Amphibious Vehicle Market Outlook:

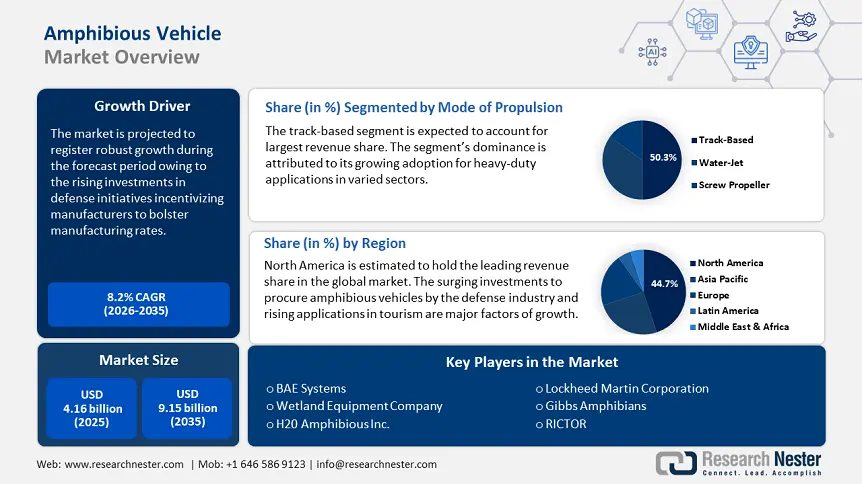

Amphibious Vehicle Market size was over USD 4.16 billion in 2025 and is projected to reach USD 9.15 billion by 2035, growing at around 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of amphibious vehicle is evaluated at USD 4.47 billion.

The market’s growth is can be attributed to rising military investments catering to geopolitical unrest and the requirement of multi-domain operational capabilities. For instance, the U.S. Department of Defense reported that in FY 2025, the Marine Corps’ Amphibious Combat Vehicle (ACV) will replace the Amphibious Assault Vehicle (AAV). Moreover, funds are allocated for the procurement of ACVs to replace older models. Similarly, China’s military modernization has expanded its naval capabilities, including the development of amphibious assault platforms such as the Type 075 Landing Helicopter Dock. Opportunities arise in disaster response and humanitarian missions beyond lucrative defense contracts. For instance, the U.S. Marine Corps Warfighting Laboratory has explored concepts such as the Ultra Heavy-Lift Amphibious Connector (UHAC), which is designed to transport heavy equipment from ship to shore and improve logistical support during emergencies. Such innovations highlight the advancements in the amphibious vehicles market and the scope of commercial applications of vehicles.

The supply chain of the market has evolved with a surging focus on advanced materials and propulsion systems. For instance, in 2023, the U.S. Government Accountability Office highlighted that leading defense manufacturers are adopting iterative design cycles to improve the performance of components used in amphibious vehicles. Moreover, manufacturers supplying ancillary components in the supply chain, such as specialized tires and waterproof electronics, are set to find opportunities in military and civilian applications. By the end of 2037, the market is projected to maintain its robust growth curve and expand its valuation.

Key Amphibious Vehicle Market Insights Summary:

Regional Highlights:

