Animal Health Market Outlook:

Animal Health Market size was valued at USD 70.7 billion in 2025 and is projected to reach USD 199.1 billion by the end of 2035, rising at a CAGR of 10.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of animal health is estimated at USD 78.4 billion.

The global market is a critical component of agricultural and public health infrastructure focused on the development and distribution of products for disease prevention, management, and treatment in both livestock and companion animals. The market’s scale is substantial, driven by the need to ensure food security and meet rising protein demand. For example, the data from the Agencia IBEG Noticias in September 2024 shows that the value of livestock products in Brazil increased by 5.4% in 2023 and reached USD 122.4 billion. This data highlights the economic importance of maintaining animal health and productivity. The regulatory oversight is an important factor defining the industry; agencies such as the U.S. FDA Center for Veterinary Medicine are responsible for approving new animal drugs and feed additives, ensuring their safety and efficacy.

Market dynamics are influenced by the long cycle of product development and significant capital investment in research. The FDA’s CVM approves a limited number of new animal drug applications annually, reflecting the high regulatory and scientific barriers to entry. The growth in the companion animal segment correlates with the demographic trends, as noted by the American Pet Products Association report in March 2025, which states that nearly 94 million U.S. households own at least one pet, creating a sustained demand for veterinary services and pharmaceuticals. From the production animal perspective, disease outbreaks have major economic repercussions. The Animal and Plant Health Inspection Service implements a control program for diseases such as Highly Pathogenic Avian Influenza. The data from Congress.gov in April 2025 shows that nearly 1,689 flocks were confirmed with HPAI, affecting 168.62 million birds in 2022. This reality reinforces the market foundation in preventive healthcare, including vaccination and biosecurity, as essential for economic stability and continuity in the supply chain.

Total Number of HPAI H5N1 Detections by Species in Mammals in the United States (2022-2024)

|

Species Detection by Year |

2022 |

2023 |

2024 |

Overall |

Species Detection by Year |

|

Abert’s squirrel |

0 (0%) |

1 (0.9%) |

0 (0%) |

1 (0.2%) |

Abert’s squirrel |

|

American black bear |

1 (0.9%) |

3 (2.7%) |

0 (0%) |

4 (1.0%) |

American black bear |

|

American marten |

0 (0%) |

1 (0.9%) |

0 (0%) |

1 (0.2%) |

American marten |

|

American mink |

0 (0%) |

0 (0%) |

1 (0.6%) |

1 (0.2%) |

American mink |

Source: NLM February 2025

Key Animal Health Market Insights Summary:

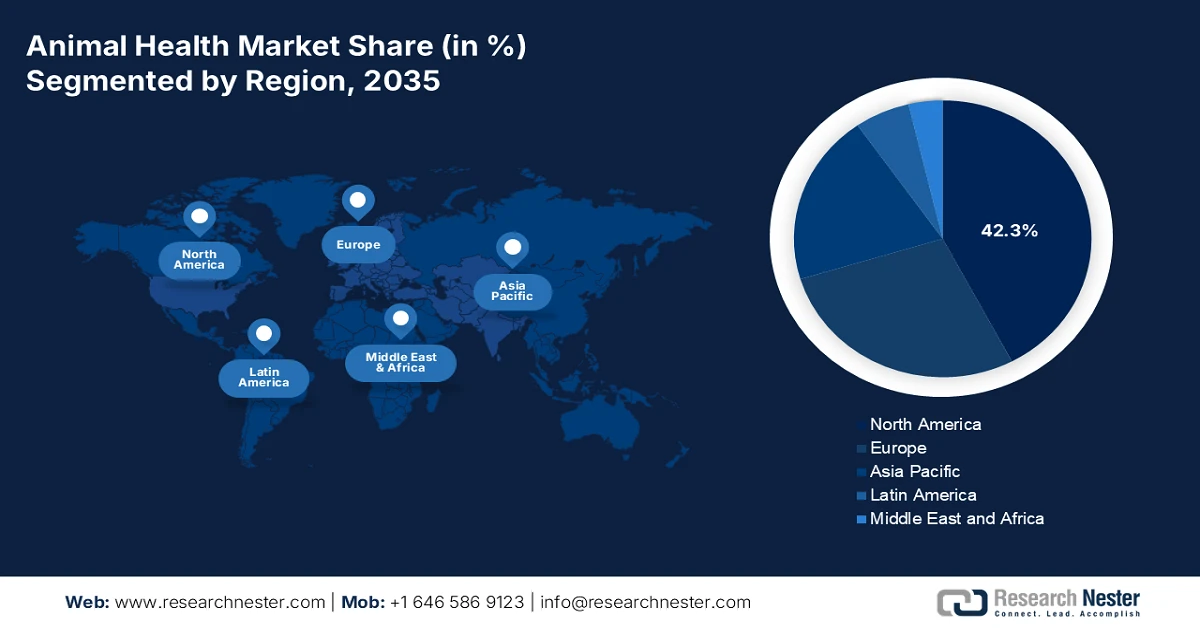

Regional Highlights:

- North America is anticipated to command a 42.3% revenue share by 2035 in the animal health market, underpinned by a mature veterinary infrastructure and high companion animal healthcare spending supported by strong R&D intensity.

- Asia Pacific is projected to expand at a CAGR of 7.5% during 2026–2035, accelerated by rising protein consumption, increasing pet ownership, and government-led livestock modernization programs.

Segment Insights:

- Under the end user category, veterinary professionals are expected to secure a 70.3% share by 2035 in the animal health market, reinforced by regulatory frameworks that mandate licensed veterinarians as primary decision-makers for advanced therapeutics adoption.

- Within the technology segment, the conventional subsegment is set to retain the largest market share through 2035, sustained by its cost-efficient applicability across livestock and companion animal care relying on established pharmaceuticals, vaccines, and diagnostics.

Key Growth Trends:

- Rising government spending on zoonotic disease prevention

- Expansion of livestock production

Major Challenges:

- High R&D costs and lengthy timelines

- Relationship barrier in sales & marketing

Key Players: Zoetis Inc. (U.S.), Merck Animal Health (U.S.), Boehringer Ingelheim (Germany), Elanco Animal Health (U.S.), Ceva Santé Animale (France), Virbac (France), Vetoquinol (France), Dechra Pharmaceuticals PLC (UK), IDEXX Laboratories, Inc. (U.S.), Covetrus (U.S.), Phibro Animal Health Corporation (U.S.), HIPRA (Spain), Norbrook (UK), Kyoritsu Seiyaku (Japan), Zydus Animal Health (India), Huvepharma (Bulgaria), Jurox (Australia), Choongwae (South Korea), Pharmgate (Sweden), ECO Animal Health (UK).

Global Animal Health Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 70.7 billion

- 2026 Market Size: USD 78.4 billion

- Projected Market Size: USD 199.1 billion by 2035

- Growth Forecasts: 10.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, United Kingdom, Japan

- Emerging Countries: China, India, Brazil, South Korea, Australia

Last updated on : 27 January, 2026

Animal Health Market - Growth Drivers and Challenges

Growth Drivers

- Rising government spending on zoonotic disease prevention: Governments are prioritizing more on the animal health as a frontline defense against the zoonotic diseases that threaten public health and economic stability. The World Organization for Animal Health report in April 2024 states that nearly 75% of the infectious human diseases have animal origin, prompting sustained public investment in surveillance and control systems. In the U.S., the USDA 2023 data shows that nearly USD 384 million is allocated for animal health inspection service, with a significant portion directed toward veterinary biologics, veterinary diagnostics, zoonotic disease management, and more. Similarly, the European Commission has increased the funding under its EU4Health and Horizon Europe programs to strengthen the cross-border animal disease monitoring.

