Antibody Validation Market Outlook:

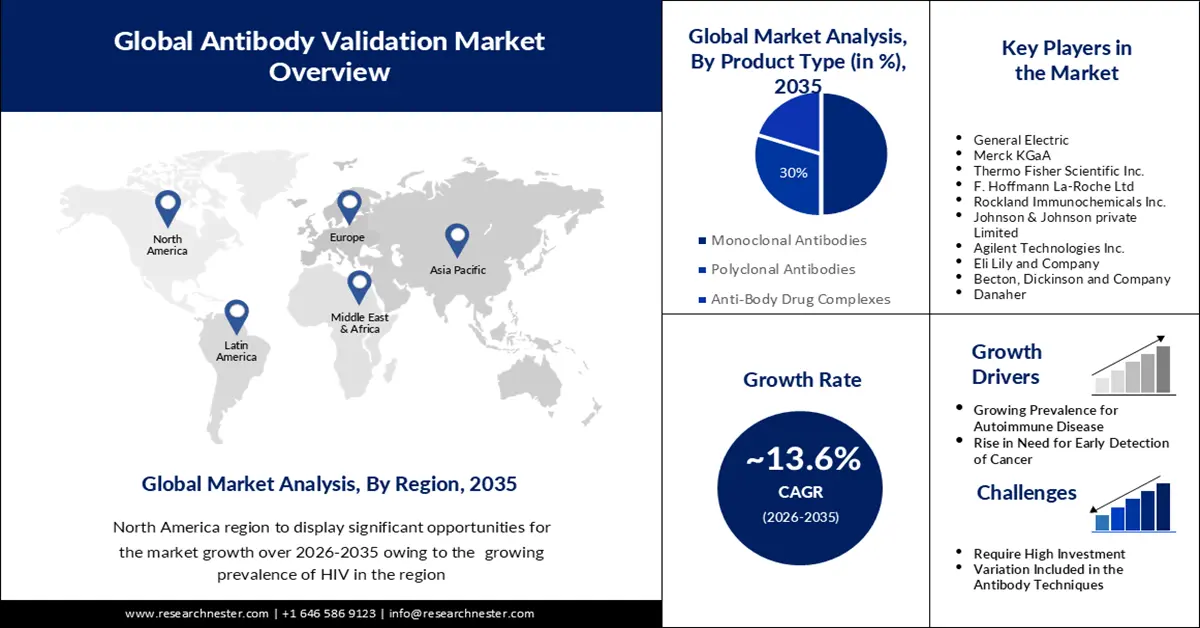

Antibody Validation Market size was over USD 476.39 billion in 2025 and is projected to reach USD 1.71 trillion by 2035, witnessing around 13.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of antibody validation is evaluated at USD 534.7 billion.

This growth of the market is anticipated to be influenced on account of growing cases of COVID-19. A large number of people were found to have symptoms of COVID-19 but were not been tested. Hence, due to this, the COVID-19 antibody validation demand was boosted. For instance, to treat COVID-19, an estimated 70 monoclonal antibodies are currently being developed or are through clinical studies.

Moreover, similar to COVID-19 there are numerous other diseases that are set to spread among people. These diseases include Ebola, Marburg virus disease, Lassa fever, MERS-CoV, SARS, and more. However, most of these diseases have no vaccine and research is yet to be conducted. These diseases are referred to as "Disease X," a pandemic-causing sickness that would never have been encountered by mankind before. COVID-19 has been identified as Disease X, prompting scientists to rush to discover therapies and vaccinations to combat it. Hence, in order to avoid the covid19 situation in the coming years, the demand for antibody validation is growing.

Key Antibody Validation Market Insights Summary:

Regional Highlights:

- North America is predicted to capture a 30% share of the antibody validation market by 2035, attributed to the rising prevalence of HIV and increased investments in R&D.

- Europe is expected to witness notable growth by 2035, underpinned by expanding technological adoption within biotechnology and pharmaceutical sectors along with increasing strategic collaborations.

Segment Insights:

- The monoclonal antibodies segment in the antibody validation market is projected to command the largest share by 2035, propelled by its expanding use across oncology, autoimmune disorders, and other therapeutic applications.

- The pharmaceutical & biotechnology firms segment is anticipated to secure a substantial share by 2035, supported by increasing utilization of research antibodies in drug discovery and analytical workflows.

Key Growth Trends:

- Growing Prevalence of Autoimmune Disease

- Rise in Need for Early Detection of Cancer

Major Challenges:

- Require High Investment

- Variation Included in the Antibody Techniques

Key Players: General Electric, Merck KGaA, Thermo Fisher Scientific Inc., F. Hoffmann La-Roche Ltd, Rockland Immunochemicals Inc., Johnson & Johnson private Limited, Agilent Technologies Inc., Eli Lily and Company, Becton, Dickinson and Company, Danaher.