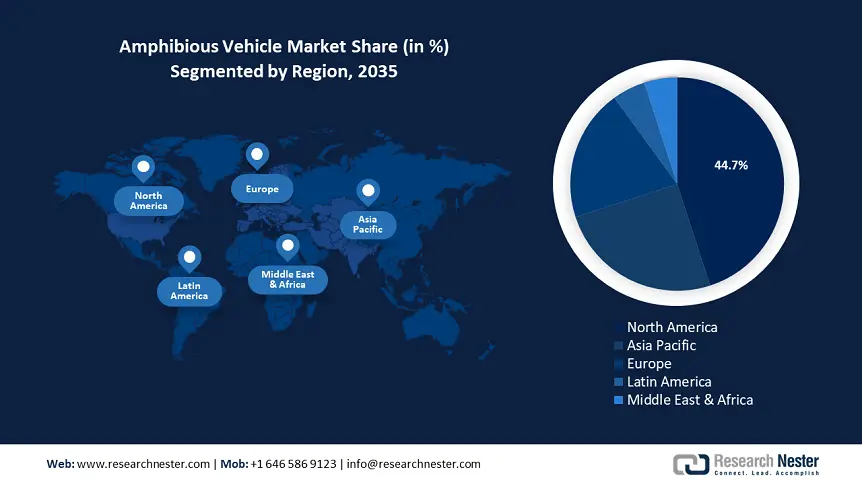

- North America commands a 44.7% share of the Amphibious Vehicle Market, driven by rising defense investments and disaster response use cases, ensuring robust growth through 2026–2035.

- Asia Pacific's Amphibious Vehicle Market is set for rapid growth by 2035, propelled by defense spending, tourism, and disaster response vehicle demand.

Segment Insights:

- The water-jet segment is set for substantial growth from 2026-2035, attributed to its efficiency in aquatic environments.

- The track-based segment is projected to hold over 50.3% market share by 2035 due to the superior off-road capabilities and stability in challenging terrains.

Key Growth Trends:

- Rising application in tourism and rescue operations

- Growing calls to integrate in building robust coastal infrastructure

Major Challenges:

- Vulnerability to anti-access/area denial (A2/AD) systems

- Mechanical constraints in diverse environments

- Key Players: BAE Systems, General Dynamics Corporation, Lockheed Martin Corporation, Zeal Motors, H20 Amphibious Inc., Gibbs Amphibians, Hanhwa Defense, Amphibious Marine Inc., RICTOR, Norinco Group, Textron Systems, Wetland Equipment Company.

Global Amphibious Vehicle Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.16 billion

- 2026 Market Size: USD 4.47 billion

- Projected Market Size: USD 9.15 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, France, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Amphibious Vehicle Market Growth Drivers and Challenges:

Growth Drivers

- Rising application in tourism and rescue operations: A major factor of the growth of the amphibious vehicle market after defense applications is the surging integration in eco-tourism. Luxury tourism expansion by companies such as Gibbs Amphibians for high-net-worth travelers with yachts and island-hopping tours is forecasted to be a niche market segment. Furthermore, the number of cases of floods is increasing globally owing to global warming. For instance, in October 2024, the National Environment Satellite, Data, and Information Service reported that over the previous two decades, there has been an upward curve in the frequency of flood-related disasters.

Opportunities arise for NGOs and governments to collaborate with amphibious vehicle manufacturers to deploy low-cost ambulances or evacuation vehicles in flood-prone regions. For instance, in September 2024, Brazil proposed a new law, i.e., 1824/24 mandating car makers to manufacture amphibious vehicles with penalties announced for non-compliance in the backdrop of the large-scale flooding of 2024. - Growing calls to integrate in building robust coastal infrastructure: The rising sea levels have been a case of concern for coastal infrastructure. In September 2023, NOAA reported that the global average sea level has risen by 8 to 9 inches (21-24 centimeters) since 1880, with the global sea level setting record high levels of 101.4 mm above 1993 levels. The inclusion of amphibious vehicles in urban disaster preparedness frameworks provides lucrative opportunities for automakers and ancillary components manufacturers. Moreover, investments and partnerships via major programs such as the UN’s West Africa Coastal Areas Management Program (WACA) can provide opportunities for the integration of amphibious vehicles for last-mile supply delivery during cyclones.

- Technological convergence with autonomous systems: Technological advancements pushing for the integration of AI, robotics, and unmanned systems in amphibious vehicles have fostered new use cases in defense and commercial applications. The expansion of use cases benefits the key players within the market. Self-driving amphibious tugs for port operations have the potential to cut labor costs significantly while also expanding the scope of defense applications. Opportunities are rife in major defense programs such as NATO’s launch of Baltic Sentry, announced in January 2025 to protect critical infrastructure. Earlier, NATO released a whitepaper detailing successful trials of unmanned amphibious drones for mine clearance in the Baltic Sea.

