Animal Protein Market Outlook:

Animal Protein Market size was valued at USD 31.22 billion in 2025 and is expected to reach USD 51.34 billion by 2035, expanding at around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of animal protein is evaluated at USD 32.65 billion.

The growth of the market can be attributed to the rising consumption and production of meat which is one of the primary sources of animal protein. The world's largest producer of beef and veal is the United States. The production in US reached around 13 million metric tons in 2022. Additionally, more than three times as many beef cows as dairy cows were living in the United States in 2022 to meet the country's output demand.

In addition to these, factors that are believed to fuel the market growth of animal protein include the wide usage of animal protein in various industries, including pharmaceutical, food & beverage, cosmetic, and others. Animal proteins are used to make both the active and inactive components, such as binders, fillers, stabilizers, transporters, and others, that are used in the production of pharmaceutical products. Moreover, products such as, animal fats, fish oil, and dairy proteins are extensively used in the food industry. Furthermore, the growing awareness for healthy lifestyle has given major push to the protein supplements, which is likely to augment the market growth.

Key Animal Protein Market Insights Summary:

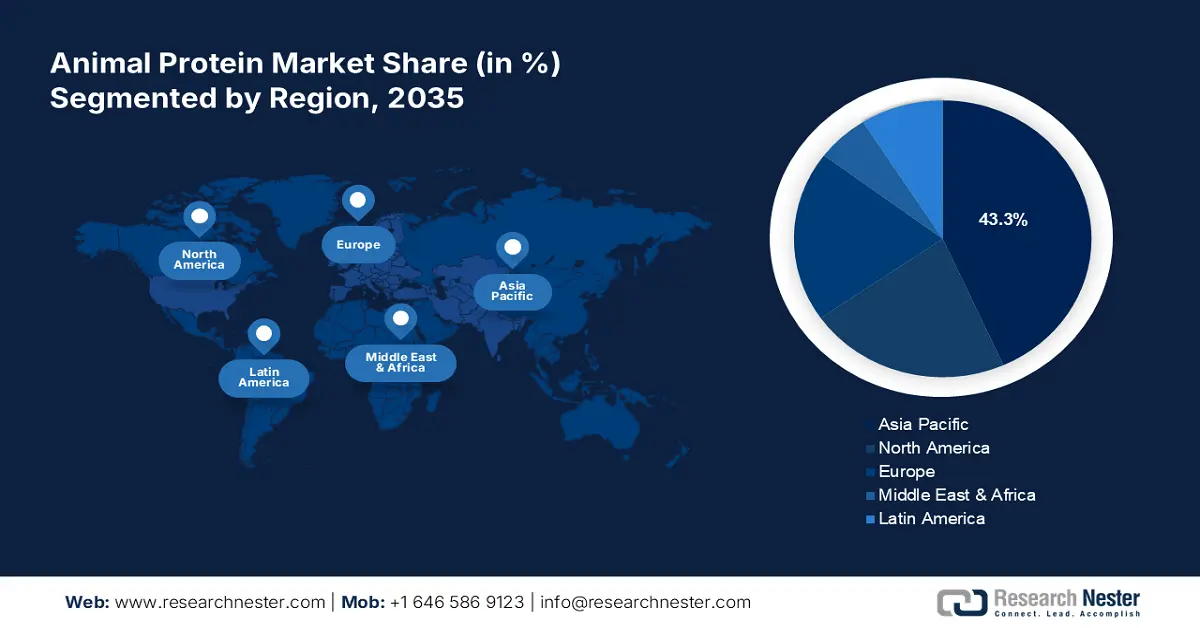

Regional Highlights:

- Asia Pacific animal protein market will dominate more than 43.3% share by 2035, driven by increasing milk production and rising consumption of protein supplements.

- North America market will secure the second largest share by 2035, driven by rising intake of whey protein and health consciousness.

Segment Insights:

- The food & beverages segment in the animal protein market is projected to hold the largest share by 2035, fueled by rising use of animal proteins in food and beverages due to high nutritional value.

- The dairy protein segment in the animal protein market is expected to achieve a significant share by 2035, driven by rising global milk production, increasing availability of dairy protein.

Key Growth Trends:

- Growing Demand for Protein Supplements

- Rising use of Collagen-based Products

Major Challenges:

- Rising population of vegans and vegetarians

- Strict regulation for ensuring the superior quality of animal protein

Key Players: Trobas Gelatine B.V., Archer Daneils Midland Company, Arla Foods Ingredients Group P/S, Cargill, Incorporated, Darling Ingredients Inc., Kerry Group Plc, Kewpie Corporation, Nitta Gelatin India Limited, Peterlabs Holdings Berhad, Fonterra Co-Operative Group Limited.

Global Animal Protein Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 31.22 billion

- 2026 Market Size: USD 32.65 billion

- Projected Market Size: USD 51.34 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, Brazil

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Animal Protein Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Demand for Protein Supplements – Protein supplements have become the prime ingredient in the diets of muscle-builders and gym freaks. Every 2 in five Americans often eat protein beverages and smoothies, that account for 46% of the population. Moreover, most Americans consume twice as much protein as they need.

-

Rising use of Collagen-based Products – Collagen is frequently used in cosmetics with the goal of minimizing the appearance of fine lines and wrinkles, cellulite and enhancing the flexibility of the skin. Most of the collagen is extracted from beef and fish. Cellulite is likely to affect 80 to 90 percent of females, and it usually affects the thighs and glutes.

