Antifreeze Recycler Market Outlook:

Antifreeze Recycler Market size was over USD 1.17 billion in 2025 and is projected to reach USD 2.41 billion by 2035, growing at around 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of antifreeze recycler is evaluated at USD 1.25 billion.

The antifreeze recyclers' increasing popularity is attributed to their effectiveness in the oil disposal process. These recycling technologies are finding wide applications in the industrial segment owing to their ability to align with sustainable and environmental measures. Antifreeze chemical trade activities are substantially increasing around the globe. According to the report by the Observatory of Economic Complexity (OEC), Germany and France held positions as the top exporters and importers of antifreeze chemicals, respectively, in 2022. This underscores that the high antifreeze chemical trade activities were structured across Europe. Strict environmental regulations implemented by the EU are driving the sales of antifreeze recycling technologies and chemicals.

|

Country |

Antifreeze Value in Exports (USD Million) |

Country |

Antifreeze Value in Imports (USD Million) |

|

Germany |

310 |

France |

106 |

|

Belgium |

255 |

Germany |

100 |

|

U.S. |

224 |

Canada |

99.4 |

|

Netherlands |

96.8 |

Netherlands |

68.1 |

|

France |

67.2 |

Belgium |

59.3 |

Source: OEC

Antifreeze chemicals were the 849th most traded product across the world, totaling USD 1.54 billion worth of trade, in 2022. The exports expanded by 8.56%, from USD 1.42 billion in 2021 to USD 1.54 billion by 2022. The antifreeze product complexity index stood at 415th rank in 2022, whereas the market concertation amounted to 4.23 using Shannon Entropy, highlighting the export dominance by 18 countries. China has the highest export potential with an export gap of USD 1.83 million while Germany underscores an import potential gap of USD 2.55 million.

Key Antifreeze Recycler Market Insights Summary:

Regional Highlights:

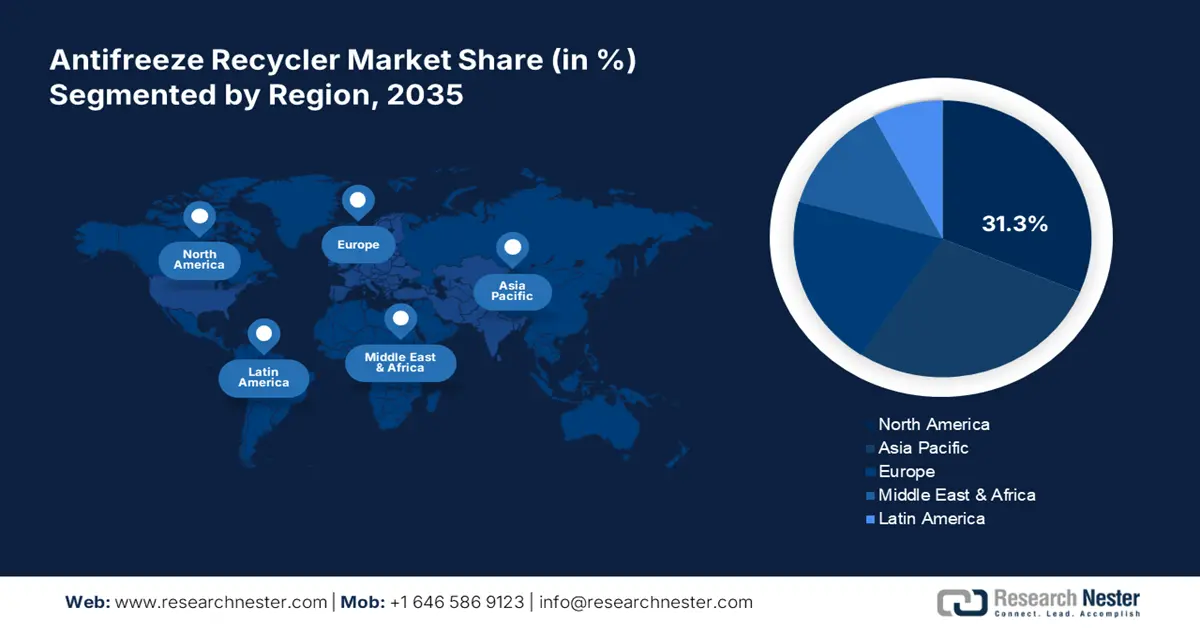

- North America holds a 31.3% share of the Antifreeze Recycler Market, propelled by strict environmental regulations and expanding logistics and transportation sectors, ensuring sustained growth through 2026–2035.

