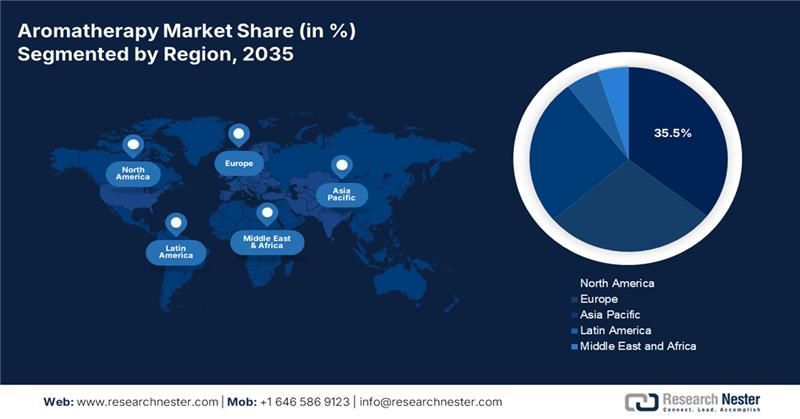

Aromatherapy Market - Regional Analysis

North America Market Insights

North America is dominating the aromatherapy market and is expected to hold the revenue share of 35.5% by 2035. The market is defined by high consumer awareness and disposable income. The key drivers include the strong integration of complementary health approaches into the mainstream wellness, with substantial consumer expenditure. The regulatory landscape governed by the FDA mandates strict compliance, shaping the product formulation and claims. The primary trend is the shift toward clinical validation and standardization, with research funding from agencies such as the NCCIH supporting studies related to the essential oils for pain and stress management. The market is also defined by the dominant direct-to-consumer and multi-level marketing models alongside rapid growth in e-commerce. The demand for certified organic and sustainably sourced products continues to rise, including the USDA and Canadian Organic standards.

The U.S. aromatherapy market is a mature, high-value sector driven by the deep consumer integration of the essential oils into daily wellness and self-care routines. The demand is propelled by the widespread use of complementary health approaches for stress, sleep, and pain management. The regulatory environment overseen by the FDA for cosmetics and dietary supplements and the FTC for advertising claims necessitates precise product positioning. The key trend is the growth of e-commerce and digital wellness platforms facilitated by federal telehealth expansion. Government research funding indirectly supports the market validation. For instance, the data from the PM&R KnowledgeNow in January 2025 indicates nearly 40% of the U.S. adults used a complementary health approach. This significant portion is related to non-vitamin natural products such as essential oils. This substantial baseline usage highlights the established demand.

Canada’s aromatherapy market operates within a robust regulatory framework as a subset of Natural Health Products governed by Health Canada, which ensures product safety, efficacy, and quality via pre-market licensing. Health Canada permits aromatherapy products containing essential oils to be marketed only if they comply with the official monographs covering ingredient eligibility, concentration limits, routes of administration, safety warning and permissible claims. The Government of Canada report in October 2025 shows that the Balsam essential oil and Balsam fir essential oil are used in aromatherapy to relieve joint/muscle pain related to sprain or rheumatoid arthritis. This official monograph system provides critical regulatory clarity for manufacturers while assuring consumers of product standardization and safety.

APAC Market Insights

The Asia Pacific is the fastest-growing aromatherapy market and is expected to grow at a CAGR of 9.4% during the forecast period 2026 to 2035. The market is defined by the powerful convergence of ancient wellness traditions and modern consumer trends. The primary demand drivers include rapidly expanding middle-class populations with increasing disposable income, a deep-rooted cultural heritage of using botanicals in traditional medicine systems, and a strong youth-driven focus on preventative health and mental wellbeing. The region is also a leading manufacturing hub for essential oils and diffusers, giving it significant supply chain advantages. The key trends shaping the market are explosive growth in social commerce and live stream shopping, the premiumization of products with clinically backed claims, and the rise of cosmetic aromatherapy, where skincare benefits are fused with scent therapy.

The aromatherapy market in China is considered as the largest in the APAC and is primarily fueled by the digital native health preservation trend among its vast urban population. The demand is concentrated on products that address sleep quality, stress relief, and air purification with smart app-connected diffusers and visually appealing gift sets dominating the e-commerce platforms. Nearly 81% of the population in China has used live stream commerce and social platforms to purchase items, according to the Darcy and Roy Press in 2024. The regulatory environment is robust, with the National Medical Products Administration classifying many infused products as cosmetics. The report from the OEC in 2023 indicates that the import value of the essential oil reached USD 348 million, underscoring the massive and stimulating scale of domestic demand. This growth path strongly establishes China as the global demand epicenter.

Japan’s aromatherapy market is a mature one and is defined by an uncompromising consumer demand for purity, scientific validation, and minimalist design. It is deeply integrated into the national wellness culture, complementing practices such as Shrinrin Yoku and serving as a recognized tool for relaxation in a high-pressure society. Products are commonly found in pharmacies, department store and integrated into hospitality and clinical care settings. The market is driven by the aging population and a strong preference for domestic brands with transparent sourcing. The NLM study in August 2022 indicates that the country is expected to have 7 million dementia patients by 2025. The study has demonstrated a measurable cognitive improvement in patients with mild Alzheimer’s disease following structured aromatherapy use, supported by a validated clinical scale (GBS). It strengthens the clinical evidence base that highlights the interest from memory care centers, geriatric clinics, long-term care facilities, and integrative medicine programs.

Europe Market Insights

The Europe’s aromatherapy market operates within an advanced and complex regulatory ecosystem governed by EU-wide directives on cosmetics, health claims, and product safety. A primary market driver is the region’s robust and established wellness culture, which views aromatherapy as a complementary approach to conventional healthcare for stress relief, sleep improvement, and general well-being. This demand is further amplified by an aging population seeking non-pharmacological interventions for chronic pain and mood management. The most significant trend is the rapid expansion of the e-commerce channel, which has democratized access to a wide variety of essential oils and diffusers, fueling direct-to-consumer sales growth. However, this is tempered by robust regulations requires that any therapeutic claims be substantiated with scientific evidence.

Germany represents Europe’s most advanced aromatherapy market and is driven by a deeply ingrained cultural acceptance of plant-based therapies within its complementary healthcare systems. The profession of the non-medical practitioner legally utilizes the essential oils, creating a formal B2B demand and high consumer trust. The OEC 2023 data indicate that Germany imports essentials worth USD 322 million. This established import volume represents a significant portion of Europe's trade and underscores a mature and industrial-scale supply chain. This foundation supports the market leader who invests in clinical-grade quality advanced diffusion technology and pharmacist-endorsed product lines. A key trend is the formalization of aromatherapy protocols within hospital palliative care and corporate wellness programs.

The UK’s aromatherapy market is defined by a strong consumer-led demand integrated into mainstream wellness and self-care routines. It operates within a clear post Brexit regulatory framework where products are predominantly governed by retained EU cosmetics regulations prohibiting unauthorized medical claims. The key drivers include the widespread retail and online availability of products, a focus on mental well-being, and the premiumization of brands offering clinical-grade blends and sustainable sourcing. Government health data highlights the context for this demand. The Mental Health Foundation report in 2025 highlights that the 37.1% of women and 29.9% of men described high levels of anxiety, a primary condition for which consumers turn to aromatherapy, sustaining consistent market growth. This demographic trend creates a robust, sustained consumer base for stress-relief products.