Application Dependency Mapping Tool Market Outlook:

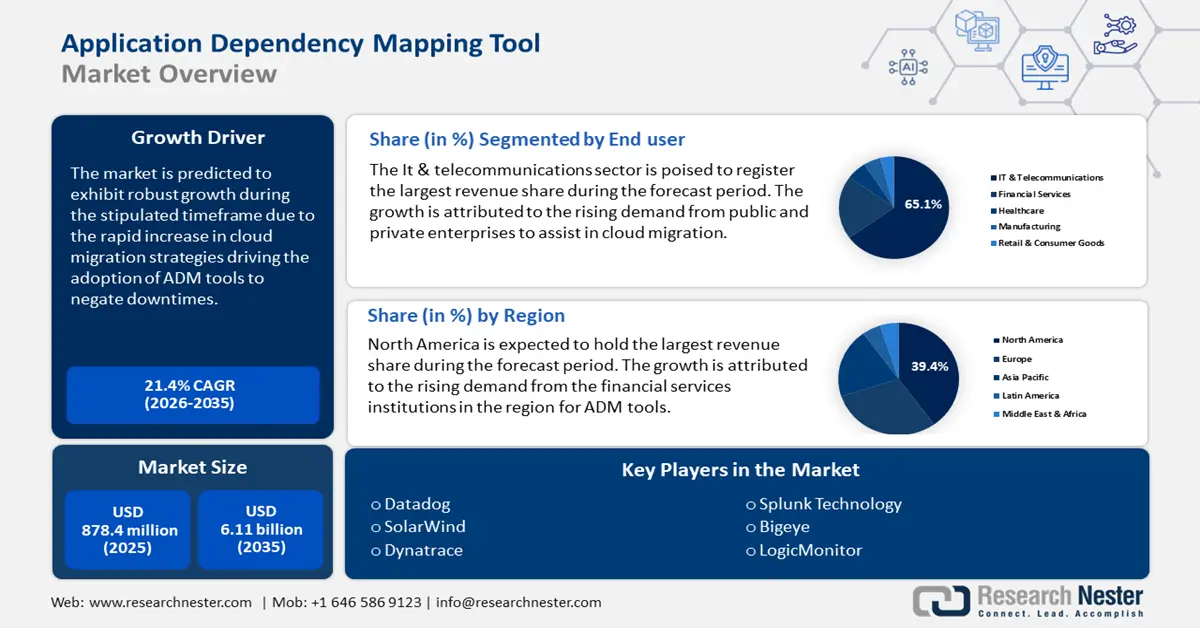

Application Dependency Mapping Tool Market size was valued at USD 878.4 million in 2025 and is likely to cross USD 6.11 billion by 2035, expanding at more than 21.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of application dependency mapping tool is assessed at USD 1.05 billion.

The application dependency mapping tool market’s growth is attributed to the widespread adoption of cloud technologies. Application dependency mapping (ADM) tools are in demand to assist organizations in gaining comprehensive visibility into their application ecosystems. The largest share in application is expected to be led by the IT & Telecommunications, financial services, and healthcare sectors. For instance, in the healthcare industry, ADM tools are increasingly applied to map dependencies in the electronic health record (EHR) systems to ensure uninterrupted patient data access and compliance with regulations such as HIPAA. Moreover, healthcare providers drive demand for application dependency mapping tools to mitigate system downtime in telemedicine platforms. The table below highlights the increasing usage of telemedicine and EHR in the U.S. healthcare system, which impacts the demand for ADM tools.

Trends in the adoption of EHR and Telemedicine

|

Trends in Physician Adoption |

Trends in Hospital Adoption |

Telemedicine use among Physicians |

Year |

|

79% |

96% |

15% |

2018 |

|

72% |

96% |

15% |

2019 |

|

78% |

96% |

87% |

2021 |

Source: ASTP

The trends after Covid-19 indicate the rising adoption of EHR and telemedicine is expected to increase in the global healthcare ecosystem, prompting a greater demand for ADM tools. Furthermore, the rising advent of microservices is expected to drive the requirement for dependency mapping to ensure that changes to one service do not have unintended consequences for other services.

