Anti-sniper Detection System Market Outlook:

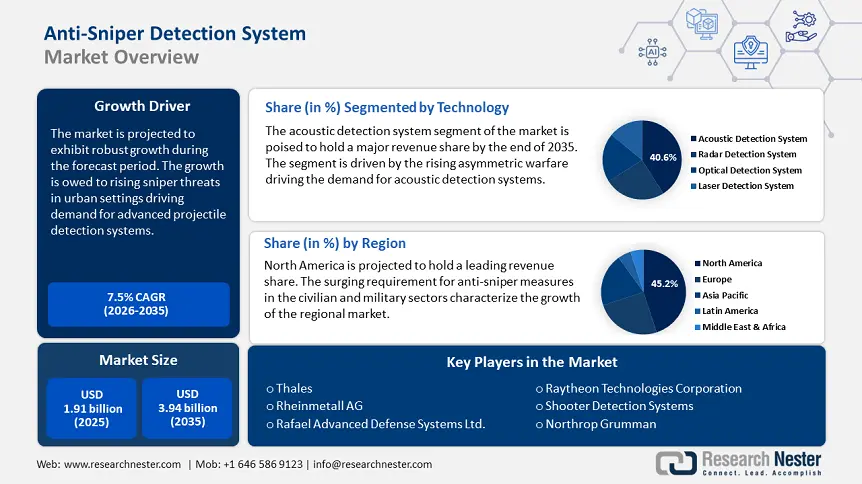

Anti-sniper Detection System Market size was over USD 1.91 billion in 2025 and is projected to reach USD 3.94 billion by 2035, growing at around 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of anti-sniper detection system is evaluated at USD 2.04 billion.

The advancements in sensor technologies have bolstered the growth of the anti-sniper detection system market. Opportunities are rife in the integration of infrared cameras to build effective sniper detection systems. Furthermore, the global market’s growth is fueled by escalating security threats with government security forces and private security bolstering investments in advanced anti-sniper detection systems to mitigate threats to VVIPs, VIPs, critical infrastructure, civilians, etc. Recent high-profile incidents, such as the sniper attack on the POTUS in July 2024 in Pennsylvania, U.S., highlighted critical blind spots in the anti-sniper detection system, leading to calls for improved detection technologies.

The anti-sniper detection system market analysis highlights a shift toward multi-sensor fusion, where acoustic and optical systems combine to offer 360-degree coverage, a trend that is rapidly gaining traction in urban and battle environments. The rising threats incentivize suppliers to provide portable and modular anti-sniper detection systems in collaborations between defense contractors and tech companies. In June 2024, the U.S. Department of Homeland Security announced the completion of the Gunshot Detection technology development initiative that will bolster the commercial off-the-shelf Guardian Indoor Active Shooter Detection System. Overall, the anti-sniper detection system market is exhibiting favorable trends for investments and is poised to maintain its robust growth by the end of 2035.

Key Anti-Sniper Detection System Market Insights Summary:

Regional Highlights:

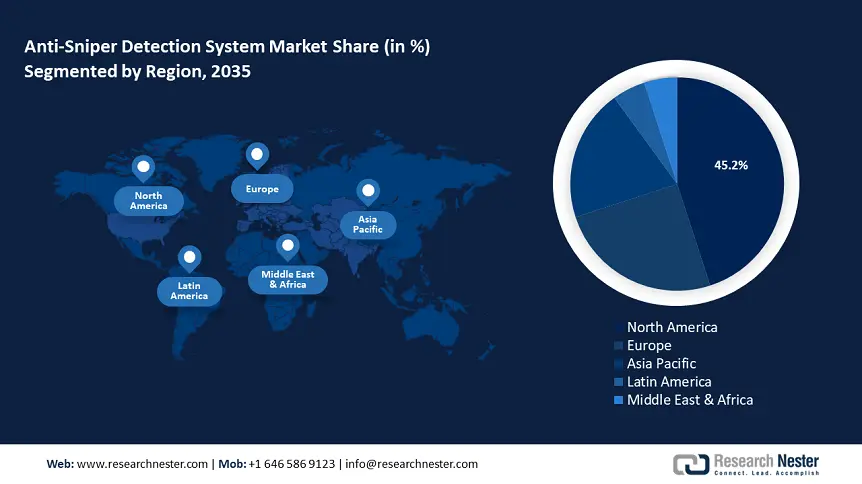

- North America dominates the Anti-sniper Detection System Market with a 45.2% share, driven by increasing demand for advanced security solutions in military and civilian sectors, ensuring strong growth through 2026–2035.

Segment Insights:

- The Acoustic Detection Systems segment is forecasted to achieve around 40.6% market share by 2035, propelled by the growing incidences of asymmetric warfare and high accuracy of acoustic sensors.

- Radar Detection Systems segment are expected to experience continued growth from 2026-2035, driven by rising demand for early threat detection and precision in complex terrains.

