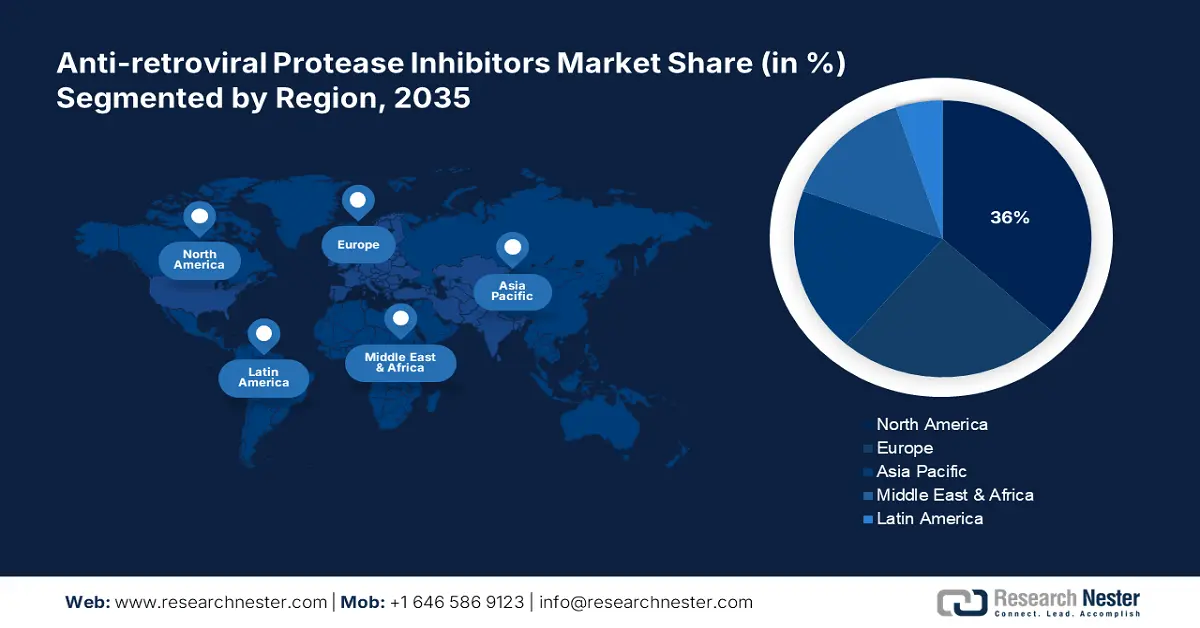

Anti-retroviral Protease Inhibitors Market - Regional Analysis

North America Market Insight

The anti-retroviral protease inhibitors market in North America is expected to hold the largest market share of 36% during the forecast period due to advanced medical infrastructure, the high disease prevalence, and funding initiatives from the government. Additionally, public and private healthcare systems in the region are focusing on improved patient outcomes for which the long-acting injectable therapies were introduced, further enhancing the management of therapies. Government initiatives, such as the U.S. Department of Health & Human Services' funding and Canada's Public Health Agency's programs, further boost business in this sector.

The anti-retroviral protease inhibitors market in Canada is growing exponentially, driven by substantial government-backed funding and growing awareness of prevention and care. According to a report by the Government of Canada in December 2023, there were nearly 1,833 cases of HIV diagnoses in Canada in 2022, out of which 597 were female. Increased national initiatives toward early diagnosis and treatment access have further accelerated the demand for protease inhibitors. All these factors have a significant contribution to the growth of the market during the forecast timeline.

The anti-retroviral protease inhibitors market in the U.S. is growing due to strong government funding, improvements in awareness and prevention, and the high burden of HIV. According to a report by the U.S. Statistics in February 2025, approximately 31,800 people were dealing with HIV in the U.S., although new HIV infections decreased 12% over the last 8 years in 2022. Additionally, People who inject drugs accounted for 7% of the infected population. Additionally, the U.S. government continues investing in programs such as Ending the HIV Epidemic to reduce the incidence of new infections. Increased access to antiretroviral therapy and earlier intervention methods have kept treatment rates at the same level.

Asia Pacific Market Insight

The anti-retroviral protease inhibitors market in the Asia Pacific is expected to hold the fastest-growing market, due to the expanding access to treatment procedures. Due to rising disposable income, the region is experiencing tremendous growth, supported by government initiatives, the availability of generic drug formulations, and technological advancements in developing next-generation protease inhibitors with reduced side effects. According to a report by UNAIDS 2024, in 2023, 6.7 million people living with HIV were residing in Asia and the Pacific. Hence, these rising instances drive demand for advanced PIs in the region.

