Apoptosis Assay Reagent Market Outlook:

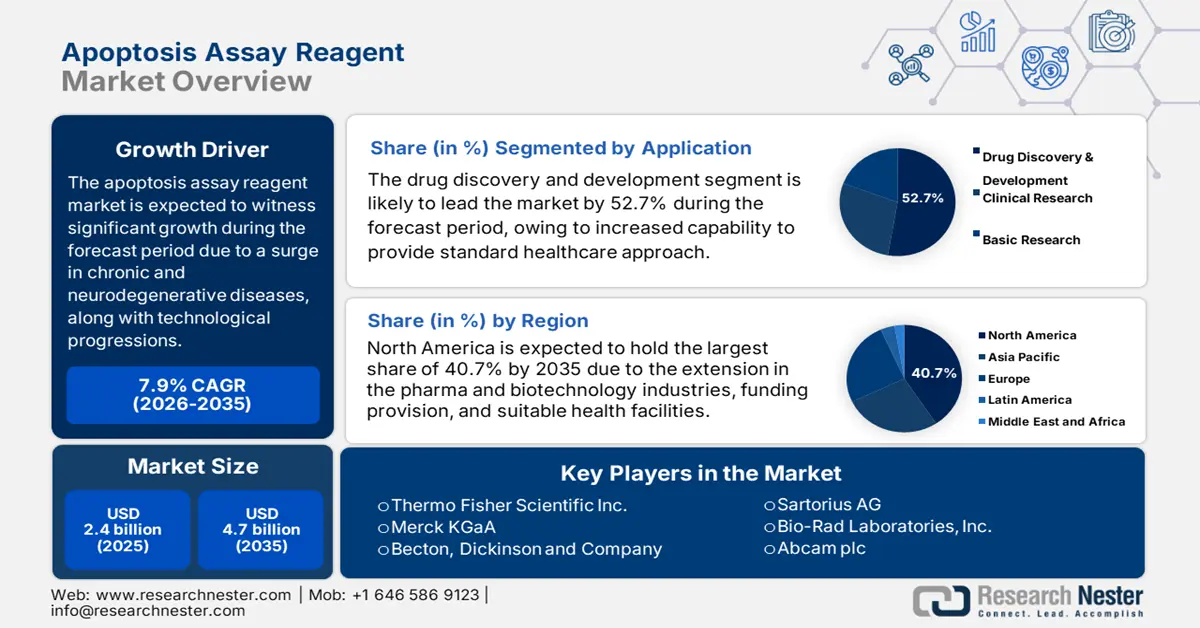

Apoptosis Assay Reagent Market size was USD 2.4 billion in 2025 and is expected to reach USD 4.7 billion by the end of 2035, increasing at a CAGR of 7.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of apoptosis assay reagent is estimated at USD 2.5 billion.

