Application Development Software Market Outlook:

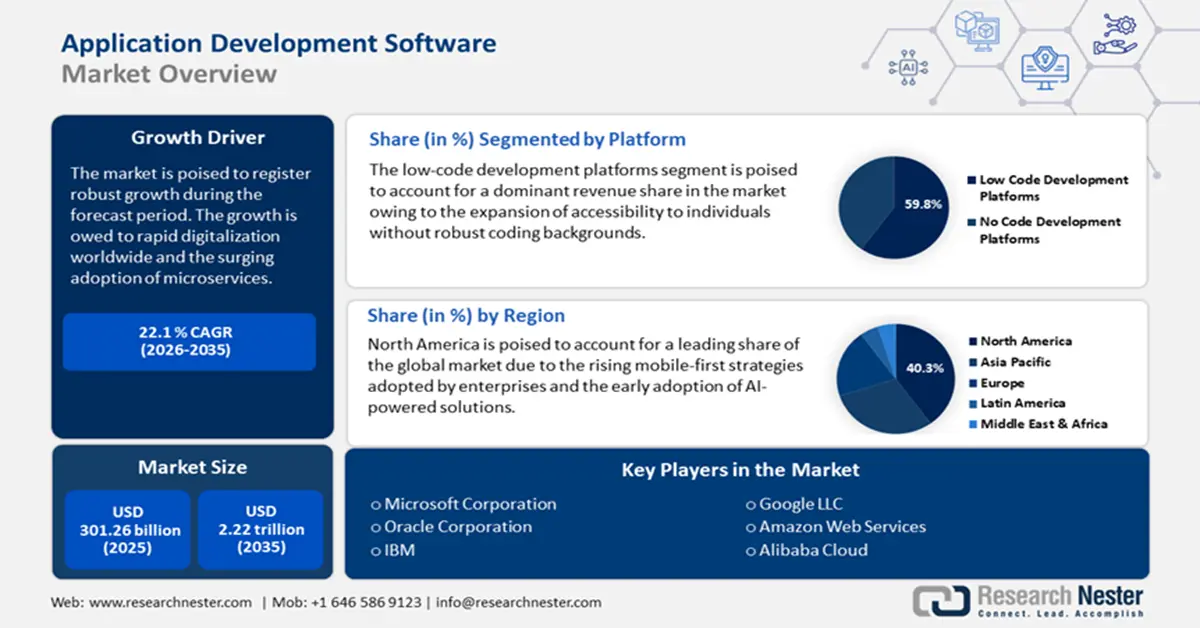

Application Development Software Market size was over USD 301.26 billion in 2025 and is poised to exceed USD 2.22 trillion by 2035, growing at over 22.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of application development software is estimated at USD 361.18 billion.

The global application development software market is driven by the rising demand for agile, scalable, and user-centric software solutions across industries. With businesses across varied sectors transitioning to digitization to improve operational efficiency, the requirement for developmental tools has surged. The increasing adoption of low-code and no-code platforms are hallmarks of the market growth by enabling individuals with minimal coding expertise to develop user-friendly applications, thereby accelerating development cycles and reducing time-to-market. In addition, a significant market driver is the exponential rise in mobile applications. The trends have led to businesses prioritizing mobile-first strategies to capture engaged, on-the-go audiences. Multiple industries, from gaming to healthcare rely on feature-rich mobile apps for personalized user experiences. The shift has spurred the demand for cross-platform development tools that simplify building apps for iOS and Android simultaneously to reduce the time-to-market (TTM). The table below highlights the largest smartphone penetration by country.

Smartphone Penetration by Country

|

Name of the Country |

Smartphone Users |

Smartphone Penetration |

|

China |

974.69 million |

68.4% |

|

India |

659.00 million |

46.5% |

|

The U.S. |

276.14 million |

81.6% |

|

Indonesia |

187.70 million |

68.1% |

|

Brazil |

143.43 million |

66.6% |

Opportunities within the application development software are abundant in AI-driven development tools. The surging investments in AI coding assistants reflect the potential within the market to promote tools that automate coding tasks. For instance, in January 2025, Citigroup announced the deployment of AI coding tools to 30,000 developers in the transition to modernization. Moreover, multiple trends are expected to converge boosting the market’s growth throughout the forecast period, such as the shift toward cloud-native architectures and the rising emphasis on cybersecurity. As mobile apps evolve into primary interfaces for customer interaction, the proliferation is poised to reinforce the sustained growth of the market by the end of 2035.

