Global App Test Automation Market

- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview Market Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROTs

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation: How they would Aid the Business?

- Competitive Landscape

- BrowserStack

- Cigniti Technologies Limited

- Invensis Technologies Pvt Ltd

- KEYSIGHT TECHNOLOGIES, INC.

- Open Text Corporation

- Parasoft Corporation

- QA Mentor, Inc.

- Ranorex GmbH

- Sauce Labs Inc.

- SmartBear Software

- Technology Analysis

- Price Benchmarking

- Discount Structure

- Analysis on App Test Automation Tools

- End-User Overview

- Recent News and Development

- Industry Risk Assessment

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2024-2037, By

- Test Type, Value (USD Million)

- Static Testing

- Dynamic Testing

- Functional Testing

- E2E Testing

- Others

- Non-Functional Testing

- API Testing

- Others

- Functional Testing

- Deployment, Value (USD Million)

- On-premises

- Cloud

- Organization Size, Value (USD Million)

- Small & Medium Enterprise

- Large Enterprise

- End user, Value (USD Million)

- IT & Telecommunication

- Healthcare

- Transportation & Logistics

- Retail

- BFSI

- Others

- Regional Synopsis (USD Million), 2024-2037

- North America, Value (USD Million)

- Europe, Value (USD Million)

- Asia Pacific, Value (USD Million)

- Latin America, Value (USD Million)

- Middle East and Africa, Value (USD Million)

- Test Type, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Test Type, Value (USD Million)

- Static Testing

- Dynamic Testing

- Functional Testing

- E2E Testing

- Others

- Non-Functional Testing

- API Testing

- Others

- Functional Testing

- Deployment, Value (USD Million)

- On-premises

- Cloud

- Organization Size, Value (USD Million)

- Small & Medium Enterprise

- Large Enterprise

- End user, Value (USD Million)

- IT & Telecommunication

- Healthcare

- Transportation & Logistics

- Retail

- BFSI

- Others

- Country Level Analysis, Value (USD Million)

- U.S.

- Canada

- Test Type, Value (USD Million)

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Test Type, Value (USD Million)

- Static Testing

- Dynamic Testing

- Functional Testing

- E2E Testing

- Others

- Non-Functional Testing

- API Testing

- Others

- Functional Testing

- Deployment, Value (USD Million)

- On-premises

- Cloud

- Organization Size, Value (USD Million)

- Small & Medium Enterprise

- Large Enterprise

- End user, Value (USD Million)

- IT & Telecommunication

- Healthcare

- Transportation & Logistics

- Retail

- BFSI

- Others

- Country Level Analysis, Value (USD Million)

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Test Type, Value (USD Million)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Test Type, Value (USD Million)

- Static Testing

- Dynamic Testing

- Functional Testing

- E2E Testing

- Others

- Non-Functional Testing

- API Testing

- Others

- Functional Testing

- Deployment, Value (USD Million)

- On-premises

- Cloud

- Organization Size, Value (USD Million)

- Small & Medium Enterprise

- Large Enterprise

- End user, Value (USD Million)

- IT & Telecommunication

- Healthcare

- Transportation & Logistics

- Retail

- BFSI

- Others

- Country Level Analysis, Value (USD Million)

- China

- Japan

- India

- Australia

- South Korea

- Vietnam

- Thailand

- Singapore

- Malaysia

- Rest of Asia Pacific

- Test Type, Value (USD Million)

- Overview

- Latin America Market

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), By

- Test Type, Value (USD Million)

- Static Testing

- Dynamic Testing

- Functional Testing

- E2E Testing

- Others

- Non-Functional Testing

- API Testing

- Others

- Functional Testing

- Deployment, Value (USD Million)

- On-premises

- Cloud

- Organization Size, Value (USD Million)

- Small & Medium Enterprise

- Large Enterprise

- End user, Value (USD Million)

- IT & Telecommunication

- Healthcare

- Transportation & Logistics

- Retail

- BFSI

- Others

- Country Level Analysis, Value (USD Million)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Test Type, Value (USD Million)

- Global Overview

- Middle East & Africa Market

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), By

- Test Type, Value (USD Million)

- Static Testing

- Dynamic Testing

- Functional Testing

- E2E Testing

- Others

- Non-Functional Testing

- API Testing

- Others

- Functional Testing

- Deployment, Value (USD Million)

