Anticholinergic Drugs Market Outlook:

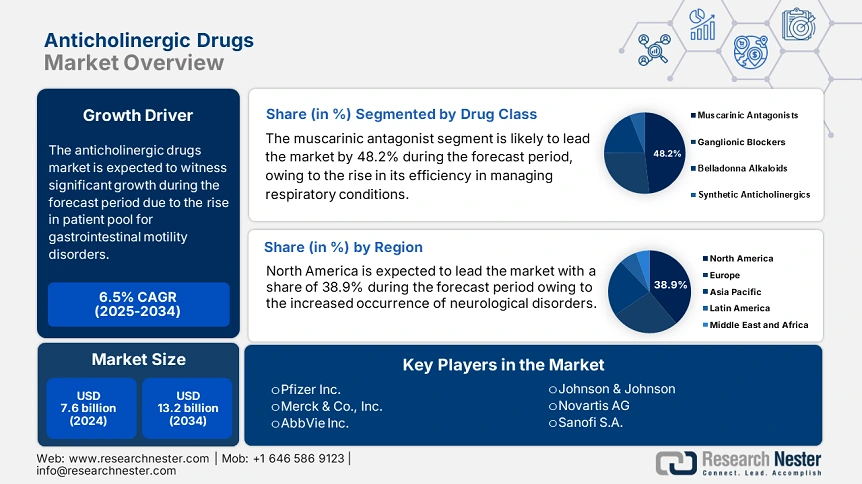

Anticholinergic Drugs Market size was valued at USD 7.6 billion in 2024 and is projected to reach USD 13.2 billion by the end of 2034, rising at a CAGR of 6.5% during the forecast period, i.e., 2025-2034. In 2025, the industry size of anticholinergic drugs is estimated at USD 8.1 billion.

The global patient pool requiring anticholinergic drugs for overactive bladder, gastrointestinal motility disorders, Parkinson’s disease, and COPD is rising rapidly. As per the U.S. Centers for Disease Control and Prevention report, nearly 25.6 million people in the U.S. are affected by urinary incontinence and are urging for antimuscarinic agents for continual treatment. The National Institute on Aging has stated that above 55.4 million people across the globe are affected by dementia, and these people are prescribed anticholinergics. Further, the other major indication is COPD, where 16.5 million people in the U.S. were affected in 2023 with ipratropium bromide and other drugs as the key components for therapeutics. The growing population in both developed and developing nations leads the market dominance.

On the supply chain side, the API synthesis, packaging, formulation, and distribution are key factors. The global manufacturing of API is from the U.S., India, and parts of Europe. The producer price index rose to 3.2% for pharmaceutical preparations in 2024, impacting the cost pressures in chemical synthesis and packaging. On the other hand, the consumer price index increased to 2.1% for prescription drugs. The U.S. International Trade Commission reports that exports of formed goods, especially to Latin America and Southeast Asia, rose by 7.5% in 2023 due to cost-effective U.S. formulations, and imports of anticholinergic-related APIs increased by 11.8% during that same period. Public-private partnerships and strategic stockpiling are the major supply chain resilience in the anticholinergic drugs market.