Anti-aircraft Warfare Market Outlook:

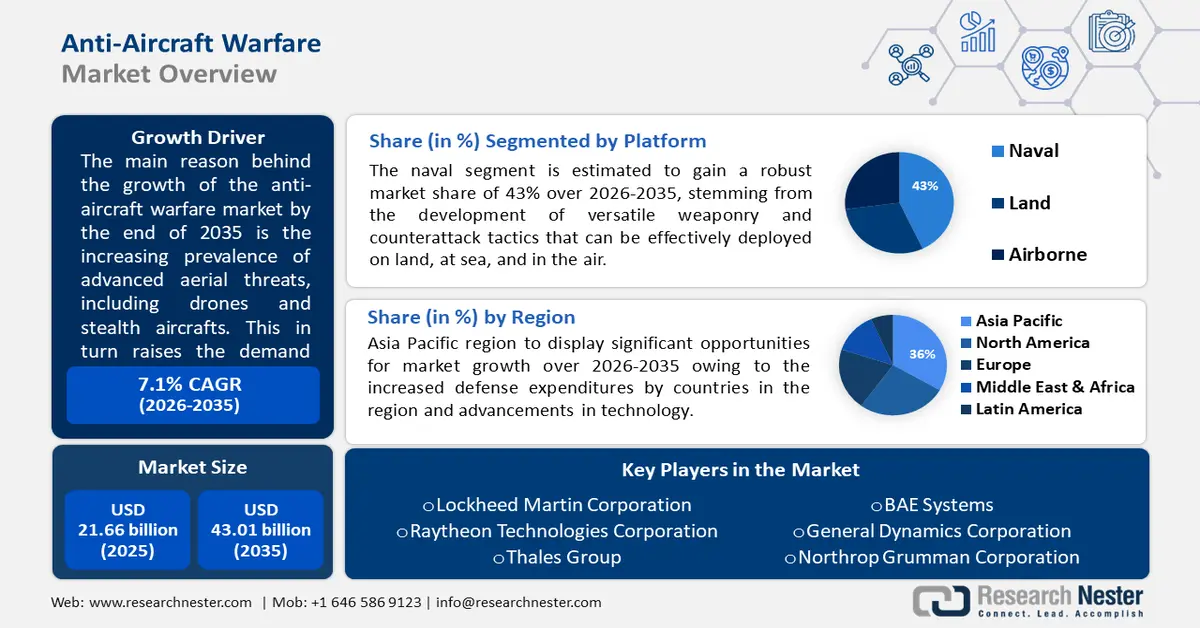

Anti-aircraft Warfare Market size was over USD 21.66 billion in 2025 and is projected to reach USD 43.01 billion by 2035, witnessing around 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of anti-aircraft warfare is evaluated at USD 23.04 billion.

The proliferation of sophisticated aerial threats, such as drones and stealthy aircraft, is driving the demand for advanced anti-aircraft warfare systems to counter these emerging threats. In 2021, 89.2 million people were displaced due to armed conflict and violence, highlighting the need for anti-aircraft and similar technological equipment to counter such violence.

Key Anti-Aircraft Warfare Market Insights Summary:

Regional Highlights:

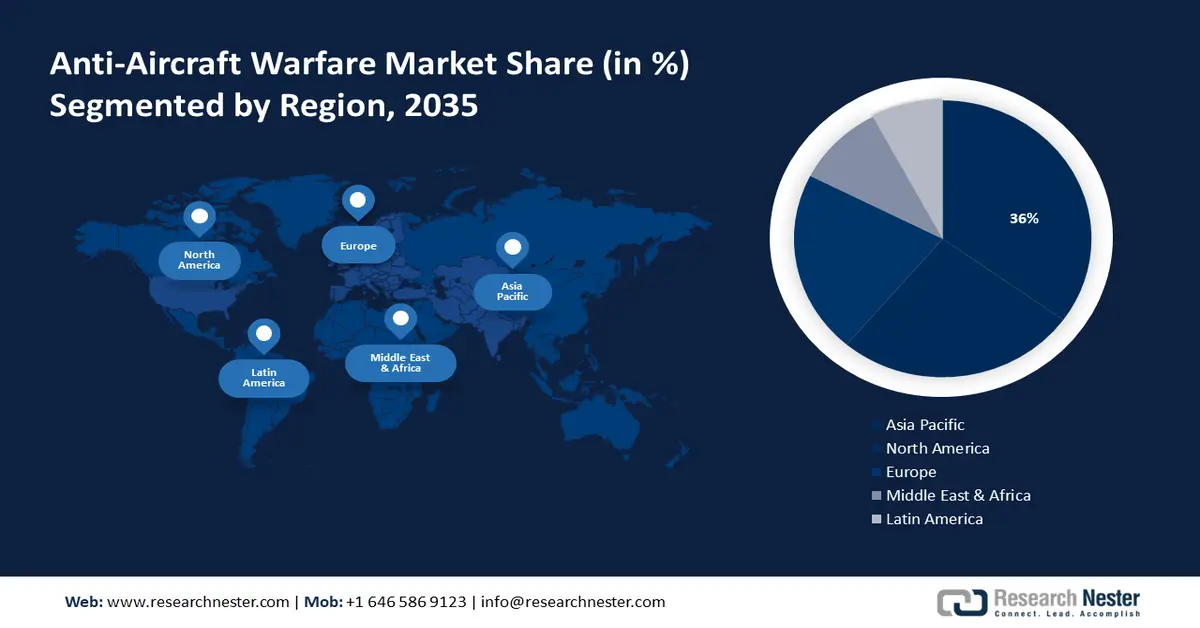

- Asia Pacific anti-aircraft warfare market will dominate around 36% share by 2035, driven by increased defense expenditures in China, India, and South Korea to mitigate regional security threats.

Segment Insights:

- The naval segment in the anti-aircraft warfare market is anticipated to experience robust growth over 2026-2035, attributed to advanced weaponry and versatile counterattack tactics.

- The medium range segment in the anti-aircraft warfare market is projected to hold a 42% share by 2035, influenced by demand for medium-range anti-aircraft systems safeguarding strategic infrastructure.

Key Growth Trends:

- Growing and changing nature of military threats

- Geopolitical Tensions and Regional Instability

Major Challenges:

- Technological Complexity

- Delays and Supply Chain Issues

Key Players: Lockheed Martin Corporation (US), RaytheonTechnologies Corporation (US), Thales Group (France), BAE Systems (UK), General Dynamics Corporation (US), Northrop Grumman Corporation (US), Airbus Defense and Space by Airbus SE, Elbit Systems Ltd. (Israel), Leonardo S.p.A. (Italy), Rheinmetall AG (Germany).

Global Anti-Aircraft Warfare Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.66 billion

- 2026 Market Size: USD 23.04 billion

- Projected Market Size: USD 43.01 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Russia, China, Israel, France

- Emerging Countries: China, India, South Korea, Thailand, Brazil

Last updated on : 17 September, 2025

Anti-aircraft Warfare Market Growth Drivers and Challenges:

Growth Drivers

-

Growing and changing nature of military threats - evolving aerial threats, such as unmanned aircraft systems and cyber-attacks, are driving the anti-aircraft warfare industry to develop new technologies and strategies to counter these emerging challenges. Governments and aviation industry professionals are increasingly recognizing the need to modernize and strengthen their anti-aircraft defense systems. This includes investing in advanced radar systems, missile defense systems, and drone detection and countermeasure technologies. These advancements aim to detect, track, and neutralize potential aerial threats, ensuring the safety and security of civilian airspace and critical infrastructure. By staying ahead of these evolving threats, the anti-aircraft warfare industry is playing a crucial role in safeguarding the aviation industry and preventing potential attacks or disruptions. The Chairman of the Joint Chiefs of Staff Air Force (US) also recently emphasized the need for being prepared for new threats.

