Antipsychotic Drugs Market Outlook:

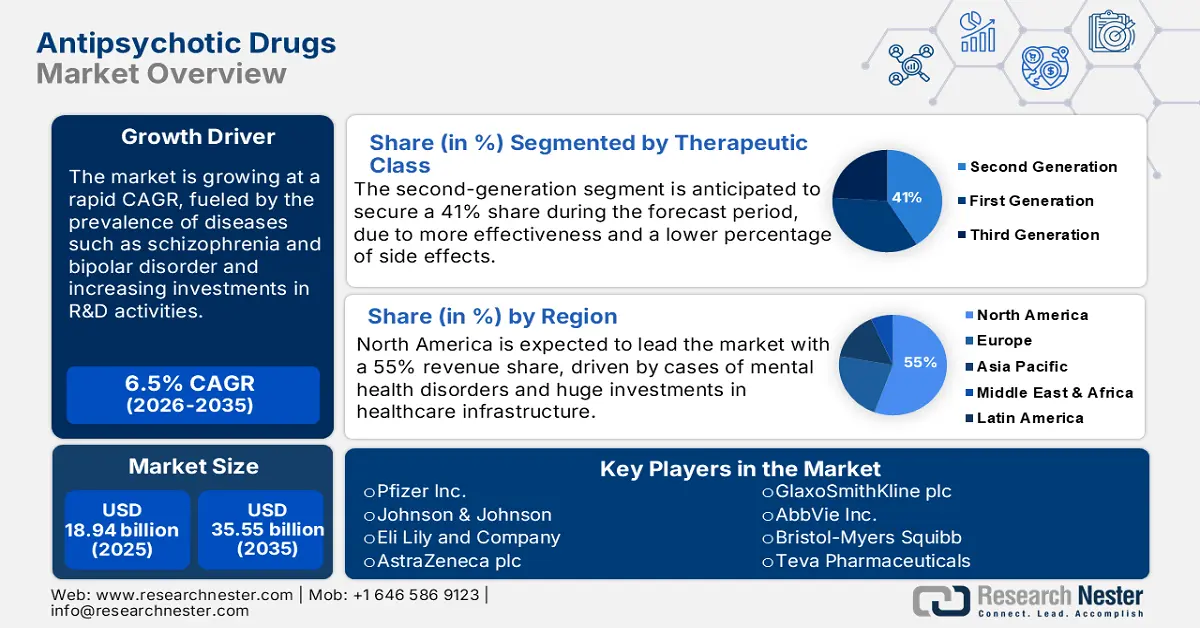

Antipsychotic Drugs Market size was over USD 18.94 billion in 2025 and is anticipated to cross USD 35.55 billion by 2035, growing at more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of antipsychotic drugs is assessed at USD 20.05 billion.

The antipsychotic drugs market is witnessing growth due to the prevalence of diseases such as schizophrenia and bipolar disorder. Advancements in the field of pharmacology and discoveries of new compounds that carry less harm are increasing the dimensions of treatment. The growing awareness and destigmatization of mental health issues is also encouraging more people to seek treatment, thus fueling expansion within the market. Some of the new opportunities that the integration of antipsychotic drugs into digital health technologies, including telemedicine, is making available are a new dimension of patient management and treatment adherence.

Regulatory approvals, granting of funds, and the initiatives taken for mental health by government bodies are boosting the demand for antipsychotic drugs. Regulatory agencies such as the United States Food and Drug Administration (FDA) and European Medicines Agency (EMA) are also expediting approval pathways for new antipsychotic medications, thus allowing prompt availability of novel therapeutics. Funding from this day is essential to help meet the increased demand for mental health services and facilitate more availability of effective antipsychotic therapies.

Key Antipsychotic Drugs Market Insights Summary:

Regional Highlights:

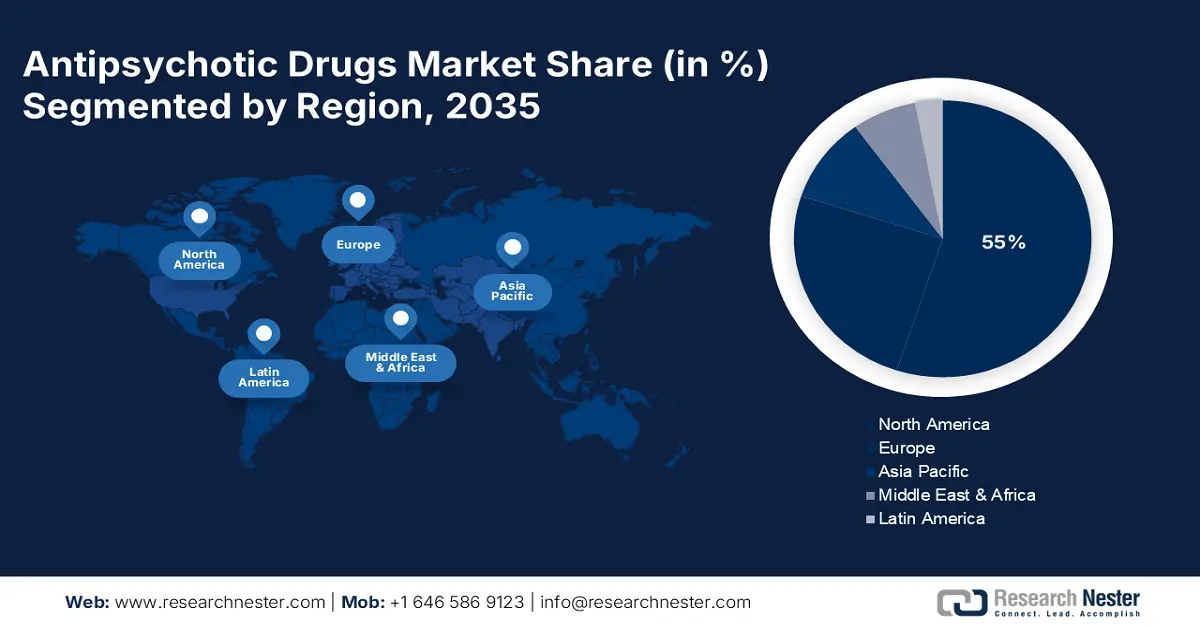

- North America’s antipsychotic drugs market will dominate around 55% share by 2035, driven by the high prevalence of mental health disorders and robust healthcare infrastructure.

Segment Insights:

- The second generation segment in the antipsychotic drugs market is projected to hold a 41% share by 2035, driven by more effectiveness and fewer side effects compared to first-generation antipsychotics.

Key Growth Trends:

- New developments in medication

- Integration with digital health technologies

Major Challenges:

- Regulatory challenges

- Side effects and patient compliance

Key Players: Eli Lilly and Company, AstraZeneca plc, GlaxoSmithKline plc, Johnson & Johnson, Otsuka Pharmaceutical Co., Ltd., Pfizer Inc., AbbVie Inc., Bristol-Myers Squibb, Teva Pharmaceuticals, and Dr. Reddy's Laboratories.

Global Antipsychotic Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.94 billion

- 2026 Market Size: USD 20.05 billion

- Projected Market Size: USD 35.55 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (55% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Antipsychotic Drugs Market Growth Drivers and Challenges:

Growth Drivers

-

New developments in medication: With continuous research and development, second and third-generation antipsychotics are discovered with enhanced efficacy in reducing the side effects produced. For example, in January 2023, Luye Pharma Group was granted FDA approval to produce an extended-release injectable drug, Rykindo. This can be used in treating both schizophrenia and bipolar disorder. These act as growth drivers for the market, promising better outcomes from the treatment.

-

Integration with digital health technologies: The integration of digital health platforms will include telemedicine and wearable devices to monitor patients and enhance adherence to treatment with antipsychotic drugs. As per (National Institutes Studies (NIH) studies published in August 2023, the progressive role of telemedicine in bridging location-wise physical barriers to traditional healthcare with offline modes leads to possibly irreversible treatment advances in managing psychiatric conditions through remote care. This is expected to contribute to the further expansion of the market.

Challenges

-

Regulatory challenges: A key challenge in the antipsychotic drugs market is the tough regulatory environment. The long period for the approval of new drugs shows that the regulatory norms are strict. In February 2023, a report from EMA detailed how stringent testing and approval processes could make it tough for manufacturers.

-

Side effects and patient compliance: Despite modern research and the development of drugs, antipsychotic agents are not without side effects. Weight gain, metabolic alterations, and sedation are some of the poor compliances reported in patients. (National Center for Biotechnology Information) NCBI published a study in March 2023 pinpointing the challenges surrounding antipsychotic drug manufacture and the need for better outcomes in treatment.

Antipsychotic Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 18.94 billion |

|

Forecast Year Market Size (2035) |

USD 35.55 billion |

|

Regional Scope |

|

Antipsychotic Drugs Market Segmentation:

Therapeutic Class Segment Analysis

Second-generation therapeutic class segment is predicted to dominate around 41% antipsychotic drugs market share by the end of 2035. These drugs are favored due to more effectiveness and lower percentage of side effects in comparison with first-generation antipsychotics. The innovation around these therapeutic classes remains continuous, as evidenced by the approval of UZEDY, a new-at-its-mechanism drug, in April 2023 by the FDA. The market's growth is, however, supplemented by the increasing use of these drugs in the treatment of an expanded range of psychiatric disorders, ensuring continued dominance in the market.

Disease Segment Analysis

The schizophrenia segment is expected to account for a significant revenue share in the antipsychotic drugs market due to its high prevalence and the continuous development of targeted therapies. Recent innovations such as the launch of Paliperidone Extended-Release Tablets by Lupin in October 2022 have greatly enhanced treatment outcomes. The schizophrenia segment is expected to continue growing, mainly because long-acting injectables, among other innovative formulations, have been increasingly the focus of development to meet the pressing need for effective and convenient alternatives.

Drug Segment Analysis

The aripiprazole segment in the antipsychotic drugs market is anticipated to register rapid revenue growth during the forecast period as it is well-used in the treatment of various psychiatric diseases. The main drive behind the drug's popularity is its favorable side effect profile with high efficacy in handling conditions like schizophrenia and bipolar disorder. In February 2024, Teva Pharmaceuticals completed enrollment in a Phase 3 clinical study with mdc-TJK, a long-acting injection of aripiprazole-investigational medicine.

