Anhydrite Market Outlook:

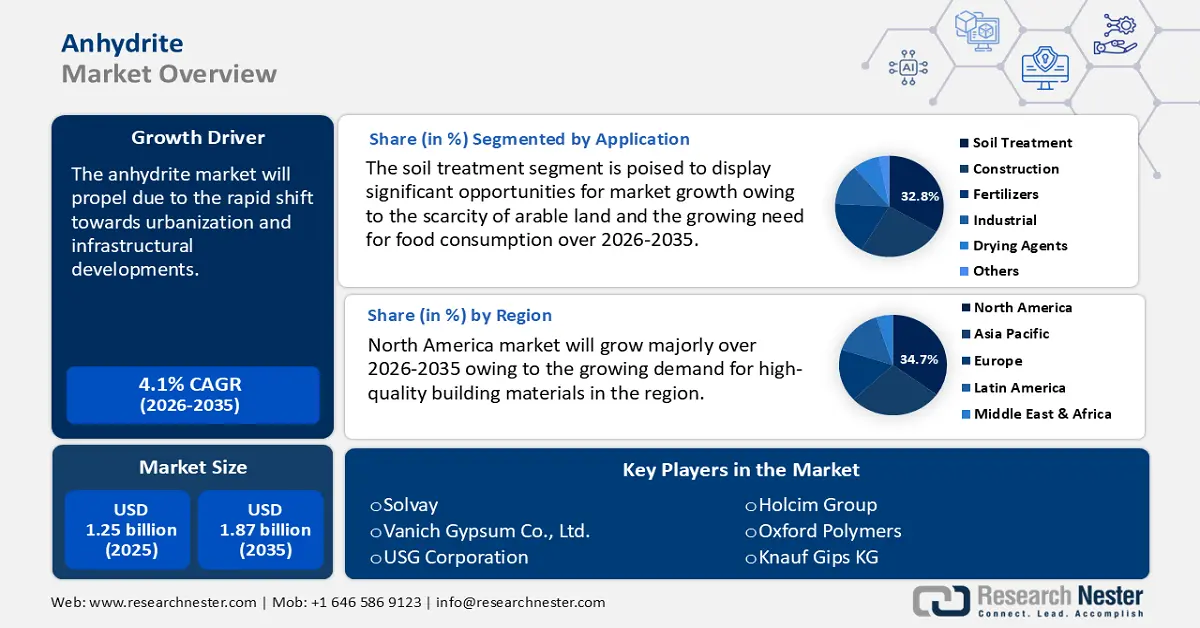

Anhydrite Market size was over USD 1.25 billion in 2025 and is anticipated to cross USD 1.87 billion by 2035, witnessing more than 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of anhydrite is assessed at USD 1.3 billion.

The market is experiencing significant growth as its use as an additive in cement production rises. This surge is largely attributed to its effectiveness in enhancing setting times and improving mechanical strength. According to the Global Cement and Concrete Association, 4.1 billion tons of cement is produced annually to suit societal demands. In percentage terms, China accounts for 51.6%, India for 9.5%, the EU for 4.3%, and the U.S. for 2.3%. The rapid shift towards urbanization and infrastructural developments has surged the need for cement products. The ability of the substance to function as a gypsum substitute enhances the qualities of cement, making it appropriate for a range of building uses. Anhydrite, for example, improves performance in challenging construction situations by enabling better control over cement hydration.

Anhydrite easily absorbs water and changes into the more prevalent gypsum (CaSO4·2H2O) when exposed. This change is reversible; heating gypsum or calcium sulfate hemihydrate to about 200 °C (400 °F) will generate anhydrite under typical air conditions.

|

Country |

Exports Value of Gypsum (in USD Million) |

Country |

Imports Value of Gypsum (in USD Million) |

|

Thailand |

225 |

India |

140 |

|

Spain |

195 |

The U.S. |

128 |

|

Oman |

175 |

Nigeria |

103 |

|

Germany |

146 |

UK |

84.4 |

|

Turkey |

121 |

Japan |

77.5 |

Source: OEC

The Observatory of Economic Complexity (OEC) reported that gypsum was the 817th most traded product in the world in 2022, with USD 1.72 billion in global commerce. Gypsum exports increased 7.95% between 2021 and 2022, from USD 1.59 billion to USD 1.72 billion. Gypsum trade accounts for 0.0073% of global trade. According to the Product Complexity Index (PCI), gypsum is ranked 950th.

