· An Outline of the Aseptic Carton Packaging Market

- Market Definition

- Market Segmentation

· Assumptions and Abbreviations

· Research methodology & Approach

- Research Process

- Primary Research

- Manufacturers

- Suppliers/Distributers

- End Users

- Secondary Research

- Market Size Estimation

· Summary of the Report for Key Decision Makers

· Forces of the Market Constituents

- Factors/Drivers Impacting the Growth of the Market

- Market Trends for Better Business Practices

- Key Market Opportunities for Business Growth

- Restraints

· Government Regulations

· Technology Transition and Adoption Analysis

· Industry Risk Analysis

· Global Economic Outlook: Challenges for Global Recovery and its Impact on Global Aseptic Carton Packaging Market

· Impact of COVID-19 on Global Aseptic Carton Packaging Market

· Industry Pricing Benchmarking & Analysis

· Industry Growth Outlook

· Industry Supply Chain Analysis

· Carton Packaging in Food & Beverage

· Analysis of Aseptic Paper Packaging Market by Thickness

· Cross Analysis of Aseptic Paper Packaging Thickness w.r.t. End-User

· Analysis on Aseptic Carton Packaging Market

· Analysis on Aseptic Carton Packaging in Food & Beverage Market

· Market Share of Manufacturers for Aseptic Carton Packaging in Food & Beverage

· Market Share of Manufacturers for Aseptic Carton Packaging in Dairy

· Analysis on Aseptic Carton Packaging Material Category

· Aseptic Carton Packaging Material Category

· Usage of Aluminum in Aseptic Carton Packaging in Food & Beverage and Dairy Industry

· End User Analysis

· Competitive Landscape

- Competitive Positioning

- Market Share Analysis, 2023

- Company Profiles

- Tetra Pak

- Detailed Overview

- Assessment of Key Offerings

- Analysis of Growth Strategies

- Exhaustive Analysis on Key Financial Indicators

- Recent Developments

- Elopak

- Mondi

- SIG

- Heli Packaging Technology (Qingzhou) Co., Ltd.

- NIPPON PAPER INDUSTRIES CO., LTD.

- UFlex Ltd. (Asepto)

- IPI S.r.l.

- LAMI PACKAGING (KUNSHAN) CO., LTD.

- Dai Nippon Printing Co., Ltd.

- Greatview Beijing Trading, Co., Ltd

- Tetra Pak

· Global Aseptic Carton Packaging Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Market Revenue by Volume (Thousand Tons) and Compound Annual Growth Rate (CAGR)

- Aseptic Carton Packaging Segmentation Analysis (2023-2036)

- By Packaging Type

- Standard/ Base shape, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Slim, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Square, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Food & Beverage, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Dairy, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Milk, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Yoghurt, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Ice Cream Mix, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Other Dairy Products, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Region

- North America, 2023-2036F (USD million) & Volume (Thousand Tons)

- Europe, 2023-2036F (USD million) & Volume (Thousand Tons)

- Asia Pacific, 2023-2036F (USD million) & Volume (Thousand Tons)

- Latin America, 2023-2036F (USD million) & Volume (Thousand Tons)

- Middle East & Africa, 2023-2036F (USD million) & Volume (Thousand Tons)

- By Packaging Type

· North America Aseptic Carton Packaging Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Market Revenue by Volume (Thousand Tons) and Compound Annual Growth Rate (CAGR)

- Aseptic Carton Packaging Segmentation Analysis (2023-2036)

- By Packaging Type

- Standard/ Base shape, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Slim, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Square, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Food & Beverage, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Dairy, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Milk, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Yoghurt, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Ice Cream Mix, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Other Dairy Products, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Country

- US, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Canada, 2023-2036F (USD Million) & Volume (Thousand Tons)

- By Packaging Type

· Europe Aseptic Carton Packaging Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Market Revenue by Volume (Thousand Tons) and Compound Annual Growth Rate (CAGR)

- Aseptic Carton Packaging Segmentation Analysis (2023-2036)

- By Packaging Type

- Standard/ Base shape, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Slim, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Square, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Food & Beverage, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Dairy, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Milk, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Yoghurt, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Ice Cream Mix, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Other Dairy Products, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Country

- UK, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Germany, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Italy, 2023-2036F (USD Million) & Volume (Thousand Tons)

- France, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Spain, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Russia, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Netherlands, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Rest of Europe, 2023-2036F (USD Million) & Volume (Thousand Tons)