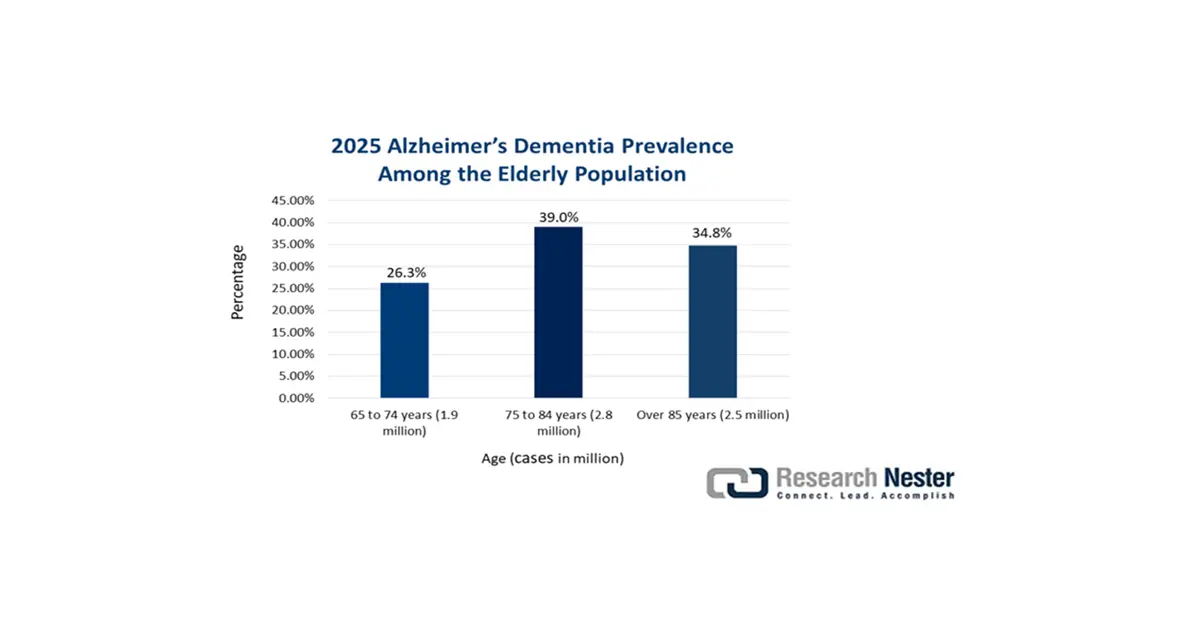

The international market is continuously growing, owing to factors, including the global occurrence of neurodegenerative diseases, such as Parkinson’s and Alzheimer’s diseases, technological progression, and a surge in increased research and development (R&D) funding. According to an article published by NLM in April 2025, approximately 7.2 million of the population in America are aged more than 65 years and have Alzheimer’s. This, however, is projected to increase to 13.8 million by the end of 2060, thereby enhancing the market demand across different regions.

Source: NLM, April 2025

Moreover, administrative and strategic shifts, along with excessive growth in the CRO and biopharmaceutical sectors, are also uplifting the market internationally. In this regard, the April 2025 NLM article indicated that a clinical study was conducted on 41 comprehensively utilized high-frequency processes that were evaluated for monitoring. The sample selection process was divided into categories, and it was found that 24% of processes, that is 10, are effectively related to medical research, 37%, that is 15, were witnessed to primarily cater to clinical utilization, and 39%, that is 16, were revealed to be associated with a regular administrative department.

Key Apoptosis Assay Reagent Market Insights Summary:

Regional Highlights:

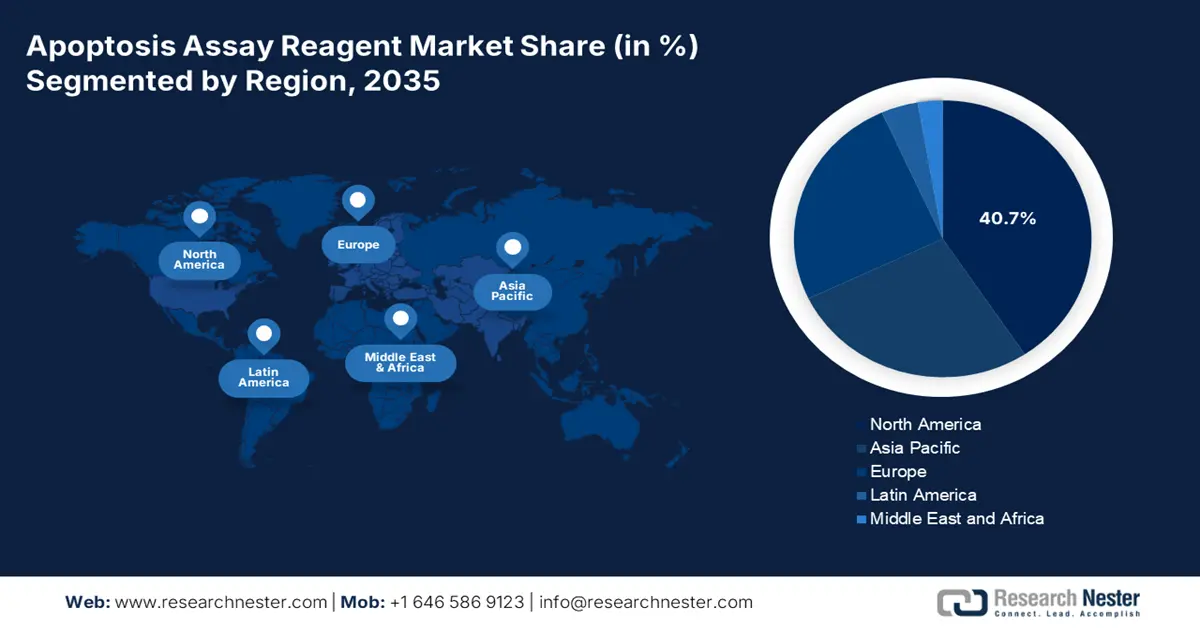

- North America in the apoptosis assay reagent market is projected to capture the largest share of 40.7% by 2035, owing to the expansion of biotechnology and pharmaceutical sectors alongside increased healthcare funding and chronic disease prevalence.

- Europe is expected to emerge as the fastest-growing region during 2026-2035, impelled by rising incidences of cardiovascular and autoimmune diseases, strong government funding, and growing adoption of personalized medicine.

Segment Insights:

- The drug discovery and development segment in the apoptosis assay reagent market is projected to hold the largest share of 52.7% by 2035, propelled by continuous research enabling the development of standardized health approaches and advanced treatment options.

- The reagents segment is anticipated to secure the second-largest share by 2035, supported by its essential role in facilitating chemical reactions and performing diverse medical evaluations for laboratory research.

Key Growth Trends:

- Automation and technological advancements

- Increased utilization of assays

Major Challenges:

- Complexities in cold-chain and logistics distribution

- Political and economic volatility

Key Players: Thermo Fisher Scientific Inc. (U.S.), Merck KGaA (Germany), Becton, Dickinson and Company (BD) (U.S.), Sartorius AG (Germany), Bio-Rad Laboratories, Inc. (U.S.), Abcam plc (UK), Agilent Technologies, Inc. (U.S.), PerkinElmer, Inc. (U.S.), Geno Technology, Inc. (U.S.), Promega Corporation (U.S.), BioVision, Inc. (U.S.), Creative Bioarray (U.S.), GeneCopoeia, Inc. (U.S.), Rockland Immunochemicals, Inc. (U.S.), Abnova Corporation (Taiwan).

Global Apoptosis Assay Reagent Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.4 billion

- 2026 Market Size: USD 2.5 billion

- Projected Market Size: USD 4.7 billion by 2035

- Growth Forecasts: 7.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.7% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 15 September, 2025

Apoptosis Assay Reagent Market - Growth Drivers and Challenges

Growth Drivers

- Automation and technological advancements: The aspect of automation and technological innovation assists health and medical providers in saving time by automating repetitive responsibilities, including administrative paperwork, billing, and appointment scheduling, thus suitable for driving the market globally. According to an article published by NLM in December 2023, the implementation of the UK-specific Conformity Assisted-marked autonomous and voice assistant clinical assistance effectively displayed patient acceptability by ensuring a follow-up pathway to reduce the demand for a clinician-based consultation by almost 60%

- Increased utilization of assays: Assays in the market have gained increased exposure, owing to the ability to successfully determine the targeted analyte presence in a clinical sample. Besides, assay kits have the ability to measure the quantity, intensive property, functional activity, and presence of the assay entity. As stated in the August 2023 NLM article, the lateral flow immunoassay (LFIA) has the capability to identify IgM/IgG antibodies, which are specific to virus in 20 µL of plasma and serum samples. This further denotes a sensitivity rate of 90%, along with a specificity rate of 96.6%, thereby driving the overall market internationally.