Animal Health Inspection Service (millions of dollars)

|

Item |

2021 |

2022 |

2023 |

|

Animal Health Technical Services |

USD 38 |

USD 38 |

USD 39 |

|

Aquatic Animal Health |

2 |

2 |

2 |

|

Avian Health |

63 |

63 |

65 |

|

Cattle Health |

105 |

105 |

109 |

|

Equine, Cervid and Small Ruminant Health |

29 |

29 |

32 |

|

National Veterinary Stockpile |

6 |

6 |

6 |

|

Swine Health |

25 |

25 |

26 |

|

Veterinary Biologics |

21 |

21 |

22 |

|

Veterinary Diagnostics |

57 |

57 |

59 |

|

Zoonotic Disease Management |

20 |

20 |

24 |

|

Total, Animal Health |

366 |

366 |

384 |

Source: USDA 2023

- Expansion of livestock production: Food security policies are driving the livestock expansion mainly in Asia and Africa, increasing the demand for preventive and therapeutic animal health solutions. The FAO data in June 2023 shows that the global meat production reached 364 million tons, and the milk production reached 944 million tons, largely supported by the productivity-focused government programs. India’s Department of Animal Husbandry and Diarying continue to scale national livestock health schemes under the Rashtriya Gokul Mission, while China’s Ministry of Agriculture emphasizes disease control to stabilize pork supply following African swine fever disruptions. Further, the global market is expected to grow and is driven by government-backed livestock productivity initiatives across Asia and Europe.

- Increased budget allocation for veterinary public health infrastructure: Governments are investing in veterinary laboratories, diagnostic networks, and field services to improve the outbreak response times. The Health for Animals in April 2023 report indicates that the livestock disease losses represent the production loss of USD 358.4 billion. Further, the multilateral programs such as the Global Animal Health Security initiative support national lab capacity building across Africa and Southeast Asia. The U.S. USDA’s National Animal Health Laboratory Network continues to receive federal funding to expand the real-time diagnostic coverage. These investments create sustained institutional demand for testing kits, reference reagents, and laboratory services, benefiting suppliers aligned with government procurement cycles rather than discretionary private spending.

Challenges

- High R&D costs and lengthy timelines: Developing a new animal health product requires immense capital and patience. The journey from discovery to commercial launch might take a decade and exceed millions. This creates a significant barrier in the animal health market, mainly for the smaller firms. The top players in the market exemplify managing this via scale, investing some amount in R&D to sustain a robust pipeline. Smaller biotechs often partner with the major players and focus on niche indications to share the burden and risks.

- Relationship barrier in sales & marketing: In key segments, vets are the primary prescribers and influencers. Established players have deep, long-term relationships built via technical support, education, and direct sales teams. The newcomers in the market initially struggled with the commercial uptake of novel pet therapeutics despite FDA approval, partly due to limited vet channel penetration, demonstrating that a great product is not enough without commercial reach.

Animal Health Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.9% |

|

Base Year Market Size (2025) |

USD 70.7 billion |

|

Forecast Year Market Size (2035) |

USD 199.1 billion |

|

Regional Scope |

|

Animal Health Market Segmentation:

End user Segment Analysis

Under the end user segment, the veterinary professionals are dominating the segment in the animal health market and are poised to hold the share value of 70.3% by 2035. The segment is known as the primary gatekeeper and decision maker for product adoption. This dominance is structurally enforced by regulations that classify most advanced therapeutics, mainly prescription pharmaceuticals and biologics, as restricted to use by or on the order of a licensed veterinarian, cementing their central role. The economic significance of this channel is substantial. For example, the data from the American Animal Hospital Association in April 2024 indicates that the employment of veterinarians is expected to grow 17% from 2020 to 2030, a rate much faster than the average for all occupations, highlighting the sector’s expansion and underlying demand for professional animal healthcare services that directly drive the product sales via this end user.

Technology Segment Analysis

In the technology segment, the conventional subsegment is leading and is expected to hold the largest share in the market. Even though the advanced technologies are growing rapidly, the conventional technology encompasses established pharmaceutical chemistry, traditional vaccine development, and standard diagnostics. This is due to its foundational role in the mass market and cost-effective solutions for both livestock and companion animal care. However, significant public investment is stimulating innovation in the adjacent fields. A statistical indicator comes from the USDA’s National Institute of Food and Agriculture, which actively funds advanced research. For example, the report from the NIFA in November 2025 shows NIFA announced an investment of USD 3.3 million help mitigate antimicrobial resistance, which directly funds the development of technologies and strategies within the animal health sector.

