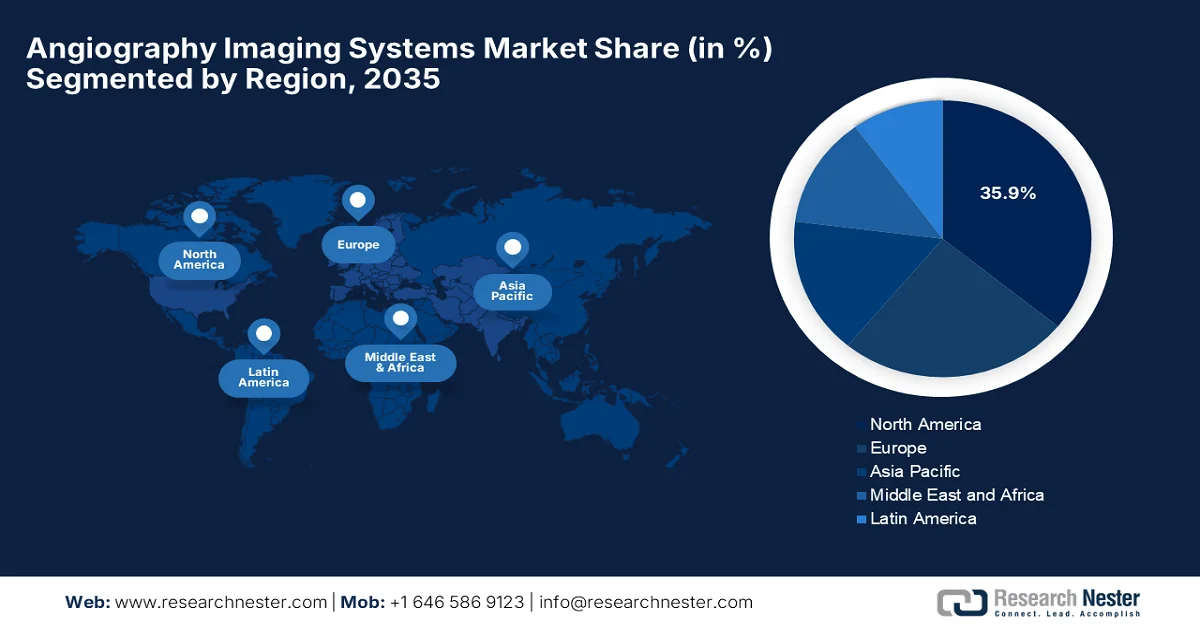

Angiography Imaging Systems Market - Regional Analysis

North America Market Insights

The North America angiography imaging systems market is forecasted to emerge as the dominating landscape with a share of 35.9% by 2035. The region’s leadership in this region is mainly propelled by increasing healthcare expenditure, advanced medical infrastructure, and increasing adoption of modern medical systems. Favorable regulatory procedures and continued innovations from industry players are also prompting a profitable business environment in the region. In October 2025, the U.S. FDA reported that it cleared Spectrawave Inc.’s X1-FFR device, an X-ray angiographic imaging–based coronary vascular simulation software, under 510(k) number K251355. The device is classified under QHA and LLZ codes and was determined to be substantially equivalent (SESE) and falls under the radiology medical specialty. X1-FFR supports non-invasive coronary flow assessment and procedural planning, aiding clinicians in diagnosing and managing coronary artery disease, hence bolstering the angiography imaging systems market growth.

The U.S. angiography imaging systems market is the key contributor for region’s growth and is mainly driven by strong R&D, insurance, and continued healthcare investments by both public and private organizations. For instance, as per the industry-validated analysis by the AHA Journals Organization published in October 2025, it analyzed how insurance coverage in the U.S. aligns with guidelines and landmark trials for invasive coronary angiography and percutaneous coronary intervention in stable coronary artery disease. Among 33 major payers, 55% of ICA and 42% of PCI policies were publicly available, revealing significant variability in adherence to professional society guidelines and trials such as ORBITA and ISCHEMIA. Therefore, this suggests that the variability and partial coverage of ICA and PCI procedures in the country could drive demand for advanced angiography systems as providers seek efficient, guideline-aligned solutions to optimize patient care and reimbursement.

The angiography imaging systems market in Canada is also significantly growing owing to the presence of rapidly aging populations, growing cardiovascular disease burden. The strong government backing and a strong focus on AI-based diagnostics and improved image quality are also driving consistent revenue in the country’s market. As per the article published by NIH, the Canadian Medical Imaging Inventory 2022-2023 report highlights that most imaging equipment in Canada is over 5 years old, with a significant portion exceeding 10 years, and the country lags behind OECD averages in units per population for CT, MRI, and PET-CT. It also stated that publicly funded hospitals dominate the imaging landscape, concentrated mainly in urban areas. Hence, this denotes the urgent need for advanced technologies in Canada, driving demand for modern angiography imaging systems, and boosting market growth.

