Asparaginase Market Outlook:

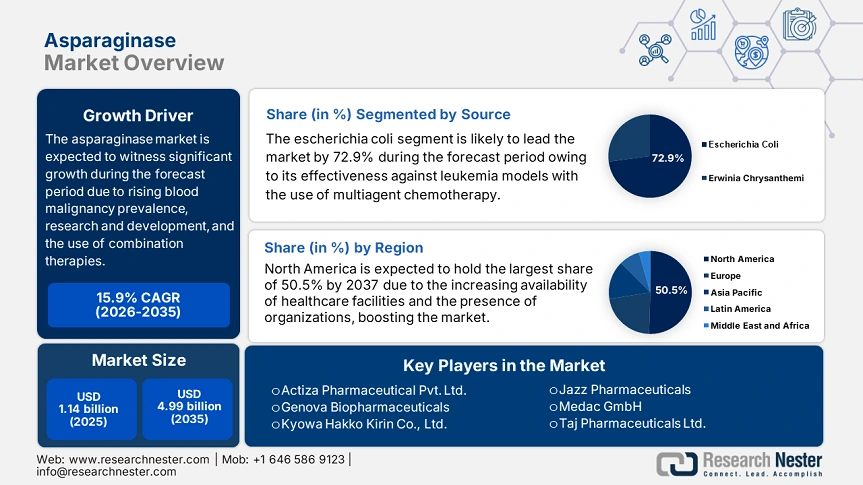

Asparaginase Market size was over USD 1.14 billion in 2025 and is anticipated to cross USD 4.99 billion by 2035, witnessing more than 15.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of asparaginase is assessed at USD 1.3 billion.

Asparaginase as a therapy solution is an essential enzyme utilized both in pharmaceutical as well as food manufacturing processes. In terms of the medical sector, it plays a pivotal role in aiding illnesses, including all kinds of cancer. Besides, as stated in the June 2022 NLM article, 30% to 81% of patients facing hypersensitivity issues significantly limited the use of asparaginase. This necessitates the advanced development of therapy, thus driving the market development across nations. The implementation of encapsulation of asparaginase is projected to enrich the treatment procedure and increase its efficiency.

Furthermore, the asparaginase market is an exponential component of pediatric cancer protocols that is available in mainly three formulations, including Erwinase, PEGylated E. coli (PEG), and native Escherichia coli. In this regard, a clinical study was conducted which was published in January 2025 by the America Society of Clinical Oncology Journal. The study forecasted the need and the payer’s pricing of Erwinase-based asparaginase treatment, especially for youth cancer. In addition, the pricing strategy was evaluated based on the intensified regimen (IR) and base regimen (BR), especially in Burundi, Ghana, and Turkmenistan. The cost of the treatment varied, depending on high-income (HIC) and low- and middle-income (LMIC) nations, thus driving the market demand.

Erwinase Price Comparison Based on HI and LMIC

|

Countries |

Average Cost (HIC) |

Average Cost (LMIC) |

||

|

BR |

IR |

BR |

IR |

|

|

Burundi |

USD 19,659.5 |

USD 34,950.2 |

USD 456.1 |

USD 810.9 |

|

Ghana |

USD 24,799.6 |

USD 44,088.2 |

USD 575.3 |

USD 1,022.9 |

|

Turkmenistan |

USD 15,245.5 |

USD 27,103.1 |

USD 353.7 |

USD 628.8 |

Source: America Society of Clinical Oncology Journal, January 2025

Key Asparaginase Market Insights Summary:

Regional Highlights:

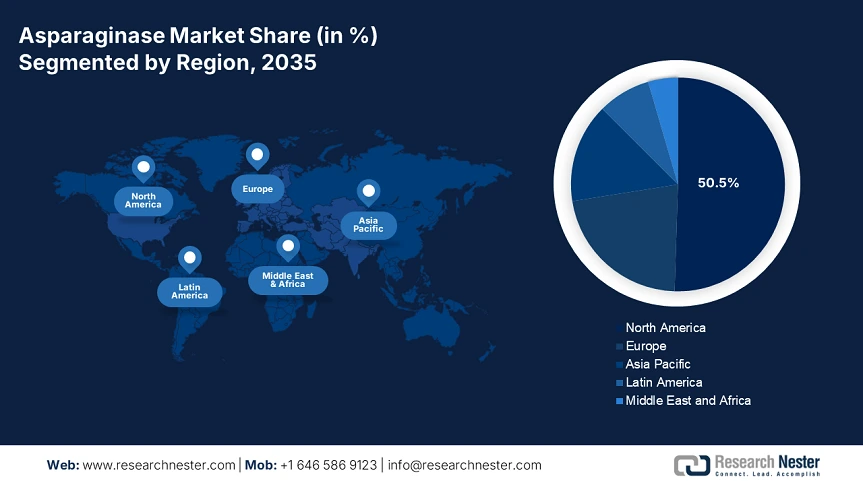

- North America dominates the asparaginase market with a 50.5% share, fueled by well-developed medical facilities and increasing prevalence of leukemia, supporting strong growth prospects through 2035.

