Armored Vehicle Market Outlook:

Armored Vehicle Market size was over USD 36.43 billion in 2025 and is poised to exceed USD 59.91 billion by 2035, witnessing over 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of armored vehicle is estimated at USD 38.1 billion.

The growth of the market can be attributed to the increasing spending on defense, which spends a large percentage of that amount on the manufacturing or importing of armored vehicles to make the defense system robust for any major or minor combat situation. Furthermore, the rising use of combat vehicles worldwide for suppressing military and civilian unrest is also estimated to flourish the market growth over the forecast period. According to the United States Government Accountability Office, defense spending amounted to USD 714 billion in 2020 and more than USD 730 billion in FY 2021.

Global armored vehicle market trends such as, rising terrorism and anti-national activities have led to an increased demand for such vehicles, for protection from both domestic and international threats, and are estimated to influence the growth of the market over the forecast period. It is estimated that there are around 90,000 armored vehicles in use currently across the globe. The main armored vehicle for bigger military units is the tank, whereas further military kinds include amphibious landing vessels, infantry fighting vehicles, and others. As of 2021, Egypt became the country to have the highest number of military combat tanks, which sums up to around 4000.

Key Armored Vehicle Market Insights Summary:

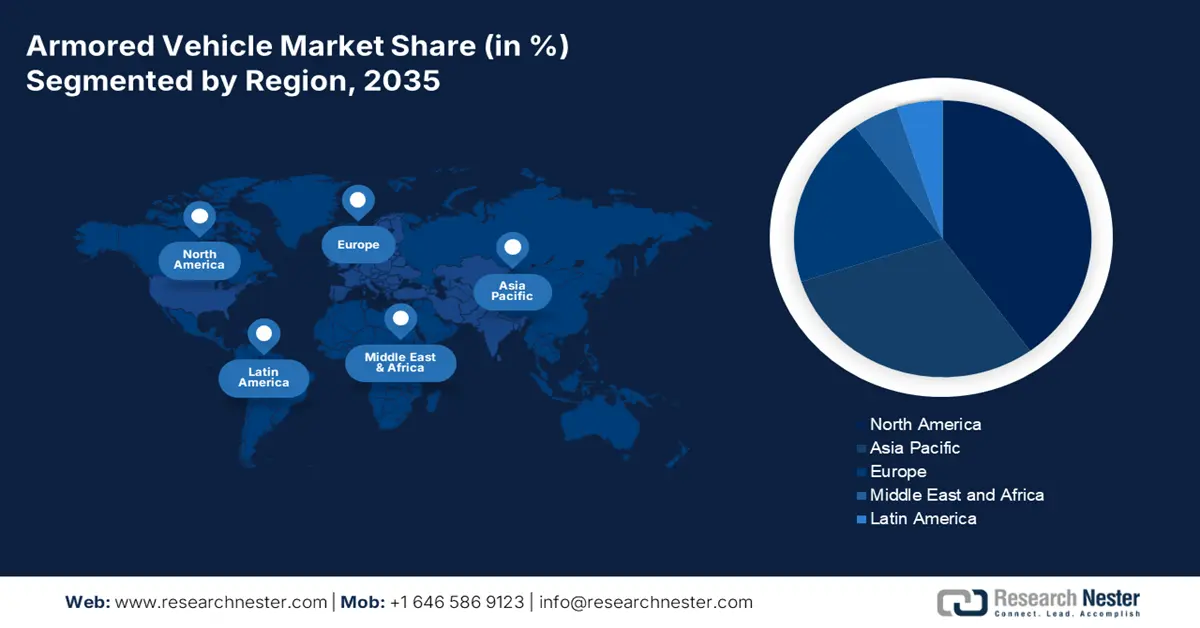

Regional Highlights:

- North America armored vehicle market holds the largest share by 2035, driven by high U.S. defense spending, modernization of fighting vehicles, and advanced tank capabilities.

Segment Insights:

- The military segment in the armored vehicle market is expected to hold the largest share by 2035, driven by geopolitical tensions, terrorism, and rising global defense budgets.

- The heavy armor vehicle segment in the armored vehicle market is anticipated to hold the largest share by 2035, fueled by its high utility in defense and protection from heavy artillery.

Key Growth Trends:

- Rising Spending on Global Military Across the Globe

- Increment in Organized and Riot Crime

Major Challenges:

- High Costs of Acquisition and Maintenance

- Delays in Production and Delivery

Key Players: General Dynamics Corporation, BAE Systems plc, Oshkosh Defense, LLC, Rheinmetall Group, Krauss-Maffei Wegmann GmbH & Co. KG, Hyundai Rotem Co., Ltd., Nexter group KNDS, Craft Machine Inc., Lenco Industries, Inc., Lockheed Martin Corporation.

Global Armored Vehicle Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 36.43 billion

- 2026 Market Size: USD 38.1 billion

- Projected Market Size: USD 59.91 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Russia, China, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Armored Vehicle Market Growth Drivers and Challenges:

Growth Drivers

- Growing Threat of Terrorism - It is estimated that over 20,000 people died owing to the terrorist-related activities in 2019.

- With the increasing audacity of terrorist groups, the use of armored vehicles is bound to increase and is expected to boost the armored vehicles market in the forecasted period. When a country owns a huge number of armored vehicles, it shows the power owned by the country to the world and escalates its reputation on a global scale.

