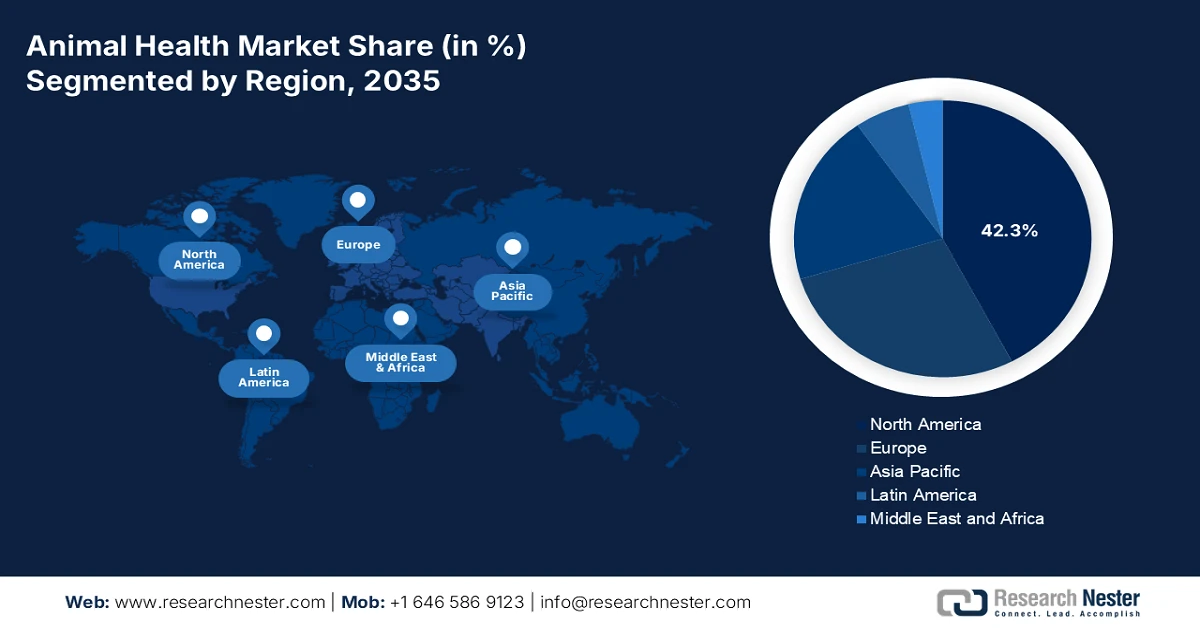

Animal Health Market - Regional Analysis

North America Market Insights

The North America animal health market is the global leader and is expected to hold the regional revenue share of 42.3% by 2035. The market is driven by the established veterinary infrastructure, high per-animal healthcare expenditure in the companion animal sector, and significant R&D investment. The key drivers include a strong focus on preventive care, advanced biologics adoption, and integrated data-driven livestock management. Trends shaping the region are the rapid growth of pet health insurance, increasing demand for specialized therapeutics and diagnostics, and collaborative public-private initiatives addressing antimicrobial resistance and zoonotic disease threats, supported by substantial government funding in both the U.S. and Canada. Further, the government spending on biosecurity and AMR research solidifies this leadership.

The U.S. market is defined by innovation, premiumization, and technological integration in companion animal care alongside precision livestock farming. The December 2025 approval of the Praziquantel Tablets launched by Felix Pharmaceuticals Pvt. Ltd. reinforces the ongoing demand for the regulated antiparasitic therapies in companion animals. Further, the regulatory approval for the species-specific formulations supports the market expansion by ensuring the product safety, dosage accuracy, and compliance with veterinary prescribing standards. This approval aligns with the increasing government and veterinary emphasis on parasite control programs to reduce animal morbidity and prevent human transmission risks. As companion animal ownership and preventive care uptake rise globally, such authorized pharmaceutical launches contribute to the sustained volume demand across veterinary clinics and licensed pharmacies, strengthening the structural growth outlook in the market.