Segment Insights:

- The Acute Lymphoblastic Leukemia (ALL) segment is projected to hold a 47.6% share by 2035, fueled by the high prevalence of pediatric ALL and asparaginase’s role as a key chemotherapy agent.

- The Escherichia Coli segment is projected to achieve a 72.9% share by 2035, driven by its established antitumor efficiency against leukemia.

Key Growth Trends:

- Advancement in drug development

- Availability of personalized drugs and novel therapies

Major Challenges:

- High cost of treatment

- Toxicity and side effects

- Key Players: Amgen, Jazz Pharmaceuticals plc, Medac GmbH, Taj Pharmaceuticals Ltd..

Global Asparaginase Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.14 billion

- 2026 Market Size: USD 1.3 billion

- Projected Market Size: USD 4.99 billion by 2035

- Growth Forecasts: 15.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (50.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Asparaginase Market Growth Drivers and Challenges:

Growth Drivers

-

Advancement in drug development: The asparaginase market is subjected to growth internationally based on the continuous research, development, manufacture, production, approval, and availability of the latest drugs for different kinds of cancer treatment. For instance, in March 2025, the U.S. FDA approved Imfinzi as adjuvant monotherapy which has been developed by AstraZeneca. The approval also includes the combination of cisplatin and gemcitabine as a neoadjuvant treatment for patients with muscle-invasive bladder cancer (MIBC). Therefore, drug innovation is an effective growth factor for the market to flourish internationally.

-

Availability of personalized drugs and novel therapies: The trend of adopting precision medicines and targeted therapies is another factor that is positively amplifying the asparaginase market globally. Besides, the continuous research to gain insight into the molecular and genetic basis of chronic disorders has resulted in an increased emphasis on executing treatments for patients. Therefore, this trend is effectively boosting the market growth and enhancing its demand in the health sector.

Challenges

-

High cost of treatment: One of the major challenges for the asparaginase market is its expensive treatment cost along with its limited accessibility worldwide. The newly introduced and approved asparaginase therapies, especially with innovative formulations and advancements, are highly priced. This eventually creates financial restraints, majorly in developing economies in comparison to developed ones. In addition, this factor leads to restricted market penetration, thereby a hindrance to market expansion globally.

-

Toxicity and side effects: The adoption of asparaginase therapeutics can result in the occurrence of toxicity in the human body, which in turn leads to the cause of side effects. This includes pancreatitis and allergic reactions due to which its use gets limited for certain patients displaying increased complications. Therefore, maintaining an effective balance in the presence of these risks is a huge challenge for the market. However, to combat this, efforts are being developed to formulate and improve safety profiles to get rid of any barriers.

Asparaginase Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.9% |

|

Base Year Market Size (2025) |

USD 1.14 billion |

|

Forecast Year Market Size (2035) |

USD 4.99 billion |

|

Regional Scope |

|

Asparaginase Market Segmentation:

Source (Escherichia Coli, Erwinia Chrysanthemi)

Escherichia coli segment is poised to capture over 72.9% asparaginase market share by 2035. This segment has established antitumor efficiency against leukemia representations with the intention to aid rare disorders. This treatment procedure includes the implementation of multiagent chemotherapy regimens with the utilization of intravenous and intramuscular injections. As per the January 2021 NLM article, E. coli is usually diluted in 30% glycerol and is frozen at -80 degrees Celsius for long-term storage capabilities. It is the most prevalent variety with its extensive use in the healthcare sector, thus driving the segment’s growth.

Application (Acute Lymphoblastic Leukemia (ALL), Lymphoblastic Lymphoma (LBL))

By 2035, acute lymphoblastic leukemia (ALL) segment is anticipated to hold more than 47.6% asparaginase market share. Asparaginase holds noteworthy value as a chemotherapy agent in aiding pediatric acute lymphoblastic leukemia (ALL), one of the most predominant forms of cancer among the youth population. According to the January 2025 America Cancer Society report, approximately 6,100 latest ALL cases have been recorded, comprising 2,650 in females and 3,450 in males. Additionally, almost 1,400 deaths have taken place due to this condition, thus driving the market demand.