Key Application Development Software Market Insights Summary:

Regional Highlights:

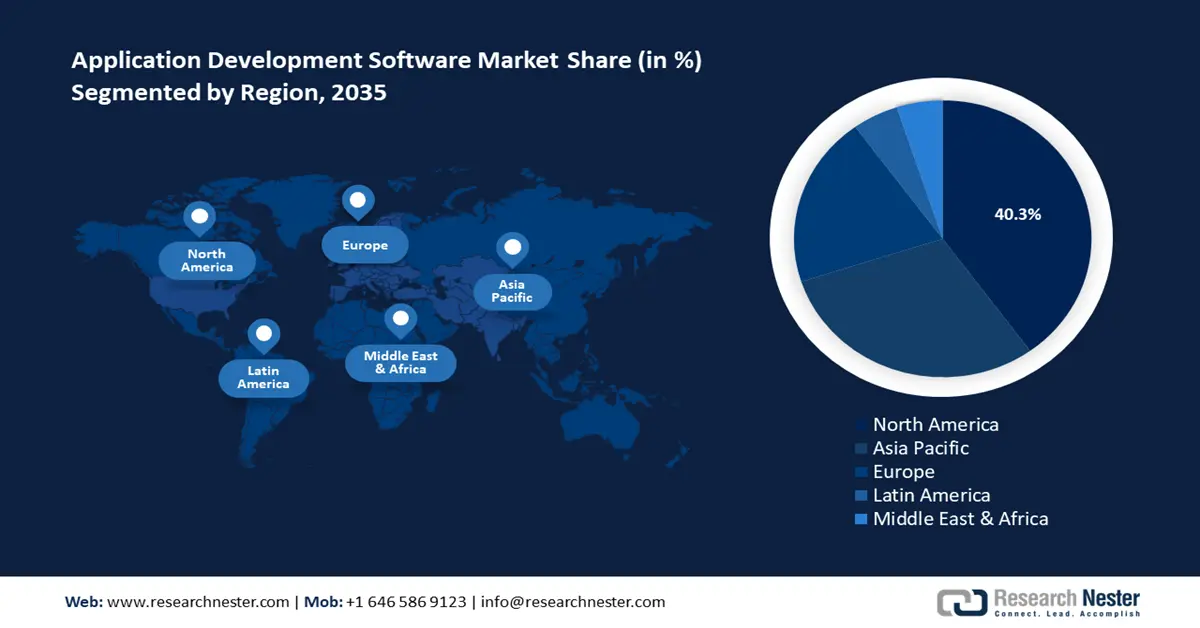

- North America holds a 40.3% share in the Application Development Software Market, propelled by early adoption of AI/ML tools and mature cloud infrastructure, driving robust growth through 2035.

- The APAC Application Development Software Market is expected to hold the second-largest share by 2035, driven by substantial proliferation of mobile devices and sustained digital transformation.

Segment Insights:

- The No Code Platform segment is projected to achieve a 40% share by 2035, fueled by the growth of citizen development initiatives for non-technical users.

- Low Code Platform segment is expected to capture a 59.80% share by 2035, driven by enabling faster app development with minimal coding and broad accessibility.

Key Growth Trends:

- Rising adoption of microservices and containerization

- Expansion of hybrid work models

Major Challenges:

- Fragmentation of development frameworks

- Security vulnerabilities in low-code and no-code platforms

- Key Players: Microsoft Corporation, Oracle Corporation, IBM, Salesforce, SAP SE, Amazon Web Services, Adobe Inc., Alibaba Cloud, Google LLC, Atlassian, Cisco Systems, Siemens AG.

Global Application Development Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 301.26 billion

- 2026 Market Size: USD 361.18 billion

- Projected Market Size: USD 2.22 trillion by 2035

- Growth Forecasts: 22.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, United Kingdom

- Emerging Countries: China, India, Singapore, Brazil, Mexico

Last updated on : 12 August, 2025

Application Development Software Market Growth Drivers and Challenges:

Growth Drivers

- Rising adoption of microservices and containerization: The shift toward modular, cloud-native architectures enables enterprises to build scalable applications. The proliferation of microservices benefits the sector’s expansion. Development tools that streamline container orchestration, service discovery, distributed system management, etc., are gaining traction. The largest demand is expected to arise from the fintech and SaaS sectors. Moreover, the transition of enterprises from legacy systems to cloud-native frameworks prioritizes development tools that automate container management. Additionally, the Cloud Native Computing Foundation’s (CNCF) report in 2022 reflects that 96% of organizations worldwide leverage Kubernetes for container orchestration.

