Automotive Artificial Intelligence Market Outlook:

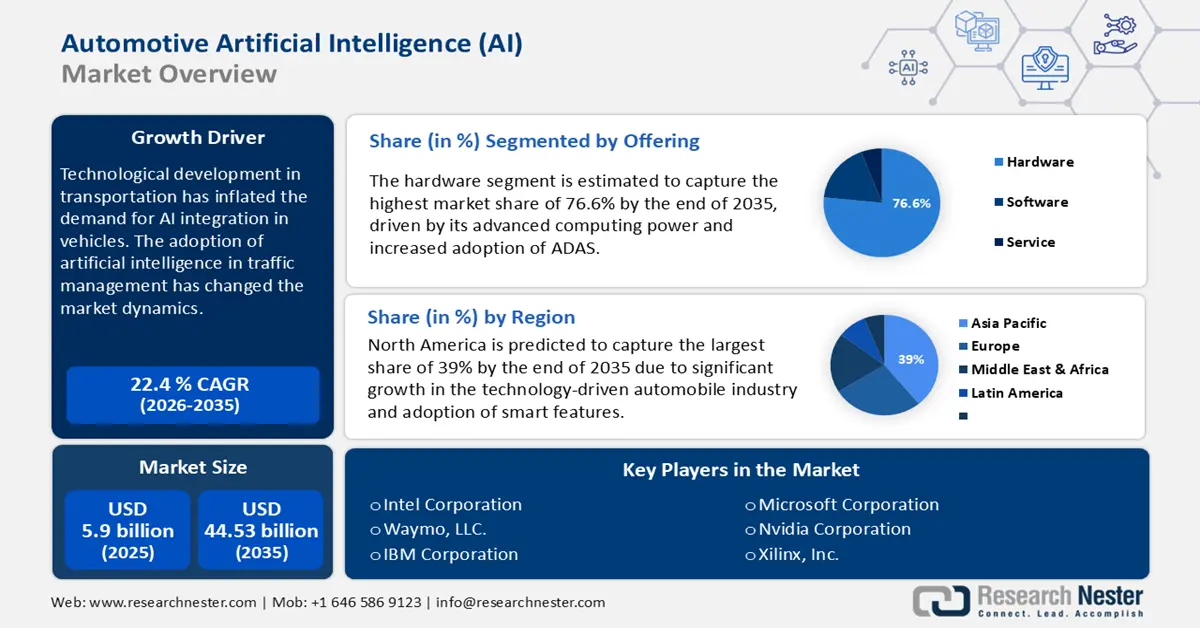

Automotive Artificial Intelligence Market size was valued at USD 5.9 billion in 2025 and is likely to cross USD 44.53 billion by 2035, registering more than 22.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive artificial intelligence is estimated at USD 7.09 billion.

Technological development in transportation has inflated the demand for AI integration in vehicles. The adoption of artificial intelligence in traffic management has changed the market dynamics. From public routing to logistics tracking, autonomous vehicles are improving consumer experience. The driverless concept has encouraged automakers to implement sensing technologies in cars.

Companies are investing in future developments in this sector. In January 2024, Volkswagen established a specialized AI laboratory to introduce new digital products. Such collaboration with technology inspires optimum usage of innovation in the automotive industry. Autonomous driving is being developed to offer consumers enhanced assistance for navigation and decision making. The automotive artificial intelligence market is enlarging with the gaining traction in predictive maintenance. Improved safety and reduced accidents are inspiring on-road release of AI-driven vehicles. Major player is leveraging machine learning to safety features and optimize supply chain process.

Key Automotive Artificial Intelligence (AI) Market Insights Summary:

Regional Highlights:

- North America automotive AI market will hold around 39% share by 2035, driven by integration of AI features in vehicles and government-backed research.

- Asia Pacific market projects lucrative growth during the forecast timeline, driven by infrastructure investments and partnerships to enhance smart driving technology.

Segment Insights:

- The hardware segment in the automotive artificial intelligence market is anticipated to capture a 76.60% share by 2035, driven by the growing need for high-performance processors and GPUs in automated vehicles.

- The machine learning segment in the automotive artificial intelligence market is anticipated to achieve a dominant share by 2035, driven by advanced computing power and its role in ADAS adoption.

Key Growth Trends:

- Increased safety during AV driving

- Consumer awareness of environmental stability

Major Challenges:

- Security concerns

Key Players: Intel Corporation, Waymo, LLC., IBM Corporation, Microsoft Corporation, Nvidia Corporation, Xilinx, Inc., Micron Technology, Inc., Tesla, Inc., General Motors Company, Ford Motor Company.