Key Anhydrite Market Insights Summary:

Regional Highlights:

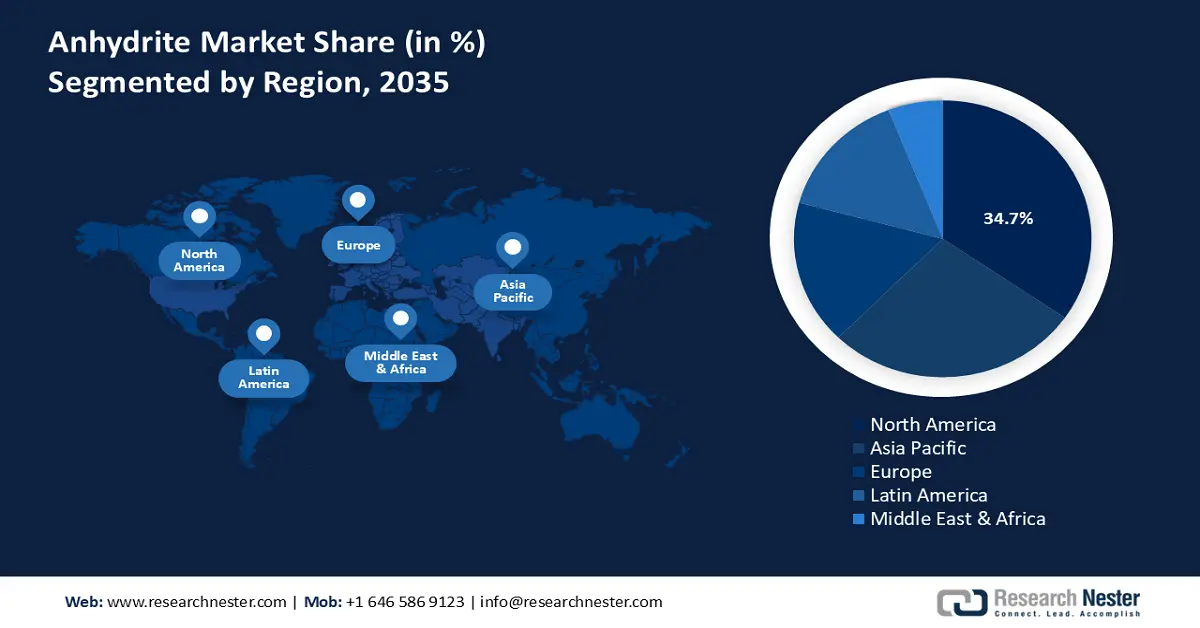

- Across 2026-2035, North America in the anhydrite market is projected to secure over 34.7% revenue share by 2035, bolstered by expanding infrastructure development and rising adoption of sustainable construction practices.

- By 2035, Asia Pacific is expected to attain more than 34.6% share, strengthened by accelerating urbanization, construction activity, and growing agricultural soil enhancement needs.

Segment Insights:

- By 2035, the soil treatment segment in the anhydrite market is set to account for over 32.8% share, sustained by mounting pressures on arable land and increasing global food consumption.

- Through 2026-2035, the synthetic segment is positioned for notable expansion, propelled by its widening use across construction materials, fillers, and agricultural applications.

Key Growth Trends:

- Shift towards sustainable and lightweight materials

- Recent advancements

Major Challenges:

- Availability of alternatives

- Limitations in its applications

Key Players: Solvay, Vanich Gypsum Co., Ltd., USG Corporation, Holcim Group, Oxford Polymers, Knauf Gips KG, Saint-Gobain SA, Bisley & Company Pvt. Ltd., Quzhou Zunlong Trading Co., Ltd., Mineralis Lucentum Sl.

