Aroma Chemicals Market Outlook:

Aroma Chemicals Market size was over USD 6.25 billion in 2025 and is poised to exceed USD 10.38 billion by 2035, witnessing over 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aroma chemicals is estimated at USD 6.54 billion.

The growth of the market can be attributed to the growing personal care and cosmetics industry, along with rising consumer spending worldwide. For instance, the global revenue in the beauty and personal care industry is estimated to be 530 billion USD as of 2022. Also, in the United States, the beauty & personal care industry generated USD 84 billion in 2022. Rising preference among people to improve and maintain personal grooming and good physical appeal. Also, increasing consumer awareness to maintain personal hygiene with the growing prevalence of skin disorders and hygiene-associated infections is estimated to drive market growth during the forecast period. The increasing restrictions in the organization on following grooming habits for work are also rising the purchase of personal care products.

Aroma chemicals are found in a variety of products, including seasonings, food, beverages, personal care products, cleaning products, essential oils, air fresheners, and others. The demand for sustainable products with a minimal carbon footprint is growing, driving the growth and setting trends for the global aroma chemicals market, as well as the larger industries themselves. The growing preference for sustainable goods or products to support or save the environment among people is rising day by day. The rising demand for organic products among people that are made from renewable products to reduce side effects is projected to drive market growth. Organic products are in high demand as they do not contain any synthetic chemicals that damage human health. The combustion or decomposition of these organic products is less harmful compared to other conventional products which release greenhouse gases into the air.

Key Aroma Chemicals Market Insights Summary:

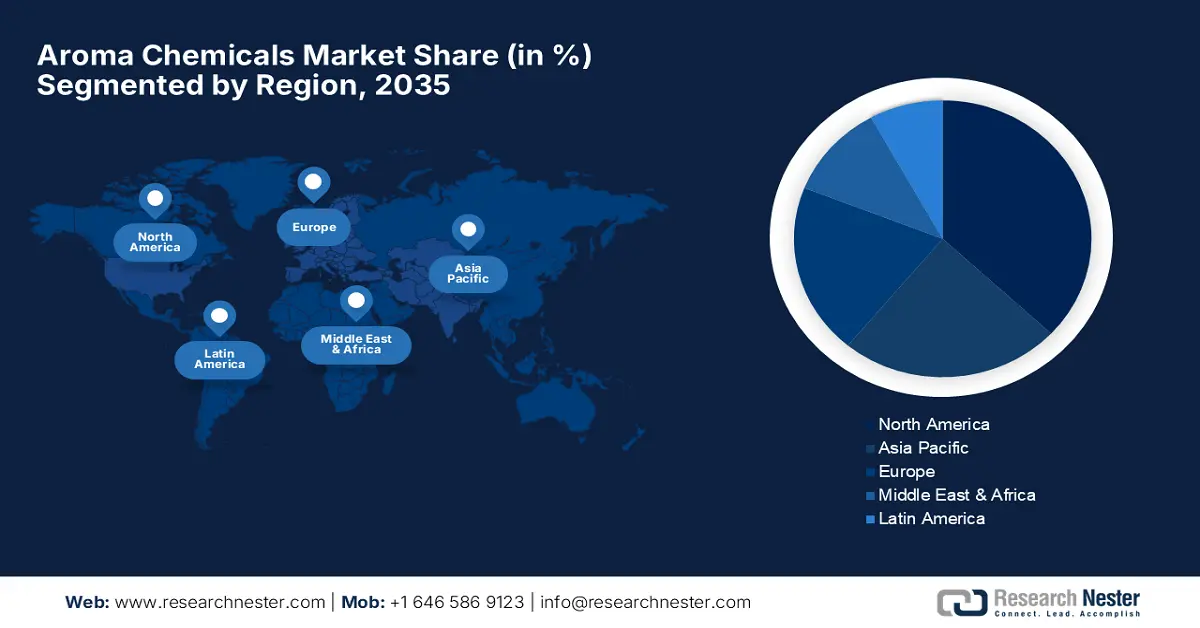

Regional Highlights:

- North America aroma chemicals market commands the largest share by 2035, driven by the growing demand for different types of chemical products and aroma chemicals.

Segment Insights:

- The liquid segment in the aroma chemicals market is anticipated to hold a significant share by 2035, driven by the increasing use of liquid aroma products in aromatherapy.

- The synthetic segment in the aroma chemicals market dominates with the largest share, driven by the availability of over 2000 synthetic ingredients, forecast period 2026-2035.

Key Growth Trends:

- Rising Consumer Spending Across the World with Increasing Disposable Income

- Rising Demand for the Creation of Sustainable Products with Increasing Awareness Among Individuals

Major Challenges:

- Health and Environmental Concerns Related to Manufacture and Usage

- Strict Government Regulations Regarding the Use of Hazardous Chemicals

Key Players: BASF SE, SH Kelkar and Company Private Limited, Givaudan, International Flavors & Fragrances Inc., Takasago International Corporation, Solvay, Symrise AG, Robertet, Kao Chemicals Europe, S.L.U., Destilaciones Bordas Chinchurreta S.A.