A notable development in the application dependency mapping tool market is the integration of machine learning (ML) and artificial intelligence (AI) capabilities. This allows ADM tools to automate anomaly detection and perform predictive analytics. For instance, in February 2023, Dynatrace Inc., a key player in the sector that leverages AI, announced the launch of the Carbon Impact app which delivers real-time insights into the carbon footprint of an organization’s multi-cloud ecosystem and leverages dependency mapping to provide app-level details for accurate optimization insights. The successful use cases bode well to create a sustained demand for ADM tools.

Moreover, the global trends of rapid digital transformation are expected to create a steady demand so that organizations can maintain operational continuity which is vital for long-term success. The table below highlights the top 5 countries in the United Nation’s E-Government Survey- Accelerating Digital Transformation for Sustainable Development.

UN E-Government Survey 2024

|

Name of the Country |

EGDI (2024) |

EGDI (2022) |

|

Denmark |

0.9847 |

0.9717 |

|

Estonia |

0.9727 |

0.9393 |

|

Singapore |

0.9691 |

0.9133 |

|

Republic of Korea |

0.9679 |

0.9529 |

|

Iceland |

0.9671 |

0.9410 |

Source: the UN

The E-government Development Index (EGDI) highlights the rate at which countries are bridging the digital gap, which bodes well for the continued demand for ADM tools to hasten the process.

Key Application Dependency Mapping Tool Market Insights Summary:

Regional Highlights:

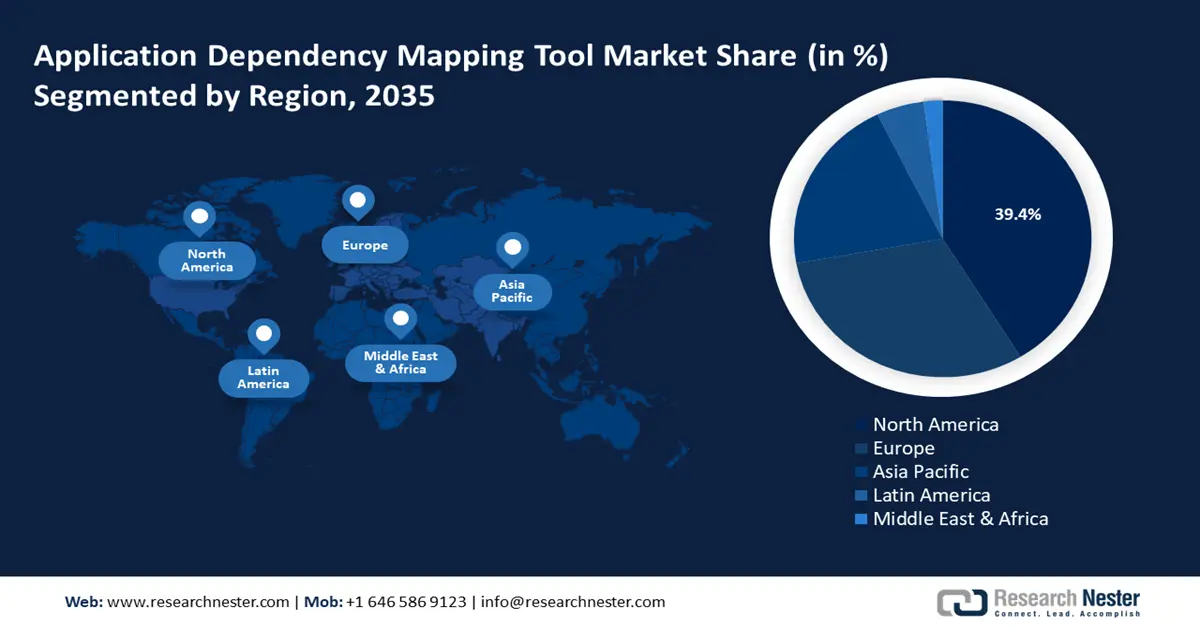

- North America application dependency mapping tool market will account for 39.40% share by 2035, driven by accelerated digital transformation and adoption of cloud-native architectures.