Our in-depth analysis of the global asparaginase market includes the following segments:

|

Source |

|

|

Application |

|

|

Route of Administration |

|

|

Distribution Channels |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Asparaginase Market Regional Analysis:

North America Market Analysis

North America asparaginase market is expected to dominate revenue share of around 50.5% by the end of 2035. Factors such as well-developed medical facilities, excessive demand for cancer treatment solutions, and the increasing prevalence of leukaemia are effectively driving the market in the region. In addition, the government plays a huge role in the market expansion on the basis of fund provision to ensure standard lifestyles for the regional population. Moreover, the ongoing research and development by organizations and institutions are also positively impacting market growth, thereby driving the demand.

The asparaginase market in the U.S. is attributed to the presence of regulatory bodies to approve drugs for treatment processes that are manufactured and produced by organizations. For instance, in June 2024, AbbVie and Genmab received the U.S. FDA approval for epkinly which has been jointly developed by both organizations. This is suitable for the treatment of adults affected with relapsed follicular lymphoma. Epkinly is the only intravenous T-cell-based bispecific antibody approved in the country for B-cell lymphoma and designed to concurrently bind to CD3 on T cells and CD20 on B cells, persuading T-cell-mediated carnage of CD20-positive cells.

The asparaginase market in Canada is subjected to steady development due to the provision of funding by governmental and administrative bodies. For instance, in January 2023, the Government of Canada invested USD 23 million to establish the Canadian Pediatric Cancer Consortium (CPCC). This is because, in the country, an estimated 10,000 children are residing with cancer, out of which only 1,500 receive a proper diagnosis every year. Therefore, this resulted in the development of pediatric cancer research to ensure better and healthier lifestyles for young cancer patients in the country.

APAC Market Statistics

The asparaginase market in the Asia Pacific region is projected to witness the fastest growth during the forecast period. Factors including rising leukaemia occurrence, enhanced usage of applications, and the expansion of both food and pharmaceutical industries are highly responsible for the upliftment of the market in the region. In addition, organizations from the region also play a vital role for market growth through partnerships, mergers and acquisitions, and collaborations to execute product innovation and service enlargement.

The asparaginase market in India is witnessing major expansion owing to its effective adoption to cater to critical treatment for tumors. As per the April 2023 NLM article, a clinical study was conducted on children from a tertiary care oncology facility in the southern part of the country. Based on the study, 80.7% of patients received generic pegylated L-asparaginase and 19.3% received conventional asparaginase, as a part of the treatment procedure. Therefore, this denotes the increased need for asparaginase in the country which effectively amplifies the market.

The asparaginase market in China is gaining increased exposure owing to its extensive use to aid children suffering from cancer disorders. As per a clinical study published by NLM in February 2021, 1,194 patients from the country were considered as the patient pool, and among them the hypersensitivity rate was 95% and the hepatic injury rate was also 95%. The study denoted that after the use of PEG-asparaginase, both these conditions were eventually reduced. In addition, the tenure and administration of hospital accommodation of these patients were less after the intake in comparison to patients undertaking E. coli, thus driving the market growth in the country.

Key Asparaginase Market Players:

- Actiza Pharmaceutical Pvt. Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amgen

- Jazz Pharmaceuticals plc

- Medac GmbH

- Taj Pharmaceuticals Ltd.

- LGM Pharma

- Gennova Biopharmaceuticals

- Kyowa Hakko Kirin Co., Ltd.

- Merck (Germany)

- Servier Pharmaceuticals LLC

- Novus Biologicals LLC

- CalciMedica Inc.

The upliftment of the asparaginase market is subjected to effective contributions initiated by organizations globally. This includes certain strategies including mergers and acquisitions, partnerships, and collaborations with the objective to launch new products or initiate service expansion across nations. For instance, in March 2023, CalciMedica Inc. declared the conclusion of its formerly proclaimed merger with Graybug Vision, Inc. Both organizations will concentrate on additional development of its prime product candidate Auxora, an intravenous-formulated, proprietary, and small molecule calcium release-activated calcium (CRAC) channel inhibitor. This is suitable for the appropriate treatment of ALL which is a life-threatening inflammatory disease.

Here's the list of some key players:

Recent Developments

- In December 2024, Amgen stated that the significant addition of BLINCYTO to chemotherapy improves disease-free survival in newly diagnosed pediatric patients with National Cancer Institute (NCI) standard risk (SR) B-cell acute lymphoblastic leukemia (B-ALL) of average or higher risk of relapse.

- In November 2022, Jazz Pharmaceuticals plc notified the U.S. FDA approval of a complementary Biologics License Application (sBLA) to add a MWF intramuscular (IM) dosing schedule for Rylaze.

- Report ID: 7461

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Asparaginase Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.