Global Automotive Artificial Intelligence (AI) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.9 billion

- 2026 Market Size: USD 7.09 billion

- Projected Market Size: USD 44.53 billion by 2035

- Growth Forecasts: 22.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 8 September, 2025

Automotive Artificial Intelligence Market Growth Drivers and Challenges:

Growth Drivers

-

Increased safety during AV driving: The fast-paced adoption of AI in vehicle testing turned out to be safer than human operation. Governments are also pushing driverless vehicle testing to promote human safety. According to a report published by the U.S. National Science Foundation in March 2023, artificial intelligence can reduce the testing miles to 99.99%. Software simulation-operated testing can be performed in a closed track and can save time and cost for test AVs. Increasing road accidents are also contributing to dependence on the automotive AI market.

According to a WHO report, published in December 2023, around 1.9 million people lose their lives each year due to traffic crashes. Additionally, 20 to 50 million people suffer from non-fatal injuries. The fully automated features have the potential to prevent such events. Real-time data comprehension of AI has reduced the risk of accidents by predicting and responding to potential hazards. Regulatory collaboration fosters safety standards and protocols in the automotive artificial intelligence market. Additionally, establishes public trust in autonomous driving technologies. - Consumer awareness of environmental stability: Focus on building sustainable transportation systems is impacting AI integrations in EVs. The collaboration of energy storage and AV technology aims to increase energy efficiency. Reinforcement of machine learning is also elevating the functionality of vehicles, enlarging the demand for AI. Integration of smart operating systems has also influenced EV adoption. Commercial connecting platforms are penetrating growth in the automotive AI market.

In October 2024, Uber launched an AI assistant for their drivers to promote EV adoption. This application will be powered by OpenAI’s GPT 4o, which can answer every possible question regarding EV. These robust systems are also being used to increase the efficiency of electric vehicles by optimizing safer battery storage. Educational campaigns about eco-friendly technology usage in AV help to make informed decisions. The transparency in the automotive artificial intelligence market also garners consumer loyalty. Further, increasing demand for more sustainable options.

Challenges

-

Expensive production cost: The initial cost of generating artificial intelligence for the automotive industry is high. The market growth is highly dependent on innovative solutions. Research and development of such AI systems can be expensive, limiting the accessibility of the automotive artificial intelligence market. The full potential of artificial intelligence is yet to be explored, which may result in a lack of operational knowledge. Hiring skilled professionals, who have expertise in both AI and automotive engineering can be difficult and costly. Thus, continued technological advancements may present challenges for manufacturers to keep up with the evolution.

-

Security concerns: Preservation of sensitive consumer data has always been a hurdle for deployment in the automotive artificial intelligence (AI) market. Stringent regional regulations can create compliance-related issues in adopting such mechanical advancement. Decision-making algorithms in AVs may raise questions about ethical accountability. Accumulating consumer trust in automated transportation is another difficulty in complete adoption. Gaining user confidence in its safety-critical application remains a major task before commercialization. Many automakers lack the availability of upgraded versions of these systems, making it difficult to incorporate AI in production.

Automotive Artificial Intelligence Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

22.4% |

|

Base Year Market Size (2025) |

USD 5.9 billion |

|

Forecast Year Market Size (2035) |

USD 44.53 billion |

|

Regional Scope |

|

Automotive Artificial Intelligence Market Segmentation:

Offering Segment Analysis

As per the offerings, the hardware segment is estimated to capture the highest share of 76.6% by the end of 2035 in the automotive artificial intelligence market. The transition of vehicles toward automation has raised the need for more powerful processors and GPUs. In March 2024, Nvidia Corporation launched its new Blackwell GPU. It can accelerate the computing power of a generative AI to deliver real-time data in vehicles. These are now accepted by reputed technology service providers including Microsoft, OpenAI, and Tesla. Developed sensor technologies including LiDAR, camera, and RADAR are propelling the demand for high-performance hardware. Developed sensor technologies including LiDAR, camera, and RADAR are propelling the demand for high-performance hardware.

Technology Segment Analysis

Based on technology, the machine learning segment is dominating the automotive artificial intelligence market. The growth in this segment is driven by its advanced computing power and increased adoption of ADAS. Swelling safety concerns in consumers while driving are demanding liable data processing in automotive artificial intelligence. The learning capability of AI form the real-world efficiently serves the purpose through their effective sensory processors. Usage of recent developments such as AI chips in decision-making algorithms has enhanced its capabilities. The ability to streamline operations in the supply chain is driving manufacturers to adopt AI solutions. Further, solidifying the dominance of machine learning.

