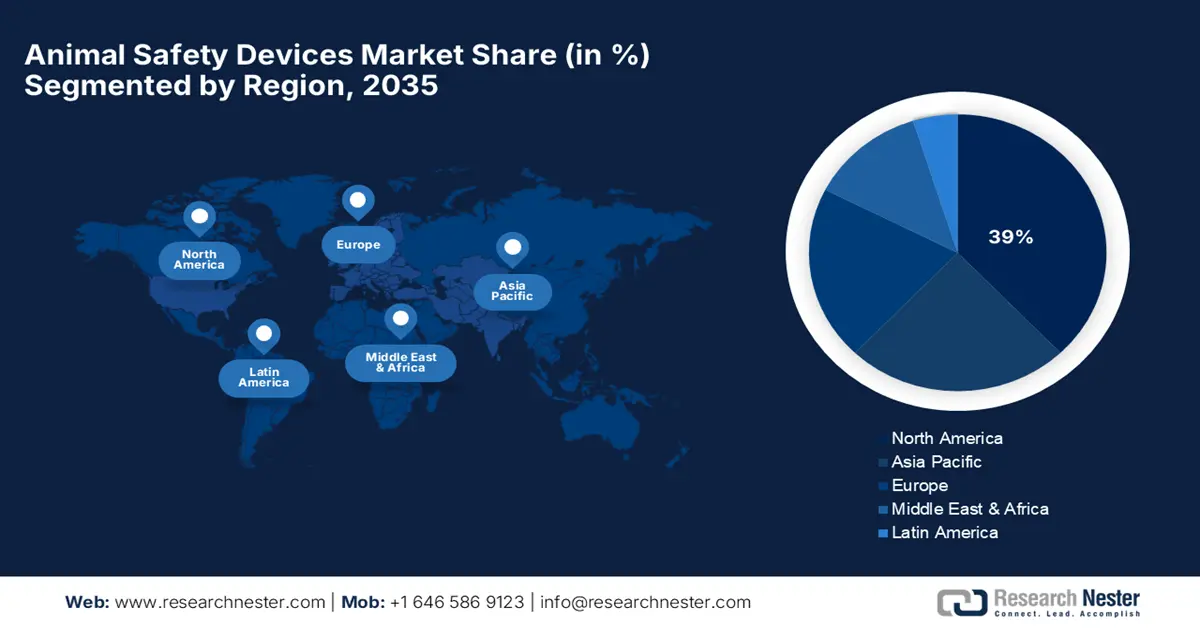

Animal Safety Devices Market - Regional Analysis

North America Market Insights

North America is poised to capture around 39% market share during the forecast period, driven by solid pet consumer expenditure, an advanced agricultural sector, and innovative government regulation to continue to support animal health and food safety. The region is at the forefront of the adoption of pet tech and is rapidly embracing mandatory electronic identification systems for animals. This convergence of consumer demand and regulatory action fuels a widespread, dynamic, and very valuable animal safety devices market for a range of animal safety products.

The U.S. animal safety devices market is significantly impacted by the implementation of federal regulations harmonizing animal traceability requirements across the nation. The USDA's new Animal Disease Traceability (ADT) rule is a prime driver, and agencies at the state level are actively facilitating compliance. In its newsletter of July 2024, the California Department of Food & Agriculture (CDFA) explained the new federal rule to its stakeholders, indicating that from November 5, 2024, all official ear tags applied to cattle and bison shall be readable visually and electronically, and specifically referencing the use of approved 840 RFID tags.

Canada possesses a well-established and solid national traceability infrastructure for animals that functions under a stable and foreseeable animal safety devices market for compliant safety devices. The Canadian Food Inspection Agency (CFIA) continued to be in charge of the national Livestock Identification and Traceability program throughout 2023. This program requires reporting animal movement and government-tagged indicators (tags) for key species, including cattle, bison, sheep, and pigs, thereby providing a steady, regulation-guided demand for identification technology.

Europe Market Insights

Europe is likely to notice significant growth between 2026 and 2035, underpinned by a broad and mature regulation system for traceability and animal identification. The European Union has passed mandatory electronic identification systems for different species of livestock, creating a large, mature, and stable animal safety devices market. According to 2024 figures from Eurostat, the EU's 2023 livestock population comprised 133 million pigs and 74 million bovines, giving a numerical value to the huge addressable base available for eID and movement registration platforms across the continent.

Germany market is registering considerable growth with an efficient and computerized national traceability infrastructure for livestock. Tierhaltungskennzeichnung, or Animal Husbandry Labelling, is a German law mandating the labeling of living conditions for German livestock. It was implemented in August 2023 for pigs during their fattening period, developed by the Greens-led German Ministry of Agriculture (BMEL). Such a developed and strenuously regulated system warrants a perpetual need for compatible animal safety equipment and enables Germany to lead European traceability and animal health management.

The UK is a key animal safety devices market, particularly for pet companion animal safety devices, due to fresh government legislation. In a significant decision in the field of animal welfare, the UK government brought forward a fresh law in March 2023 that made compulsory microchipping of all pet cats in England. This legislation, which affects an estimated 9 million cats and carries a highest penalty of £500 for non-compliance, has created enormous opportunities for microchipping services and associated database registrations, underlining the profound impact of public policy on the animal safety device market.

APAC Market Insights

Asia Pacific animal safety devices market is anticipated to develop with a strong CAGR of 8% between 2026 and 2035, hence emerging as one of the most promising markets. This is fueled by increasing disposable incomes, rising pet population, and a high focus on food safety and animal health in agriculture in the Asia Pacific. As APAC countries advance their agriculture and as middle classes expand in cities, there will be increasing demand for a wide array of animal safety devices ranging from livestock ear tags to pet GPS tracking devices.

China animal safety devices market is growing, driven by government programs to improve animal health and disease control within its huge livestock industry. The Ministry of Agriculture and Rural Affairs in China periodically issues bulletins and regulations for animal disease prevention and traceability. For instance, China government swiftly responded to a July 2024 report from Romania about a Peste des Petits Ruminants (PDPR) outbreak in Tulcea province. To safeguard its animal husbandry and biosecurity, an announcement was issued based on relevant laws, preventing the disease's spread into China.

India market is poised for steady growth, driven by government plans for containing animal disease and stimulating the productivity of the livestock economy. The government's Department of Animal Husbandry and Dairying (DAHD) highlighted its National Animal Disease Control Programme (NADCP) in March 2025. The flagship programme incorporates significant elements of animal identification, vaccination, and tracing, providing a platform that necessitates the extensive application of animal safety devices, such as RFID tags, to achieve its ambitious national health and traceability objectives.