Distribution Channel Segment Analysis

The veterinary hospitals and clinics will continue as the dominant distribution channel segment in the animal health market, serving as the critical nexus for diagnosis, prescription, and administration of high-value animal health products. This channel’s leadership is reinforced by the legal requirement for veterinary oversight of prescription-only products and the increasing technical complexity of treatments from monoclonal antibodies to advanced surgical care. Its market footprint is vast, and government data confirms the scale of its economic activity. According to Arcadia University, in May 2024, the veterinary clinics in the U.S. range from 28,000 to 32,000. This number highlights the immense commercial volume flowing via this primary channel and its pivotal role in the broader animal health economy.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Animal Type |

|

|

Distribution Channel |

|

|

Route of Administration |

|

|

End user |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Animal Health Market - Regional Analysis

North America Market Insights

The North America animal health market is the global leader and is expected to hold the regional revenue share of 42.3% by 2035. The market is driven by the established veterinary infrastructure, high per-animal healthcare expenditure in the companion animal sector, and significant R&D investment. The key drivers include a strong focus on preventive care, advanced biologics adoption, and integrated data-driven livestock management. Trends shaping the region are the rapid growth of pet health insurance, increasing demand for specialized therapeutics and diagnostics, and collaborative public-private initiatives addressing antimicrobial resistance and zoonotic disease threats, supported by substantial government funding in both the U.S. and Canada. Further, the government spending on biosecurity and AMR research solidifies this leadership.

The U.S. market is defined by innovation, premiumization, and technological integration in companion animal care alongside precision livestock farming. The December 2025 approval of the Praziquantel Tablets launched by Felix Pharmaceuticals Pvt. Ltd. reinforces the ongoing demand for the regulated antiparasitic therapies in companion animals. Further, the regulatory approval for the species-specific formulations supports the market expansion by ensuring the product safety, dosage accuracy, and compliance with veterinary prescribing standards. This approval aligns with the increasing government and veterinary emphasis on parasite control programs to reduce animal morbidity and prevent human transmission risks. As companion animal ownership and preventive care uptake rise globally, such authorized pharmaceutical launches contribute to the sustained volume demand across veterinary clinics and licensed pharmacies, strengthening the structural growth outlook in the market.

Recent Animal Drug Approvals

|

Date |

Application Number |

Sponsor |

Product Name |

Species |

|

December 22, 2025 |

200-834 |

Felix Pharmaceuticals Pvt. Ltd. |

Praziquantel Tablets |

Cats |

|

December 22, 2025 |

200-832 |

ZyVet Animal Health, Inc. |

Robenacoxib |

Cats |

|

December 22, 2025 |

200-829 |

Aurora Pharmaceutical, Inc. |

Klentz |

Dogs |

|

December 19, 2025 |

200-823 |

Dechra Veterinary Products LLC |

Zygolide |

Horses |

Source: FDA January 2026

The Canada animal health market is supported by the sustained federal investment focused mainly on disease prevention, surveillance, and animal welfare. The Government of Canada report in October 2024 indicates that in 2024, nearly USD 13,343,409 over the five years to Animal Health Canada through the AgriAssurance Program under the Sustainable Canadian Agriculture Partnership, reinforcing the long-term demand for animal health solutions. Funding directed toward expanding national surveillance networks and adopting a One Health approach increases the institutional requirements for veterinary diagnostics data systems and epidemiological services across livestock sectors. Additional investment in emergency management planning and industry-wide training strengthens the preparedness for transboundary disease events, supporting recurring procurement of preventive and response-related animal health inputs.

APAC Market Insights

Asia Pacific market is the fastest growing and is expected to grow at a CAGR of 7.5% during the forecast period 2026 to 2035. The market is driven by the protein demand from a rising middle class, increasing pet ownership, and government modernization of livestock sectors. The key drivers include disease control mandates for trade, such as China’s African Swine Fever recovery efforts, and national initiatives to curb antimicrobial resistance. India’s National Livestock Mission aims to boost productivity with significant funding. The trend is toward integrated solutions combining vaccines, nutrition, and digital herd management. However, the growth is uneven, with the mature markets such as Japan and Australia focusing on premiumization while emerging economies prioritize food security and disease eradication.

