Antivirus Software Market Outlook:

Antivirus Software Market size was valued at USD 4.72 billion in 2025 and is likely to cross USD 8.45 billion by 2035, expanding at more than 6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of antivirus software is assessed at USD 4.97 billion.

With the rise of sophisticated attacks targeting individuals and organizations, antivirus solutions have evolved to offer real-time threat detection, behavior-based analysis, and multi-layered protection. This market caters to diverse segments, from individual users to enterprises, with specialized tools designed to address varying security needs. According to the Australia Cyber Security Centre (ACSC), over 76,000 cybercrime reports were received in 2021-22, showing an increase of 13% from 2020-21, which equates to one report every 7 minutes.

The rising adoption of cloud computing and IoT devices has further fueled the demand for advanced antivirus solutions. The National Cybersecurity Center of Excellence estimated that over 75 billion IoT devices will be in use by the end of 2025. Market players continue to innovate by integrating artificial intelligence and machine learning to enhance threat prediction and response, ensuring the antivirus software market remains dynamic and essential in the modern digital landscape.

Key Antivirus Software Market Insights Summary:

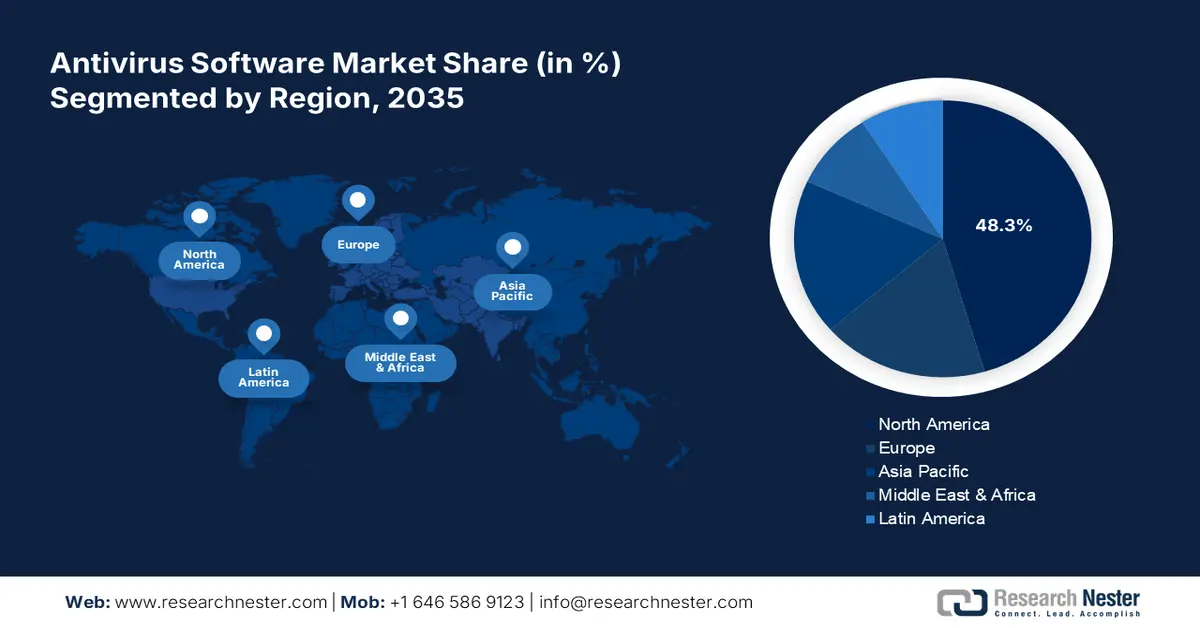

Regional Highlights:

- North America's 48.3% share in the Antivirus Software Market is bolstered by increasing cyberattacks, digital transformation, and strong cybersecurity infrastructure, securing growth through 2035.

- Europe's Antivirus Software Market is anticipated to maintain a considerable share by 2035, fueled by GDPR regulations and rising digital awareness and security initiatives.

Segment Insights:

- The PC segment is anticipated to hold a 77.1% share by 2035, propelled by widespread PC use and demand for robust malware protection.

