Animal Fungal Treatment Market Outlook:

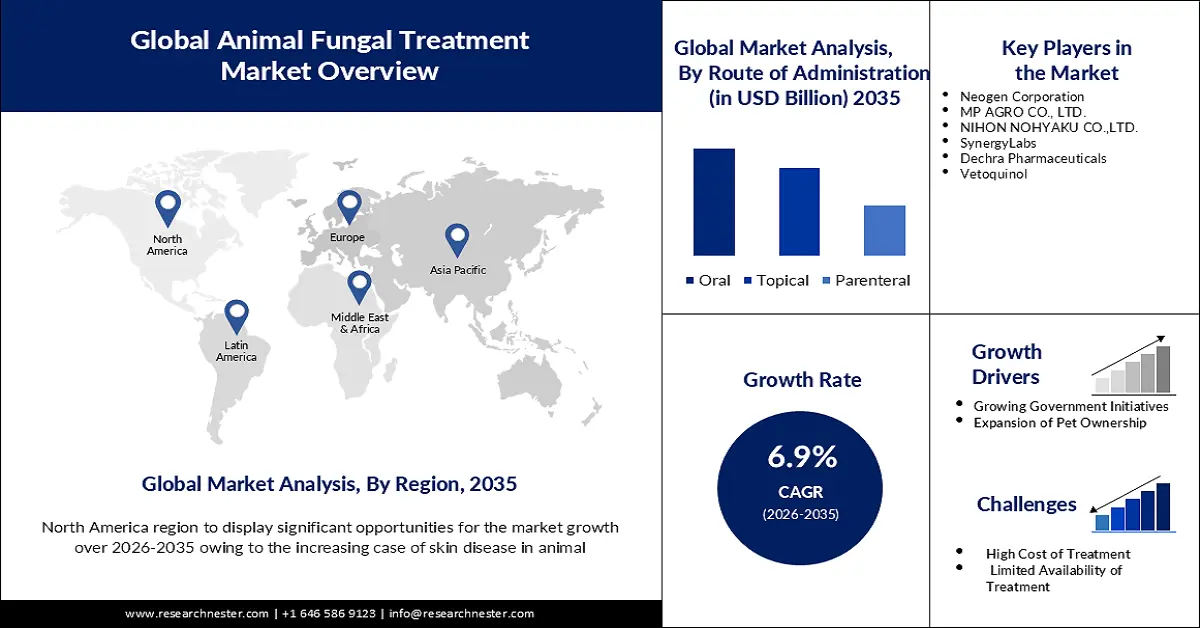

Animal Fungal Treatment Market size was valued at USD 1.44 billion in 2025 and is expected to reach USD 2.81 billion by 2035, registering around 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of animal fungal treatment is assessed at USD 1.53 billion.

The demand for foods produced from animals, such as meat, dairy products, and eggs, has been acknowledged to have increased recently. The FAO estimates that, by 2050, they will need to produce 60% more food to meet the dietary needs of 9.3 billion people on Earth. If people tried to do it by farming as normal, the resources we have would be over-utilized.

Fungal infections, which are normally associated with animals, continue to occur in people mainly as a result of human activity. Due to increased mobility and development and changes in the surrounding environment, emerging fungal infections are on the rise and need to be closely monitored. If there is a known species switching hosts or if the number of cases increases, people are known to be infected with diseases linked to animals.

Key Animal Fungal Treatment Market Insights Summary:

Regional Highlights:

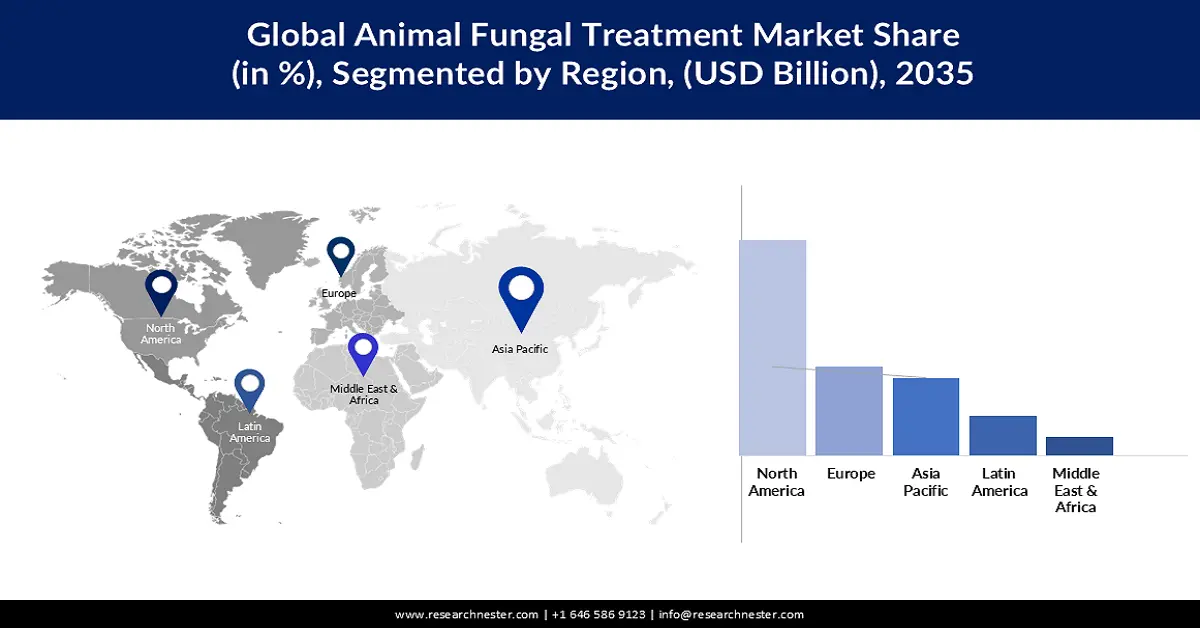

- By 2035, North America is anticipated to secure a lucrative revenue share in the animal fungal treatment market, owing to the high prevalence of fungal skin diseases in animals and the region’s strong veterinary R&D advancements.

- Europe is projected to command a significant share by 2035, underpinned by rising agricultural livestock needs and increased reliance on antifungal solutions for disease detection and management.

Segment Insights:

- The hospital segment of the animal fungal treatment market is expected to account for a remarkable share by 2035, propelled by access to specialized antifungal therapies and expert inpatient guidance.

- The oral segment is set to capture substantial share by 2035, supported by its ease of administration and greater affordability for pet owners.

Key Growth Trends:

- Rising Government Initiatives

- Expansion of Pet Ownerships

Major Challenges:

- Lack of Adequate Animal Care Infrastructure

- High Cost of Treatment

Key Players: Neogen Corporation, MP AGRO CO., LTD., NIHON NOHYAKU CO., LTD., SynergyLabs, Dechra Pharmaceuticals, Vetoquinol.

Global Animal Fungal Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.44 billion

- 2026 Market Size: USD 1.53 billion

- Projected Market Size: USD 2.81 billion by 2035

- Growth Forecasts: 6.9%

Key Regional Dynamics:

- Largest Region: North America (Lucrative Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, United Kingdom, France, Japan

- Emerging Countries: China, India, Brazil, South Korea, Australia

Last updated on : 19 November, 2025

Animal Fungal Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Rising Government Initiatives - By recognizing the interdependence of human, animal, and environmental health, the government is promoting a comprehensive approach to health. One of the benefits of a government program for animal health is to increase awareness and management of zoonoses, which can be transmitted from animals to humans. Furthermore, it is necessary to improve cooperation between doctors, veterinarians, environmental scientists, and Public Health Experts to promote the health and welfare of all animal species. By fostering connections between different communities and industries that drive the animal fungal treatment market, the government programme aims to generate new and improved concepts that address the underlying issues and produce long-term, sustainable solutions for animal health and well-being.

- Expansion of Pet Ownerships - Whenever the summer approaches, veterinarians warn pet owners to be alert for a possible fungus infection that may affect their animals as temperatures increase. In addition, health officials are informing pet owners of the potential for their animals to be infected with an uncommon fungal disease. Blastomycosis, a fungus, can be contracted by animals living in soil that resembles a humus. Therefore, the rivers, lakes, streams and marshes are common places where they might be exposed to it. From 1988 to 2023, approximately 66 % of US households reported that they owned at least one pet, an increase of about 18 % from the previous survey period.