Recent Animal Drug Approvals

|

Date |

Application Number |

Sponsor |

Product Name |

Species |

|

December 22, 2025 |

200-834 |

Felix Pharmaceuticals Pvt. Ltd. |

Praziquantel Tablets |

Cats |

|

December 22, 2025 |

200-832 |

ZyVet Animal Health, Inc. |

Robenacoxib |

Cats |

|

December 22, 2025 |

200-829 |

Aurora Pharmaceutical, Inc. |

Klentz |

Dogs |

|

December 19, 2025 |

200-823 |

Dechra Veterinary Products LLC |

Zygolide |

Horses |

Source: FDA January 2026

The Canada animal health market is supported by the sustained federal investment focused mainly on disease prevention, surveillance, and animal welfare. The Government of Canada report in October 2024 indicates that in 2024, nearly USD 13,343,409 over the five years to Animal Health Canada through the AgriAssurance Program under the Sustainable Canadian Agriculture Partnership, reinforcing the long-term demand for animal health solutions. Funding directed toward expanding national surveillance networks and adopting a One Health approach increases the institutional requirements for veterinary diagnostics data systems and epidemiological services across livestock sectors. Additional investment in emergency management planning and industry-wide training strengthens the preparedness for transboundary disease events, supporting recurring procurement of preventive and response-related animal health inputs.

APAC Market Insights

Asia Pacific market is the fastest growing and is expected to grow at a CAGR of 7.5% during the forecast period 2026 to 2035. The market is driven by the protein demand from a rising middle class, increasing pet ownership, and government modernization of livestock sectors. The key drivers include disease control mandates for trade, such as China’s African Swine Fever recovery efforts, and national initiatives to curb antimicrobial resistance. India’s National Livestock Mission aims to boost productivity with significant funding. The trend is toward integrated solutions combining vaccines, nutrition, and digital herd management. However, the growth is uneven, with the mature markets such as Japan and Australia focusing on premiumization while emerging economies prioritize food security and disease eradication.

The China animal health market continues to expand and is supported by the increased localization of supply chains and regulatory-aligned investments by global manufacturers. Partnerships such as Novus International’s distributor agreement with the Co-Innova Animal Nutrition Technology Co., Ltd. strengthen the market access for the animal nutrition and health products by leveraging established domestic distribution networks to serve China’s large swine and poultry sector. At the same time the Bimeda’s €25 million sterile injectable manufacturing facility in Shijiazhuang, Hebei Province, built to China Human Drug GMP standards, significantly enhances the in-country production capacity for veterinary injectables. As the first facility of its kind in the province to receive this approval, it aligns with the government priorities to improve the quality of biosecurity and self-reliance in animal disease management.

India animal health market is propelled by the mission to enhance the livestock productivity and support its vast rural economy, which is driven by the strong government initiatives. The focus is on improving milk yield, controlling endemic diseases like foot and mouth disease, and expanding access to veterinary services. The demand is rising for vaccines anti parasitics and feed additives. The concrete example of state-led demand is the government’s ongoing vaccination programs. The report from the Department of Animal Husbandry and Dairying in 2022 to 2023 shows that the total number of animals vaccinated for the FMD is 20.77 crore as of January 2023, which is nearly 80.4% of the total population. This data highlights the massive systematic public procurement that anchors the market.

Europe Market Insights

The Europe market is defined by the mature high-value segments governed by the stringent EU-wide regulations. The demand is driven by a dual focus, maintaining high welfare standards in intensive livestock production and addressing the humanization of companion animals. The regulatory push is the primary growth driver for vaccines, diagnostics, and antibiotic alternatives. Further, the threat of transboundary diseases such as Avian Influenza necessitates robust government-coordinated surveillance and vaccination programs. The market is also seeing consolidation and innovation, with increased digital tool adoption for herd management and a growing pet insurance sector fueling expenditure in the companion animal segment. Sustained investment in the public-private partnerships for One Health initiatives further expands the region's advanced market structure.

Germany animal health market dominates the Europe market and is driven by its technologically advanced export-oriented livestock sector and high standards of companion animal care. The primary growth driver is the integration of precision livestock farming and digital health technologies to meet stringent environmental and antibiotic reduction targets. The government actively supports this shift. According to the Smart Agriculture report in 2021, the funding for the digitalization in agriculture, which includes animal health monitoring, was allocated approximately 50 Million Euros for 14 different projects in Germany. This investment directly stimulates the demand for connected diagnostics, automated monitoring systems, and data management platforms, ensuring market leadership via innovation.

The government-led disease surveillance and outbreak response activities are strongly influencing the UK market. The report from the Animal and Plant Health Agency in March 2025 states that the UK recorded 57 cases of highly pathogenic avian influenza H5N1 at premises in England, alongside management of 233 confirmed bluetongue virus cases following the first UK detection in August 2024, which underscores the sustained public expenditure on animal disease control. These outbreaks have intensified demand for the veterinary diagnostics field services, movement control implementation, and biosecurity support across the poultry and ruminant sectors. Further, the ongoing coordination with the livestock keepers and veterinary delivery partners reflects the institutional nature of this spending. As transboundary disease risks increase, such government-driven response frameworks continue to anchor stable, non-discretionary demand within the UK market.