Aortic Stenosis Treatment Market Outlook:

Aortic Stenosis Treatment Market size was valued at approximately USD 9.42 billion in 2025 and is projected to reach around USD 25 billion by the end of 2035, rising at a CAGR of approximately 10.3% during the forecast period 2026-2035. In 2026, the industry size of the aortic stenosis treatment is evaluated at USD 24.6 billion.

The research and development in aortic stenosis treatment is promptly upgrading with utmost focus on upgrading transcatheter aortic valve replacement devices. Prominent companies such as Medtronic and Edwards are altering the designs of the valves to have a low-profile system for delivery. Research efforts are also being made in the embolic protection devices with AI-enabled planning and computational modelling to enhance the safety and outcomes. Healthcare providers are giving tailored treatment, which is shaping the market with long-lasting management. The advances in material science are reshaping the methods of how aortic stenosis is treated globally.

The supply chain of the market is highly regulated and involves numerous stakeholders from sourcing the raw materials to delivery to the patient. The procurement of the raw material starts with special materials such as medical-grade metals and animal tissues from pigs or cows. Market players such as Lifesciences and Abbott use these materials to fabricate catheters. The supply chain plays a prominent role in the smooth growth of the market, and companies are putting in efforts to lead a well-organized downstream supply chain.

Key Aortic Stenosis Treatment Market Insights Summary:

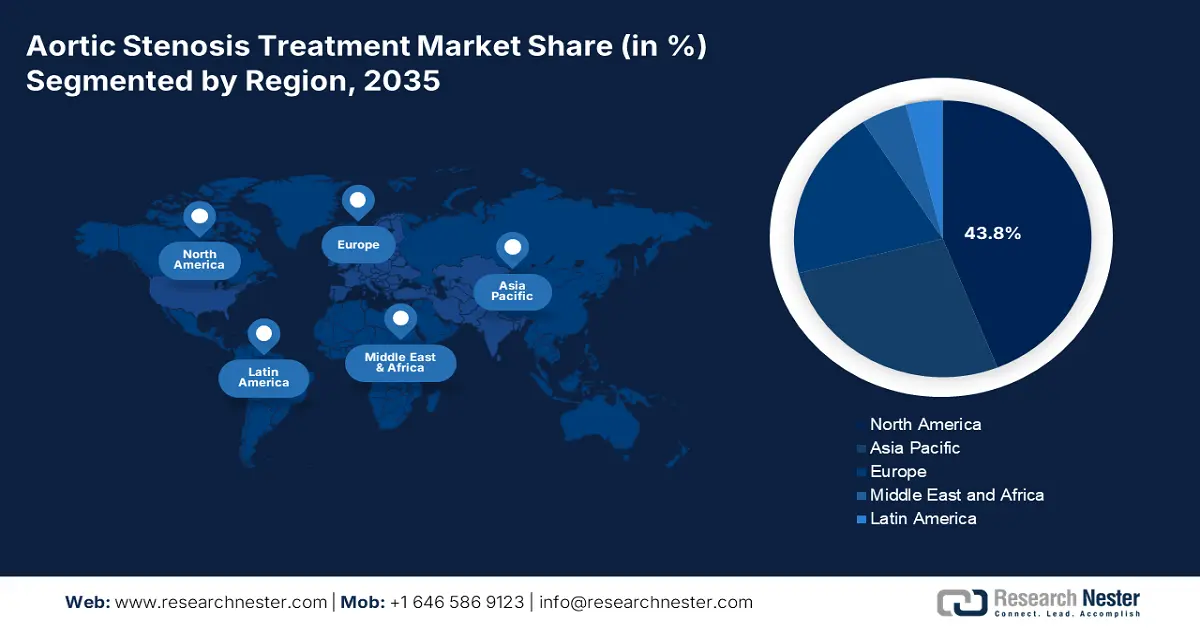

Regional Insights:

- North America is anticipated to hold 43.8% share by 2035, owing to widespread adoption of TAVR and expanding insurance reimbursements.

- Asia-Pacific is expected to capture 17.8% share by 2035, fueled by a growing elderly population, enhanced awareness, and government cardiovascular spending.

Segment Insights:

- Hospitals segment is projected to account for 66.7% share by 2035, propelled by their surgical infrastructure, access to trained cardiac specialists, and established reimbursement routes.

- TAVR minimally invasive procedure segment is expected to hold 65.3% share by 2035, impelled by expanded indications to intermediate and low-risk patients and favorable clinical outcomes.

Key Growth Trends:

- Rising prevalence of cardiovascular diseases

- Rising focus on the minimally invasive and patient-centered care

Major Challenges:

- Lack in advanced procedures

Key Players: Edwards Lifesciences Corporation, Neovasc Inc., HighLife SAS, Abbott Laboratories, Boston Scientific Corporation, Medtronic PLC, CryoLife Inc., Siemens Healthcare GmbH, and others.

