.7 billion in 2025 and is anticipated to cross USD 62.94 billion by 2035, growing at more than 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of assisted reproductive technology is assessed at USD 33.73 billion.

It is believed that the rising burden of infertility is driving innovations in the field of assisted reproductive technology (ART) that covers all reproductive procedures that deal with eggs or embryos. As per the World Health Organization (WHO), approximately 1 in 6 adults globally, or 17.5% of the population, are infertile.

Key Assisted Reproductive Technology Market Insights Summary:

Regional Highlights:

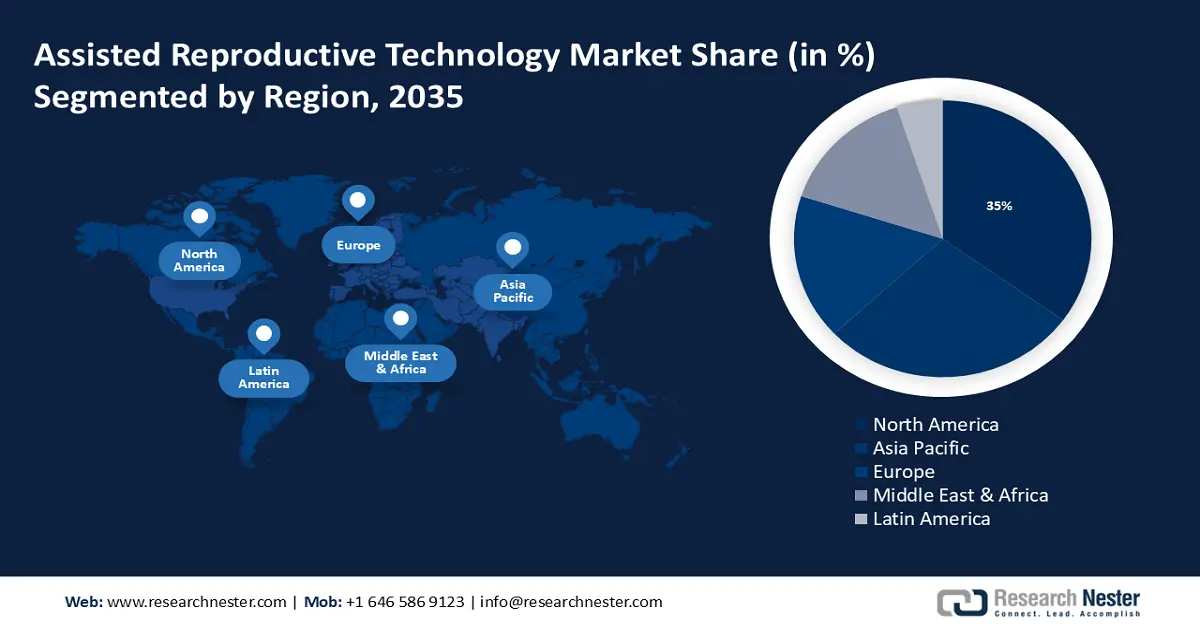

- North America assisted reproductive technology market will hold more than 35% share by 2035, fueled by rising disposable income leading to increased demand for assisted reproductive technology.

- Asia Pacific market will exhibit massive growth from 2026 to 2035, fueled by rising demand for IVF from global medical tourists.

Segment Insights:

- The in-vitro fertilization segment in the assisted reproductive technology market is expected to achieve significant growth till 2035, driven by rising global IVF procedure rates and infertility treatments.

- The accessories & disposables segment in the assisted reproductive technology market is forecasted to achieve substantial growth till 2035, propelled by the rising use of soft embryo transfer catheters.

Key Growth Trends:

- Recent developments in assisted reproductive technology

- Growing awareness about infertility

Major Challenges:

- Strict rules and regulations

- High treatment cost

Key Players: Calibre Scientific, CooperSurgical, Inc., FUJIFILM Irvine Scientific, Cryolab Ltd., Bloom IVF Centre, Merck KGaA, Ferring B.V., Vitrolife AB, European Sperm Bank.

Global Assisted Reproductive Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 31.7 billion

- 2026 Market Size: USD 33.73 billion

- Projected Market Size: USD 62.94 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Assisted Reproductive Technology Market Growth Drivers and Challenges:

Growth Drivers

-

Recent developments in assisted reproductive technology - Over the past ten years, there have been numerous new advancements in the field of assisted reproductive technology, which have improved the understanding of the reasons behind infertility and provided methods that increase treatment's safety and effectiveness.

For instance, stem cell therapy has recently been a popular therapeutic option for treating female reproductive and endocrine disorders by enhancing the synthesis of ovarian and oocyte cells. - Growing awareness about infertility - By dispelling myths and misconceptions and giving individuals and couples hope, awareness campaigns are helping normalize the use of assisted reproductive technologies (ART).