- Rising Spending on Global Military Across the Globe – There has been rising spending on military through installation of various equipment in armored vehicles, such as handheld imagers, that is further expected to drive the market’s growth over the forecast period. Furthermore, the high military spending across the globe in relation to different countries in order to provide more security to the citizens of those countries. As per the estimated data, 62% of the world's military spending was made by the top 5 defense spenders—the United States, China, India, Russia, and the United Kingdom. The United States allotted USD 780 billion for the defense industry in 2020, a 4% increase from 2019.

- Increment in Organized and Riot Crime – There has been an increase in the riot crime cases across the globe, and it is anticipated to boost the growth of the global armored vehicle market. For instance, it was observed that in India, 51,500 cases of riots were registered in 2020, an increase of 5,000 cases from 2019.

- Growing Advancement and Advent of Unmanned Vehicles - According to data, over the course of the missions, more than 130 US Air Force, Army, Navy, and Marine Corps EOD soldiers were killed in Iraq.

- Increased Use in Private Security – According to statistics, over 1 million people were employed in private security in the U.S.

Challenges

- High Costs of Acquisition and Maintenance – The most of the estimated acquisition costs are spent on remanufactured and upgraded versions of current vehicles, and it is expected to restrain the market’s growth. For instance, it is projected that the total acquisition costs for the Army’s ground combat vehicles in the United States will reach nearly 5 billion per year till 2050.

- Delays in Production and Delivery

- Geopolitical Restraints and Factors

Armored Vehicle Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 36.43 billion |

|

Forecast Year Market Size (2035) |

USD 59.91 billion |

|

Regional Scope |

|

Armored Vehicle Market Segmentation:

End-user

The global armored vehicle market is segmented and analyzed for demand and supply by end-user into military and civilian. Out of these sub-segments, the military segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the increasing geopolitical issues, acts of terrorism, and military spending, followed by the increasing global budget on defense. The military, also known as the armed forces, is described to be the largest group of international ambassadors since it has the highest responsibility to show. The military is a highly organized group that deals with multiple missions, whether they are national or international. For instance, the world military expenditure crossed over USD 2000 billion in 2022. Additionally, the military has the highest number of armored vehicles, backed by the escalated export/import volumes of tanks and other armored vehicles. For instance, in 2022, Ukraine imported 240 T-20 tanks from Poland and nearly 150 M133 armored personnel carriers from the United States.

Armor

The global armored vehicle market is also segmented and analyzed for demand and supply by armor into heavy, medium, and light armor vehicle. Out of these, the heavy armor vehicle segment is anticipated to hold the largest market size over the forecast period owing to its highly utilization in the defense system. Moreover, heavy armor vehicles have the capacity to include multiple types of weapons in a single vehicle. Tanks are the most common example of heavy armor vehicles, and they are used in the military at a higher scale. Germany is known to produce and sell a higher number of the main battle tank (MBT), Hence, the country is very popular with foreign armies. In addition, these tanks provide protection from the artillery ammunition that is further anticipated to boost the segment’s growth in the market. Furthermore, these vehicles provide excellent protection against suspicious attackers. For instance, it has been observed that it takes only 6 seconds for attackers to complete their task. Hence, with the help of heavily armed vehicles, their users are provided with sufficient time to realize that they are under attack and can plan accordingly.

Our in-depth analysis of the global armored vehicle market includes the following segments:

|

By Platform |

|

|

By Movement |

|

|

By Role |

|

|

By End-User |

|

|

By Armor |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Armored Vehicle Market Regional Analysis:

North American Market Insights

The North America armored vehicle market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The growth of the market can be attributed to the fact that the United States is the country with the highest spending on defense and military in the world. Furthermore, in the announced Defense Budget of 2023 by the United States Department of Defense, an estimated USD 773 billion will be spent on defense in total, with USD 12.6 billion to modernizing army and marine corps fighting vehicles. The United States is quite developed when it comes to its tank force since it has the world’s largest tank force. In 2020, the United States was observed to have around 5000 tanks in the active position and a stock of approximately 2000 in reserve. Additionally, it has the most advanced tanks in the world which are M1 Abrams Tanks. Hence, such factors are estimated to hike the market growth in the region over the forecast period.

Armored Vehicle Market Players:

- General Dynamics Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BAE Systems plc

- Oshkosh Defense, LLC

- Rheinmetall Group

- Krauss-Maffei Wegmann GmbH & Co. KG

- Hyundai Rotem Co., Ltd.

- Nexter group KNDS

- Craft Machine Inc.

- Lenco Industries, Inc.

- Lockheed Martin Corporation

Recent Developments

-

General Dynamics Corporation’s modification contract was recently won by Land Systems, a division of General Dynamics Corporation, to procure replacement parts for the Light Armored Vehicle class of vehicles, as well as the Abrams Main Battle Tank. The USD 414.7 million contract is anticipated to be finished on September 28, 2029.

-

BAE Systems was offered a contract of building multiple ACV-30 production-ready test vehicles (PRTVs) by the U.S. Marine Corps. To constitute these PRTVs, Marine Corps awarded USD 88 million. AVC-30 is designed in a way to increase crew protection and to reduce weight.

- Report ID: 4586

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Armored Vehicle Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.