Segment Insights:

- The it & telecommunications segment in the application dependency mapping tool market is projected to hold a 65.10% share by 2035, driven by rapid cloud migration and the need for tools to manage complex IT infrastructures.

- The cloud-based deployment segment in the application dependency mapping tool market is anticipated to achieve the largest share by 2035, driven by the cost-effectiveness, scalability, and ease of use of cloud-based ADM tools.

Key Growth Trends:

- Increase in cloud migration strategies

- Rising requirement for dependency visibility for security posture

Major Challenges:

- Integration complexities with legacy systems

- Performance challenges in large-scale environments

Key Players: DataDog, SolarWind, Dynatrace, Zoho Corporation, Device42, Inc., Retrace, App Dynamics. LogicMonitor, New Relic, Zenoss, Splunk Technology, Manage Engine, Bigeye.

Global Application Dependency Mapping Tool Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 878.4 million

- 2026 Market Size: USD 1.05 billion

- Projected Market Size: USD 6.11 billion by 2035

- Growth Forecasts: 21.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, China, Japan

- Emerging Countries: China, India, Singapore, Malaysia, Thailand

Last updated on : 18 September, 2025

Application Dependency Mapping Tool Market Growth Drivers and Challenges:

Growth Drivers

- Increase in cloud migration strategies: The application dependency mapping tool sector is expected to expand during the forecast period by leveraging rising demand to accelerate cloud migration strategies. Organizations globally are investing to transition to cloud infrastructures to avoid digital cliff. Understanding the intricacies of application interdependencies is vital to ensure seamless migrations necessitating the application of ADM tools.

Investments in the IT infrastructure to is positioned to create lucrative opportunities to supply ADM tools to identify potential challenges and optimize the migration strategies. Furthermore, ADM tools are necessary to minimize downtimes and maintain service continuity during transitions so as it does not affect consumers. While the private sector is expected to remain the largest end user of ADM tools, the public sector is rapidly expanding its share in usage of ADM tools driven by the rapid adoption of cloud services. The table below highlights key factors in government spending on public cloud services, which necessitates dependency mapping services.

|

Government Spending on Public Cloud Services |

|

|

Spending trends on public cloud services |

|

|

Local government spending trends |

|

|

Global public spending estimates |

|

Source:

Digitalization has been effective for the public sector in services delivery and the increasing spending is poised to drive further demand for ADM tools.

- Rising requirement for dependency visibility for security posture: The escalating cyber threats creates boosts the expansion of the application dependency mapping tool market. Organizations require visibility into application interactions to negate the threat of cyberattacks. ADM tools assist organizations in mapping dependencies to allow identification of vulnerabilities in the system. Moreover, the proactive approach has been the hallmark of major organizations to safeguard sensitive data while ensuring compliance with industry regulations.

In October 2023, Sonatype, a major player in the North America software supply chain management ecosystem, published the annual State of the Software Supply Chain report indicating that open-source consists of more than 90% of modern software solutions, which makes it essential for development teams to map software dependencies to prevent vulnerabilities such as Log4j. - Growing demands for support to complex IT ecosystems: The adoption of multi-cloud and hybrid-cloud strategies has created a lucrative application dependency mapping tool market. Multi-cloud and hybrid-cloud strategies have created complex IT environments with numerous interdependencies. ADM tools assist in providing real-time mapping of complex infrastructure for efficient optimization of resources across diverse platforms. In June 2024, Nutanix, a major database-as-a-software solutions provider, released the global Financial Services Enterprise Cloud Index report which estimates the hybrid and multi-cloud adoption for financial services to triple.

Moreover, the expansion of application mapping capabilities by major players in the application dependency mapping tool market bodes well for the sector’s growth. Key players in the sector, such as Uila Inc., have extended application mapping capabilities to include network devices performance and dependencies, to maintain competitive advantage in the application dependency mapping tool market. Additionally, in November 2023, Device42 launched the hybrid cloud service dependency mapping solution to provide close to real-time IT infrastructure visibility.