- On-premises

- Cloud

- Organization Size, Value (USD Million)

- Small & Medium Enterprise

- Large Enterprise

- End user, Value (USD Million)

- IT & Telecommunication

- Healthcare

- Transportation & Logistics

- Retail

- BFSI

- Others

- Country Level Analysis, Value (USD Million)

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Test Type, Value (USD Million)

- Global Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

App Test Automation Market Outlook:

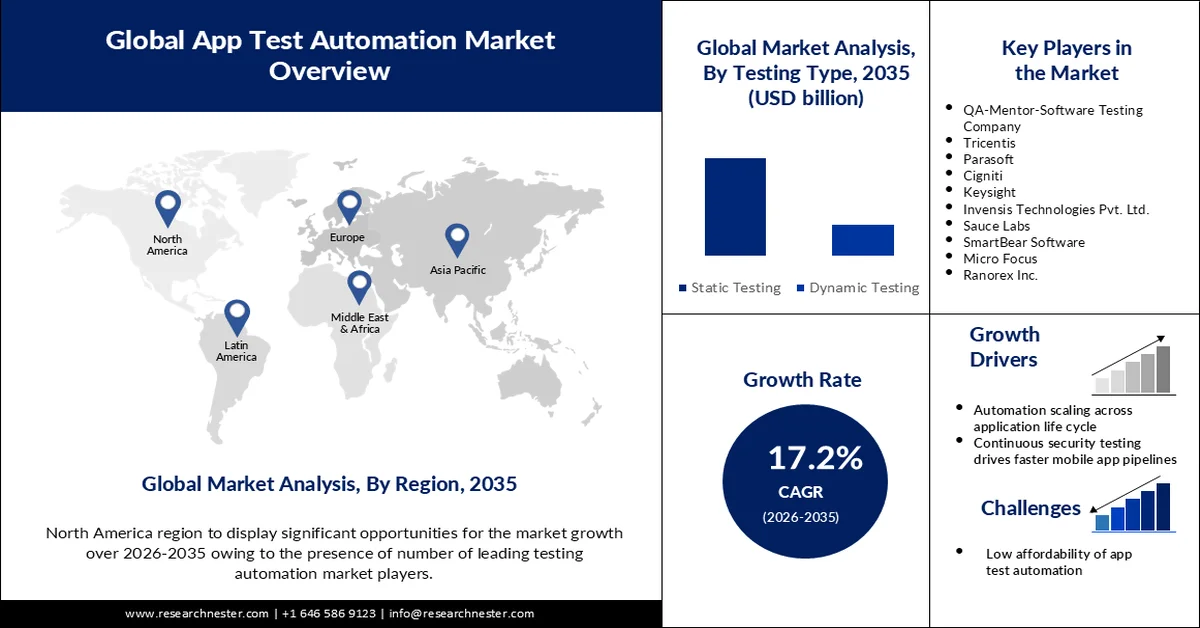

App Test Automation Market size was valued at USD 28.88 billion in 2025 and is likely to cross USD 141.21 billion by 2035, registering more than 17.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of app test automation is assessed at USD 33.35 billion.

The app test automation market is anticipated to expand at a rapid pace, with businesses trying to work toward better software quality while cutting down time-to-market. The growing adoption of DevOps practices and AI-driven testing solutions in the market is further escalating the demand. For instance, in March 2024, Sauce Labs integrated with GitHub Actions with the aim of bringing continuous testing into CI/CD pipelines. The integration will simplify the test processes for developers with improved reliability and efficiency. This is further supported by government initiatives in favor of digital transformation and the adoption of automation technologies.

Cloud-based testing platforms and codeless automation have recently witnessed an unprecedented rise, which is boosting the app test automation landscape. In February 2023, Apexon partnered with cloud providers in order to deliver next-generation automation and security solutions for customers. This helps organizations manage a smoother DevOps lifecycle without compromising standards pertaining to high-quality software. In addition, other factors, such as investment by various governments of emerging markets in digital infrastructure, will eventually contribute to increasing the adoption of advanced automated tools and create lucrative opportunities for the market players during the forecast period.

