Asset Performance Management Market Outlook:

Asset Performance Management Market size was over USD 2.74 billion in 2025 and is anticipated to cross USD 8.66 billion by 2035, witnessing more than 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of asset performance management is assessed at USD 3.04 billion.

The primary driving factor of asset performance management (APM) is the increasing need for organizations to enhance operational efficiency and reduce maintenance costs. Businesses are investing in APM solutions to better predict and prevent equipment failures, optimize asset utilization, and extend the lifespan of their assets. This focus on maximizing asset performance and minimizing downtime, coupled with advancements in technologies such as Internet of Things (IoT), artificial intelligence (AI), and big data analytics, is fueling the growth of the APM market.

Several companies are integrating AI-powered APM systems to enhance their operational efficiency and predictive maintenance capabilities. For instance, GE Vernova, a global leader in electrification, decarbonization, and energy solutions, announced the release of Autonomous Inspection in May 2024. This cloud-based computer vision software solution automates manual inspection and monitoring of industrial assets using image capture devices and artificial intelligence/machine learning (AI/ML) algorithms.

Key Asset Performance Management Market Insights Summary:

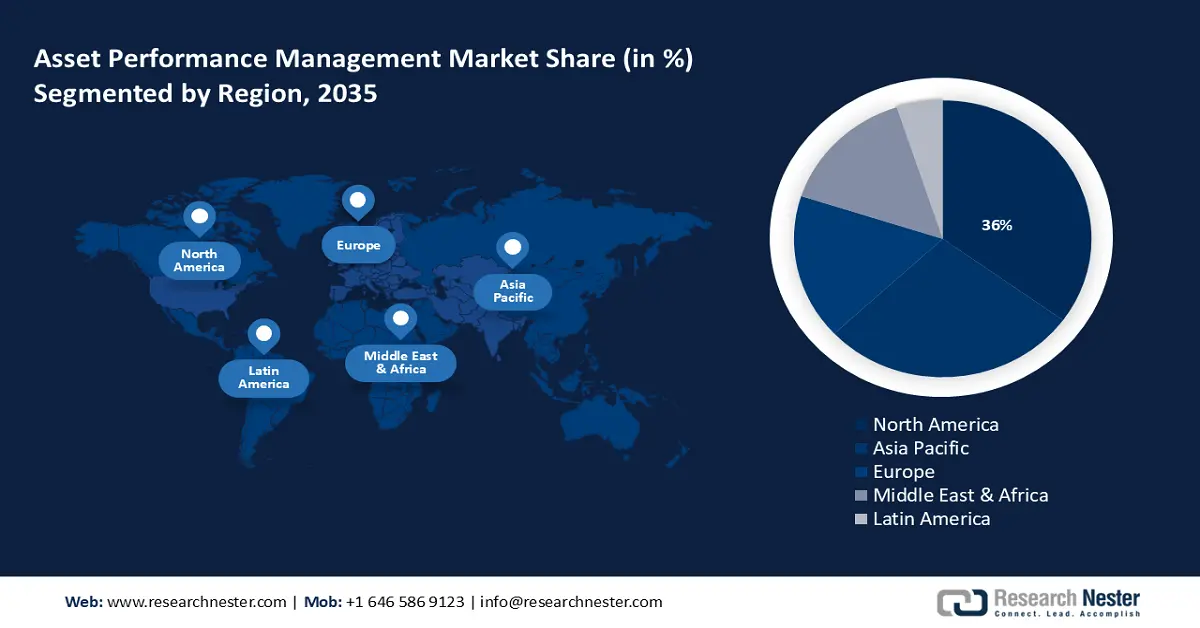

Regional Highlights:

- The North America asset performance management market is anticipated to capture 36% share by 2035, driven by the integration of advanced technologies like IoT and AI in asset performance management.

Segment Insights:

- The hosted segment in the asset performance management market is forecasted to hold a 65.10% share by 2035, driven by rising investment in public cloud infrastructure.

- Energy and utilities segment in the asset performance management market is expected to secure a significant share by the forecast year 2035, driven by the need for efficient operations to achieve net zero emissions.

Key Growth Trends:

- Growing industrial Internet of Things (IIoT) sector

- Rising implementation of digital twin technology

Major Challenges:

- Cybersecurity concerns

- High implementation costs

Key Players: Honeywell International, Inc., ABB, Aspen Technology, Inc., AVEVA Group plc, Bentley Systems, Incorporated, GE Digital, Rockwell Automation, Inc., SAP SE, SAS Institute, Inc., Total Resource Management, Inc., Siemens Energy AG.

Global Asset Performance Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.74 billion

- 2026 Market Size: USD 3.04 billion

- Projected Market Size: USD 8.66 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Asset Performance Management Market Growth Drivers and Challenges:

Growth Drivers

- Growing industrial Internet of Things (IIoT) sector: The increasing uptake of IIoT is significantly changing asset management through increased asset lifespan. APM systems use the industrial Internet of Things (IIoT) to ensure equipment reliability which plays a significant part in several industries, including manufacturing, energy, healthcare, and transportation. The global Industrial IoT sector growth rate is anticipated to reach around 13.8% between 2024 and 2029, with a market volume of over USD 454 billion by 2029. The expansion of IIoT is creating a fertile environment for the APM market by providing the tools and data necessary to optimize asset performance, improve maintenance practices, and achieve better operational outcomes.

- Rising implementation of digital twin technology: Digital twins create virtual replicas of physical assets, systems, or processes, enabling real-time monitoring and simulation. Organizations can use digital twins to test and refine operational strategies, optimize asset performance, and improve efficiency. This can lead to significant cost savings and performance improvements. More than 25% of manufacturing firms worldwide have either fully or partially adopted a digital twin plan for some of their operational assets, and another 62% are either in the process of developing or have already completed their digital twin strategy.