Key Growth Trends:

- Improved accuracy of acoustic-based systems

- Escalation in asymmetric warfare

Major Challenges:

- Detection limitations in multi-shooter scenarios

- Integration constraints with existing security infrastructure

- Key Players: Thales, Raytheon Technologies, Northrop Grumman Corporation, Rheinmetall AG, Rafael Advanced Defense Systems, Shooter Detection Systems, Leonardo S.p.A., ELTA Systems Ltd., Saab AB.

Global Anti-Sniper Detection System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.91 billion

- 2026 Market Size: USD 2.04 billion

- Projected Market Size: USD 3.94 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.2% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Russia, China, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Israel

Last updated on : 12 August, 2025

Anti-sniper Detection System Market Growth Drivers and Challenges:

Growth Drivers

- Improved accuracy of acoustic-based systems: Acoustic-based systems have achieved greater detection accuracy, creating lucrative anti-sniper detection system market investment opportunities. The advancements in detection accuracy align with the rising emphasis on projectile detection. Private companies can leverage lucrative defense contracts from initiatives such as the Counter Sniper Program to deploy wearable sensors in conflict zones or peacekeeping missions. Macro trends impacting the anti-sniper detection system market include the rapid advent of AI, leading to the development of AI-driven signal processing suits, which can be integrated with defense platforms to negate sniper projectiles. The Acusonic system of Thales, ShotSpotter of SoundThinking, Inc., etc., are popular detection systems exhibiting heightened interest by security and law enforcement agencies.

- Escalation in asymmetric warfare: The increase in asymmetric warfare has driven the demand for anti-sniper detection systems. Non-state actors and insurgent groups have increasingly employed snipers in conflicts, evident in Ukraine-Russia, Sahel, etc. The Institute for Economics and Peace’s Global Terrorism Index of 2023 has quantified more than 7 thousand terrorism-related deaths in 2022. Furthermore, snipers are a persistent challenge in hybrid warfare.

The U.S. Government Accountability Office (GAO) findings confirmed that the procurement of sniper-detection technologies has spiked post-2018, driven by efficacy against high-impact threats. Additionally, the NATO Defense Expenditure Report of 2022 highlights a 20% YoY rise in member-state spending on counter-sniper systems. The heightened expenditure has created promising opportunities for private players within the anti-sniper detection system market.

- Rising demand for event security: The surging demand for event security has intensified investments to procure advanced anti-sniper detection systems. Expanding large-scale events, such as the FIFA World Cup of 2026, G20 summits, etc., are poised to fuel sustained application of anti-sniper detection systems. Additionally, the scope of application has expanded in porous borders affected by geopolitical tensions for constant monitoring of sniper projectiles.

Established markets such as the U.S. provide greater opportunities for defense systems suppliers owing to rising cases of gun violence. Another supportive trend positioned to drive opportunities within the anti-sniper detection system market is the increasing allocations to defense budgets, as nations across the world have bolstered defense modernization efforts. For instance, in April 2024, the Stockholm International Peace Research Institute reported that the total global military expenditure had reached USD 2443 billion in 2023, exhibiting a 6.3% increase from 2022 led by the U.S., China, and Russia.

Challenges

-

Detection limitations in multi-shooter scenarios: Evolving security threats involve multiple snipers operating simultaneously which can lead to limitations in accurate detections. Bottlenecks in detection accuracy can discourage the application of projectile detection suites. Businesses that are able to provide much accurate detection suites are poised to experience greater applications in defense initiatives.

-

Integration constraints with existing security infrastructure: Interoperability challenges can arise due to differences in communication protocols which can pose a challenge in adoption rates. Real-time coordination between detection platforms and automated counter-sniper responses can evolve to be a major hurdle in anti-sniper detection system market growth. Furthermore, retrofitting legacy defense infrastructure can be costly, although the higher defense budgets are expected to navigate the challenge.

Anti-sniper Detection System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 1.91 billion |

|

Forecast Year Market Size (2035) |

USD 3.94 billion |

|

Regional Scope |

|

Anti-sniper Detection System Market Segmentation:

Technology (Acoustic Detection Systems, Radar Detection Systems, Optical Detection Systems, Laser Detection Systems)

Acoustic detection systems segment is predicted to account for anti-sniper detection system market share of around 40.6% by 2035, owing to growing incidences of asymmetric warfare in many parts of the globe. Highly accurate acoustic sensors that can achieve above 95% accuracy in pinpointing gunfire in cluttered environments are poised for greater adoption rates. Macroeconomic factors supporting the segment’s growth are the rising defense budgets in Europe and APAC nations. For instance, Japan approved a 9.4% increase in its FY2025 defense budget to USD 55.1 billion, aligning with global trends of defense modernization.

The radar detection systems segment is set to expand during the anticipated timeline. Trends within the defense sector highlight the rising calls for early threat detection, which bodes well for the segment’s continued growth. The precision of radar technology makes it indispensable in complex terrains where optical systems can falter. The current market patterns indicate substantial investments aimed at miniaturizing radar components. For instance, in November 2023, the U.S. Navy funded Mercury Systems Inc. to develop manufacturing capabilities for commercial photonic chiplets to heighten processing in defense applications.