- By Packaging Type

· Asia Pacific Aseptic Carton Packaging Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Market Revenue by Volume (Thousand Tons) and Compound Annual Growth Rate (CAGR)

- Aseptic Carton Packaging Segmentation Analysis (2023-2036)

- By Packaging Type

- Standard/ Base shape, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Slim, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Square, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Food & Beverage, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Dairy, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Milk, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Yoghurt, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Ice Cream Mix, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Other Dairy Products, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Country

- China, 2023-2036F (USD Million) & Volume (Thousand Tons)

- India, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Japan, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Singapore, 2023-2036F (USD Million) & Volume (Thousand Tons)

- South Korea, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Australia, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Thailand, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Vietnam, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Indonesia, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Philippines, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Rest of Asia Pacific, 2023-2036F (USD Million) & Volume (Thousand Tons)

- By Packaging Type

· Latin America Aseptic Carton Packaging Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Market Revenue by Volume (Thousand Tons) and Compound Annual Growth Rate (CAGR)

- Aseptic Carton Packaging Segmentation Analysis (2023-2036)

- By Packaging Type

- Standard/ Base shape, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Slim, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Square, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Food & Beverage, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Dairy, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Milk, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Yoghurt, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Ice Cream Mix, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Other Dairy Products, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Country

- Brazil, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Argentina, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Mexico, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Rest of Latin America, 2023-2036F (USD Million) & Volume (Thousand Tons)

- By Packaging Type

· Middle East & Africa Aseptic Carton Packaging Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Market Revenue by Volume (Thousand Tons) and Compound Annual Growth Rate (CAGR)

- Aseptic Carton Packaging Segmentation Analysis (2023-2036)

- By Packaging Type

- Standard/ Base shape, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Slim, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Square, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- By End-User

- Food & Beverage, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Dairy, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Milk, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Yoghurt, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Ice Cream Mix, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Other Dairy Products, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million) Volume (Thousand Tons), CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Country

- GCC, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Israel, 2023-2036F (USD Million) & Volume (Thousand Tons)

- South Africa, 2023-2036F (USD Million) & Volume (Thousand Tons)

- Rest of Middle East & Africa, 2023-2036F (USD Million) & Volume (Thousand Tons)

- By Packaging Type

Aseptic Carton Packaging Market Outlook:

Aseptic Carton Packaging Market size was valued at USD 16.26 billion in 2025 and is set to exceed USD 29.4 billion by 2035, expanding at over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aseptic carton packaging is estimated at USD 17.15 billion.

The growth of the market can be attributed to growing preference of customers towards natural food and beverages products. Consumer are getting more conscious about their health and hence their focus on organic food is growing. For instance, about 75% of adult in 2022 bought organic food owing to health concerns. Additionally, for the majority of customers, health became their first priority since the COVID-19 epidemic. Since many people believe organic foods to be healthier than conventional foods, interest in organic foods has grown. Also, changing lifestyle of people is also estimated to boost the demand for organic food, hence further boosting the growth of the market.

Organic or natural food and beverage are known to have various nutrients. Hence aseptic carton plays a significant role in preserving the nutrients present in food for longer period of time. Further, there has been growing wastage of food all across the globe. For instance, one third of the food produced annually is lost or wasted, and food loss and waste still contribute to about 7% of all global GHG emissions. Hence, the preference for aseptic carton is growing since it permits producers to keep their goods on the shelf for an extra six to twelve months without refrigeration. Therefore, the wastage of food at retailer and consumer level is reduced. Further, it enables food to maintain more color, texture, flavor, and nutrition while also ensuring that both food and packing materials are free of dangerous microorganisms when food is packaged. Hence, the demand for aseptic carton packaging is growing.

Key Aseptic Carton Packaging Market Insights Summary:

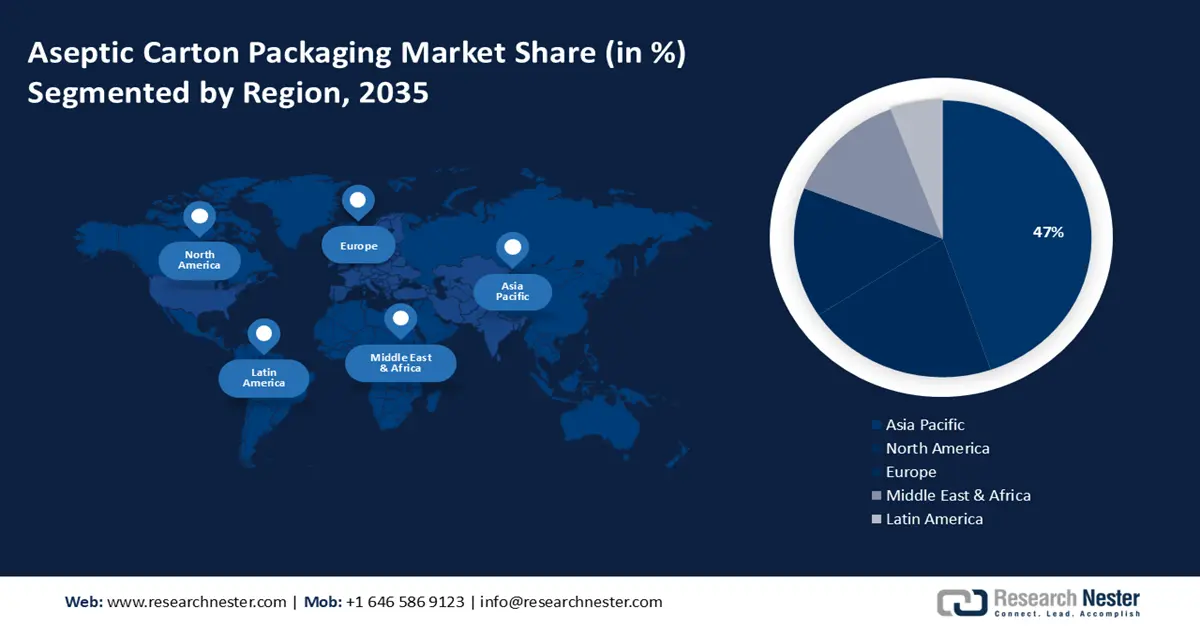

Regional Highlights:

- Asia Pacific aseptic carton packaging market is predicted to capture 47% share by 2035, driven by dairy demand, lifestyle changes, and rising purchasing power.

Segment Insights:

- The dairy segment in the aseptic carton packaging market is projected to hold a 60% share by 2035, driven by the rising need for eco-friendly packaging to extend shelf life of dairy products.

- The standard/base shape packaging segment in the aseptic carton packaging market is expected to secure the largest share by 2035, driven by customer preference for preservative-free packaging, especially for liquids.

Key Growth Trends:

- Growing Demand for Beverages Among People

- Surge in Demand for Ready-to-Eat Products

Major Challenges:

- Growing Demand for Beverages Among People

- Surge in Demand for Ready-to-Eat Products

Key Players: Tetra Pak, Elopak, Mondi, SIG, Nippon Paper Industries Co., Ltd., UFlex Ltd. (Asepto), IPI S.r.l., LAMI PACKAGING (KUNSHAN) CO., LTD., Dai Nippon Printing Co., Ltd., Heli Packaging Technology (Qingzhou) Co., Ltd., Greatview Beijing Trading, Co., Ltd.

Global Aseptic Carton Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.26 billion

- 2026 Market Size: USD 17.15 billion

- Projected Market Size: USD 29.4 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Aseptic Carton Packaging Market Growth Drivers and Challenges:

Growth Drivers

- Growing Demand for Beverages Among People- Beverages are thought to be the aseptic carton packaging market's most widespread application. Hence the growing demand for beverages is estimated to boost the market growth. Further among beverages, milk is estimated to be preferred by large number of people owing to its nutrients content. Across major demographics, an about 68% of adults believe that milk is the most nutrient-dense type of beverage. Among adults, about 38% think 2% milk is the healthiest option, while approximately 30% think whole milk is the best option. Hence, the use of aseptic carton packing is favored for such products since it preserves product quality, increases shelf life, and prevents contamination and microorganism growth. This is accomplished by sterilizing the packaging containers prior to packaging. Hence growing preference of people for milk is estimated to boost the growth of the market.

- Surge in Demand for Ready-to-Eat Products - The percentage of Americans who ate ready-to-eat food in 2020 was close to 35%.

- Rise in Investment for Food & Beverage Industry - Investment for food and beverage businesses surged by about 74% annually to approximately USD 4 billion in 2020.

- Upsurge in Wastage of Food - In the world, one-third of the food produced for human use is lost or squandered. This comes to nearly 2 billion tonnes annually, or about USD 2 trillion.