Key App Test Automation Market Insights Summary:

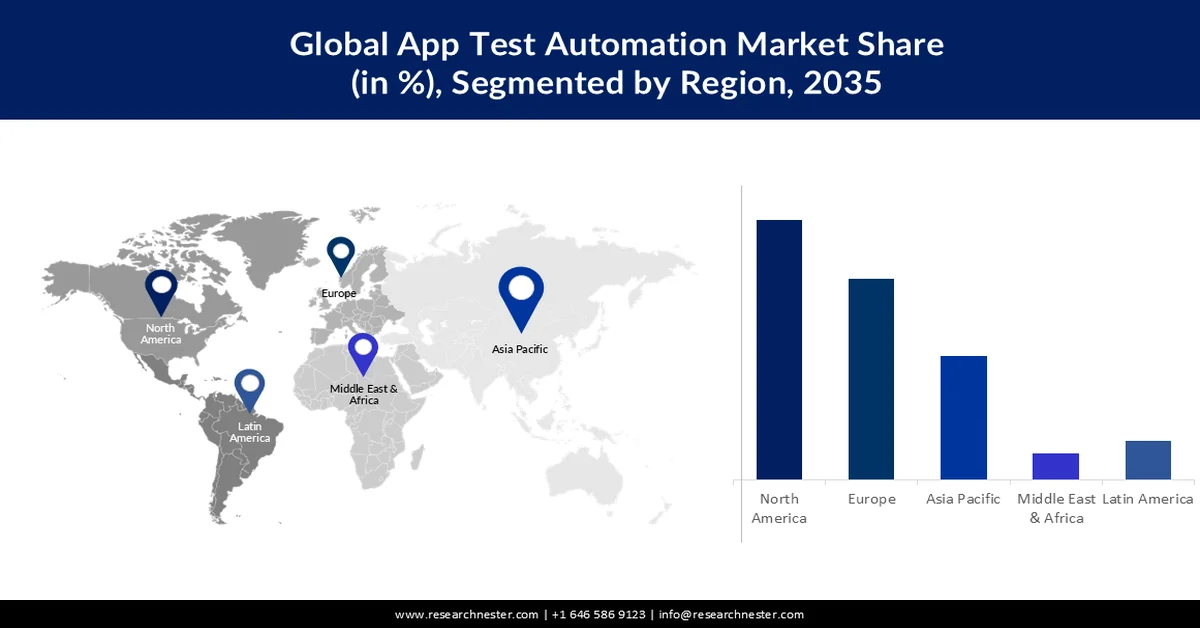

Regional Highlights:

- The North America app test automation market is expected to capture over 40% share by 2035, owing to strong technological developments and enterprise adoption of automation platforms.

- The Asia Pacific market is projected to grow at a rate of 18.7% by 2035, impelled by its large IT workforce and rising demand for automation in software testing.

Segment Insights:

- The Static Testing segment is projected to account for a 55% share by 2035, owing to its wide usage and ability to detect errors in the earliest stages of software development.

- The On-Premises segment is expected to hold a 53.5% revenue share by 2035, propelled by industries prioritizing data security and control.

Key Growth Trends:

- Adoption of DevOps and Agile practices

- Increasingly using AI within testing

Major Challenges:

- Complexity of testing across diverse platforms

- Security concerns in cloud-based testing

Key Players: WebFX, Cuker, Disruptive Advertising, SEO Brand, Bird Marketing Limited, Parrot Creative Limited, AMP, TopSpot Internet Marketing, Intero Digital, Ready North.

Global App Test Automation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.88 billion

- 2026 Market Size: USD 33.35 billion

- Projected Market Size: USD 141.21 billion by 2035

- Growth Forecasts: 17.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, India, United Kingdom, Germany, China

- Emerging Countries: India, China, Japan, South Korea, Singapore

Last updated on : 25 February, 2026

App Test Automation Market - Growth Drivers and Challenges

Growth Drivers

-

Adoption of DevOps and Agile practices: The increasing trend of DevOps and Agile practices has fueled the demand for automated testing solutions significantly. Continuous testing emerged as a critical element to maintain software quality, courtesy of dynamic and iterative development cycles. This approach ensures faster delivery while reducing errors, thus finding its place in modern software workflows. In May 2023, Micro Focus released UFT 16, an AI-powered test automation tool with better integration in CI/CD pipelines. The release has made automated testing a vital component in facilitating smooth processes in development and deployment.