Key Growth Trends:

- Proliferation of IoT devices requiring enhanced protection

- Expansion of cloud-based antivirus software offerings

Major Challenges:

- Compatibility issues

- Privacy concerns

- Key Players: Cisco Systems, Inc., Comodo Security Solutions, Inc., ESET, spol. s r.o., Fortinet, Inc., Fortra, LLC.

Global Antivirus Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.72 billion

- 2026 Market Size: USD 4.97 billion

- Projected Market Size: USD 8.45 billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.3% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Antivirus Software Market Growth Drivers and Challenges:

Growth Drivers

-

Proliferation of IoT devices requiring enhanced protection: The increase in IoT devices has increased the attack surface for cyber threats, driving the need for enhanced antivirus protection. As IoT adoption grows across industries, securing connected devices from malware, ransomware, and unauthorized access has become a top priority, boosting demand for advanced antivirus solutions tailored to IoT ecosystems. For instance, in April 2021, AT&T in alliance with SentinelOne, launched a Managed Endpoint Security solution. It links endpoint threat detection through a single software agent, consolidating Antivirus, Endpoint Protection, Endpoint Detection and Response, and IoT security functions.

-

Expansion of cloud-based antivirus software offerings: This expansion is transforming the market by offering scalable, real-time protection without the need for extensive hardware. This approach is particularly appealing to businesses and individuals seeking cost-effective solutions with easy deployment and automatic updates, making it a key driver of antivirus software market growth. For instance, in March 2021, ESET launched ESET PROTECT, a new endpoint security management platform, in India. ESET PROTECT Cloud is a foundation for security management in ESET’s cloud-based business offerings which is capable of catering to organizations of all sizes.

Challenges

-

Compatibility issues: This poses a challenge in the antivirus software market as new and niche operating systems emerge, creating gaps in protection. Many antivirus solutions are primarily designed for widely used platforms, leaving smaller or less common systems exposed to cyber threats. This lack of compatibility not only creates security gaps but also forces users to seek alternative solutions, which may not offer the same level of protection or features. Furthermore, businesses operating in multi-platform environments struggle to find unified solutions, leading to inefficiencies and potential vulnerabilities in their cybersecurity frameworks.

-

Privacy concerns: Modern antivirus solutions often require deep access to user data and system files to effectively detect and neutralize threats. This level of access, however, raises fears about potential misuse of sensitive information or breaches by malicious actors. With increasing awareness about data privacy, users are becoming more cautious about granting extensive permissions to antivirus software. This hesitancy is compounded by high-profile cases of data misuse, making privacy assurances and transparent data handling practices essential for building trust and driving adoption.

Antivirus Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 4.72 billion |

|

Forecast Year Market Size (2035) |

USD 8.45 billion |

|

Regional Scope |

|

Antivirus Software Market Segmentation:

Type (PC, Phones/Pad)

By the end of 2035, PC segment is estimated to hold over 77.1% antivirus software market share. This is due to the widespread use of PCs in both personal and professional settings. The prevalence of targeted malware attacks on these devices, and the demand for robust protection among gamers and remote workers is driving the segment’s growth notably. As per a 2024 survey, 90% of America’s total population agrees that PCs require antivirus protection.

In July 2023, the FBI noted two trends in the U.S. emerging across the ransomware environment. Dual ransomware attacks were conducted in close proximity to one another, resulting in a combination of data encryption, exfiltration, and financial losses from ransom payments. The FBI issued warnings against such threats in October 2023 to prevent companies from getting trapped, resulting in higher adoption of antivirus software.

Application (Enterprise, Individual, Government)

Based on application, the enterprise segment is projected to register a significant share in the antivirus software market during the forecast period. Enterprises handle sensitive data and must comply with stringent regulations such as GDPR and HIPAA, driving the demand for advanced antivirus tools. Additionally, the adoption of cloud computing and IoT technologies has accelerated the attack surface, making endpoint protection a priority for businesses.

The enterprises demand robust cybersecurity solutions to combat threats including ransomware, phishing, and zero-day attacks. As per a survey conducted among the owners of small businesses across six countries in January 2024, 61% of the small businesses lost more than USD 10,000 dealing with the attacks, of whom 17% have experienced more than one cyberattack. Rising remote work trends have further amplified the need for enterprise-grade antivirus solutions to secure employees’ devices and networks.

