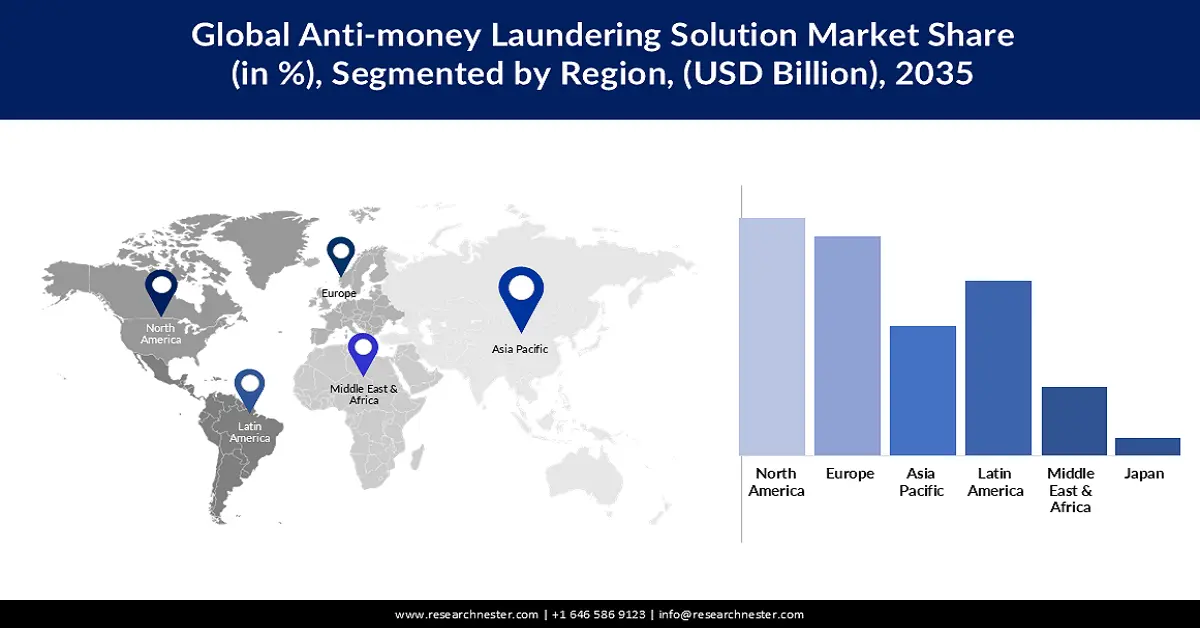

Anti-money Laundering Solution Market Regional Analysis:

North American Forecasts

North America industry is anticipated to hold largest revenue share of 28% by 2035. The US is especially vulnerable to all forms of illicit money because of the scale of the US financial system and the significance of the US dollar in the payment system that supports worldwide trade.

Criminals and professional money launderers still locate, transport, and try to hide illicit earnings using a variety of strategies, including time-tested ones. Some examples are using cash for traditional transactions, making pricey or high-end investments, and keeping up with the quickly evolving world of virtual assets and related service providers such as decentralized finance and the growing use of technologies that increase anonymity. The US was found to have the highest number of AML events per capita in the world. The US accounts for 84 % of the total, of the top 10 countries with the highest incidence of AML per capita.

Money laundering is a significant and concerning matter in the United States. The region is appealing aim for money laundering owing to its vast size and vulnerabilities in multiple domains. Therefore, the demand for AML solutions in the region is at a high peak as a result driving the anti-money laundering solution market growth.

The government in Canada has introduced various regulatory standards to put a stop to the escalating money laundering cases in the region. In Canada's AML regime, the Criminal Code and the Proceeds of Crime and Terrorist Financing Act play an active role.

European Market Statistics

Europe anti-money laundering solution market is estimated to witness significant growth till 2035. Criminals in this region are frequently launder money using a variety of means, such as creating fictitious identities, using shell companies and trusts, and orchestrating transactions to avoid discovery. In addition, the money laundering cases are high in the Europe region. According to a study in the United Kingdom, approximately 112 billion are laundered every year. It is estimated that 3% of global GDP is laundered every year around the world. The amount of laundered money in the United Kingdom amounts to around 4.3% of GDP each year.

Credit bureaus keep an eye out for any unusual behavior and draw attention to any unexpected or contradicting information found on credit reports. This helps to identify and stop money laundering. For instance, TransUnion, a worldwide information and analytics supplier, became one of SmartSearch's identity-check providers for its digital anti-money laundering solution in April 2023. SmartSearch now offers a 'triple-bureau' electronic verification and digital compliant platform, leveraging global data partners Experian, Equifax, and TransUnion to give regulated firms a match and pass rate.

The United Kingdom has strict and advanced legislation in place to prevent financial crimes. Money laundering offenses have been highlighted in the United Kingdom's Anti Money Laundering Regulations, which have made it clear that money laundering should be avoided. The UK is also a member of the Financial Action Task Force. In line with FATF guidelines and EU directives on Money Laundering, the United Kingdom's anti-money laundering legislation is in line with them.

Germany is currently significant hub for money laundering and crime. To protect the integrity of the financial system and maintain investor confidence, this has led to a focus on strengthening anti money laundering safeguards. Germany has increased its investment in cybersecurity and fraud detection tools, as well as efforts to increase public awareness of the risk of fraud, due to the advent of digital financial services.

The growth of the AML solution market in France can be propelled by the increasing integration of AML solutions in the financial institutions.