Antibody Discovery Market Outlook:

Antibody Discovery Market size was valued at USD 2.06 billion in 2025 and is expected to reach USD 5.25 billion by 2035, registering around 9.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of antibody discovery is evaluated at USD 2.24 billion.

The rising demand for bio-based alternatives to treat deadly medical conditions such as chronic disorders, cancer, and infections is fueling the antibody discovery market. There is a well-versed application of such biologics in treating these hard-to-cure diseases. Thus, the growing population of affected individuals is propelling an emergent surge in antibody-curated novel therapeutics. A 2022 GLOBOCON dataset reported 20.0 million and 9.7 million new and death cases of cancer worldwide. The report further predicted the number of cancer patients to register 35.0 million by 2050. Another article from the Mayo Clinic, released in February 2024, projected the global economic burden of chronic conditions to obtain USD 47.0 trillion by 2030.

With the growing interest of pharmaceutical companies in the market, the pace of drug development is fastening. They are heavily investing in biopharmaceutical R&D to introduce a new treatment approach to supply the unmet needs of these non-communicable diseases. Furthermore, increasing demand and expenditure for personalized medicines are accelerating the expansion and diversification of this specific category. According to an NLM study, the global industry of antibody therapies was valued at USD 186.0 billion in 2021, which is further estimated to attain USD 445.0 billion by 2028. This showed a probable increment of 13.2% during the timeline from 2022 to 2028, attributable to the ongoing clinical trials and preclinical studies.

Key Antibody Discovery Market Insights Summary:

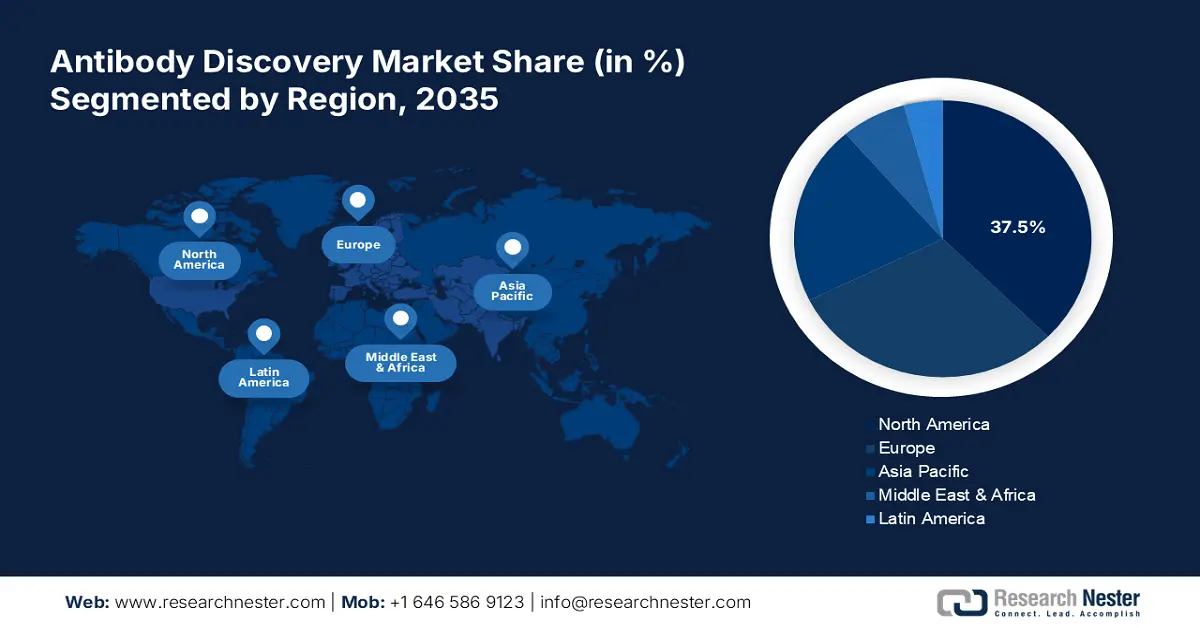

Regional Highlights:

- North America commands a 37.5% share in the antibody discovery market, propelled by frequent and fruitful participation in R&D for accelerating innovative biological production, ensuring robust growth through 2035.

- The Asia Pacific region is anticipated to hold a substantial share in the Antibody Discovery Market from 2026 to 2035, driven by strengthening healthcare infrastructure and growth in pharmaceutical microbiology sectors.