Global Aortic Stenosis Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.42 billion

- 2026 Market Size: USD 24.6 billion

- Projected Market Size: USD 25 billion by 2035

- Growth Forecasts: 10.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.8% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Canada, Germany, France, UK

- Emerging Countries: Japan, China, India, South Korea, Malaysia

Last updated on : 9 September, 2025

Aortic Stenosis Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Rising prevalence of cardiovascular diseases: One of the strongest drivers of the aortic stenosis treatment market is the rising prevalence of cardiovascular diseases. According to data published by the World Health Organization, an estimated 19.7 million people have died from cardiovascular disease. Aortic stenosis is considered to be the most common valvular heart disease, particularly in developed regions. Innovations such as Transcatheter Aortic Valve Replacement are transforming the treatment landscape by rendering minimally invasive alternatives. With the rising development, the market is anticipated to witness rising growth.

- Rising focus on the minimally invasive and patient-centered care: The healthcare industry is transitioning towards minimally invasive solutions. Physicians and patients prefer less invasive procedures, which minimize surgical trauma. There has been a rising demand for improved quality of life, and a need for faster return to normal activities is fostering the demand for modern treatment modalities, developing robust momentum for the expansion of the market. There has been an increased demand for patient-centric care, and with the rising acceptance, market growth is expected to increase significantly.

- Expansion of the healthcare infrastructure: Countries are investing heavily in the development of state-of-the-art healthcare infrastructure. The infrastructure growth in a region comes with development in imaging technologies, which play a crucial role in the early as well as accurate detection of aortic stenosis. Public and private healthcare practitioners are developing dedicated care centers for cardiac-related treatments. Furthermore, various governments are joining hands with private players to expand capabilities for cardiac care. Also, with the rising healthcare accessibility and awareness regarding the treatment options, the demand for aortic stenosis therapies.

Challenges

- Lack in advanced procedures: Sub-Saharan Africa and Southeast Asia face a major challenge due to inadequate healthcare infrastructure in the aortic stenosis treatment market. Hospitals in these areas lack catheterization laboratories and trained interventional cardiologists, thereby complicating complex procedures like TAVR. This infrastructure gap widens the gap and complicates market entry for manufacturers and adds costs for training, equipment installation, and procedural standardization. Consequently, device-based therapies are underutilized, even as patient demand expands. Closing this gap involves synchronized investment by governments and public-private partnerships.

Aortic Stenosis Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.3% |

|

Base Year Market Size (2025) |

USD 9.42 billion |

|

Forecast Year Market Size (2035) |

USD 25 billion |

|

Regional Scope |

|

Aortic Stenosis Treatment Market Segmentation:

End user Segment Analysis

Hospitals dominate the aortic stenosis treatment market and is poised to hold the market share of 66.7% by 2035. The segment is fueled due to their surgical infrastructure, access to trained cardiac specialists, and set up reimbursement routes. Cardiac specialty centers are growing, particularly in urban Europe and Asia, but fall short of the procedural capability of North American or EU hospital systems. Moreover, hospitals are supported by care pathways and intensive post-operative care units that are essential for high-risk aortic stenosis patients. Their capacity to treat complications and provide multidisciplinary cardiac care also supports their leadership in the market.

Treatment Modality Segment Analysis

The TAVR minimally invasive procedure leads the segment and is expected to hold the share of 65.3% by 2035. The segment is fueled primarily by the growth of TAVR indications to intermediate and low-risk patients, aided by clinical results demonstrating lower morbidity, decreased length of stay, and faster recovery. The Centers for Medicare & Medicaid Services (CMS) supports complete reimbursement for TAVR procedures, making expanded access available in the U.S. Moreover, data from NIH studies show that TAVR use has increased in the last decade, replacing SAVR in most elderly patients.

Valve Mechanism Segment Analysis

Balloon expandable valves are currently dominating the market, holding 55% of the share by 2035. Recently, balloon-expandable valves from Edwards Lifesciences have showcased robust clinical outcomes. The growth of the segment is also driven by the high familiarity of cardiologists and surgeons with balloon-expandable technology. These factors make it a default choice for healthcare practitioners. These valves have secured approvals for usage in the high intermediate in various countries. Additionally, such valves are useful as they have established outcomes and trust from many physicians.