-

Rising Production of Meat – Growing production of meat is expected to create lucrative opportunities for animal proteins. According to the reported data, in comparison to fifty years ago, the world currently produces more than three times as much beef. About 340 million tons were produced in 2018.

-

Rise in the Number of Cattle – Higher population of livestock and aquaculture is likely to give a major boost to the production of animal-based products. In 2021, there were around 996 million cattle in the world, which further increased to nearly 1 billion in the year 2022.

-

Higher Consumption of Baby Formula – Infant formula milk are very important for the healthy growth of the baby, it provides essential nutrients and vitamins. Baby formula contains different types of animal proteins, such as whey protein, cow’s milk, goat’s milk, milk protein isolate, and others. Over the course of the first month, newborns steadily eat more baby formula and eventually reach a feeding size of 3 to 4 ounces (90 to 120 ml) per feeding, or 32 ounces per day.

Challenges

-

Rising population of vegans and vegetarians

-

Adverse effects of animal protein- Animal protein stimulates the secretion of IGF-1 hormone which in turn increases the division of cells and increases the risk of developing cancer. Moreover, high protein, heavy meat diets may cause problems with the liver, and worsen coronary artery disease. It also causes problems with bones and the calcium levels in the body. Therefore, the negative impact of animal protein is expected to hamper the market’s growth

-

Strict regulation for ensuring the superior quality of animal protein

Animal Protein Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 31.22 billion |

|

Forecast Year Market Size (2035) |

USD 51.34 billion |

|

Regional Scope |

|

Animal Protein Market Segmentation:

Application Segment Analysis

The global animal protein market is segmented and analyzed for demand and supply by application into food & beverages, pharmaceuticals & nutraceuticals, cosmetics & personal care, and feed. Out of the four application of animal protein, the food & beverages segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the rising use of animal proteins, such as dairy, egg protein, and gelatin in the food and beverage industry owing to their high nutritional value. Moreover, higher consumption of ice cream is also expected to boost the segment growth. Ice creams are made with gelatin, which serves as an emulsifier. Moreover, it maintains the freshness of the ice cream and provides it texture. With a yearly intake of around 28 liters per person, New Zealand is the country with the highest ice cream consumption in the world. Moreover, during the Australian summer, ice cream consumption surges, around 3% of grocery customers buy ice cream cartons weekly while nearly 19% consume them monthly. In addition to this, every two to three months, about 21% of consumers buy ice cream tubs.

Product Segment Analysis

The global animal protein market is also segmented and analyzed for demand and supply by product into egg protein, dairy protein, fish protein, and gelatin. Amongst these four segments, the dairy protein segment is expected to garner a significant share in the year 2035. The growth of the segment is primarily ascribed to the rising production of milk. The amount of milk produced globally in 2019 increased by around 1% to 852 million tons, out of which around 81% consisted primarily of cow milk, nearly 15% buffalo milk, and goat, sheep, and camel milk had a share of approximately 4%.

Our in-depth analysis of the global market includes the following segments:

|

By Form |

|

|

By Product |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Animal Protein Market Regional Analysis:

APAC Market Insights

Asia Pacific region is projected to account for more than 43.3% market share by 2035, driven by increasing milk production and rising consumption of protein supplements. In the last eight years, between the years 2014–15 and 2021–22, India's milk output has climbed by around 51 percent, reaching a total of around 2 million tons owing to the government’s adoption of several programs. Furthermore, the rising consumption of dietary supplements that is consist of protein in the region is expected to boost market growth. Protein bars make up the majority of the remaining part of the sports nutrition market in China, which is dominated by protein powder with a 91% market share.

North American Market Insights

The North American animal protein market, amongst the market in all the other regions, is projected to hold the second largest share during the forecast period. The growth of the market can be attributed majorly to the rising intake of whey protein. Fitness facilities frequently offer protein supplements, which is drawing customers' attention to whey protein. Demand for whey protein is further rising as consciousness of healthy lives and the prevalence of diseases linked to lifestyles are advancing. The United Nations has the highest number of gym members in all the world. The total count is amounting to around 64 million.

MEA Market Insights

Further, the market in the Middle East and African, amongst the market in all the other regions, is projected to hold a significant share by the end of 2035. The growth of the market can be attributed majorly to the increasing consumption of meat in various parts of the region. The Gulf Cooperation Council nations ate over 3.9 million metric tons of meat in 2019. Over 1.6 million metric tons of meat were produced in the area that year. Moreover, the increased likeability for cakes and other bakery products is also expected to boost the market growth. South Africa consumed around 2 million metric tons of meals and desserts in 2020–2021.

Animal Protein Market Players:

- Trobas Gelatine B.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Archer Daneils Midland Company

- Arla Foods Ingredients Group P/S

- Cargill, Incorporated

- Darling Ingredients Inc.

- Kerry Group Plc

- Kewpie Corporation

- Nitta Gelatin India Limited

- Peterlabs Holdings Berhad

- Fonterra Co-Operative Group Limited

Recent Developments

-

Kerry Group Plc announces the expansion of the company in the Middle East by inaugurating a new 21,500 square foot new state of the art facility in Saudi Arabia. This facility is the largest in the Middle East, Turkey, and North Africa. Moreover, Kerry Group has invested around USD 86 million in the region in past few years

-

Fonterra Co-Operative Group Limited launched the new whey protein concentrate, Pro-Optima in collaboration with Columbia River Technologies which is a joint venture of Three Mile Canyon and Tillamook. It is a Grade A functional whey protein concentrate and has the ability to push the protein content of yoghurt to the highest level.

- Report ID: 4720

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Animal Protein Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.