The China animal health market continues to expand and is supported by the increased localization of supply chains and regulatory-aligned investments by global manufacturers. Partnerships such as Novus International’s distributor agreement with the Co-Innova Animal Nutrition Technology Co., Ltd. strengthen the market access for the animal nutrition and health products by leveraging established domestic distribution networks to serve China’s large swine and poultry sector. At the same time the Bimeda’s €25 million sterile injectable manufacturing facility in Shijiazhuang, Hebei Province, built to China Human Drug GMP standards, significantly enhances the in-country production capacity for veterinary injectables. As the first facility of its kind in the province to receive this approval, it aligns with the government priorities to improve the quality of biosecurity and self-reliance in animal disease management.

India animal health market is propelled by the mission to enhance the livestock productivity and support its vast rural economy, which is driven by the strong government initiatives. The focus is on improving milk yield, controlling endemic diseases like foot and mouth disease, and expanding access to veterinary services. The demand is rising for vaccines anti parasitics and feed additives. The concrete example of state-led demand is the government’s ongoing vaccination programs. The report from the Department of Animal Husbandry and Dairying in 2022 to 2023 shows that the total number of animals vaccinated for the FMD is 20.77 crore as of January 2023, which is nearly 80.4% of the total population. This data highlights the massive systematic public procurement that anchors the market.

Europe Market Insights

The Europe market is defined by the mature high-value segments governed by the stringent EU-wide regulations. The demand is driven by a dual focus, maintaining high welfare standards in intensive livestock production and addressing the humanization of companion animals. The regulatory push is the primary growth driver for vaccines, diagnostics, and antibiotic alternatives. Further, the threat of transboundary diseases such as Avian Influenza necessitates robust government-coordinated surveillance and vaccination programs. The market is also seeing consolidation and innovation, with increased digital tool adoption for herd management and a growing pet insurance sector fueling expenditure in the companion animal segment. Sustained investment in the public-private partnerships for One Health initiatives further expands the region's advanced market structure.

Germany animal health market dominates the Europe market and is driven by its technologically advanced export-oriented livestock sector and high standards of companion animal care. The primary growth driver is the integration of precision livestock farming and digital health technologies to meet stringent environmental and antibiotic reduction targets. The government actively supports this shift. According to the Smart Agriculture report in 2021, the funding for the digitalization in agriculture, which includes animal health monitoring, was allocated approximately 50 Million Euros for 14 different projects in Germany. This investment directly stimulates the demand for connected diagnostics, automated monitoring systems, and data management platforms, ensuring market leadership via innovation.

The government-led disease surveillance and outbreak response activities are strongly influencing the UK market. The report from the Animal and Plant Health Agency in March 2025 states that the UK recorded 57 cases of highly pathogenic avian influenza H5N1 at premises in England, alongside management of 233 confirmed bluetongue virus cases following the first UK detection in August 2024, which underscores the sustained public expenditure on animal disease control. These outbreaks have intensified demand for the veterinary diagnostics field services, movement control implementation, and biosecurity support across the poultry and ruminant sectors. Further, the ongoing coordination with the livestock keepers and veterinary delivery partners reflects the institutional nature of this spending. As transboundary disease risks increase, such government-driven response frameworks continue to anchor stable, non-discretionary demand within the UK market.

Key Animal Health Market Players:

- Zoetis Inc. (U.S.)

- Merck Animal Health (U.S.)

- Boehringer Ingelheim (Germany)

- Elanco Animal Health (U.S.)

- Ceva Santé Animale (France)

- Virbac (France)

- Vetoquinol (France)

- Dechra Pharmaceuticals PLC (UK)

- IDEXX Laboratories, Inc. (U.S.)

- Covetrus (U.S.)

- Phibro Animal Health Corporation (U.S.)