Challenges

- Integration complexities with legacy systems: The application dependency mapping tools sector can face challenges in integrating solutions with legacy IT systems. Despite the rapid proliferation of cloud migration, a considerable percentage of companies in various industries depend on older systems that do not support ADM functionalities. Additionally, mapping dependencies in such environments requires extensive customization and manual intervention which can increase deployment time and costs.

- Performance challenges in large-scale environments: Organizations with vast IT infrastructure provide lucrative opportunities for the adoption of ADM tools, but can also face scalability issues. In complex environments, the increase in servers and applications increases dependencies, where some Adm tools may struggle to provide accurate insights. The challenge can affect small-scale ADM solutions providers and reduce application dependency mapping tool market trust. Furthermore, the advent of cloud-based solutions is expected to assist in navigating the challenge.

Application Dependency Mapping Tool Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

21.4% |

|

Base Year Market Size (2025) |

USD 878.4 million |

|

Forecast Year Market Size (2035) |

USD 6.11 billion |

|

Regional Scope |

|

Application Dependency Mapping Tool Market Segmentation:

End user

By end user, the IT & telecommunications sector segment is set to hold application dependency mapping tool market share of over 65.1% by the end of 2035. ADM tools are indispensable in managing complex IT infrastructure, driving their demand. The rapid rate of cloud migration among private and public sector enterprises is a major driver of IT ADM tools. In February 2024, Cisco launched innovations in the Observability platform including digital experience monitoring (DEM) for hybrid and cloud environments. Cisco’s focus on this area will likely encourage vendors in the ADM tool market to expand the scope of offerings with robust hybrid and multi-cloud capabilities to cater to the IT & telecommunications sectors.

The financial services sector is projected to account for the second-largest revenue share by end user in the global application dependency mapping tool market. The digital transformation of the financial services sector is a major driver of the growing demand for ADM tools. A major trend propelling the sector’s growth as a prominent end use of ADM tools is the rising reliance on cloud computing. The U.S. Department of Treasury published a report indicating that in the past decade, financial institutions have increased the use of cloud services to support internal operations, and the trend has been consistent among large and small financial institutions. Furthermore, emerging markets such as India which is experiencing a digital revolution are poised to provide new revenue streams for key players offering ADM tools.

Deployment Type

By deployment type, the cloud-based segment of the application dependency mapping tool market is predicted to hold the largest revenue share by the conclusion of the stipulated timeframe in 2035. The cost-effectiveness and scalability of cloud-based solutions are prominent factors in the segment’s profitability. Cloud-based ADM tools offer advantages such as automatic updates and ease of accessibility which drives adoption. In November 2024, Splunk, a leading player in the industry, announced the availability of its enterprise security, observability, and platform offerings on Microsoft Azure, with the partnership empowering the organization to assist in scaling digital transformation on Azure. The availability of Splunk’s SaaS offerings is poised to improve the cloud-based ADM tools offerings.

Our in-depth analysis of the global application dependency mapping tool market includes the following segments:

|

End user |

|

|

Deployment Type |

|

|

Business Function |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Application Dependency Mapping Tool Market Regional Analysis:

North America Market Insights

North America in application dependency mapping tool market is expected to dominate around 39.4% revenue share by the end of 2035. The key factor in the sector’s profitable expansion in North America is attributed to the region’s accelerated digital transformation and the increasing adoption of cloud-native architectures. Businesses in the region are demanding the management of complex IT ecosystems that combine legacy systems with modern applications and cloud environments. Moreover, the rising focus on cybersecurity in industries such as the financial sector boosts the demand for ADM tools. In July 2024, the U.S. Department of Treasury and the Financial Services Sector Coordinating Council (FSSCC) published a suite of resources to share with financial services institutions in the U.S. for a secure cloud adoption journey with deliverables. Such resources are expected to bolster ADM tools solutions providers to leverage the burgeoning trends in the application dependency mapping tool market and expand their revenue shares.