- Vigorous investments and partnerships: This particular driver ensures drug approval and provides millions of employment opportunities across different health sectors, thus bolstering the market across different nations. For instance, as stated in the October 2024 PIB data report, the government health expenditure (GHE) in India has effectively increased from 1.1% to 1.8% as of 2022. In addition, government spending also increased by 16.6% over the past four years, while there was a sharp boost in health spending in the country by 37% by the end of 2022, therefore denoting a huge growth opportunity for the overall market globally.

Laboratory Reagents 2023 Export and Import Driving the Apoptosis Assay Reagent Market

|

Countries |

Export |

Import |

|

U.S. |

USD 108 million |

- |

|

Germany |

USD 59.3 million |

- |

|

China |

USD 22.8 million |

- |

|

Argentina |

- |

USD 132 million |

|

Philippines |

- |

USD 69.2 million |

|

Lebanon |

- |

USD 43.2 million |

Source: OEC

Challenges

- Complexities in cold-chain and logistics distribution: The existence of severe reagents, such as live-cell probes, antibodies, and certain enzymes, is temperature-sensitive and demands uninterrupted cold-chain logistics. This tends to create challenges for suitable distribution in emerging markets and rural areas, thereby negatively impacting the market internationally. Besides, there has been continuous identification of broken cold chains as one of the primary causes of diagnostic failures, particularly in low-and middle-income countries. Meanwhile, for manufacturers, offering product integrity in these nations needs generous investments, especially in logistic partners and specialized packaging to boost the market demand.

- Political and economic volatility: The aspect of present fluctuations, trade wars, political instability, and import tariffs have the ability to create disruptions in supply chains and result in making the market entry financially unpredictable for the market globally. For instance, an unexpected currency devaluation, particularly in a target market, can rapidly remove profitability on pre-set contracts. Besides, companies, such as Merck KGaA, readily implemented financial hedging strategies, along with dynamic pricing models to address the challenge across volatile regions that readily discouraged investments, leading to price increases and supply shortages.

Apoptosis Assay Reagent Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 2.4 billion |

|

Forecast Year Market Size (2035) |

USD 4.7 billion |

|

Regional Scope |

|

Apoptosis Assay Reagent Market Segmentation:

Application Segment Analysis

The drug discovery and development segment is anticipated to account for the highest share of 52.7% by the end of 2035. The segment’s upliftment is highly driven by the ability to achieve the objective of a standard and suitable health approach, along with the latest medicines and treatment options through continuous research. As per an article published by the Human Specific Research Organization in December 2024, the discovery and development process comprise 5,000 to 10,000 compounds that take almost 4.5 years to carefully identify new drug candidates and accordingly optimize drug action, thus suitable for the segment’s growth.

Product Segment Analysis

The reagents segment is expected to garner the second-highest share during the projected timeline. The segment’s growth is highly fueled by its capability to facilitate chemical reactions and its utilization for different medical evaluations, including kidney function and blood glucose tests, particularly for chemical laboratory research. In this regard, the May 2025 Biologicals article indicated that there exists more than 3.5 million antibody-specific products in the healthcare industry, of which almost 99% derive from animals, such as recombinant, monoclonal, and polyclonal, and the remaining 1% caters to antibodies without animal extracts, thus denoting a crucial aspect to conduct laboratory experiments.