- Geopolitical Tensions and Regional Instability - A tense global climate fuels the anti-aircraft warfare market. In 2024, the list of geopolitical conflicts and threats is only increasing. Heightened geopolitical tensions lead to increased defense spending, with a significant portion earmarked for fortifying air defense systems. Additionally, unstable regions ridden with conflict often see a rise in inspection drone and missile use. To counter these threats and protect critical infrastructure, military bases, and civilians, countries invest in advanced AAW systems. In essence, geopolitical tensions breed insecurity, making robust air defense a top priority. This compels nations to prioritize acquiring and developing ever more sophisticated AAW technology, propelling significant growth in the market.

- Focus on Indigenous Development - The focus on indigenous development in the market highlights a significant trend where nations are increasingly prioritizing the development and production of their own air defense systems like military radar systems. This strategic shift aims to reduce reliance on foreign suppliers, enhance domestic military capabilities, and bolster national security. By investing in indigenous air defense systems, countries can achieve greater self-reliance, customization to specific operational needs, and reduced vulnerability to supply chain disruptions or geopolitical influences. This trend underscores a proactive approach by nations to strengthen their defence infrastructure and ensure a more sustainable and secure defence posture against evolving aerial threats. Countries like India are leading the self-reliance movement in producing weapons.

Challenges

- Technological Complexity - Anti-aircraft warfare systems are becoming increasingly complex due to the integration of cutting-edge technologies. This presents a double-edged sword. However, these advancements necessitate substantial research and development efforts to seamlessly combine these technologies. Essentially, the need for a powerful anti-aircraft warfare system hinges on overcoming the technical hurdles of integrating complex functionalities.

- Delays and Supply Chain Issues - The anti-aircraft warfare industry, while anticipated for sustained growth, encounters significant obstacles. Global supply chain disruptions, characterized by trade tensions and unforeseen events, can significantly delay critical component deliveries and stall entire AAW system projects. Additionally, the inherent complexity of modern AAW systems can lead to manufacturing delays due to unforeseen technical challenges or testing setbacks.

Anti-aircraft Warfare Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 21.66 billion |

|

Forecast Year Market Size (2035) |

USD 43.01 billion |

|

Regional Scope |

|

Anti-aircraft Warfare Market Segmentation:

Platform Segment Analysis

By the end of 2035, naval segment is expected to account for more than 43% anti-aircraft warfare market share. The segment growth can be attributed to the advanced forms of weaponry and counterattack tactics that are versatile on land, in water, and in air. The naval sub-segment encompasses a range of platforms such as submarines, surface ships, helicopter, maritime patrol aircraft, and unmanned systems, highlighting the diverse strategies employed to defend naval assets against aerial threats. Additionally, the market analysis emphasizes the significance of the naval sub-segment within the broader anti-aircraft warfare industry, reflecting its critical role in safeguarding maritime territories and assets against airborne threats.

There are continual new development in this sub-segment, one of them being the static automatic transfer switch (SABT). To ensure uninterrupted power for critical systems like radar, weapons, and communications, naval vessels traditionally rely on uninterruptible power supplies (UPS). However, these systems are vulnerable to component failures and maintenance needs. This is where SABT comes in. This automatic switch seamlessly transfers critical loads between power sources, enhancing the reliability of onboard power delivery for naval operations.

Component Segment Analysis

In anti-aircraft warfare market, weapon segment is expected to capture around 39% revenue share by the end of 2035. The segment growth is driven by the increasing demand for advanced and capable weapons to counter evolving aerial threats such as drones, missiles, and increasingly adaptable aircrafts globally. Governments are looking to counter evolving aerial threats, and that means investing in cutting-edge weaponry. This sub-segment encompasses a range of technologies, from surface-to-air missiles to advanced radar and targeting systems. These advancements are crucial for robust defense capabilities against airborne adversaries, whether on land, at sea, or in the air.

Range Segment Analysis

The medium range segment is set to hold over 42% anti-aircraft warfare market share by the end of 2035. This growth is attributed to the rising demand for medium-range anti-aircraft weapon systems. These systems play a crucial role in safeguarding strategic infrastructure by providing a critical tier of defense. The availability of long-range, medium-range, and short-range anti-aircraft systems fosters a flexible air defense posture. This allows military forces to tailor their deployments based on specific operational needs, ultimately optimizing overall air defense readiness and effectiveness.