Global Aroma Chemicals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.25 billion

- 2026 Market Size: USD 6.54 billion

- Projected Market Size: USD 10.38 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Aroma Chemicals Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Consumer Spending Across the World with Increasing Disposable Income – The global spending on aromatic products in any industry had declined during the pandemic, except the ones with medicinal properties. With consumer income increasing and spending returning to pre-pandemic levels, growth can be expected in the global aroma chemicals market as well. According to the World Bank, the gross net income per capita increased from USD 10,075 in 2005 to USD 18,508 in 2021 across the globe.

-

Rising Demand for the Creation of Sustainable Products with Increasing Awareness Among Individuals – It has been found in a survey that over 65% of people while shopping, think of sustainability around the world.

-

Increasing Use of Organic Products Among People to Minimize Environmental Harm –According to research, in the U.S., organic food products only sold for USD 20 billion in 2010 and reached USD 50 billion in 2020.

-

Growing Use of Cosmetics Among People with a Growing Preference to Look Good –According to a study, over 295.7 million Americans were using deodorant in 2020. By 2024, the number of deodorant users is expected to increase to 305 million.

-

Use in Aromatherapy and Essential Oils Owing Rising Mental Illnesses – Essential oils and aromatherapy have been used for over a thousand years and are now growing in use and practice. Hence, it is expected to surge the market’s growth in the upcoming years. Over 32% of Americans believe in the benefits of aromatherapy.

Challenges

-

Health and Environmental Concerns Related to Manufacture and Usage – as aroma chemicals are organic compounds that volatilize, or vaporize into the air. The volatile organic chemicals (VOCs) emitted by aromatic products may contribute to poor indoor air quality (IAQ) and are associated with a variety of adverse health effects, including headaches, nausea, dizziness, dementia, and respiratory symptoms.

-

Strict Government Regulations Regarding the Use of Hazardous Chemicals

-

High Competition among Prominent Players and Wars Associated with Cost Differences

Aroma Chemicals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 6.25 billion |

|

Forecast Year Market Size (2035) |

USD 10.38 billion |

|

Regional Scope |

|

Aroma Chemicals Market Segmentation:

Type Segment Analysis

The global aroma chemicals market is segmented and analyzed for demand and supply by type into synthetic, and natural. Out of them, the synthetic segment is expected to capture the largest market share in 2035. This is owing to their huge existence along with their widespread use in a variety of industries. This is attributed to the fact that about 500 natural raw ingredients exist, whereas there are over 2000 synthetic elements to choose from, as per the reported data. The aroma products are made from synthetic chemicals that imitate the natural odors of fruits and flowers to give them in sweet and subtle smell. Synthetic chemicals are mostly prepared from petrochemicals, and these types of chemicals are used in manufacturing industries, where they produce perfumes and scented products such as soaps, deodorants, toilet cleaners, etc. Synthetic chemicals are cheaper than natural chemicals as they are made artificially. These chemicals can be harmful to humans as they are made from by-products of petroleum-based substances.

Form Segment Analysis

The global aroma chemicals market is also segmented and analyzed for demand and supply by form into dry and liquid. Amongst these two segments, the liquid segment is expected to garner a significant share. Liquids are used in various forms such as perfumes, oils, scents, and sprays. The increasing concern of people to mask their body order costs from sweat tap is also increasing the demand for liquid aroma chemicals market. Liquids are the main component of aromatherapy. Moreover, aromatherapy is a popular treatment to reduce stress, headaches, and migraines and can help to recover from depression or anxiety. Also, disorders of pain, heart disease, digestion problems, cold, cough, or any other respiratory disorder can be cured with aromatherapy. The sales of essential oils, resinoids, perfumery, and toilet preparations in China in the year 2021 were USD 160,400,900 up from the base of USD 140,330,300 in the year 2020 as per the estimations. Various plant parts are used to extract essential oils, and are dissolved in bathing water, and used for massage during aromatherapy. Also, solid perfumes are very expensive, and they consume more raw materials. Liquid perfumes stay longer than solid perfumes and are cheaper in price.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Product |

|

|

By Application |

|

|

By Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aroma Chemicals Market Regional Analysis:

North American Market Insights

The North America aroma chemicals market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The growth of the market can be attributed majorly to the growing demand for different types of chemical products amongst the different end-users, along with the growing demand for aroma chemicals. For instance, in 2021, over 990 million tons of chemical products were shipped across the United States. The aroma chemicals are used in the manufacturing of perfumes or scents. These chemicals are extracted from natural sources from the distillation process. Also, many synthetic chemicals are used for the preparation of aroma chemicals with natural scents or flavors. Air fresheners, room fresheners, cosmetic products such as hair care, skincare, and personal care products, soaps, lotions, and shampoos contain aroma chemicals. All these products have huge demand in the region as people’s spending capacity is growing going to high disposable income.

Aroma Chemicals Market Players:

- ·BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SH Kelkar and Company Private Limited

- Givaudan

- International Flavors & Fragrances Inc.

- Takasago International Corporation

- Solvay

- Symrise AG

- Robertet

- Kao Chemicals Europe, S.L.U.

- Destilaciones Bordas Chinchurreta S.A.

Recent Developments

-

International Flavors and Fragrances Inc. and Evolva, a Swiss biotech firm, have entered into a new partnership agreement to further develop and commercialize vanillin.

-

BASF SE joins the market for natural F&F components by purchasing Isobionics, and through a collaboration agreement with Conagen, a biotechnology research leader.

- Report ID: 4604

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aroma Chemicals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.