- Expansion of hybrid work models: The growing popularity of hybrid and remote work models has intensified the demand for collaborative development environments. The expansion of such work models influences the application development software market by reshaping how teams collaborate and deliver software solutions. The demand for tools that bridge geographic gaps in cloud-based development environments marks growth opportunities. The U.S. Bureau of Labor Statistics has highlighted that more than 50% of U.S. businesses have adopted cloud-based collaboration tools by 2023 while the European Commission indicates that more than 70% of enterprises in the EU adopted hybrid work tools by 2022 as per the EU Digital Economy Index.

- Growth of enterprise data: The rapid increase in enterprise data has necessitated advanced application development software solutions to manage and analyze actionable insights, contributing to the demand growth in the application development software market. The advent of AI has contributed to the surge in data. In January 2024, IBM Corporation released a report indicating that 42% of enterprise-scale companies had actively deployed AI in their businesses. The trends have created lucrative opportunities for the adoption of application development tools to create custom software that can prove real-time analytics. The table below highlights the AI uptake rates based on surveys of various respondents in the U.S.

|

Name of Institution |

|

Survey Dates |

AI Uptake |

|

Center for Economic Studies |

164,500 firms |

Sep 2023-Feb 2024 |

5% |

|

Federal Reserve Bank of New York |

350 firms |

August 2024 |

25% (Service), 16%(Manufacturing) |

|

Federal Reserve Bank of Dallas |

363 firms |

April 2024 |

38.30% |

|

Federal Reserve Bank of Richmond |

211 firms |

May 24-June 24 |

34% |

Challenges

- Fragmentation of development frameworks: The evolution of programming languages, frameworks, and DevOps tools has led to fragmentation in the application development ecosystem. Multiple frameworks such as React, Angular, Vue.js, Flutter, etc., have unique libraries and dependencies. The lack of standardization complicates software maintenance which makes it challenging for seamless cross-platform compatibility.

- Security vulnerabilities in low-code and no-code platforms: Despite low-code and no-code platforms expanding the accessibility of application development software solutions, they have also added security risks. The advent of non-technical users in building applications can lead to bottlenecks in security measures. Many enterprises face challenges in governing and securing applications developed outside traditional IT frameworks leading to vulnerabilities in the sector’s growth.

Application Development Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

22.1% |

|

Base Year Market Size (2025) |

USD 301.26 billion |

|

Forecast Year Market Size (2035) |

USD 2.22 trillion |

|

Regional Scope |

|

Application Development Software Market Segmentation:

Platform (Low Code Development Platforms, No Code Development Platforms)

Low code development platform segment is poised to dominate over 59.8% application development software market share by 2035. Low-code development platforms have gained considerable traction by assisting developers to build applications with minimal hand-coding, by utilizing pre-built components and visual interfaces. Furthermore, the low code development platforms make application creation more accessible to individuals without extensive coding platforms. For instance, financial institutions leverage low-code workflows aligned with regulations such as the EU’s GDPR or Japan’s FSA guidelines. Opportunities arise in the government's adoption of low-code solutions to modernize citizen services. Recent market movements include Globant’s acquisition of low-code platform GeneXus to expand its product portfolio announced in April 2022.

The no-code development platform segment is poised to hold more than 40% revenue share in the application development software market by the end of 2035. A key factor of the segment’s profitable expansion is the accessibility to non-technical users to build functional apps via drag-and-drop interfaces. Furthermore, a major driver of the segment is the growth of citizen development initiatives which is estimated to bolster adoption of no-code development platforms. In September 2024, Kissflow released its Citizen Development Trends 2024 report based on insights from Chief Information Officers (CIOs) from enterprises with more than 5000 employees. The survey report highlights that 83% of respondents have an active citizen development program.

Deployment Mode (On-Premise, Cloud-Based)

The on-premise segment in application development software market is expected to hold a dominant revenue share throughout the forecast timeline. The setup offers improved control over data security, which is a major facet of its larger revenue share. Despite the cost-effectiveness and surging popularity of cloud-based solutions, many enterprises invest in on-premise deployments to maintain oversight of their data. Opportunities are rife in industries dealing with sensitive data such as BFSI, healthcare, etc.