Our in-depth analysis of the antipsychotic drugs market includes the following segments:

|

By Therapeutic Class

|

|

|

Disease |

|

|

Drug |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Antipsychotic Drugs Market Regional Analysis:

North America Market Insights

North America industry is set to hold largest revenue share of 55% by 2035. This is attributed mainly to the high prevalence of mental health disorders and the robust healthcare infrastructure in the region. In particular, the U.S. continues to invest significantly in mental health services while it leads the market in R&D activities. The rising government efforts in expanding the accessibility of mental health care is also primarily driving the market in this region.

The U.S. is leading the antipsychotic drugs market, primarily due to several cases of mental health disorders and huge investments in healthcare infrastructure. There has been an extensive increase in mental health awareness in the country, which has been escalating the demand for curing options. In addition, in 2023, USD 10.8 billion was disbursed via the SAMHSA to provide special mental health services using new, innovative antipsychotic drugs that will have the U.S. at the forefront of market dominance.

Canada's antipsychotic medications industry, too, is experiencing growth, supported by authorities' initiatives and an increasing concentration on mental wellness. In April 2024, the authorities in Canada dedicated substantial investments in psychological wellness companies, with their notable commitment of CAD 4.5 billion over half a decade to reinforce mental wellness and habit providers around the nation. The increase in psychological disorders, especially dementia, which is anticipated to have an impact on 1.7 million Canadians by 2050, according to the Alzheimer Society of Canada, is fueling demand for antipsychotic drugs.

Europe Market Insights

Europe antipsychotic drugs market is anticipated to expand at a rapid pace in the forecast period, pushed by expanding recognition of psychological wellness troubles and significant governing administration investments in healthcare. The market growth is supported by the escalating prevalence of psychiatric issues and also the enlargement of healthcare companies. Germany and France are crucial marketplaces in Europe, with both nations investing heavily in psychological wellness infrastructure.

The antipsychotic drugs market in Germany is growing rapidly due to increasing awareness about mental disorders and government support. The government prefers to manage this crisis by increasing the funding for mental health facilities and research activities. Federal Ministry of Health in 2023 said that an increased earning of the sector's mental health programs would work toward added access to care and promote the creation and development of innovative treatments. The aging population with an increasing incidence of dementia and other psychiatric disorders adds to the demand for antipsychotic drugs, making Germany an extremely important market in Europe.

The government's efforts, along with a substantial focus on mental health care, have made France one of the leading markets for antipsychotic drugs in Europe. The local government has considered psychiatry and mental health a national priority, significantly increasing funding to finance care and treatments for mental illnesses beginning in 2023. Besides, the growth in the incidence of mental disorders, such as those affecting the elderly, is continuing to contribute to the increased demand for antipsychotic drugs. With a proactive approach towards mental health and a strong healthcare system, France is considered one of the major revenue generators in Europe.

Antipsychotic Drugs Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson

- Eli Lily and Company

- AstraZeneca plc

- GlaxoSmithKline plc

- AbbVie Inc.

- Bristol-Myers Squibb

- Teva Pharmaceuticals

The global antipsychotic drugs market is highly competitive and consists of several global and regional players. This market sees companies such as Johnson & Johnson, Otsuka Pharmaceutical Co., Ltd., Pfizer Inc., and Teva Pharmaceutical Industries Ltd. leading the way as large investments in research and development are being made by these companies to introduce new and better treatments for psychiatric disorders. Their commitment to innovation lies in various patient needs. Therefore, the market faces rapid evolution in innovations and improvement in the treatment pattern.

In this competitive environment, firms are adopting various strategies to position themselves in the antipsychotic drugs market. The very pertinent strategy is product innovation and firms are working thoroughly to enhance the existing therapies and to develop new ones. Strategic collaborations and partnerships are also popular, where companies leverage complementary strengths and resources. In addition, acquisitions are quite common in portfolio expansion and gaining access to new technologies. Such dynamic environments also provide the impetus for continuous improvement that eventually percolates down to the patient level with psychiatric conditions.

Here are some leading players in the antipsychotic drugs market:

Recent Developments

- In April 2024, Seaport Therapeutics launched an oversubscribed Series A financing round of USD 100 million to advance its novel neuropsychiatric medicines, signaling innovation and investment growth in the antipsychotic drugs sector.

- In April 2024, Teva Pharmaceuticals and MedinCell received FDA approval for Uzedy (risperidone extended-release injectable suspension), expanding treatment options for patients with schizophrenia and reinforcing their commitment to mental health therapies.

- In October 2023, Reviva Pharmaceuticals reported positive results from a late-stage study for its schizophrenia drug, emphasizing its potential as a new therapeutic option for patients with mental health disorders.

- In September 2023, Pharmanovia announced the acquisition of a global central nervous system (CNS) portfolio from Sanofi, strengthening its presence in the antipsychotic drugs market and expanding its therapeutic offerings.

- Report ID: 6384

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Antipsychotic Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.