Component (Sensor Technology, Signal Processing Unit, Communication System, Display System)

The sensor technology segment in anti-sniper detection system market is projected to register a significant revenue share during the forecast period due to continuous improvements in sensor technology to increase the efficacy of detection systems. Opportunities are rife to release next-generation anti-sniper detection systems that can identify projectiles at longer distances. A research paper published in Defense Technology in September 2023 proposed a new projectile recognition method by combining the particle swarm optimization support vector and spatial-temporal constraint of six sky-screens detection sensors. The commercial application of the new method holds promise in further reinventing anti-sniper detection systems.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Component |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anti-sniper Detection System Market Regional Analysis:

North America Market Forecast

North America anti-sniper detection system market is set to hold revenue share of over 45.2% by the end of 2035. The increasing demand for advanced security solutions in the military and civilian sectors is driving growth in the region. The NORAD Modernization Plan, backed by a USD 38 billion U.S.-Canada joint investment, is poised to create opportunities for the advent of sniper-detection systems. Moreover, threat detection compatibility programs between the U.S. and Canada are expected to shape the market trajectories throughout the forecast period.

The U.S. anti-sniper detection system market is anticipated to expand during the forecast period. A key feature of the U.S. market is the increasing cases of gun violence, which has spurred discussions on gun safety and effective measures to curb gun-related adverse incidents. The rising frequency of active shooter incidents has driven the demand for anti-sniper detection systems in law enforcement agencies. Additionally, a major end user in the U.S. anti-sniper detection system market is from private security agencies employed by ultra-high-net-worth individuals. The Operation Safe Cities program launched by federal law enforcement is poised to integrate acoustic sensors in Tier 1 law enforcement hubs, expanding the scope of application. By the end of 2035, the U.S. market is set to provide the largest opportunities in North America.

The anti-sniper detection system market in Canada is primed to exhibit growth during the stipulated timeframe. The armed forces of Canada have been actively exploring advanced detection solutions to improve soldier protection. In April 2024, the government announced the North, Strong, and Free vision for Canada’s defense with an overall investment of USD 8.1 billion over 5 years and USD 73 billion over 20 years in defense spending. Furthermore, Canada has committed support to NATO initiatives in the ongoing Ukraine-Russia conflict which is poised to create opportunities to supply advanced sniper detection systems.

Europe Market Forecast

The Europe anti-sniper detection system is projected to hold the second-largest revenue share after North America, buoyed by increasing investments in defense initiatives. The IISS report of 2024 highlights a 50% increase in defense spending in nominal terms in Europe in comparison to 2024 which bodes well for the integration of anti-sniper detection systems in anti-sniper detection system. An emerging driver of the market is the increasing terrorism threat in Europe which has bolstered investments in counter-terrorism initiatives.

The Germany anti-sniper detection system market is projected to exhibit robust growth throughout the forecast period. The Bundeswehr’s Digitalization Strategy provides opportunities to provide AI-enhanced sniper detection for counter terrorism initiatives. Moreover, opportunities arise in integrating gunshot detection in Germany’s smart city networks that will improve response time to active threats. A key feature of the market is the regular hosting of major events in market, such as the recently concluded Euros and weekly soccer matches of Bundesliga and other leagues.

The France anti-sniper detection system market is estimated to grow during the stipulated timeline. The growing focus on urban security, to negate high-profile attacks which have happened in the past, is a major driver of the market. The defense modernization programs have bolstered innovation, creating lucrative opportunities for the integration of anti-sniper detection systems. Additionally, France is committed to NATO defense spending and modernization initiatives, which businesses can leverage for lucrative defense contracts.

Key Anti-sniper Detection System Market Players:

- Thales

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Raytheon Technologies

- Northrop Grumman Corporation

- Rheinmetall AG

- Rafael Advanced Defense Systems

- Shooter Detection Systems

- Leonardo S.p.A.

- ELTA Systems Ltd.

- Saab AB

The anti-sniper detection system market is anticipated to expand during the forecast timeline. Major players in the market are investing heavily in research and development to improve the accuracy and reliability of detection systems, integrating advanced technologies such as machine learning and artificial intelligence. Trends within the market highlight efforts to localize supply chain to mitigate disruptions fueled by geopolitical risks. The companies that are able to provide greater accuracy in projectile detection are expected to have an advantage in the competitive market.

Here are some key players in the market:

Recent Developments

- In January 2025, the U.S. Army announced plans to award initial prototype contracts for the Next-Generation Command and Control program. Initial prototypes are expected to be delivered within 6 months of the award date.

- In August 2024, Leonardo S.p.A. was awarded USD 52 million follow-on production order for sniper weapon sights. The production order was made under the Family of Weapon Sights-Sniper IDIQ contract.

- Report ID: 7301

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anti-Sniper Detection System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.