- Asia Pacific’s antifreeze recycler market is projected for rapid growth through 2026–2035, driven by ongoing industrial and urban activities and growth in automotive, mining, construction sectors.

Segment Insights:

- The Industrial Antifreeze Recycler segment is expected to capture a 65.50% market share by 2035, driven by growth in industrial activities and stricter environmental regulations.

- The Automatic segment of the Antifreeze Recycler Market is projected to capture a 45.50% share by 2035, propelled by increasing automation trends in industrial operations.

Key Growth Trends:

- Steady ICE vehicle registrations

- Industrial growth

Major Challenges:

- EV adoption a major challenge

- Lack of awareness and high costs

- Key Players: Eriez Manufacturing Co., ETL Fluid Experts Ltd., Finish Thompson Inc., and Fountain Industries.

Global Antifreeze Recycler Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.17 billion

- 2026 Market Size: USD 1.25 billion

- Projected Market Size: USD 2.41 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Russia

Last updated on : 13 August, 2025

Antifreeze Recycler Market Growth Drivers and Challenges:

Growth Drivers

- Steady ICE vehicle registrations: Even if electric vehicles are gaining traction, the majority of registrations are of internal combustion engine (ICE) vehicles worldwide. According to the International Organization of Motor Vehicle Manufacturers (OICA), China is projected to remain the largest market for internal combustion engine vehicles in 2025, with sales exceeding 25 million units, followed by Europe at around 14 million units, and the United States at about 9 million units. The large-scale fleet operators are of ICE powertrain owing to high durability and cost-effectiveness. The logistics and transportation companies invest in antifreeze recycling technologies as a part of their involvement in sustainability and cost-reduction strategies. These strategic moves are often observed in Europe and North America owing to the strict environmental regulations.

- Industrial growth: The rapid industrial and car manufacturing activities across the world are generating profitable opportunities for antifreeze recycler manufacturers. The Federal Reserve Bank of St. Louis states that the U.S. industrial production: total index (INDPRO) was 101.9621 in November 2024. Furthermore, the Quarterly Report, Q1 2024 by the United Nations Industrial Development Organization revealed that the industrial economies captured around 91.0% of the global manufacturing value added in the first quarter of FY24. The high use of heavy machinery and equipment drives up the oil need. Countries across the world are implementing strict regulations to mitigate environmental pollution. Industries to comply with these regulations are heavily employing antifreeze recyclers in their facilities.

Challenges

- EV adoption a major challenge: The growing adoption of electric vehicles directly hinders the sales of internal combustion engine (ICE) vehicles. Automobile oil is widely processed through antifreeze recyclers for proper disposal and to reduce environmental pollution. Thus, the growing adoption of electric vehicles is expected to act as a major challenge for antifreeze recycler manufacturers.

- Lack of awareness and high costs: The lack of awareness of antifreeze recyclers in certain markets particularly those with low environmental regulations is hampering market growth to some extent. The high costs of antifreeze recyclers are also lowering their demand in price-sensitive markets. Thus, the lack of strict regulations in some regions and high prices are challenging the growth of the antifreeze recycler market.

Antifreeze Recycler Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 1.17 billion |

|

Forecast Year Market Size (2035) |

USD 2.41 billion |

|

Regional Scope |

|

Antifreeze Recycler Market Segmentation:

Type (Mobile Antifreeze Recycler, Industrial Antifreeze Recycler)

Industrial antifreeze recycler segment is projected to dominate antifreeze recycler market share of over 65.5% by 2035. The growth in industrial activities in both developing and developed countries is contributing to segmental growth. The strict environmental regulations imposed on several industries are augmenting the demand for antifreeze recyclers. Automotive, mining, manufacturing, and construction manufacturing facilities are highly investing in antifreeze recyclers. As the demand for industrial machinery and equipment grows the need for antifreeze recyclers is set to gain boom. China, Japan, Germany, and the U.S. are some of the top industrial machinery and equipment marketplaces across the world. This highlights that industrial antifreeze recycler producers have win-win opportunities in both Eastern and Western regions.