The anti-retroviral protease inhibitors market in China is growing due to the giant market players and government disbursement of funding. Additionally, as per a report by UNAIDS in October 2024, around 1.4 million people are living with HIV in China, and women make up around 23.7% of them, according to the latest data from the health authorities of China. Government initiatives, such as the National Free Antiretroviral Treatment Program, are increasing the treatment access for HIV patients in China. This growing accessibility, combined with domestic pharmaceutical advancements, is positioning China as a key regional player in the global anti-retroviral protease inhibitors market.

The anti-retroviral protease inhibitors market in India is growing due to strong government-supported healthcare initiatives and growing awareness among the public on matters of health. The National AIDS Control Organisation (NACO), operating under the aegis of the National AIDS Control Programme (NACP), undertakes the primary task of administering free antiretroviral (ART) treatment throughout the country. Initiatives such as the Treat All policy create a platform for early treatment initiation, irrespective of the stage of the disease. The increased establishment of ART Centres and Link ART Centres to cater to the last-mile underserved and rural populations is another facet of the expansive system.

Europe Market Insight

The anti-retroviral protease inhibitors market in Europe is expected to hold steady growth due to a series of aligned policy and programmatic actions. The states of Europe are reviving and enhancing HIV action plans, e.g., the WHO European Region's 2022 2030 Action Plan towards the elimination of HIV, viral hepatitis, and STIs. Increased focus on HIV early diagnosis, higher rates of HIV testing, care linkage, and reduced late HIV presentation are driving demand for successful treatments such as protease inhibitors. Approvals of new injectable and long-acting HIV prevention products also indicate positive policy and market trends towards new antiretroviral options.

The anti-retroviral protease inhibitors market in the UK is experiencing growth due to a mix of government action, social campaigns, and expanded access to treatment. As per a report by the UK Government in June 2023, the UK government has pledged to have an 80% decrease in fresh HIV infections by 2025. According to a February 2025 UK Government report, 95% of all individuals with HIV were diagnosed, 98% of those diagnosed were treated, and 98% of individuals who were treated were suppressed from the virus and could not transmit the virus to other individuals. These programs are extensively propelling the demand for advanced anti-retroviral protease inhibitors within the UK economy.

The anti-retroviral protease inhibitors market in Germany is growing due to interaction among government programs, health education campaigns, and access to care. The government of Germany has utilized extensive techniques to fight HIV infection by increasing testing services and integrating HIV care in primary healthcare clinics. Public education campaigns have tried to make more people aware of HIV prevention as well as the value of early diagnosis. There has also been an attempt at de-stigmatization of HIV, hoping more people would access testing and treatment.

HIV and AIDS Epidemiological Characteristics in the Regions of Europe (2022)

|

Characteristic |

WHO Regions of Europe |

West |

Centre |

East |

EU/EEA |

|

Reporting countries/number of countries |

49/53 |

21/23 |

15/15 |

13/15 |

30/30 |

|

Number of HIV diagnoses |

110,486 |

22,397 |

8,945 |

79,144 |

22,995 |

|

Rate of HIV diagnoses per 100,000 population |

12.4 |

5.1 |

4.5 |

30.7 |

5.1 |

|

Percentage age 15–24 years |

5.7% |

8.9% |

11.7% |

4.2% |

8.9% |

|

Percentage age 50+ years |

16.7% |

21.8% |

15.1% |

15.5% |

19.9% |

|

Male-to-female ratio |

1.8 |

2.4 |

2.9 |

1.6 |

2.4 |

|

Percentage of migrants |

26.7% |

52.3% |

27.0% |

2.2% |

48.3% |

|

AIDS and late HIV diagnosis |

|||||

|

Percentage HIV diagnoses CD4 <350 cells/mm³ |

50.6% |

46.2% |

44.5% |

55.1% |

47.9% |

|

Number of AIDS diagnoses |

7,220 |

1,873 |

825 |

4,522 |

2,349 |

|

Rate of AIDS diagnoses per 100,000 population |

1.1 |

0.5 |

0.4 |

4.4 |

0.6 |

Source: ECDC, 2023