- HIPRA (Spain)

- Norbrook (UK)

- Kyoritsu Seiyaku (Japan)

- Zydus Animal Health (India)

- Huvepharma (Bulgaria)

- Jurox (Australia)

- Choongwae (South Korea)

- Pharmgate (Sweden)

- ECO Animal Health (UK)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Zoetis Inc. is a global leader in the market, distinguishing itself via a strategy of innovation and premiumization. The company heavily invests in R&D for novel biologics, monoclonal antibodies, and targeted therapeutics, moving beyond traditional pharmaceuticals. Its strategic initiatives focus on leveraging data analytics and connected devices to offer integrated precision care solutions for both livestock and companion animals, strengthening its direct relationships with veterinarians worldwide. In 2024, the company made a revenue of USD 9,256 million, based on the company’s annual report.

- Merck Animal Health maintains a powerful position in the animal health market via its deep integration with the pharmaceutical R&D and a diverse portfolio spanning vaccines, pharmaceuticals, and digital solutions. A key strategic initiative is its intelligence platform, which combines identification, traceability, and monitoring technology to provide data-driven insights for livestock producers, enhancing productivity, biosecurity, and sustainability across the food chain. In 2024, the company’s net sales reached € 21,156 million.

- Boehringer Ingelheim has solidified its top-tier status in the animal health market by strategically balancing a strong companion animal portfolio with leading swine and poultry vaccines. Its initiative emphasizes Disease Preemption via advanced vaccination protocols and integrated herd management. The acquisition of parts of Bayer Animal Health significantly expanded its pet care business, demonstrating a strategic move to consolidate market share and enhance its innovation pipeline.

- Elanco Animal Health, following its separation from Eli Lilly and acquisition of Bayer’s Animal Health unit, has executed a strategic transformation to become a more focused pure play leader in the animal health market. Its initiative centers on portfolio optimization into high-growth areas such as pet parasiticides and vaccines, while driving innovation in animal welfare and sustainability-focused farm animal solutions to improve producer efficiency and meet evolving consumer demands.

- Ceva Sante Animale has grown into a major player in the animal health market by championing a partnership model with the livestock producers and veterinarians, emphasizing co-innovation. Strategic initiatives include targeted R&D in poultry vaccines and swine biosecurity, as well as significant investment in emerging markets. Its focus on preventive medicine and customized vaccination programs supported by diagnostic services strengthens its position as a key solution provider in the global animal protein production.

Here is a list of key players operating in the global market:

The global animal health market is defined by intense competition and consolidation and is dominated by a mix of long-standing pharmaceutical giants and specialized life science firms. The key strategic initiatives include the significant investment in the R&D for advanced biologics vaccines and parasiticides, alongside digital health solutions for livestock and companion animals. The major players are expanding via acquisition, strategic partnerships, and strengthening their direct-to-veterinarian channels. For example, Elanco Animal Health Incorporated has acquired Bayer Aktiengesellschaft’s animal health business, which covers the development and distribution of prescription and non-prescription products for farm and companion animals. Further, there is a major focus on portfolio diversification and geographic expansion, mainly into high-growth emerging markets to capture share across both livestock productivity and the rapidly growing pet care sectors.

Corporate Landscape of the Animal Health Market:

Recent Developments

- In July 2025, MSD Animal Health, a division of Merck & Co., Inc., announced that the European Commission (EC) had approved NUMELVI (atinvicitinib) Tablets for Dogs. The tablet is a veterinary innovation in fast, effective, and safe targeted itch relief.

- In July 2025, Boehringer Ingelheim, a global leader in animal health, announced the launch of its latest poultry vaccine in India, which is a single-dose, next-generation solution that protects against Bursal, Newcastle, and Marek’s disease.

- In January 2025, the World Organization for Animal Health launched The Animal Echo, which aims to foster an ongoing exchange of insights on animal health and welfare globally. The Animal Echo is a collaborative knowledge-sharing space offering insight on some of the world’s most pressing challenges through the lens of animal health.

- Report ID: 1225

- Published Date: Jan 27, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Animal Health Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.