Global Anhydrite Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.25 billion

- 2026 Market Size: USD 1.3 billion

- Projected Market Size: USD 1.87 billion by 2035

- Growth Forecasts: 4.1%

Key Regional Dynamics:

- Largest Region: North America (34.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, India, United Kingdom

- Emerging Countries: Brazil, Indonesia, Vietnam, Mexico, Turkey

Last updated on : 2 December, 2025

Anhydrite Market - Growth Drivers and Challenges

Growth Drivers

- Shift towards sustainable and lightweight materials: Due to its minimal environmental impact, anhydrite will gain momentum as green building and sustainable agriculture gain more attention. According to the UN Environment Program, with an astounding 37% of worldwide emissions, the building and construction industry is the biggest source of greenhouse gas emissions. The carbon footprint of manufacturing and using commodities like steel, aluminum, and cement is substantial.

Anhydrite may also find new uses due to the growing need for lightweight building materials. In line with current trends towards sustainable building techniques, lightweight construction materials are becoming popular due to their energy efficiency and portability. It is utilized in plasters, flooring compounds, and as a drying agent in construction. Anhydrite is also used as a fertilizer addition and soil conditioner in agriculture. - Recent advancements: The integration of enforced CO2 mineralization into anhydrite-rich rocks is significantly propelling the growth of the anhydrite market. This process involves capturing CO2 emissions and converting them into suitable mineral carbonates within anhydrite formations, effectively reducing atmospheric CO2 levels. Such carbon capture and utilization technologies are gaining momentum as industries and governments prioritize sustainable practices to combat climate change.

According to the International Energy Agency, there are about 45 commercial facilities using carbon capture, utilization, and storage (CCUS) in power production, fuel transformation, and industrial processes. Over 700 projects are in various phases of development across the CCUS value chain, indicating that while CCUS implementation has historically lagged behind predictions, momentum has increased significantly in recent years. While storage capacity increased by 70% in 2023, the capture capacity increased by 35% by 2030. This raises the estimated storage capacity to about 615 million tons (Mt) of CO2 annually and the total quantity of CO2 that could be absorbed in 2030 to about 435 Mt.

Challenges

- Availability of alternatives: In the process of making cement, synthetic gypsum which is made from industrial waste provides comparable functionality to anhydrite at a lesser cost. Due to its extensive availability and environmentally benign sourcing, it is a desirable substitute for businesses trying to reduce production costs. For instance, owing to its constant quality and lower environmental impact, synthetic gypsum is preferred by many cement producers.

- Limitations in its applications: One of anhydrite's application restrictions is its relatively poor solubility, which can make it challenging to absorb into the soil. Additionally, compared to other materials like cement or gypsum, its hardness and lack of flexibility make it less acceptable for some construction purposes. Additionally, anhydrite may contain impurities like salt or clay, which could degrade its quality and make it unsuitable for some applications. Lastly, changes in pricing and competition from substitute materials may have an impact on the market demand for anhydrite.

Anhydrite Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 1.25 billion |

|

Forecast Year Market Size (2035) |

USD 1.87 billion |

|

Regional Scope |

|

Anhydrite Market Segmentation:

Applications Segment Analysis

The soil treatment segment is set to dominate over 32.8% anhydrite market share by 2035. The segment is growing due to the scarcity of arable land and the growing need for food consumption. The USDA reported that the world's population expanded by 45% between 1990 and 2019, but the amount of food produced by the global agricultural system increased by 61% in terms of calories available for consumption. Between 2011 and 2050, accessible food calories are expected to increase by 44% and crop calories by 47%, respectively, considering income-driven diets and the 39% world population growth. Also, certain government programs related to soil protection will have a favorable impact on anhydrite demand.

As a soil amendment, anhydrite can enhance the fertility and structure of the soil. Anhydrite improves soil drainage and ventilation by increasing the soil's porosity and water-holding capacity. Additionally, it aids in balancing the pH levels of the soil, increasing plant availability of nutrients and encouraging strong root development. Furthermore, anhydrite can lessen soil compaction and erosion, which can enhance soil health and crop output.

Type Segment Analysis

The synthetic segment in anhydrite market will grow at a significant rate during the assessed period. Gypsum is dehydrated at high temperatures to create synthetic anhydrite, a type of anhydrite. Although it is created under controlled settings to guarantee uniformity in its physical and chemical qualities, it is chemically identical to anhydrite found in nature. Paint fillers, plasters, cements, and drywall are construction-related uses for synthetic anhydrite. It can be used as a drying agent, to make paper, and as fertilizer. It stabilizes and binds sub-base gravel in foundations and is utilized in self-leveling soils.