Challenges

- Vulnerability to anti-access/area denial (A2/AD) systems: Advanced A2/AD systems threaten amphibious operations. Systems such as long-range precision-guided munitions, anti-ship missiles, and sophisticated surveillance networks are designed to detect amphibious forces during transit or landing phases. The proliferation of A2/AD systems amongst non-state actors can pose major risks to amphibious task forces, mitigating the amphibious vehicle adoption rates in defense applications.

- Mechanical constraints in diverse environments: The efficacy of amphibious vehicles is the seamless performance across terrestrial and aquatic terrains, and mechanical stresses leading to failures can negatively impact the manufacturer's standing in the market. Moreover, defense contracts are lucrative and require military-grade durability, and failures can lead to decreased reliability. For instance, the U.S. Marine Corps’ ACV has encountered specific mechanical issues with the central tire inflation system in the past. Addressing the mechanical challenges necessitates rigorous testing procedures by the key players in the market.

Amphibious Vehicle Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 4.16 billion |

|

Forecast Year Market Size (2035) |

USD 9.15 billion |

|

Regional Scope |

|

Amphibious Vehicle Market Segmentation:

Mode of Propulsion (Track-Based, Water-Jet, Screw Propeller)

Track-based segment is projected to dominate amphibious vehicle market share of around 50.3% by the end of 2035. The segment’s dominance is owed to the superior off-road capabilities and stability in challenging terrains, which expands its scope of application for military and heavy-duty applications. The design ensures that amphibious vehicles can maintain mobility in environments where wheeled counterparts might struggle, which in turn bolsters the application for operations requiring land-to-water transition capabilities. Opportunities are rife to supply hybrid-electric propulsion systems, reducing fuel consumption and bolstering operational range.

The water-jet segment is expected to expand during the stipulated timeframe, attributed to its efficiency in aquatic environments. Water-jet propulsion systems utilize high-pressure water streams for thrust, making them ideal for amphibious vehicles exclusively operating in flood-prone regions. The increasing flood threats across the world have bolstered the potential use cases of water-jet propulsion amphibious vehicles. Ongoing advancements include innovations in modular water-jet designs which will improve the ease of customization and maintenance.

Application (Surveillance & Rescue, Water Transportation, Water Sports, Excavation)

Key players in the amphibious vehicle market are predicted to find greater opportunities in surveillance and rescue operations during the forecast period. The investments to improve surveillance and rescue operations is a key factor in the segment’s growth. Moreover, amphibious vehicles equipped with specialized features such as GPS navigation, thermal imaging, and autonomous operation capabilities improve the success rate of search and rescue missions. Use cases include the U.S. Coast Guard’s application of amphibious crafts such as the Rescue Water Craft for flood evacuations

Our in-depth analysis of the global market includes the following segments:

|

Mode of Propulsion |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Amphibious Vehicle Market Regional Analysis:

North America Market Forecast

North America amphibious vehicle market is projected to hold revenue share of over 44.7% by the end of 2035. The market’s growth is characterized by rising investments to procure advanced amphibious vehicles in the defense sector and surging applications in the commercial sectors. Investments to modernize marine fleets open lucrative defense contracts for manufacturers. For instance, the U.S. Marine Corps’ ACV program represents a significant investment in next-generation platforms, while Canada’s Arctic operations potentially will leverage amphibious vehicles for coastal patrolling in the remote Northern regions. Additionally, the versatility of amphibious vehicles has expanded their use in areas such as disaster response and recreational activities.