- Increasingly using AI within testing: Artificial Intelligence is transforming app test automation and is increasing efficiency and accuracy in testing processes. AI-powered tools apply predictive analytics, adaptive learning, and autonomous functionalities to streamline testing workflows for the faster detection of issues by developers, thus improving overall software reliability. With the inclusion of advanced AI capabilities, Eggplant AI 2.0 introduced a new era in autonomous testing in January 2024. This development demonstrates a growing reliance on intelligent automation solutions to solve modern software development challenges. AI-driven testing has now become one of the major enablers of innovation in the space.

- Increased cloud-based test platforms: Cloud-based test environments are observing increased demand due to being scalable, cost-efficient, and suitable for different test environments. Performing all the stages of testing is easy and affordable without the need for expensive investments in on-premises infrastructure. This reduces enterprise test cycles and makes more flexibility possible to adapt quickly to changing requirements. In June 2023, Microsoft teamed up with Leapwork to offer codeless test automation of Dynamics 365, making the complex testing of very large applications easier. The collaboration between the two is a good example of how cloud-based solutions are growing rapidly, and businesses want agility and efficiency in software testing.

Challenges

-

Complexity of testing across diverse platforms: One of the crucial challenges in app test automation comes with testing applications on several device types, operating systems, and various environments. The fragmentation in device types and software versions makes such a testing process cumbersome, requiring robust and adapted tools. Ensuring complete compatibility and consistency in working across platforms often requires huge involvement in terms of time consumption and resources. This complexity can further be multiplied in multiple global markets, where regions differ in their device preferences and network conditions.

- Security concerns in cloud-based testing: While cloud-based test environments offer unmatched scale and economics, they also create serious security concerns. Companies dealing with sensitive information are required to be in strict compliance with regulatory requirements for the protection of personal data, such as the Health Insurance Portability and Accountability Act (HIPAA) and the General Data Protection Regulation (GDPR). Such security concerns pose critical challenges, such as the risk of unauthorized access, data breaches, and deficiencies in encryption mechanisms. Further, dependence on a third-party cloud service provider involves issues related to control over and insight into the data stored.

App Test Automation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.2% |

|

Base Year Market Size (2025) |

USD 28.88 billion |

|

Forecast Year Market Size (2035) |

USD 141.21 billion |

|

Regional Scope |

|

App Test Automation Market Segmentation:

Test Type Segment Analysis

The static testing segment is estimated to capture app test automation market share of around 55% by the end of 2035. The dominance of this segment is due to its wide usage and capability to find errors in the earliest stages of software development. In June 2023, ESCRIBA AG, in collaboration with Software AG, merged static testing solutions into the automation framework. This development represented the importance of the approach for modern software development. Furthermore, the segment is anticipated to witness continuous growth through increased demand for proactive quality assurance methods.

Deployment Segment Analysis

In app test automation market, on-premises segment is set to dominate revenue share of around 53.5% by the end of 2035, driven by industries prioritizing data security and control. On-premises solutions protect sensitive data better and are ideal for industries like finance, healthcare, and government with tight regulatory controls. On-premises solutions have better personalization options as well as integration with on-premises IT infrastructures that have complicated systems. In February 2024, Micro Focus released UFT One 17.5, featuring additional on-premises functionality and features that ensure more secure and efficient testing. Furthermore, this segment's growth underlines the continued reliance on secure, localized solutions despite the rise of cloud-based alternatives.

Our in-depth analysis of the global market includes the following segments:

|

Test Type |

|

|

Deployment |

|

|

Organization Size |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

App Test Automation Market - Regional Analysis

North America Market Insights

North America app test automation market is anticipated to dominate revenue share of over 40% by 2035, driven by strong technological developments and enterprise adoption of automation platforms. Operational efficiency, coupled with its mature IT landscape, is benefiting this region by offering lucrative opportunities to both new and established players. In September 2024, Opkey announced a strategic collaboration with Flexagon, touting an AI-driven, no-code test automation platform with greater development and testing workflows. This further reflects the region's concentration on lower costs and higher productivity while maintaining a competitive advantage in technological automation.