Our in-depth analysis of the global aortic stenosis treatment market includes the following segments:

|

Segment |

Subsegments |

|

Treatment Modality |

|

|

Implantation Procedure |

|

|

Valve Mechanism |

|

|

Product Type |

|

|

End user |

|

|

Patient risk/ Indication |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aortic Stenosis Treatment Market - Regional Analysis

North America Market Insights

The aortic stenosis treatment market in North America dominates the market and is expected to hold the market share of 43.8% at a CAGR of 8.5% by 2035. The market growth is driven by the widespread adoption of Transcatheter Aortic Valve Replacement (TAVR) and expanding insurance reimbursements. The U.S. and Canada together dominates the market position and hold significant revenue. The growth can be attributed to the strong government healthcare spending, supportive regulatory environments, and extensive hospital infrastructure. Increase in aging population, rising valvular disease incidence, and a mature medtech industry pipeline will drive increasing treatment volumes and the need for new surgical and non-surgical treatments.

The U.S. aortic stenosis treatment market is growing steadily with rising elderly populations and robust institutional backing from federal medical programs. The CMS has increased reimbursement coverage of TAVR for patients with intermediate and low risk, resulting in wider availability across public hospitals. Increased life expectancy, enhanced device security, and national investment in managing heart disease through the U.S. Department of Health & Human Services (HHS) make the treatment market one of the most valued cardiovascular segments.

Asia Pacific Market Insights

The Asia-Pacific is the fastest-growing aortic stenosis treatment market and is poised to hold the market share of 17.8% at a CAGR of 9.9% by 2035. The market is driven by growing elderly populations, enhanced awareness, and government spending on cardiovascular treatment. Major players are Japan, China, India, South Korea, and Malaysia, with increasing demand for Transcatheter Aortic Valve Replacement (TAVR) due to its minimally invasive nature and adaptability to age cohorts. Also, the development of cardiac care facilities in India and China's secondary cities is making it possible to access diagnostic and interventional procedures on a wider scale.

China holds the largest share in the aortic stenosis treatment market in the APAC region and is anticipated to hold the market share. Moreover, the National Health Commission of China has given priority to structural heart disease under its 14th Five-Year Plan, further increasing financing for TAVR training and facilities. Also, the rapidly aging population of the country has a larger pool of patients. For instance, Beijing has made its priority for elder care and health services with the help of the “silver economy”.

Europe Market Insights

The aortic stenosis treatment market in Europe is set for strong growth and is expected to hold a significant market share by 2034. The market is driven by a mix of supportive reimbursement policies, sophisticated healthcare infrastructure, and growing acceptance of minimally invasive therapies such as TAVR. Aging populations are driving demand, especially in nations with well-developed public healthcare systems such as Germany, France, and the UK. European markets are further supported by cross-border collaborative funding through the EU4Health and European Health Data Space (EHDS) programs.

Germany is the highest shareholder in the aortic stenosis treatment market and is expected to retain its market share. The market is driven by sophisticated tertiary care networks and a rising elderly population. The government has robust reimbursement frameworks under GKV statutory health insurance, including TAVR patients. Strategic position as a med-tech manufacturing base strengthens Germany's access to next-generation valves, increasing local and EU-wide supply. According to the German Federal Bureau of Statistics, between 2011 and 2022, 336,879 aortic valve procedures were performed even in patients of age below 40 years.

Key Aortic Stenosis Treatment Market Players:

- Edwards Lifesciences

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medtronic plc

- Abbott Laboratories

- Boston Scientific Corporation

- JenaValve Technology

- Terumo Corporation

- MicroPort Scientific

- CryoLife (now Artivion)

- Biotronik

- Lepu Medical

- LivaNova

- NVT AG

- Sahajanand Medical Technologies

- Transcatheter Technologies GmbH

- Admedus

- Osypka Medical

- Scinomed Lifecare

- Taewoong Medical

- Malaysian Bio-XCell

- B. Braun Melsungen AG

The global market is highly competitive and is led by multiple key players such as Edwards Lifesciences and Medtronic. These players collectively hold a significant share and are driven by the enhanced TAVR platforms and global distribution. Companies are focusing on product innovation, regulatory expansion, and strategic collaboration to be competitive in the market. Companies, including Boston Scientific and Abbott, are actively investing in next-gen value systems and AI-enabled delivery tools. On the other hand, the Asia Pacific layers are scaling regulatory and manufacturing reach. The market is redefined by the local R&D, government-backed infrastructure, and value-based pricing.

Here is a list of key players operating in the global aortic stenosis treatment market:

Recent Developments

- In January 2025, Abbott Laboratories in Navitor Vision Launch released an enhanced TAVI system featuring three radiopaque “Vision” markers to improve visualization and deployment precision during implantation. These large, highly visible markers are embedded in the valve frame to enhance visualization during fluoroscopic guidance.

- In May 2025, Edwards Lifesciences received FDA approval for treating asymptomatic severe aortic stenosis patients for SAPIEN 3 Ultra and Ultra RESILIA. This marks the first-ever TAVR approval for asymptomatic individuals, based on the EARLY TAVR trial, which showed TAVR significantly outperformed traditional surveillance.

- Report ID: 3125

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aortic Stenosis Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.