For instance, to assist people worldwide who want to safely begin or continue their reproductive plans during the COVID-19 epidemic, the International Federation of Fertility Societies (IFFS) launched an engaging graphics campaign to instill the confidence to bring up specific issues with neighborhood healthcare practitioners, determine whether it's time to look into fertility diagnostic testing and treatment alternatives and make that decision. - Rising adoption of advanced technologies - With the ability to conduct cognitive functions on a machine, artificial intelligence (AI) is a powerful inventive wave that is quickly gaining popularity in assisted reproductive technology (ART) to reduce interobserver inconsistency, alter drug portions in oocyte incitement, decrease close clinical interactions, improve sperm test determination, and evaluate oocyte quality and embryo selection.

As of right now, more than 30% of businesses around the globe said they were utilizing AI.

Challenges

-

Strict rules and regulations - All therapies or operations that involve working with human oocytes or embryos are referred to as assisted reproductive technology, therefore the technology is well-regulated, which can increase the operational costs limiting the availability of the services in certain regions.

- High treatment cost - Patients bear a heavy financial burden due to the wide variations in the direct costs of assisted reproductive technology treatment throughout nations.

Limited public support for assisted reproductive technology is primarily caused by the high cost which includes cost associated with donor selection, screening, and treatment.

Assisted Reproductive Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 31.7 billion |

|

Forecast Year Market Size (2035) |

USD 62.94 billion |

|

Regional Scope |

|

Assisted Reproductive Technology Market Segmentation:

Technology Segment Analysis

In-vitro fertilization (IVF) segment is likely to capture around 92% assisted reproductive technology market share by the end of 2035. The segment growth can be attributed to the rising number of in-vitro fertilization (IVF) procedures across the globe. The most popular form of assisted reproductive technology is in vitro fertilization which helps in infertility treatment.

IVF is also known as unaided or spontaneous conception in which sperm and eggs are mixed in a lab to generate an embryo. For instance, globally, more than 5 million IVF babies have been born, and over 2 million cycles are carried out annually, translating into around 400,000 births.

End-Use Segment Analysis

Fertility clinics segment in the assisted reproductive technology market is predicted to dominate majority share by the end of 2035 led by the growing cases of delayed marriage. More than 4% of women worldwide reach their late forties without ever getting married.

Late-married couples frequently experience infertility, which increases their trips to fertility clinics that provide the best assisted reproductive technology (ART) alternatives to help couples and even single individuals who want to start a family.

Product Segment Analysis

The accessory & disposable segment is assessed to generate substantial CAGR by the end of 2035. The growth of the segment can be accredited to the rising usage of catheters. For instance, every year, more than 4 million central venous catheters are implanted.

Soft embryo transfer catheters are used instead of rigid catheters and are examples of accessories and disposables that are utilized during ART treatments for embryo transfer, which noticeably raises the pregnancy rate.

One treatment for infertility is intrauterine insemination or IUI an assisted reproductive technology method where sperm are inserted into a woman's uterus via a catheter to aid in fertilization.

Our in-depth analysis of the market includes the following segments:

|

End-Use |

|

|

Technology |

|

|

Product |

|

|

Diagnosis |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Assisted Reproductive Technology Market Regional Analysis:

North American Market Insights

North America industry is anticipated to hold largest revenue share of 35% by 2035. The market demand in the region is also expected on account of the rising personal disposable income. This has led to a rise in assisted reproductive technology services since with increased income more people to afford these treatments.

Infertility treatment in the United States often involves in vitro fertilization, which is an intricate set of steps that can result in pregnancy. For instance, more than 2% of all babies born in the United States in 2021 were made possible by assisted reproductive technology. In the United States, more than 720 infants are delivered through gestational surrogacy every year since it is less complicated legally.

Besides this, in Ontario, Canada assisted reproductive technology (ART) is used in over 1% of births; this percentage has been increasing.

APAC Market Insights

The Asia Pacific region will also encounter massive revenue for the assisted reproductive technology market through 2035. The need for IVF therapy is anticipated to rise in the Asia-Pacific area since the number of travelers from across the globe is seeking medical treatments including reproductive treatment in nations like Thailand, China, Japan, India, and other nations.

The IVF business in Japan grew as a result of high levels of disposable income among Japanese citizens, and easily available financial assistance for the treatment.

China's sperm donation facilities, located in Beijing and Shanghai among other places, are urging healthy men and college students to donate their sperm following the nation's first negative population increase in 61 years. For instance, there were more than 25 human sperm banks on the Chinese mainland between 1981 and 2020.

Assisted Reproductive Technology Market Players:

- Microm U.K. Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cosmos Biomedical Ltd.

- Calibre Scientific

- CooperSurgical, Inc.

- Cryolab Ltd.

- Bloom IVF Centre

- Merck KGaA

- Ferring B.V.

- Vitrolife AB

- European Sperm Bank

The assisted reproductive technology market consists of many key players who are launching various strategic initiatives to expand their market position in the industry.

Recent Developments

- Calibre Scientific announced the acquisition of Microm UK Limited and Scopescreen, LLC to add private and public fertility clinics, as well as research organizations, to its clientele in the US, the UK, and Ireland, and spur innovation and achieve significant progress toward bettering patient and practitioner outcomes.

- Vitrolife AB acquired eFertility (STB Zorg B.V.) to improve global IVF clinics' level of standardization and digitalization by making significant progress in creating a smoothly integrated and more effective clinic process.

- Report ID: 6070

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.