- Development of blockchain technology: Advances in blockchain technology are enhancing the functionality of smart contracts, which automate and enforce agreements based on predefined conditions. In APM, smart contracts can streamline maintenance schedules, automate warranty claims, and manage service-level agreements (SLAs), leading to more efficient operations. Moreover, the development of blockchain standards and protocols is improving interoperability between different systems and stakeholders. This ensures seamless and secure data sharing, allowing for more effective collaboration and integrated asset management across the supply chain.

Challenges

- Cybersecurity concerns: The growing digitization of economies is causing an unprecedented spike in data volumes, which has exponentially increased the significance of data security. Businesses all around the world are now concerned about data security as cyberattacks have been rising in tandem with the growth of digitization. Moreover, asset performance management handles large amounts of operational data from linked devices, which makes them a prime target for cyberattacks, leading to significant financial losses.

- High implementation costs: The use of APM is hampered primarily by the high cost of hardware and software. The implementation and upkeep of APM demand a high degree of skill, which can be a difficult, expensive, and time-consuming procedure. Additionally, in asset management, controlling maintenance costs is another challenge, which may create obstacles for businesses with smaller maintenance budgets.

Asset Performance Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 2.74 billion |

|

Forecast Year Market Size (2035) |

USD 8.66 billion |

|

Regional Scope |

|

Asset Performance Management Market Segmentation:

Deployment Segment Analysis

Hosted segment is set to account for around 65.1% asset performance management market share by 2035 on account of the rising investment in public cloud infrastructure, driven by growing automation, digital transformation, and the widespread use of connected devices across different industries. For instance, global end-user spending on public clouds increased to over USD 590 billion in 2023, from around USD 420 billion in 2021 and almost USD 499 billion in 2022. Public cloud deployment offers a wide range of options for computing solutions, and more frequent updates of APM solutions to satisfy the expanding requirements of businesses across all sizes and industries. APM can be installed locally on a cloud, which may improve asset reliability throughout any type of infrastructure and expedite business processes. APM solution accessibility has increased due to the acceleration of installation timelines brought by cloud technology deployment.

Vertical Segment Analysis

The energy and utilities segment is anticipated to hold a significant revenue share in the asset performance management market during the projected timeframe. Energy businesses have to conduct efficient operations to reach net zero emissions. As per the International Energy Agency, global yearly investments in renewable energy will need to more than triple to over USD 4 trillion by 2030 to achieve net zero emissions by 2050. This calls for managers and other officials to use asset performance management solutions to monitor asset conditioning and evaluate the health of their assets to reduce waste and energy usage. The growing emphasis that firms are placing on predictive maintenance to make sure that assets are operating at their best is also seen to be propelling the expansion of this industry.

Our in-depth analysis of the asset performance management market includes the following segments:

|

Vertical |

|

|

Component |

|

|

Deployment |

|

|

Enterprises Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Asset Performance Management Market Regional Analysis:

North America Market Insights

Asset performance management market in North America industry is predicted to hold largest revenue share of 36% by 2035. Technological advancements such as IoT, AI, cloud computing, digital twins, and blockchain are driving innovation in the APM market in the region. These technologies enhance the capabilities of APM solutions, leading to more efficient, predictive, and data-driven asset management practices. Moreover, the industrial and energy sectors are major drivers of APM adoption. Organizations are leveraging APM solutions to optimize asset performance, reduce downtime, and increase operational efficiency.

The U.S. companies are leading in the integration of IoT, AI, and machine learning in APM systems. These technologies enhance predictive maintenance, real-time monitoring, and data analytics. For instance, IBM offers advanced APM solutions leveraging AI and IoT for improved asset management and operational efficiency.

The demand for Industry 4.0 and smart manufacturing in Canada drives the adoption of APM solutions. These solutions support the integration of automation, data exchange, and advanced analytics in manufacturing processes.

APAC Market Insights

The Asia Pacific asset performance management market will register a substantial CAGR during the forecast period owing to the increasing IT infrastructure investments made by businesses to significantly enhance asset management performance. Asset management maximizes the performance and dependability of IT infrastructures which is crucial for improving its effectiveness.

The asset performance management industry in Japan is thriving owing to its widespread use in IT, and telecommunications. Japan's booming IT and telecommunications sectors are characterized by world-class innovation and a wealth of opportunities.

Besides this, China, and India are the main markets in Asia for asset performance management systems. The existence of numerous manufacturing sectors in these nations is promoting the use of asset performance management programs. The industrial sector involves a variety of processes that call for a wide range of assets, which need to be as efficient as possible.

Asset Performance Management Market Players:

- Emerson Electric Co.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International, Inc.

- ABB

- Aspen Technology, Inc.

- AVEVA Group plc

- Bentley Systems, Incorporated

- GE Digital

- Rockwell Automation, Inc.

- SAP SE

- SAS Institute, Inc.

- Total Resource Management, Inc.

- Siemens Energy AG

Numerous important companies in the asset performance management market are starting several tactical projects to increase their market share and strengthen their positions in the industry. It is predicted that the top five companies will control the majority of the market share by taking calculated risks, expanding, forming agreements, and participating in joint ventures.

Recent Developments

- In April 2024, Total Resource Management, Inc. announced a partnership with Aspen Technology, Inc. to encourage and Support Predictive Maintenance (PdM) and Asset Performance Management (APM) Initiatives that boost output and proactively handle problems that have an impact on the performance of businesses.

- In November 2023, ABB introduced the digital asset performance management platform Ability SmartMaster to verify and keep an eye on the status of field devices and equipment in the water, wastewater, chemical, oil, gas, and other sectors in India.

- Report ID: 6338

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Asset Performance Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.