Our in-depth analysis of the global application development software market includes the following segments

|

Platform |

|

|

Deployment Mode |

|

|

Enterprise Size |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Application Development Software Market Regional Analysis:

North America Market Forecast

North America in application development software market is set to capture over 40.3% revenue share by 2035, attributed to the early adoption of AI and ML tools and a mature cloud infrastructure. Cross-border tech collaboration between the U.S. and Canada benefits the integration of application development tools across various industries. For instance, in September 2024, DARPA, DSTL, and DRDC formed the U.S.-UK-Canada AI collaboration to bolster AI research. Furthermore, the proliferation of cloud-based application development software solutions for tech hubs in the region is beneficial for sustained market growth.

The U.S. application development software market is expected to hold a leading revenue share in North America. The market is characterized by its dominance in enterprise-scale DevOps automation and federal mandates for software supply chain security, such as Executive Order 14028. The U.S. has intensified its efforts in the global AI race with a USD 500 billion investment announced for AI infrastructure in January 2025, which is poised to improve the functionality of applications popular in the U.S. market. Moreover, the U.S. has the highest smartphone proliferation rates globally, which is reflective of the mass acceptance of mobile applications in the country, creating burgeoning opportunities for localized app development.

The Canada application development software market is forecast to expand during the forecast period. The government has actively promoted digital initiatives, encouraging businesses to adopt modern application development practices. In December 2024, the government announced up to USD 2 billion in investment by launching the Canadian Sovereign AI Compute Strategy to build domestic AI compute capacity at home. Additionally, in October 2024, the government announced two programs as a part of the USD 2.4 billion package for AI innovations in the 2024 budget to help SMEs across the country accelerate digitalization by leveraging AI. The proactive measures enacted by the government create a lucrative market for application development software in Canada.

APAC Market Forecast

The APAC application development software market is poised to register the second-largest revenue share during the stipulated timeline. APAC has had a substantial proliferation of mobile devices and a sustained digital transformation across various industries. Furthermore, the penetration of 5G across APAC has accelerated the adoption of application development platforms to assist businesses in reaching a broader audience. Cross-border collaborations such as the ASEAN Digital Integration Framework benefit innovation in application development platforms in the region.

The China application development software market is predicted to hold a dominant revenue share. The market is propelled by digital sovereignty mandates, with state-backed innovations in open-source ecosystems. The Fourteenth Five-Year Plan prioritizes integrated circuit design tools and AI frameworks to reduce foreign dependency. Furthermore, China has a large population characterized by smartphone penetration creating lucrative opportunities to provide application development software to various sectors.

The India application development software market is poised to achieve robust growth during the forecast period. India has a budding tech ecosystem and a receptive consumer base for mobile applications, creating a burgeoning market rife with investment opportunities. The India Stack, i.e., UPI, and Aadhar, has spurred hyper-localized solutions. The government’s proactive stance, characterized by the USD 1 billion worth IndiaAI mission is expected to maintain the market’s growth coupled with a large number of startups focused on building user-centric mobile applications to provide unique solutions in the context of the India consumer market.

Companies Dominating the Application Development Software Landscape

The application development software market is poised to expand during the forecast period. Leading companies in the market are investing in industry vertical-specific solutions to capture market share. The expansion of cloud-native platforms with prebuilt industry templates and partnerships with hyperscalers are projected to assist companies in bolstering their market share. In April 2024, Cloud Software Group, Inc., and Microsoft Corporation announced collaboration via an eight-year strategic partnership agreement to strengthen go-to-market collaboration for the Citrix virtual application platform.

Key Application Development Software Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Oracle Corporation

- IBM

- Salesforce

- SAP SE

- Amazon Web Services

- Adobe Inc.

- Alibaba Cloud

- Google LLC

- Atlassian

- Cisco Systems

- Siemens AG

Recent Developments

- In January 2025, Anysphere announced the raising of USD 105 million in a funding round led by Thrive Capital. The company’s flagship product, Cursor, leverages LLM models from Open AI and Anthropic to help programmers with code completion.

- In January 2025, the Alibaba Cloud announced an expanded suite of large language models and AI development tools. The advancements are aimed at assisting developers worldwide in cost-effectively building AI applications and bolstering the generative AI ecosystem.

- Report ID: 7284

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.