Our in-depth analysis of the global anhydrite market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anhydrite Market - Regional Analysis

North America Market Insights

North America in anhydrite market is poised to capture over 34.7% revenue share by 2035. The main factors driving the market trend are its applications as an industrial chemical, a soil conditioner in construction, and the manufacturing of cement. The market is supported by the growing trend of infrastructure development and the demand for high-quality building materials in the region. Further supporting market performance in North America is the increased emphasis on sustainable building techniques, which encourage the usage of products based on anhydrite.

In the U.S., the anhydrite market is driven by its extensive use in the construction industry, particularly in the production of Portland cement and prefabricated products. The market is projected to experience steady growth, driven by ongoing infrastructure. The demand for quality construction materials, including anhydrite, is expected to rise in response to these trends. Additionally, the increasing focus on sustainable building practices supports the adoption of anhydrite-based products.

Anhydrite plays a notable role in Canada’s industrial landscape, particularly in regions like Nova Scotia. For over 2 centuries, Nova Cotia has been a significant producer and exporter of gypsum and anhydrite. Applications such as soil treatment, construction, fertilizers, and industrial drying agents are driving market expansion. Canada’s rich mineral resources position it well to contribute to and benefit from this expanding market.

APAC Market Insights

By 2035, Asia Pacific anhydrite market is anticipated to capture over 34.6% share. Anhydrite, which is used to make cement and as a soil conditioner in agriculture, is heavily consumed by the construction sector. The growing infrastructure projects and urbanization in China and India greatly contribute to the market trend. According to data from the National Bureau of Statistics (NBS), China's urbanization rate—which calculates the proportion of permanent urban dwellers to the overall population—increased by 55.52 percentage points between the end of 1949 and the end of 2023, reaching 66.16%. Additionally, the use of anhydrite for soil enhancement is growing due to the region's developing agricultural industry. The market dynamics are also positively impacted by the increased emphasis on green technologies and sustainable building methods.

In China, the market is expanding due to the booming infrastructure development initiatives and the rising construction industry. The U.S. Government Accountability Office reported that the largest infrastructure finance scheme in the world is China's Belt and Road Initiative. It has increased China's influence globally and provided funding for ports, highways, and other projects. Between 2013 and 2021, the United States contributed USD 76 billion to infrastructure projects in the transportation, energy, and other sectors, while China contributed USD 679 billion. Also, the government’s focus on urbanization and infrastructure projects has further propelled the demand for anhydrite in the construction sector.

Moreover, India's expanding agriculture sector contributed to the growing demand for anhydrite, which is used as a soil conditioner to improve soil quality and enhance crop productivity. Also, the growing need for soil management practices in agriculture aligns with the use of anhydrite, supporting its market growth. The Indian food and grocery business is the sixth largest in the world, with 70% of sales coming from retail, and Inc42 projects that the country's agricultural sector will grow to USD 24 billion by 2025.

Anhydrite Market Players:

- Solvay

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Vanich Gypsum Co., Ltd.

- USG Corporation

- Holcim Group

- Oxford Polymers

- Knauf Gips KG

- Saint-Gobain SA

- Bisley & Company Pvt. Ltd.

- Quzhou Zunlong

- Mineralis Lucentum

Major companies provide domestic and foreign markets in the fiercely competitive global anhydrite market. To maintain a dominant position in the anhydrite market, major manufacturers are implementing several strategies for product innovation, end-user launches, and research and development (R&D). To comply with rules and lessen their environmental impact, they are also employing sustainable production practices. To get access to new markets and expand their market share, businesses are also expanding their worldwide reach through strategic alliances and acquisitions.

Recent Developments

- In July 2022, CGC Inc., an affiliate of USG Corporation headquartered in Alberta, began producing wallboards in Wheatland County. This investment could help CGC better service its loyal clients in Alberta and the West, while also demonstrating the company's commitment to the Canadian market.

- In October 2020, Vale, a Brazilian mining firm, revealed plans to invest USD 2 billion in producing anhydrite from waste from nickel mining operations. The project aims to produce up to 1.5 million tons of anhydrite annually, which will be utilized for fertilizer and soil conditioning.

- Report ID: 7019

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anhydrite Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.