End user Segment Analysis

The pharmaceutical and biotechnology companies segment is projected to constitute the third-highest share during the forecast period. The segment’s development is highly attributed to huge R&D budgets, suitable demand for strong and validated apoptosis data to generate a drug discovery pipeline, especially for neurodegeneration and oncology. These companies are considered as primary consumers of automated screening systems, premium-grade reagent kits, and high-throughput to meet strong administrative submission standards and escalated preclinical development, thereby suitable for boosting the overall segment in the market.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Product |

|

|

End user |

|

|

Detection Tech |

|

|

Assay Type |

|

|

Cell Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Apoptosis Assay Reagent Market - Regional Analysis

North America Market Insights

North America in the apoptosis assay reagent market is considered to be the dominating region, garnering the largest share of 40.7% by the end of 2035. The market’s exposure in the region is highly attributed to an expansion in the biotechnology and pharmaceutical sectors, a surge in research funding and innovative health facilities, and the increased prevalence of chronic diseases. According to an article published by the CMS in May 2025, healthcare spending in the overall region is continuously growing within a range of 2% to 3%. In addition, the Medicare trust and Medicaid are effectively functioning, thereby suitable for boosting the market’s exposure.

The apoptosis assay reagent market in the U.S. is growing significantly, owing to increased expenditure to conduct life science research, the availability of progressive health technologies, the expansion of drug discovery programs, chemical analysis instruments sourcing, and an increase in the adoption of personalized therapy and clinical diagnostics development. As per a data report published by the Research America Organization in January 2022, the country’s medical research and development has successfully reached USD 245.1 billion, with an 11.1% growth rate. This denotes extensive development across the private and public sector R&D ecosystem, which is positively impacting the market in the country.

The apoptosis assay reagent market in Canada is also developing due to the presence of a steady government to ensure investment in healthcare, focus on research for immunology and cancer biology, a rise in regenerative medicine utilization, provincial funding, and the presence of biotechnology clusters. According to the July 2025 Government of Canada report, USD 10.3 million for more than two years, along with USD 5 million, has been allocated to support ongoing funding for the regional Immunization Research Network. In addition, the provision of USD 675,000 for supporting research projects and a clinical trial through the Stem Cell Network is also bolstering the market’s exposure.

Chemical Analysis Instruments 2023 Export and Import in North America

|

Countries |

Export |

Import |

|

U.S. |

USD 11.5 billion |

USD 7.8 billion |

|

Canada |

USD 539 million |

USD 376 million |

|

Mexico |

USD 462 million |

USD 544 million |

|

Costa Rica |

USD 21.2 million |

USD 17.8 million |

|

Panama |

USD 8.2 million |

- |

|

Guatemala |

USD 7 million |

- |

|

Dominican Republic |

USD 8.2 million |

USD 28.4 million |

|

El Salvador |

USD 4.8 million |

- |

Source: OEC

Europe Market Insights

Europe in the apoptosis assay reagent market is anticipated to be the fastest-growing region during the projected timeline. The market’s growth in the region is highly driven by a rise in cardiovascular and autoimmune diseases, collaborative research strategies, strong government funding, technological advancements, and personalized medicine adoption. As per a data report by the Ministry of European Investments and Projects in 2023, investment for outpatient clinics in the public infrastructure has issued a budget of EUR 120 million, followed by EUR 122 million, pertaining to research solution development in the medical field.

The apoptosis assay reagent market in Germany is gaining increased exposure, owing to an increased focus on personalized medicines and apoptosis-specific therapy and diagnostics monitoring, innovation in high-throughput flow cytometry, strong private and public sector funding, and an increase in the implementation of premium automated and consumable imaging platforms. As per a data report published by EFPIA in June 2023, the level of public reimbursement rate in the country accounts to be 94%, which in turn allows medicine reimbursement, thereby denoting a huge opportunity for the market to effectively flourish in the country.

The apoptosis assay reagent market in the UK is also growing due to the provision of the national healthcare budget, along with the availability of government biotech innovation programs, personalized medicine, and cancer diagnostics. According to a data report published by the Office for National Statistics in May 2024, the country’s healthcare expenditure was £292 billion in 2023, which accounted for a decrease in the gross domestic product (GDP) from 11.1% in 2022 to 10.9%. However, there was an increase in health spending by 5.6% in nominal terms, while the government-based healthcare expenditure in the country amounted to almost £239 billion, thereby denoting an optimistic outlook for the overall market in the country.