- Growth in Export of Beverages - Non-alcoholic beverage exports increased by about 25% between 2019 and 2020, from about USD 440 million to approximate USD 558 million.

Challenges

- Strict Government Regulation on Use of Plastic and Recycling Products - Aseptic cartons are food containers built with multi-layer packaging that has layers of paper, plastic, and metal. In order to increase efficiency, process, ability, and cost-effectiveness, plastic is often used in traditional aseptic packing. The usage of plastics is now subject to stringent rules set by governments around the world, which is estimated to have a negative effect on the aseptic carton packaging market. For instance, forks, plates, and polystyrene trays are just a few of the single-use plastic products that the UK government plans to outlaw in an effort to reduce plastic waste pollution. The following products would be prohibited: certain varieties of polystyrene cups and food containers; plastic plates, trays, bowls, cutlery; balloon sticks.

- Need for Greater Technology Understanding

- Fluctuating Prices of Raw Material

Aseptic Carton Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 16.26 billion |

|

Forecast Year Market Size (2035) |

USD 29.4 billion |

|

Regional Scope |

|

Aseptic Carton Packaging Market Segmentation:

End-user Segment Analysis

The global aseptic carton packaging market is segmented and analyzed for demand and supply by end-user into food & beverage, dairy, and others. Out of which, the dairy segment is anticipated to hold largest market share of 60% by the end of 2035, backed by a rising need for low-cost, environmentally friendly packaging options that could increase dairy products' shelf lives without sacrificing their quality. Also, there has been growing export of dairy products which is also increasing need for aseptic carton which would further increase the shelf life of dairy products and keep it fresh during export. For instance, there were about 253 shipments of dairy milk products from India, shipped by about 44 Indian exporters to approximately 85 buyers.

Packaging Segment Analysis

The global aseptic carton packaging market is also segmented and analyzed for demand and supply by packaging into standard/base shape, slim, square, and others. The standard/base shape segment is set to generate largest revenue share by 2035, backed by shifting customer preferences away from preservatives and any other harsh ingredients in food packing, especially liquid food products. Multiple layers of plastic, paperboard, and aluminum foil make up the aseptic container, which gives its contents a longer shelf life without the need for refrigeration or preservatives.

Our in-depth analysis of the global market includes the following segments:

|

By Packaging |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aseptic Carton Packaging Market Regional Analysis:

APAC Market Insights

Asia Pacific is set to dominate 47% aseptic carton packaging market share by 2035, backed by growing demand for quality and convenience products, a change in lifestyle of consumer, the surge of the dairy beverage market, and a rapid growth in purchasing power in the Asia-Pacific region. In 2018, the aggregate consumption of dairy products in Asia and the Pacific was more than 63 billion kg, with Asia accounting for about 94% of the consumption. The market for aseptic carton packaging would also be driven by the expanding demand for processed food in the market.

Europe Market Insights

The aseptic carton packaging market in Europe region is estimated to garner the second highest revenue by 2035. The growth of the market in this region can be attributed to increasing need for environmentally friendly packaging that is highly recyclable and keeps the nutritious value of the contents while extending the shelf life of the product. Hence, owing to the growing advantages of aseptic carton packaging, it is becoming highly preferred by most dietary-conscious beverage brands in Europe region. Additionally, to meet consumer demand, a number of businesses are concentrating on developing technological advances for the manufacture of aseptic cartons.

Aseptic Carton Packaging Market Players:

- Tetra Pak,

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Elopak,

- Mondi,

- SIG,

- Nippon Paper Industries Co., Ltd.,

- UFlex Ltd. (Asepto),

- IPI S.r.l.,

- LAMI PACKAGING (KUNSHAN) CO., LTD.,

- Dai Nippon Printing Co., Ltd.,

- Heli Packaging Technology (Qingzhou) Co., Ltd.,

- Greatview Beijing Trading, Co., Ltd.

Recent Developments

-

To assist customers in recycling their used beverage cartons using Milkbasket's app, Tetra Pak, a major manufacturer of packaging and processing solutions, partnered with Reliance-owned Milkbasket, India's first and largest daily micro-delivery service. Users of the Milkbasket app were able to participate in this project by placing a pick-up request through the app in addition to their regular grocery delivery order, and then simply leaving the old cartons in the Milkbasket bag outside their door.

-

Elopak announced the release of the Pure-Pak eSense carton, a more environmentally friendly aseptic carton constructed without an aluminium layer.

- Report ID: 4693

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aseptic Carton Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.