Our in-depth analysis of the automotive artificial intelligence market includes the following segments:

|

Offering |

|

|

Technology |

|

|

Application |

|

|

Process |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Artificial Intelligence Market Regional Analysis:

North America Market Insights

North America industry is expected to dominate majority revenue share of 39% by 2035. Features such as cruise control, lane-keeping assist, and advanced parking systems are becoming standards for integrating AI into vehicles. Improved automobile performance and reduced data analysis downtime inspire automakers to invest in future developments. Shifting consumer expectations for enhanced functionality is creating scopes for innovation. Researchers are leveraging AI penetration for public usage through government funding. In March 2023, Mcity 2.0 was launched under the supervision of NSF and CCAT. This vehicle testing facility was run and optimized by the University of Michigan.

The U.S. is augmenting and experiencing massive growth in the automotive AI market. The collaboration of major tech companies and automakers is captivating investments in machine learning and computer vision in vehicles. The U.S. government is also shaping the standards of deployed autonomous transportation. In February 2023, the U.S. government introduced a 5-year SERI project, initiating a research facility NIST. This program was aimed to elevate the AI, cybersecurity, and communications in Avs. Increasing venture capital investment in the automotive sector is inspiring startups to adopt AI. In January 2024, Cerence collaborated with Microsoft to deliver AI-powered in-car experience to users. This model will simplify user access through the implementation of OpenAI ChatGPT.

Canada is also curating development in the automotive artificial intelligence market. The capability of maintenance prediction through analyzing vehicle data helps to reduce repair costs. Generative AI also helps automakers accumulate consumer preferences to offer them personalized solutions. Canada government is also funding research and development in this sector. They are focused on transitioning into smart transportation through machine learning technologies, including artificial intelligence. Such regulatory support is encouraging companies to introduce innovation in this industry. The strong industry presence of Canada is pioneering greater opportunities for investments.

APAC Market Insights

Asia Pacific is portraying lucrative growth opportunities in the automotive AI market. Developing countries such as India, Japan, China, and South Korea are heavily investing in infrastructure development. Regional automakers are focusing on integrating smart technologies in manufacturing automobiles. Governments are focusing on implementing driverless traffic practices to reduce road fatalities. Automobile leaders are collaborating to develop more convenient user interfaces for drivers. In September 2024, Hyundai Motor allied with Kia and Samsung Electronics to enhance the SDV user experience. This partnership was aimed to improve the connectivity between the vehicle and smartphone for smoother operation. According to the agreement, Kia will develop an AI-powered platform by 2025 for seamless connection.

India is predicted to become a large consumer base for the automotive artificial intelligence market in upcoming years. Growing adoption of AI in industries including transportation has inflated the demand for autonomous driving. The adaptive landscape has created a thriving ecosystem for startups and innovation in this sector. Investments in building smart cities are inspiring domestic automakers to integrate AI. Push towards green transportation, autonomous solutions are implemented to manufacture energy-efficient vehicles. Rising consumer expectations for personalized driving experience is enlarging the market. In September 2024, Honda began a joint research facility with IIT Delhi and IIT Bombay. This collaboration will work on developing CI for societies to realize a complete AI-powered system.

China is also emerging to lead the automotive AI market in this region. Inflating demand for smart features including AI navigation, voice recognition, and personalized infotainment systems is influencing automakers. The strong tech ecosystem and government backing are driving the continued expansion. This is further, fueling technological innovation in autonomous transportation. Favorable subsidies and policies are contributing to the deployment of self-driving vehicles on public roads. Local companies are also introducing innovative automatic systems to stand out in global competition. In October 2024, XPENG introduced a new AI-defined vehicle, XPENG P7+. This automobile can challenge international competitors through its affordable price range.

Automotive Artificial Intelligence Market Players:

- Intel Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Waymo, LLC.

- IBM Corporation

- Microsoft Corporation

- Nvidia Corporation

- Xilinx, Inc.

- Micron Technology, Inc.

- Tesla, Inc.

- General Motors Company

- Ford Motor Company

Leading companies in the automotive artificial intelligence market are now investing to develop their autonomous driving technologies. They are pushing research and innovation in this sector to offer improved user experience. The updated software-driven vehicles are now capable of delivering real-time insight data. ADAS solutions are being launched to suit and enhance EV operations. In May 2024, Autobrains launched a new design for an ADAS solution to implement liquid AI in EVs for China. Many automakers are partnering with tech companies to accelerate AI development. The key players in the automotive AI sector include:

Recent Developments

- In September 2024, Microsoft collaborated with KT in engineering to develop industry-specific AI solutions for the South Korea market. According to the agreement, KT will have access to leverage Microsoft Copilot Studio and Azure Studio. The collaboration is aimed at building customized AI systems for usage in industries, including in-vehicle infotainment.

- In May 2024, Intel Corporation launched an AI-enhanced software-defined vehicle (SDV) system-on-chip (SoC) to power the next-generation vehicles of China. In collaboration with Neusoft and ThunderSoft, Intel plans to develop this technology to create intelligent cockpits for automakers.

- Report ID: 1970

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Artificial Intelligence (AI) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.