Challenges

- Lack of Adequate Animal Care Infrastructure - Livestock provides a wide range of important benefits to healthy diets and survival resources. This is particularly true in developing countries, where there are limited options for nutrition-dense foods. The development of fungal treatment methods for the welfare of farm animals needs to be coordinated with the production of animal products in order to ensure that food systems are sustainable.

- Limited Availability of Fungal Treatment in Developing Countries is set to hinder animal fungal treatment market growth in the forecast period

- The High Cost of treatment is set to hinder market expansion in the projected period

Animal Fungal Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 1.44 billion |

|

Forecast Year Market Size (2035) |

USD 2.81 billion |

|

Regional Scope |

|

Animal Fungal Treatment Market Segmentation:

Distribution Channel Segment Analysis

Based on the distribution channel, the hospital segment is expected to account for remarkable market share by 2035. Hospital pharmacies are necessary in the field of animal fungus treatment as they offer access to specialized medicines, expert advice, and innovative therapeutic methods for complex patients. Hospital pharmacists are the major source of inpatient treatment, as they offer immediate and extensively advanced antifungal medicinal products. Another factor contributing to the growth of this market segment is the availability of specialty medicinal products. Hospital pharmacies stock a wide range of antifungals, including injectables, IV formulations, and those that are not readily available in the field. In these pharmacies, veterinarians and pharmacists also provide professional advice on the selection of medicines, dosage, or potential interactions in difficult situations.

Route of Administration Segment Analysis

Based on the route of administration, the oral segment is poised to account for substantial market share by 2035. Compared to injections or skin treatments, administration by mouth is usually easier and more manageable for both the animal and its owner. Furthermore, the tablet formulation of oral medicine provides flexibility in the dose and ease of administration offering convenience for the animals to consume it easily by crushing it, swallowing it, or mixing it with other food products. For example, for the treatment of ringworm in dogs and cats itraconazole, an established wide-spectrum antifungal is usually administered orally as a tablet. In addition, oral medicines are often more affordable than other forms of treatment and can be accessed to a wider range of pet owners. Different brands of itraconazole tablets are marketed by companies such as Merck Animal Health and Zoetis, which contribute significantly to the animal fungal treatment market

Our in-depth analysis of the global market includes the following segments:

|

Drug Type |

|

|

Route of Administration |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Animal Fungal Treatment Market - Regional Analysis

North American Market Insights

In animal fungal treatment market, North America region is anticipated to capture lucrative revenue share by 2035. In North America, skin diseases caused by fungi are more common in animals. The availability of specialist care has led to an increase in demand for specific dermatology antifungal medicines. In addition, advances in antifungal medicinal products have been achieved by the region's robust veterinary research and development initiatives. Due to the development of new and improved formulations, veterinarians have more options for treating them. In addition, the trend of pet humanization, where animals are viewed as family members, is increasing in North America. Escalating demand for best dermatology antifungal treatment to cure skin conditions driven by willingness of pet owners to make investment in health and wellness of their pets.

European Market Insights

In animal fungal treatment market, Europe region is estimated to hold significant revenue share by 2035. The need for animals in agriculture is the reason why there is an increased demand for animal fungal treatments. In order to meet the growing population, agricultural enterprises in this region are having difficulty responsibly producing a sufficient quantity of food. Demand for high quality, safe and effective protein animal products will be significantly increased over the coming ten years as a result of an increase in domestic livestock population in this region. International trade in animals and animal products increases the risk of new outbreaks and infectious fungal infections continue to have a negative impact on the production of farm animals. In the detection, surveillance, management and ultimate eradication of animal diseases and disorders, antifungal medicinal products may be of significant assistance. In 2018, around 3.5 million sheep and goats, 4.3 million head of cattle as well as 1 000 tons of poultry were traded across EU countries.

Animal Fungal Treatment Market Players:

- Merck & Co., Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Elanco

- Zoetis Services LLC

- Virbac

- Neogen Corporation

- MP AGRO CO., LTD.

- NIHON NOHYAKU CO., LTD.

- SynergyLabs

- Dechra Pharmaceuticals

- Vetoquinol

Recent Developments

- Zoetis said that Virtual Recall, which helps veterinary practices improve the quality of services and communicate with their customers, has been bought by Zoetis.

- Zoetis announced the launch of Vetscan Imagyst, a diagnostic platform that uses a combination of image recognition, algorithms and cloud based artificial intelligence to deliver precise test results to the clinic.

- Report ID: 3130

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Animal Fungal Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.