Segment Insights:

- The Phage Display segment of the Antibody Discovery Market is anticipated to experience robust growth through 2035, fueled by the need for high-affinity biologics production.

- The Human Antibody segment of the Antibody Discovery Market is poised to dominate by 2035, driven by demand for reduced immunogenicity and enhanced efficacy in personalized medicine applications.

Key Growth Trends:

- Penetration of tech-based innovations

- Strategic collaborations between biotech companies

Major Challenges:

- Expensive and elongated procedures

- The rising burden of resistive conditions

- Key Players: Danaher Corporation, Eurofins Scientific, Evotec, Charles River Laboratories, Genscript Technology Corporation, Biocytogen.

Global Antibody Discovery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.06 billion

- 2026 Market Size: USD 2.24 billion

- Projected Market Size: USD 5.25 billion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Antibody Discovery Market Growth Drivers and Challenges:

Growth Drivers

- Penetration of tech-based innovations: The proven success of regimens from the antibody discovery market has induced the need for escalation in production and commercialization. This is where biotechnology companies marked their contribution by incorporating next-generation technologies such as AI and cloud computing. Their solutions revolutionized the standards of new clinical findings by enabling speed, flexibility, and accuracy in the process. For instance, in March 2024, AION Labs unveiled an AI-powered antibody designing platform, CombinAble.AI. It is a perfect blend of machine-learning models and computational simulations, designed to upscale antibody discoveries.

- Strategic collaborations between biotech companies: The strategic team formation between different expertise holders from the antibody discovery market is propelling growth. They possess each other’s assets through these collaborations to overcome hurdles during research and clinical evaluation. This has significantly accelerated the augmentation and participation in this sector. For instance, in October 2023, Salipro Biotech AB signed a multi-target antibody research agreement with Icosagen to initiate their Antibody Discovery Collaboration. This amalgamation enacted their advanced creations to combat complex membrane proteins such as G protein-coupled receptors and solute carrier transporters.

Challenges

- Expensive and elongated procedures: The high cost of offerings from the antibody discovery market is a major hurdle for optimum adoption. The process of developing and optimizing antibody-based therapies is complex and time-consuming, which may impact the product pricing strategies. On the other hand, tailoring affordable solutions while maintaining compliance with stringent regulations may become challenging for service providers. Moreover, the lengthy preclinical and clinical trials may dilute the interest of both consumers and applicants.

- The rising burden of resistive conditions: Increasing cases of resistance is also a setback in the antibody discovery market. Pathogens such as bacteria and viruses often develop restrictive characteristics against these therapeutics. In addition, different genetic mutations and asymptomatic sub-types may present constraints in the reliability and durability of a wide range of treatments. This may result in failure to deliver a long-acting effect, discouraging biopharma leaders and patients from investing due to uncertainty in effectiveness.

Antibody Discovery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 2.06 billion |

|

Forecast Year Market Size (2035) |

USD 5.25 billion |

|

Regional Scope |

|

Antibody Discovery Market Segmentation:

Method (Phage Display, Hybridoma)

Based on the method, the phage display segment is projected to account for antibody discovery market share of around 50.3% by 2035. The need for robust production to cope with increasing demand is the significant driver of this segment. Phage display is a widely used technology for rapid candidate identification in the process of developing high-affinity biologics. This method is also preferred due to its wide spectrum of screening capabilities, used in creating targeted therapeutics. For instance, in November 2022, Bio-Rad Laboratories launched the Pioneer Antibody Discovery Platform, offering services for high-grade biologic candidates. This clinical product is built with a state-of-the-art phage display library, specifically designed to include more than 200 billion unique sequences.

Type (Humanized Antibody, Human Antibody, Chimeric Antibody, Murine Antibody)

In terms of type, the antibody discovery market is poised to be dominated by the human antibody segment by the end of 2035. These fully human biologics are desired for offering reduced immunogenicity and enhanced efficacy. The directly derived composites of this type are capable of restraining from triggering an immune response in patients, making it comparatively safer than others. Additionally, the demand for this kind of antibody is rising with the enlarging market captivity of phage displays, transgenic mice, and next-generation sequencing, particularly personalized medicine.

Our in-depth analysis of the global market includes the following segments:

|

Method |

|

|

Type |

|

|

End users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Antibody Discovery Market Regional Analysis:

North America Market Analysis

North America antibody discovery market is set to hold revenue share of more than 37.5% by 2035. The frequent and fruitful participation in R&D for accelerating innovative biological production is directly contributing to this region’s leadership. Moreover, the continuous product and service introduction, related to this category is propelling this sector. For instance, in December 2024, Invenra launched Rapid Bispecific Antibody Discovery Services to streamline bispecific antibody discoveries. The services are tailored to address critical management during clinical trials by reducing the time required for identification.