Automation (Manual, Semi-Automatic, Automatic)

In antifreeze recycler market, automatic segment is expected to capture revenue share of around 45.5% by the end of 2035. The digitalization and automation trends are boosting the adoption of automatic antifreeze recyclers. These types of antifreeze recyclers offer l ong-term investment goals for businesses, which increases their demand. Large-scale industries often are engaged in vast production cycles and to mitigate the time required to carry out repeated tasks they invest in automatic solutions. For instance, in November 2024, the International Federation of Robotics (IFR) revealed that automotive is the largest sector installing around 135,461 automatic robots. This underscores that increasing automation in industries is set to propel the sales of automatic antifreeze recyclers.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Capacity |

|

|

Function |

|

|

Automation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Antifreeze Recycler Market Regional Analysis:

North America Market Forecast

North America in antifreeze recycler market is expected to capture around 31.3% revenue share by the end of 2035. The strict environmental regulations, high automotive manufacturing and industrial activities, and swiftly expanding logistics and transportation sectors are propelling the sales of antifreeze recyclers. In the U.S. and Canada, the onsite, offsite, and mobile antifreeze recycling services are gaining traction owing to continuous innovations in these technologies.

In the U.S., the high adoption of heavy-duty machinery and equipment is augmenting the demand for antifreeze recyclers. The strict environmental regulations are backing the sales of antifreeze recyclers. Furthermore, the high use of automation and robotics in manufacturing industries is fueling the adoption of automatic antifreeze recyclers. For instance, as per the IFR analysis, in 2023, the robot density in the manufacturing industry was 295 units per 10,000 employees.

In Canada, the presence of oil management organizations such as the Used Oil Management Association of Canada (UOMA) is pushing the antifreeze recycler market growth. For instance, the UOMA revealed that around 253.3 million liters of used oil was collected in the country, in 2023. The oil is further recycled using antifreeze technologies owing to a strong commitment towards environmental sustainability. The automotive, mining, manufacturing, and heavy-duty machinery manufacturing sectors are major contributors to the increasing sales of antifreeze recycling services.

Asia Pacific Market Statistics

The Asia Pacific antifreeze recycler market is projected to expand at the fastest CAGR between 2026 to 2035. The ongoing industrial and urban activities in the region are fueling the sales of antifreeze recyclers. Growth in automotive, mining, construction, and manufacturing trade are propelling the demand for antifreeze recyclers. The sustainability goals are driving end use companies to invest in antifreeze recyclers for effective disposal of used oils. India, China, South Korea, and Japan are the most profitable marketplaces for antifreeze recycler manufacturers.

China’s top position as the major manufacturing sector and increasing automotive ownership are fueling the sales of antifreeze recyclers. Robust use of automation and heavy-duty machinery is increasing the demand for antifreeze recycling technologies. The strong presence of chemical producers is also augmenting the sales of antifreeze chemicals used in the recycling process. The OEC report reveals that China totaled USD 29.4 million worth of antifreeze export trade, in 2022.

India is an opportunistic marketplace for antifreeze recycler manufacturers owing to the increasing number of automobile registrations. The robust automotive market directly underscores the need for antifreeze recyclers. For instance, the India Brand Equity Foundation (IBEF) report reveals that the total production of passenger vehicles, 2-wheelers, 3-wheelers, and quadricycles reached 27,73,039 units, in September 2024. Furthermore, the country is estimated to be leader in the shared mobility by 2030. This highlights that increasing automotive oil demand is set to directly propel the employment of antifreeze recyclers in the country.

Key Antifreeze Recycler Market Players:

- Diversified Manufacturing Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eriez Manufacturing Co.

- ETL Fluid Experts Ltd.

- Finish Thompson Inc.

- Fountain Industries

- PRAB Inc.

- Master Fluid Solutions

- Koch Membrane Systems

- BASF SE

- Culligan International

- Evoqua Water Technologies

- 3M Company

- Suez SA

- Dow Chemical

- Lanxess AG

- Pall Corporation

- DuPont de Nemours, Inc.

- Veolia Water

- Veolia Environment S.A.

Key players in the antifreeze recycler market are employing several organic and inorganic strategies such as new product launches, technological innovations, strategic collaborations and partnerships, mergers and acquisitions, and global expansions to earn high profits and expand their reach. To stand out in the crowd, the majority of companies are investing heavily in research and development activities to develop innovative antifreeze recyclers. Partnering with other players is aiding them to increase their audience base. The developing and underdeveloped markets are anticipated to offer high-earning opportunities to antifreeze recycler manufacturers in the coming years.

Some of the key players include:

Recent Developments

- In November 2024, NORA, an Association of Responsible Recyclers announced that it is rebranding as ENFINITE: The Industrial Liquid Recyclers Association. The information was disclosed during the opening of its annual conference and trade show in Coronado, California.

- In September 2024, Peace River Regional District (PRRD) joined hands with Interchange Recycling to offer recycling services for used oil, antifreeze, and associated containers at the Chetwynd Landfill and Hudson’s Hope Transfer Station. This sustainable move is anticipated to reduce pollution caused by improper disposal.

- Report ID: 6998

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Antifreeze Recycler Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.