Cardiovascular Disease 2022 Death Rates in Europe

|

Countries |

Prevalence (per 100,000 inhabitants) |

|

Bulgaria |

1,074.3 |

|

Romania |

924.5 |

|

Germany |

361.5 |

|

Austria |

346.6 |

|

Italy |

270.3 |

|

Portugal |

237.9 |

|

Netherlands |

225.7 |

|

France |

171.6 |

Source: Eurostat, July 2025

APAC Market Insights

Asia Pacific in the apoptosis assay reagent market is expected to account for a considerable share by the end of the projected timeline. The market’s development in the region is highly driven by an increase in drug development and clinical research, a surge in the awareness and implementation of personalized medicine, and rapid advancements in biotechnology, particularly for proteomics and genomics. As per an article published by NLM in June 2024, an estimated 75% of the population in Thailand is readily under the universal health coverage (UHC), and precision medicine is one of the healthcare benefits that is provided, despite the increased cost burden of the country’s GDP, thus suitable for bolstering the overall market in the region.

The apoptosis assay reagent market in China is gaining increased traction, owing to substantial growth in government spending, a surge in patient base, expansion in contract research organizations, robust focus on oncology research, rapid proliferation in biotechnology research centers and academic institutions, and supportive administrative policies. As per the August 2022 Cancer Biology and Medicine article, the most common type of cancer occurrence in the country is lung, accounting for 828,100 cases, followed by 408,000 colorectal cases, and 396,500 gastric cases, thereby denoting a huge growth opportunity for the market in the country.

The apoptosis assay reagent market in India is developing due to the extension in research and academic institutions, the enhancement of assay kits, growth in pharmaceutical industries, particularly in drug testing, adoption of personalized therapies, and enhanced healthcare facilities. According to the May 2023 NLM article, the country’s government readily spent 2% of the GDP on healthcare as of 2022, and also allocated an estimated ₹869 Crore (USD 9.7 billion) to the Ministry of Health and Family Welfare in the Union Budget. Besides, the health tech industry in the country achieved capital investments of almost USD 1,740 million over the past four years, thus denoting developmental opportunities for the market.

Key Apoptosis Assay Reagent Market Players:

- Thermo Fisher Scientific Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KGaA (Germany)

- Becton, Dickinson and Company (BD) (U.S.)

- Sartorius AG (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Abcam plc (UK)

- Agilent Technologies, Inc. (U.S.)

- PerkinElmer, Inc. (U.S.)

- Geno Technology, Inc. (U.S.)

- Promega Corporation (U.S.)

- BioVision, Inc. (U.S.)

- Creative Bioarray (U.S.)

- GeneCopoeia, Inc. (U.S.)

- Rockland Immunochemicals, Inc. (U.S.)

- Abnova Corporation (Taiwan)

The international market is extremely consolidated, which is led by multinational life science giants, such as Merck KGaA and Thermo Fisher Scientific, readily leveraging their extensive portfolios, along with worldwide distribution networks for dominance. The competitive approach is effectively characterized by technological progression in high-context and multiplexed assays, tactical acquisitions to expand product lines, and forge notable partnerships among pharmaceutical organizations to implement reagents into drug discovery workflows. Therefore, all these approaches adopted by key players across different nations are deliberately bolstering the market’s exposure.

Here is a list of key players operating in the global market:

Recent Developments

- In October 2024, BD notified the successful commercial launch of the first-ever robotics-compatible and high-throughput reagent kits, which will effectively enable automation to offer huge consistency and boosted efficiency for discovery studies.

- In September 2024, Sysmex Corporation declared the launch of the HISCL HIT lgG assay kit, which is suitable for readily measuring lgG antibodies against complications of Heparin and platelet factor.

- Report ID: 8103

- Published Date: Sep 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Apoptosis Assay Reagent Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.