The U.S. has become a well-built marketplace for the leaders in the antibody discovery market due to its strong emphasis on clinical trials. The country is advancing with continuous research activities in the biopharmaceutical industry. Moreover, the rising investments in this category originated from the direct funding and expenditure in medicinal R&D, as an effort to lower the economic burden of treatments. According to a report from the Pharmaceutical Research and Manufacturers of America, published in September 2024, around 34.0% of the total revenue of the U.S. biopharma industry goes to R&D, where 48.0% of the global biopharmaceutical companies are headquartered in this country.

The pioneers of the Canada antibody discovery market are highly subsidized by the country’s governing bodies. The financial support from these authorities encourages others to engage in such rigorous drug development cohorts. Moreover, this creates a favorable business atmosphere for both domestic and foreign biologics production houses. For instance, in May 2023, the governments of Canada and British Columbia conjugately announced a grant of USD 300.0 million AbCellera Biologics. This funding was intended to empower the company’s USD 701.0 million extension project of building a state-of-the-art biotech campus, consisting of a new in-house preclinical antibody development facility.

APAC Market Statistics

Asia Pacific is strengthening its strings connected with the antibody discovery market to overcome its lagging healthcare infrastructure, particularly in low-income countries. According to a Research Nester report, the pharmaceutical microbiology industry of APAC is expected to capture a significant share during the forecast period. This signifies the fastening growth of this region in sectors oriented around microbiology, including antibody designing. In this regard, in August 2022, Maruho launched an anti-IL-31 receptor A humanized monoclonal antibody, Mitchga Subcutaneous Injection 60 mg Syringes for treating itching associated with atopic dermatitis.

Despite the previous decade’s backlogs in drug development, India is leveraging development speed in the antibody discovery market to become one of the leading manufacturing hubs for the global bio-based community. The supportive government of the country is also fueling this sector with subsidiary policies and funding. According to the January 2025 PIB report, the bio-economy of India surpassed USD 130.0 billion in 2024 and is estimated to achieve USD 300.0 billion by 2030. The report further mentioned the notable contribution of Biotechnology policy- BIO-E3 in this enlargement.

China has already gained traction in the antibody discovery market with rigorous clinical trials and preclinical studies. The significant registration rate for drug approvals from domestic companies is evidence of the country’s meticulous efforts to obtain a leading position in the global scenario. According to an NLM article from September 2024, 5336 early-phase clinical trials were registered for approval from the Chinese Center for Drug Evaluation (CDE) during the timeframe between 2013-2022. It further revealed that a total of 19,685 drug trials were reported in the same timeline.

Key Antibody Discovery Market Players:

- Danaher Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eurofins Scientific

- Evotec

- Twist Bioscience

- Charles River Laboratories

- Genscript Technology Corporation

- Biocytogen

- Sartorius AG

- Fairjourney Biologics S.A

- Creative Biolabs

- Bio-Rad Laboratories, Inc.

- Invenra Inc.

- Orion Corporation

The antibody discovery market is witnessing engagement from both the biotechnology and biopharmaceutical industries. Key players in this field are collaborating to eliminate each other’s hurdles in the process of producing more effective therapeutics. They are utilizing the manufacturing and distribution excellence of their respective marketplaces for globalization, fostering a profitable trading environment. In addition, they are incorporating advanced technologies to overcome the associated challenges. For instance, in January 2025, Alloy Therapeutics introduced a new market-disrupting licensing structure, to streamline its ATX-Gx Antibody Discovery Platform and mAbForge High-Throughput Screening Service. Such key players include:

Recent Developments

- In January 2025, Invenra collaborated with Orion Corporation to initiate research to unveil new bispecific antibodies for cancer treatment. Their collaborative effort aimed at discovering novel therapeutics for life-threatening chronic diseases such as cancer by utilizing Invenra’s upgraded B-Body platform.

- In July 2024, Bio-Rad Laboratories extended Pioneer Antibody Discovery Platform services by launching additional fast generation and screening of bispecific antibodies. The company used its SpyLock Technology to enable enhanced facilities for scalable and efficient evaluation and development of antibody combinations.

- Report ID: 7087

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Antibody Discovery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.