APAC Market Insights

The Asia Pacific angiography imaging systems market is set to represent consistent growth owing to the increasing adoption of minimally invasive procedures and expanding healthcare infrastructure. Key trends witnessed by the region’s market include growing awareness of early diagnosis, government initiatives to improve healthcare access, and rising investments in imaging technologies. In April 2024, the National University Corporation of Tokyo published a notice for the procurement of one cardiovascular-specific angiography system. The system is required to be a biplane unit with interventional radiology capabilities, image-processing workstations, ablation treatment functions, and integration with the hospital’s network for patient data and image management. Therefore, the presence of institutional procurements in the region creates high-value demand and encourages pioneers to supply advanced angiography systems through contracts.

China angiography imaging systems market is progressing due to the increasing investments in terms of hospital infrastructure and ongoing innovations. Besides, the domestic manufacturers and international players are making investments in terms of research, distribution, and training, creating new revenue streams and enhancing competitiveness in the market. In this context, the National Medical Products Administration (NMPA) reported that it approved Shanghai United Imaging Healthcare Co., Ltd.’s medical angiography X-ray machine for marketing, consisting of advanced components such as a high-voltage generator, flat panel detector, 3D images processing workstation, and robotic 9-axis DSA system. The system enables full-abdomen and chest cone beam imaging, addressing the limited field of view in traditional cone beam CT. Therefore, with such continued innovations, the country’s market is set to evolve at a rapid pace in the years ahead.

Government initiatives to improve healthcare access and modernize medical facilities are the major driving factors for the growth of the angiography imaging systems market in India. The country’s market is also driven by increasing cath lab installations and skilled interventional cardiologists across public and private hospitals. Simultaneously, the domestic manufacturing initiatives and procurements from public organizations enhance both technology access and uptake nationwide. National University Corporation AIIMS New Delhi, in August 2025, reported a government eProcurement notice seeking submission of materials for the purchase of one angiography system for cardiovascular examination and interventional radiology. The requirements included a biplane angiographic unit with a treatment support workstation, ablation capability, and connectivity to the hospital network for patient data and image storage. Hence, such instances directly stimulate demand for angiography imaging systems, encouraging more players to establish their footprint in the country.

Europe Market Insights

The angiography imaging systems market in Europe is being propelled by a strong focus on enhancing interventional cardiology and vascular care infrastructure. Besides, healthcare policymakers in the region are prioritizing the modernization of medical imaging facilities, such as replacing outdated systems with advanced digital angiography suites that efficiently support 3D imaging and proper procedure guidance. In this context, Philips in June 2025 announced that it has launched the CE-marked SmartCT intelligent 3D imaging solution across Europe, integrated with the Azurion neuro biplane system to enhance real-time visualization during neurovascular procedures. This innovation streamlines stroke care by eliminating the need for separate CT scans, enabling faster, more confident treatment decisions and image clarity directly in the angiography suite; hence, such developments imply the market’s increased exposure in Europe.

Officially Reported Cardiovascular Disease Burden in the EU: Mortality, Prevalence, and Socio-Economic Impact (2022)

|

Category |

Statistic / Value |

Notes |

|

Total deaths due to CVD (2022) |

1.7 million |

Accounts for 1 in 3 deaths in the EU |

|

People affected by CVD (2022) |

62 million |

Includes all ages, both genders |

|

Premature mortality reduction (2012–2022) |

20% in males, 23% in females |

Average EU-wide reduction, varied by country |

|

Male vs Female mortality |

43% higher in men |

Age-adjusted mortality ratio across EU countries |

|

Working days lost due to illness/disability (2021) |

256 million days |

Impact on workforce productivity |

|

Working years lost due to premature deaths |

1.3 million years |

Economic and social impact |

|

Total workforce impact |

€47 billion |

Includes lost productivity from premature mortality and illness |

|

Years of life lost (under 75) |

1,301.9 per 100,000 |

EU average due to premature CVD deaths |

|

Total societal cost of CVD (2021) |

> €282 billion |

Includes direct healthcare costs, productivity losses, and long-term disability care |

Source: OECD

In Germany, the angiography imaging systems market is positively influenced by the emerging hospital network and an urgent need for a well-established diagnostic imaging culture. Regional funding programs for hospital equipment upgrades are encouraging institutions to adopt hybrid interventional suites that integrate CT and angiography capabilities. In this context, NIH in May 2025 revealed that the GEDA study in Germany made an analysis of the 10-year risk of cardiovascular disease among 3,271 adults who were aged 35 to 69 without having any prior heart attack or stroke instances. It found that 19% of participants had an increased or high test-based risk, whereas nearly half of them underestimated their risk, often due to lower education, good mental health, physically active. Therefore, these findings reflect the urgent need for targeted cardiovascular prevention strategies for populations who misperceive their risk.

The UK angiography imaging systems market is being primarily shaped by national healthcare priorities, which are aimed at reducing procedural wait times and increasing access to minimally invasive diagnostics. Public health campaigns that are targeting early detection of vascular diseases are driving greater demand for diagnostic imaging access. In May 2025, NHS England announced that it has rollout of AI-driven HeartFlow 3D heart scans across 56 hospitals, enabling faster, more accurate diagnosis of coronary heart disease across the nation. It also notes that this technology creates personalized 3D models of patients’ coronary arteries, guiding treatment planning and improving clinical efficiency. Furthermore, early adoption has helped many patients, cut unnecessary tests, and demonstrated the impact of these imaging systems on patient care and healthcare resource optimization.