The U.S. application dependency mapping tool market is poised to account for a major revenue share in North America. The current trends within the U.S. highlight rapid digital transformation across multiple sectors. With more businesses adopting cloud-first strategies, the scope of application of ADP tools is expanding in the U.S. With the financial and IT sectors expected to drive the largest demand for ADM tools and the healthcare sector emerging as a prominent applicant of ADM solutions to improve service uptime, the application dependency mapping tool market is expected to maintain its robust growth during the forecast period.

The Canada application dependency mapping tool sector is predicted to register robust growth during the forecast period. A major factor in the growth is attributed to the push for cloud migration by enterprises in Canada. ADM tools are becoming critical in enabling businesses to gain real-time visibility into their cloud environments. Moreover, the emergence of the public sector of Canada driving the adoption of cloud services is poised to create new revenue streams for the key players in the sector. In April 2024, Scotiabank, a major financial institution in Canada, announced a partnership with Google Cloud for the next phase in the bank’s cloud acceleration journey. Major announcements as such augur well for the continued growth of the application dependency mapping tool market in Canada.

Europe Market Insights

The Europe application dependency mapping tool market is projected to account for the fastest growth during the forecast period. The accelerated digital transformation in Europe buoyed by the European Union’s initiatives is a major factor in the growth. For instance, In December 2022, the EU announced investments worth USD 4.86 billion for 2023-2024 for digital transformation across Europe and help economies in the EU in developing core digital technologies. The investment also creates a rife ecosystem for the adoption of ADM tools.

The Germany application dependency mapping tool market is estimated to register rapid growth during the stipulated period. The sector in Germany is bolstered by the Industry 4.0 initiatives. Germany has well-established automotive and engineering sectors, which are experiencing rapid migration to the cloud which drives demand for ADM tools to support complex supply chains and production workflows. Additionally, the regional market is characterized by the requirement for cybersecurity measures, where ADM tools are expected to experience greater adoption owing to their ability to identify critical dependencies. Recent major investments, such as Amazon’s USD 11 billion worth of investment to expand cloud and logistics in Germany, which was announced in June 2024, are emerging trends that are poised to drive the continued growth of the sector.

The France application dependency mapping tools market is predicted to expand its revenue share by the conclusion of 2035. A major end user in France is expected to be the financial institutions that are rapidly adopting digital ecosystems to improve the scope of their service delivery. Furthermore, the government’s initiatives to promote digital transformation across various industries encourage the adoption of ADM tools to navigate complex regulatory requirements. The France 2030 remains an ambitious plan to leverage investments worth USD 55.3 billion to accelerate the digital economy, which is poised to create lucrative opportunities for the ADM tools solutions providers.

Application Dependency Mapping Tool Market Players:

- DataDog

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SolarWind

- Dynatrace

- Zoho Corporation

- Device42, Inc.

- Retrace

- App Dynamics

- LogicMonitor

- New Relic

- Zenoss

- Splunk Technology

- Manage Engine

- Bigeye

The application dependency mapping tool market is set to expand during the forecast period. Leading companies in the sector are expanding the scope of ADM tools to meet the evolving requirements of IT infrastructure. The inculcation of automated mapping, real-time insights, and AI-driven analytics into application interdependencies is poised to assist companies in maintaining an edge in the competitive application dependency mapping tool market. Furthermore, the expansion of the IT infrastructure in emerging economies provides lucrative opportunities to broaden the scope of end users. SolarWinds, a key player in the sector, announced its third quarter earnings for 2024 indicating a 6% year-on-year growth, and net income worth USD 12.6 million with revenue of around USD 200.0 million. The profit report by SolarWinds highlights the growth opportunities in the market.

Here are some key players in the application dependency mapping tool market:

Recent Developments

- In March 2024, Bigeye announced the launch of Bigeye Dependency Driven Monitoring. The launch allows enterprise data teams to connect analytics dashboards and map every dependency across legacy and modern data sources.

- In February 2023, Dynatrace launched AppEngine, i.e., the new Dyntrace platform technology to empower partners and customers with an easy-to-use low-code approach to create data-driven apps. The platform can consolidate security, observability, and business data with dependency mapping.

- Report ID: 7000

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Application Dependency Mapping Tool Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.