Our in-depth analysis of the anti-aircraft warfare market includes the following segments:

|

Platform |

|

|

Component |

|

|

Range |

|

|

Capability |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anti-aircraft Warfare Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is estimated to hold largest revenue share of 36% by 2035. The market growth in the region is also expected on account of several factors. Increased defense expenditures by nations such as China, India, and South Korea are driven by a focus on mitigating regional security threats and resolving territorial disputes.

Furthermore, advancements in anti-aircraft warfare technology by regional actors are serving to further stimulate market growth within the Asia-Pacific domain. Consequently, this region is not only the current leader in the market but is also expected to experience the most significant growth trajectory in the foreseeable future. For instance, India announced the acquisition of Igla-S man-portable air defense systems from Russia. This procurement signifies India's ongoing efforts to enhance the combat effectiveness of its armed forces.

North America Market Insights

The North American region will also encounter significant growth for the anti-aircraft warfare market during the forecast period and will hold the second position owing to several reasons. Firstly, growing geopolitical tensions and concerns about potential aerial threats from rogue nations or terrorist organizations are prompting increased defense spending. This translates to investments in upgrading and developing advanced AAW systems. Secondly, the presence of major defense contractors like Lockheed Martin and Raytheon Technologies in North America fosters a robust ecosystem for research, development, and production of cutting-edge AAW technology. This domestic expertise allows for quicker innovation and easier integration of these advancements into existing defense systems. Finally, North America's role in fostering international alliances also contributes to market growth. By offering advanced AAW systems to allies, North American companies not only expand their market reach but also strengthen global security partnerships. These combined factors position North America as a key driver and leading shareholder in the AAW market for the foreseeable future.

The U.S. Marine Corps is undergoing a major modernization effort (Force Design 2030) to adapt to a shifting security landscape, particularly in the Indo-Pacific region. This includes the development of the Medium-Range Intercept Capability (MRIC), a new missile system designed to fill a critical air defense gap against various threats, as highlighted by Lt. Col. Matthew Beck. MRIC's rapid development signifies the Corps' focus on enhancing its organic capabilities for independent operations in contested maritime environments.

Anti-aircraft Warfare Market Players:

- Lockheed Martin Corporation (US)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- RaytheonTechnologies Corporation (US)

- Thales Group (France)

- BAE Systems (UK)

- General Dynamics Corporation (US)

- Northrop Grumman Corporation (US)

- Airbus Defense and Space by Airbus SE

- Elbit Systems Ltd. (Israel)

- Leonardo S.p.A. (Italy)

- Rheinmetall AG (Germany)

The following companies are leading the global anti-aircraft warfare market through their strong product portfolios, technological advancements, global presence, and strategic partnerships and collaborations:

Recent Developments

- Lockheed Martin Corporation - Lockheed Martin recently delivered a significant upgrade to the US missile defense system. The Long Range Discrimination Radar (LRDR) in Alaska has been handed over to the Missile Defense Agency. This powerful radar can continuously track and identify objects, including ballistic missiles, at very long ranges. LRDR's key strength is differentiating real threats from decoys, allowing for more efficient use of defensive interceptors. This new radar system enhances America's ability to protect itself from missile attacks.

- Thales Group - The Dutch military procurement organization, COMMIT, has signed an agreement to acquire seven additional Thales Ground Master 200 Multi-Mission Compact radars (GM200 MM/C), with an option for two more. This follows a previous order of nine GM 200 MM/C radars in 2019. The GM200 MM/C is a highly versatile radar system designed for modern multi-mission warfare, offering radar operators more time-on-target to gather information on incoming threats. Featuring advanced 4D Active Electronically Scanned Array (AESA) technology and unique 'dual-axis multi-beam' capabilities, the GM200 MM/C provides unrestricted flexibility in elevation and bearing, delivering excellent theatre protection capabilities to the Dutch military.

- Report ID: 6105

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anti-Aircraft Warfare Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.