Anti-drone Market Outlook:

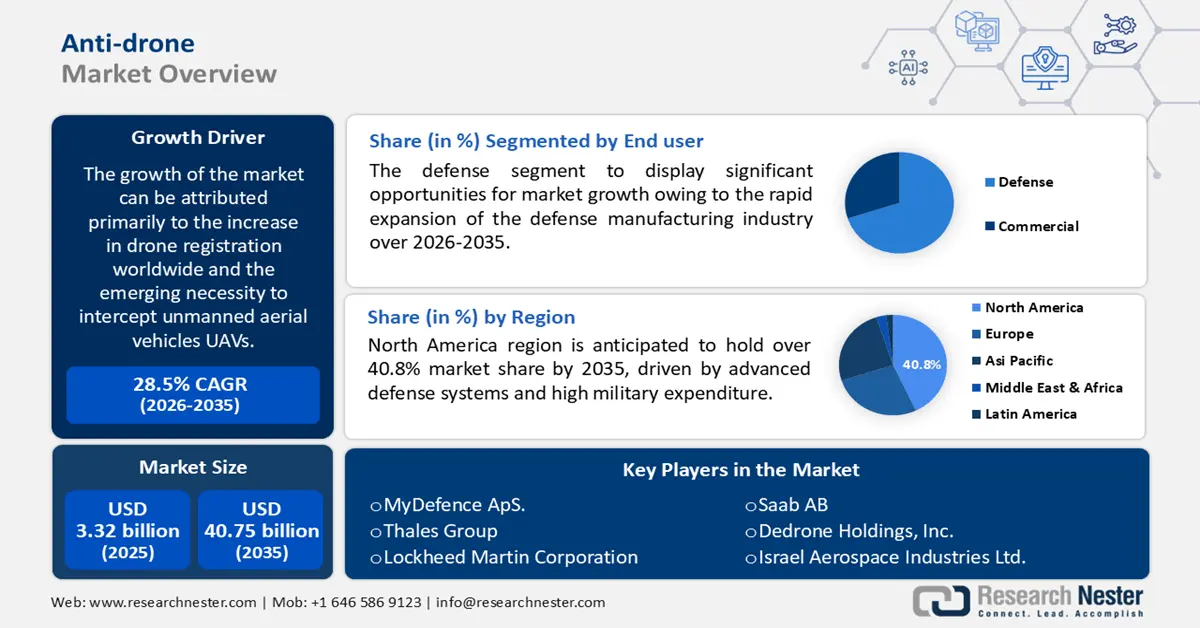

Anti-drone Market size was valued at USD 3.32 billion in 2025 and is set to exceed USD 40.75 billion by 2035, registering over 28.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of anti-drone is evaluated at USD 4.17 billion.

The market growth can be attributed to increase in drone registration worldwide and the emerging necessity to intercept unmanned aerial vehicles (UAVs). According to the Federal Aviation Administration, as of May, 2022, there were 865,505 drones registered in the United States. Rising demand for advanced UAV technology, concerns about security threats, and increased drone usage along with a surge in the penetration of low-cost UAVs has led to an increase in incidents driving the need for anti-drone technologies.

Key Anti-drone Market Insights Summary:

Regional Highlights:

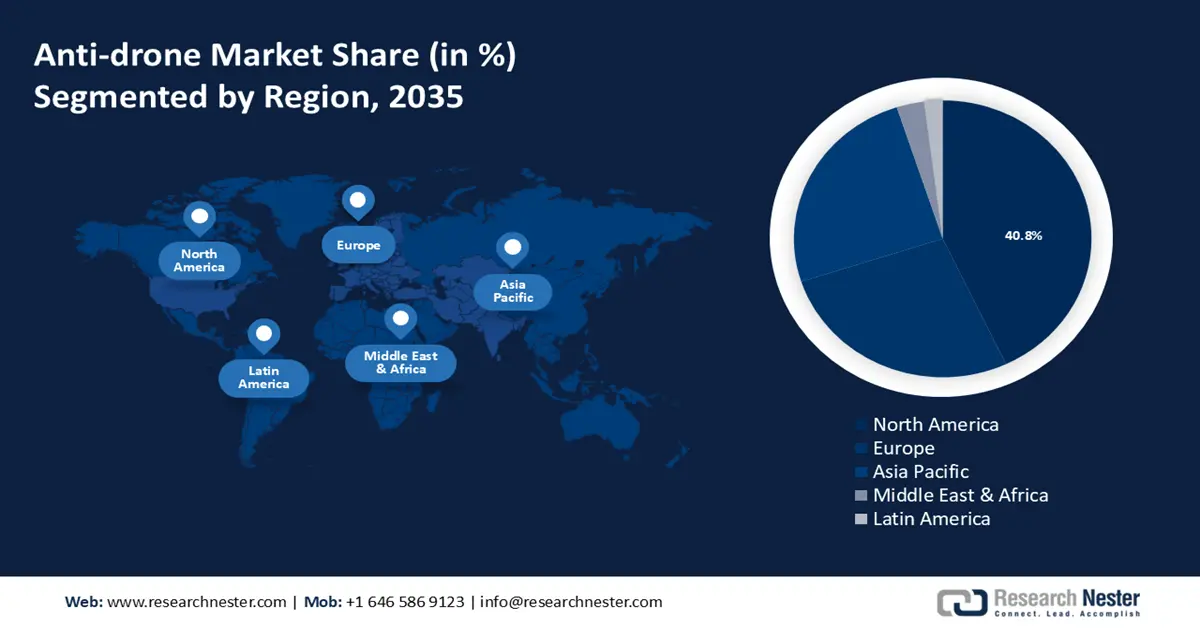

- North America anti-drone market will hold around 40.8% share by 2035, driven by advanced defense systems and high military expenditure.

Segment Insights:

- The defense segment in the anti-drone market is expected to hold the largest share by 2035, fueled by the rapid growth of the defense manufacturing industry amid rising terrorist activities.

Key Growth Trends:

- Globally Rising Investments in Research and Development

- Increase In Government Investment in The Aviation Industry

Major Challenges:

- Damage Caused to Private Property

- Concerns About Citizen Safety

Key Players: Blighter Surveillance Systems Ltd., MyDefence ApS., Thales Group, Lockheed Martin Corporation, Saab AB, Dedrone Holdings, Inc., Israel Aerospace Industries Ltd., Droneshield Ltd, Liteye Systems, Inc., Theiss UAV Solutions, LLC.

Global Anti-drone Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.32 billion

- 2026 Market Size: USD 4.17 billion

- Projected Market Size: USD 40.75 billion by 2035

- Growth Forecasts: 28.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Israel, France, Italy, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 8 September, 2025

Anti-drone Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Investments in the Drones Industry - drones are currently equipped with high-end technology, advanced parts, and a limited payload capacity and durability. Thus, the rising investments in the drone industry by private companies and organizations are expected to drive global market growth over the forecast period. It was found that in 2021, the drone industry attracted USD 6.9 billion in investments, a significant increase of over USD 2.3 billion in 2020. Investments in drone companies focused on hardware reached USD 4.8 billion.

- Globally Rising Investments in Research and Development – which as per World Bank, in 2020 amounted to 2.63 percent of global GDP, an increase from 2.2% in 2018.

- Increase In Government Investment in The Aviation Industry – for instance, in the area of airport infrastructure and navigation services, India plans to invest USD1.8 billion by 2026.

- Rise In Military Budget Allocation - it was observed that in March 2022, China allocated about USD 190 billion for its military budget, up 6.7% from the prior year. An increase of 4.3% to nearly USD 68 billion is expected for India's military in 2022.

- Increasing Expenditure on Drones - a total of USD 12 billion was spent on drones by businesses and the government. Consumer drone sales in the United States surpassed USD 1.15 billion in 2020.

Challenges

- Damage Caused to Private Property – anti-drone deployments may create problems, such as electromagnetic and Radio Frequency (RF) interference, power transmission, jam frequencies, and others. The purchase of this equipment and its operation with frequencies which is not allowed is a major concern for causing damage to private property.

- Concerns About Citizen Safety

- System Development for Detection of Drones and Components for Anti-drone Systems

Anti-drone Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

28.5% |

|

Base Year Market Size (2025) |

USD 3.32 billion |

|

Forecast Year Market Size (2035) |

USD 40.75 billion |

|

Regional Scope |

|

Anti-drone Market Segmentation:

End-user Segment Analysis

The defense segment is anticipated to capture largest market share by 2035, owing to rapid expansion of the defense manufacturing industry with the increasing number of terrorist and illegal activities expected to augment segment growth over the forecast period. For instance, in 2021-22, India's defense budget was estimated at USD 65 billion, accounting for 12% of the total budget and an increase of USD 5 billion over the budget estimates for 2021-22.

Our in-depth analysis of the global market includes the following segments:

|

By Technology |

|

|

By Application |

|

|

By End-User |

|

|

By Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anti-drone Market Regional Analysis:

North America Market Insights

North America region is anticipated to hold over 40.8% market share by 2035, on the back of presence of advanced defense systems, along with high expenditure on defense sector in nations such as the United States with growing the need for high security in military installations in order to combat the threats posed by unauthorized drones. As per the data from the World Bank, North America spent 3.253% of its GDP on the military in the year 2019.

Anti-drone Market Players:

- Blighter Surveillance Systems Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- MyDefence ApS.

- Thales Group

- Lockheed Martin Corporation

- Saab AB

- Dedrone Holdings, Inc.

- Israel Aerospace Industries Ltd.

- Droneshield Ltd

- Liteye Systems, Inc.

- Theiss UAV Solutions, LLC

Recent Developments

-

Blighter Surveillance Systems Ltd announced its partnership with Korean Integration & Certification Company, to cement its position in South Korea

-

MyDefence ApS. has shipped its anti-drone systems for over 30 SOF units, under the EU Horizon 2020 KNOX project.

- Report ID: 3095

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anti-drone Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.