The U.S. drives the North America app test automation market due to the emphasis it puts on innovation and modern technologies. Major industry players and technology giants actively drive the adoption of AI and machine learning across automation testing. In February 2024, SmartBear Software released cross-platform test automation with advanced capabilities to cater specifically to complex mobile and web apps. This development mirrors investments that are still being made continuously in the country to provide the right testing tools in line with the rising demand for perfect and efficient testing in segments.

Canada app test automation market is anticipated to reflect steady growth due to the rising focus on digital transformation and the uptake of efficient quality assurance practices in the country. Companies in Canada are seeking scalable, secure testing solutions that are customized according to local regulations. For example, Cigniti Technologies expanded its geographical presence in the region in August 2024 with different AI-driven testing services for enterprise applications. This testifies that the country is anticipated to garner a considerable share of the market with more focus on availing reliable and innovative automated testing solutions across industries.

Asia Pacific Market Insights

Till 2035, Asia Pacific app test automation market is estimated to witness growth rate of around 18.7%. The large IT workforce, combined with the growing demand for automation in software testing, drives the growth of the market. In June 2024, Panaya launched the latest SaaS-based codeless test automation solution for the seamless automation of ERP and CRM applications. This development underlines how Asia Pacific can lead the front in creating flexible enterprise-grade testing solutions.

The strong IT services industry and investment in upskilling the workforce have rapidly influenced the market in India. The growing demand for fast and error-free software solutions has made automation tools the prime focus of organizations in the country. For example, Aimore Technologies launched the Cypress Training Program in Chennai in October 2024, providing advanced automation testing competencies for IT professionals. Furthermore, government initiatives in support of digital transformation have also accelerated the pace of adoption. Locally competitive pricing has further opened up automation solutions to businesses of all sizes.

China continues to strengthen its position in the app test automation market through strategic investments and technological advancements. This emphasis is further supported by the country's focus on integrating AI and Machine Learning into automation platforms for fast-moving software development. In December 2024, Alibaba Cloud launched the AI Alliance Accelerator Program, aiming to work with 50 AI technology partners and 50 channel partners by 2025. Such development suggests China is committed to improving the effectiveness of its digital infrastructure, promoting the app test automation landscape.

App Test Automation Market Players:

- BrowserStack

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cigniti Technologies Limited

- Invensis Technologies Pvt Ltd

- KEYSIGHT TECHNOLOGIES, INC.

- Open Text Corporation

- Parasoft Corporation

- QA Mentor, Inc.

- Ranorex GmbH

- Sauce Labs Inc.

- SmartBear Software

- Tricentis

The mobile app test automation market is fiercely competitive and is led by key players such as BrowserStack, Cigniti Technologies Limited, Keysight Technologies, Inc., SmartBear Software, and Tricentis. These companies are making innovation with the power of AI and machine learning their top priority, creating new standards of efficiency and reliability for testing solutions. Other strategic methods of mergers and acquisitions have been a major tactical tool pursued by companies to gain a better market positioning and expand their offerings. This increases scalability and flexibility as players build benchmarks in app test automation through continuous benchmarking. With such advanced testing solution development, they remain competent in this dynamic market scenario.

In August 2024, Accenture launched the Accenture Responsible AI Platform in collaboration with AWS to show how AI integrates into test automation. This deal points to the trend in industry-wide collaboration toward scalable and intelligent solutions for the requirements of complex software systems. The platform exemplifies how partnerships drive innovation by combining expertise from different domains. Such initiatives by players underscore the dynamic and lucrative market.

Here are some leading companies in the market:

Recent Developments

- In July 2024, Sandhata announced its partnership with Appian to deliver low-code automation solutions. This collaboration enables businesses to enhance operational efficiency, streamline test automation, and foster innovation in application lifecycle management.

- In May 2024, IBM introduced IBM Concert, an AI-driven automation platform designed to streamline operations and technology. Released in June 2024, this innovation serves as a central hub for managing test automation workflows, significantly enhancing efficiency and scalability across application testing environments.

- In February 2024, Ranorex introduced Ranorex Studio 11, a test automation tool featuring a redesigned user interface, enhanced reporting, and expanded cloud testing support. This update empowers QA teams to execute comprehensive testing across web, desktop, and mobile apps, simplifying workflows and improving outcomes.

- Report ID: 5105

- Published Date: Feb 25, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

App Test Automation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.