The U.S. amphibious vehicle market is projected to hold a major revenue share in North America and be a lucrative market globally for manufacturers to penetrate and expand their footprints. The U.S. market is characterized by defense modernization and climate resilience initiatives. The U.S. Department of Defense’s (DoD’s) focus on multi-domain warfare has led to significant investments in the ACV platform. Furthermore, the application in hurricane-prone areas such as Louisiana and Florida offers opportunities for entry into the market to supply robust amphibious vehicles that can navigate adverse conditions, and to provide vehicle components to the existing players in the sector.

The Canada amphibious vehicle market is poised to expand during the stipulated timeline. The armed forces have exhibited interest in acquiring vehicles that can support the dual role of defense operations and disaster response initiatives. The opportunities are expected to arise in the backdrop of growing geopolitical tensions which incentivizes Canada to invest in its defense capabilities. Moreover, Canada-based automotive companies are releasing amphibious vehicles to keep up with the growing demand in the domestic market. For instance, in October 2023, Canada-based Zeal Motors announced the release of the amphibious Fat Truck model designed to transport materials and people to the job site in diverse conditions.

APAC Market Forecast

The APAC amphibious vehicle market is forecasted to exhibit the second-fastest expansion in revenue share throughout the stipulated timeframe of the market’s analysis. The increasing defense expenditures in the region is a leading factor in the market’s growth. The versatility of amphibious vehicles bolsters application in humanitarian missions and disaster response programs in APAC. Moreover, APAC has registered a rapid increase in tourist footfalls leading to opportunities to provide marine tours in amphibious vehicles. Multinational corporations across the world have manufacturing hubs in the APAC economies, necessitating transportation solutions for workers and materials across challenging terrains. Such opportunities present lucrative investment segments in Asia Pacific.

The China amphibious vehicle market is poised to hold a significant share in APAC by the end of 2035. The market is characterized by defense initiatives in China that have positioned it as a major economy in the world. In December 2024, the first of the next-generation amphibious assault ships was launched in the country, i.e., Type 076, which is poised to significantly improve naval capabilities. Opportunities arise for manufacturers to supply supporting components for the indigenously developed amphibious assault vehicles in the country to assist in reducing the time-to-market (TTM) or deployment. Moreover, the accelerated pace of such projects underscores the economy’s emphasis on expanding naval assets, characterizing growth opportunities.

The Japan amphibious vehicle sector is projected to register robust growth during the forecast timeline. The market exhibits a dual growth facet with the rising investments to bolster defense capabilities and the surging applications in tourism. For instance, the Japan National Tourism Organization (JNTO) estimated that the total number of international tourists to Japan in December 2024 was around 3,489,800 which is a 27.6% year-on-year growth. Moreover, the disaster preparedness frameworks in the country integrate the use of amphibious vehicles to avoid the calamitous impact of natural disasters such as tsunamis.

Key Amphibious Vehicle Market Players:

- BAE Systems

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- General Dynamics Corporation

- Lockheed Martin Corporation

- Zeal Motors

- H20 Amphibious Inc.

- Gibbs Amphibians

- Hanhwa Defense

- Amphibious Marine Inc.

- RICTOR

- Norinco Group

- Textron Systems

- Wetland Equipment Company

The amphibious vehicle market is poised to expand during the stipulated timeframe. Key market players are focusing on strategic partnerships and technological innovations to bolster market shares. Collaborations with governments and NGOs provide chances for businesses to supply amphibious vehicles for disaster response. To improve market penetration, companies are focusing on modular designs for customization catering to regional requirements.

Here are some key players in the market:

Recent Developments

- In February 2025, BAE Systems announced the debut of the Amphibious Combat Vehicle (ACV) in the United Arab Emirates (UAE) at the International Defense Exhibition and Conference (IDEX) 2025. The debut is vital for the company in its bid for expansion in new markets, and the ACV is designed to perform seamlessly in challenging terrains.

- In February 2024, H20 Amphibious Inc., unveiled the next-generation of amphibious cars. The new cars are able to transition from land to water seamlessly highlighting the advancements in mobility solutions.

- Report ID: 7289

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Amphibious Vehicle Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.