Global Antibody Validation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 476.39 billion

- 2026 Market Size: USD 534.7 billion

- Projected Market Size: USD 1.71 trillion by 2035

- Growth Forecasts: 13.6%

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 25 November, 2025

Antibody Validation Market - Growth Drivers and Challenges

Growth Drivers

- Growing Prevalence of Autoimmune Disease

Over 80 distinct autoimmune illnesses afflict over 3% of the world's population, the most prevalent of which are type 1 diabetes, rheumatoid arthritis, multiple sclerosis, lupus, psoriasis, Crohn's disease, and scleroderma. A person with an autoimmune disease is expected to have a weak immune system that has difficulty distinguishing between harmful antigens and healthy tissue. Due to this, the body starts a reaction that kills healthy tissues. Here, antibodies play a crucial role in building a strong immune system. Therefore, there has been growing research on antibodies, further boosting market growth.

- Rise in Need for Early Detection of Cancer

In addition to cardiovascular disorders, cancer is one of the main causes of death in the world. Over the past few decades, significant advancements have been made in the areas of early detection, efficient treatment, and follow-up, providing oncologists with strong tools in the fight against cancer. To lower mortality, improve patient quality of life, and extend patients' lives without developing an illness, additional research is necessary. Moreover, some autoantibodies have been demonstrated to be useful for early identification and cancer staging, as well as monitoring tumor regression throughout treatment and follow-up. However, in order to find more benefits, antibody validation is growing.

- Advancement of Strategies

Western blot, ELISA, flow cytometry, and IHC are examples of common antibody validation techniques. These tried-and-true techniques are convenient for most researchers. The manufacturer or the researcher must validate the antibody for each application, which could make the validation procedure time-consuming. Hence, some researchers are working on new strategies along with old techniques. Genetic techniques, separate antibody tactics, and tagged protein expression are instances of these strategies.

Challenges

- Require High Investment

- Variation Included in the Antibody Techniques - Inadequate reproductive outcomes have been the result of variations in antibody methods. There are no requirements for the reproducibility of their validation across all antibody offerings. The differences in the antibodies have an impact on research findings and clinical screening test outcomes. Monoclonal antibody development is a labor-intensive and challenging process. One of the primary issues is that current technology necessitates huge bioreactors and filtration systems for the manufacture of antibodies, which is anticipated to limit the industry expansion.

Limited Life Span of Host Animal

Antibody Validation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.6% |

|

Base Year Market Size (2025) |

USD 476.39 billion |

|

Forecast Year Market Size (2035) |

USD 1.71 trillion |

|

Regional Scope |

|

Antibody Validation Market Segmentation:

Product Type Segment Analysis

Antibody validation market from the monoclonal antibodies segment is poised to garner the highest revenue by the end of 2035. Monoclonal antibodies, commonly referred to as mABS, are generated in a lab and have the ability to bind to particular targets in the body, such as antigens on the surface of cancer cells. Monoclonal antibodies (mABs) come in many varieties, and each mAB is made to attach to a specific antigen. Direct medication, toxin, or radioactive substance delivery to cancer cells is possible by using them alone or in combination with other agents. Monoclonal antibodies' rapid application in the detection and treatment of cancer, organ transplant rejection, inflammatory and autoimmune diseases, nervous system disorders, and migraines is one of the main drivers boosting their sales. Additionally, there are now more clinical studies and FDA-approved monoclonal antibody treatments than ever before, which is propelling this segment’s revenue growth.

End User Segment Analysis

The pharmaceutical & biotechnology firms segment is expected to have noteworthy growth over the projected period. Research antibodies are frequently used in drug development for the discovery and measurement of biomarkers as well as other analytical procedures, which is what is driving this segment. Rapid investments in pharmacy, technical improvements in biotechnology, and research in pharmaceutical labs are driving up demand for the antibody validation market.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Disease Indication |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Antibody Validation Market - Regional Analysis

North American Market Insights

North America industry is predicted to dominate majority revenue share of 30% by 2035, backed by the growing prevalence of HIV, along with rising investment in research and development. According to projections, 1.2 million Americans had HIV by the end of 2021. Hence, there have been various clinical trials conducted in this region in order to stop the spread of HIV. Moreover, the prevention of malaria has also gained focus in this region, which is further boosting market growth.

European Market Insights

Europe antibody validation market is set to have significant growth between 2026 and 2035. Market revenue growth in this region is being driven by the biotechnology and pharmaceutical industries' growing use of technology. Additionally, growing partnerships, collaborations, and mergers & acquisitions are anticipated to fuel market expansion in the upcoming years.

Antibody Validation Market Players:

- General Electric

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KGaA

- Thermo Fisher Scientific Inc.

- F. Hoffmann La-Roche Ltd

- Rockland Immunochemicals Inc.

- Johnson & Johnson private Limited

- Agilent Technologies Inc.

- Eli Lily and Company

- Becton, Dickinson and Company

- Danaher

Recent Developments

- Leading science and technology company Merck KGaA revealed that its Life Science division's ZooMAb recombinant antibody platform has been granted an Accountability, Consistency, and Transparency (ACT) label by My Green Lab, a non-profit devoted to fostering a culture of sustainability in science.

- Thermo Fisher Scientific Inc. has released two new SARS-CoV-2 antibody tests: The Thermo Scientific OmniPATH COVID-19 Total Antibody ELISA test and the Thermo Scientific EliA SARS-CoV-2-Sp1 IgG test. Thermo Fisher Scientific Inc. is the world leader in providing science services.

- Report ID: 5010

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Antibody Validation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.