Our in-depth analysis of the global antivirus software market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Antivirus Software Market Regional Analysis:

North America Market Analysis

North America antivirus software market is anticipated to hold revenue share of more than 48.3% by 2035. According to an article posted by the Federal Bureau of Investigation in 2023, IC3 received 880,418 complaints from the American public. Potential losses exceeded USD 12.5 billion in the same year, which is a 10% rise in complaints received, representing a 22% increase in losses suffered, in comparison to 2022. Nearly 88% of the people in a survey conducted in America consider antivirus software to be an effective measure against cyberattacks. These factors are boosting the antivirus software industry growth significantly in the region.

The antivirus software market in the U.S. is propelled by the high prevalence of cyber attacks targeting businesses, government entities, and individuals. With a strong focus on digital innovation and a massive volume of sensitive data being processed, organizations prioritize robust antivirus solutions to safeguard critical systems. The U.S. also has a mature cybersecurity ecosystem with a strong presence of leading antivirus providers, further driving market growth.

Canada antivirus software market is growing steadily due to increasing cyber risks and a rising focus on digital security. Businesses, particularly in sectors including finance, and healthcare, are adopting antivirus tools to protect data and meet regulatory requirements. Additionally, the expansion of smart cities and digital government initiatives across Canada is creating further opportunities for advanced antivirus solutions to secure interconnected systems and networks.

Europe Market Statistics

Europe is anticipated to register a considerable share in the global antivirus software market during the forecast period. The market is majorly driven by strict data protection regulations including GDPR. According to the European Repository of Cyber Incidents (EuRepoC), more than 3390 cyber incidents were recorded in the region between January 2022 to December 2024. The region’s emphasis on digital transformation and growing awareness among consumers about online safety contribute to the steady growth of the antivirus software market in the region.

The antivirus market in France is driven by the increasing digitalization of businesses and the government’s focus on strengthening cybersecurity infrastructure. Strict adherence to GDPR and other data protection regulations has compelled organizations to adopt advanced antivirus solutions to secure sensitive information. Sectors SMEs are a significant part of the country’s economy and are increasingly investing in antivirus tools to protect against ransomware and phishing attacks. These factors are boosting the market significantly.

Germany antivirus software market is expanding rapidly due to its strong industrial base and reliance on digital technologies such as Industry 4.0 and IoT. Additionally, Germany’s strong emphasis on privacy and data security, combined with public awareness campaigns about cybersecurity, has led to a growing adoption of antivirus software among individuals and smaller businesses. These factors, alongside the rise of hybrid work models, continue to support market expansion.

Key Antivirus Software Market Players:

- Avast Software s.r.o.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- O Kaspersky Lab

- Aura Sub, LLC

- Beijing Qihu Keji Co. Ltd.

- Cheetah Mobile Group

- Cisco Systems, Inc.

- ESET, spol. s r.o.

- Fortinet, Inc.

- Fortra, LLC

- F‑Secure

- G DATA CyberDefense AG

- K7 Computing Private Limited

- Malwarebytes Inc.

- Microsoft Corporation

- Net Protector (Biz Secure Labs Pvt Ltd)

- PC Matic, Inc.

- Quick Heal Technologies Limited

- S.C. BitDefender S.R.L.

- Surfshark B.V. Total Security Limited

- Webroot by Open Text Corporation

Companies in the antivirus software market are integrating artificial intelligence and machine learning to enhance threat detection and prevention. Subscription-based models with tiered pricing are widely implemented to cater to diverse customer segments, ensuring affordability and regular updates. Additionally, firms prioritize partnerships with enterprises, government agencies, and IT service providers to expand their reach, while investing in cybersecurity awareness campaigns to build trust and educate users about evolving threats. Some of these companies are:

Recent Developments

- In October 2024, Quick Heal Technologies Limited launched India's first fraud prevention solution, AntiFraud.AI, which is a Made in India solution, revolutionizing digital safety against the escalating threat of financial fraud.

- In September 2022, NortonLifeLock completed the acquisition of Avast, which is a leader in digital security and privacy. The merger was a compelling strategic and financial move and represented an attractive opportunity to create a new, industry-leading consumer Cyber Safety business.

- Report ID: 6853

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Antivirus Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.