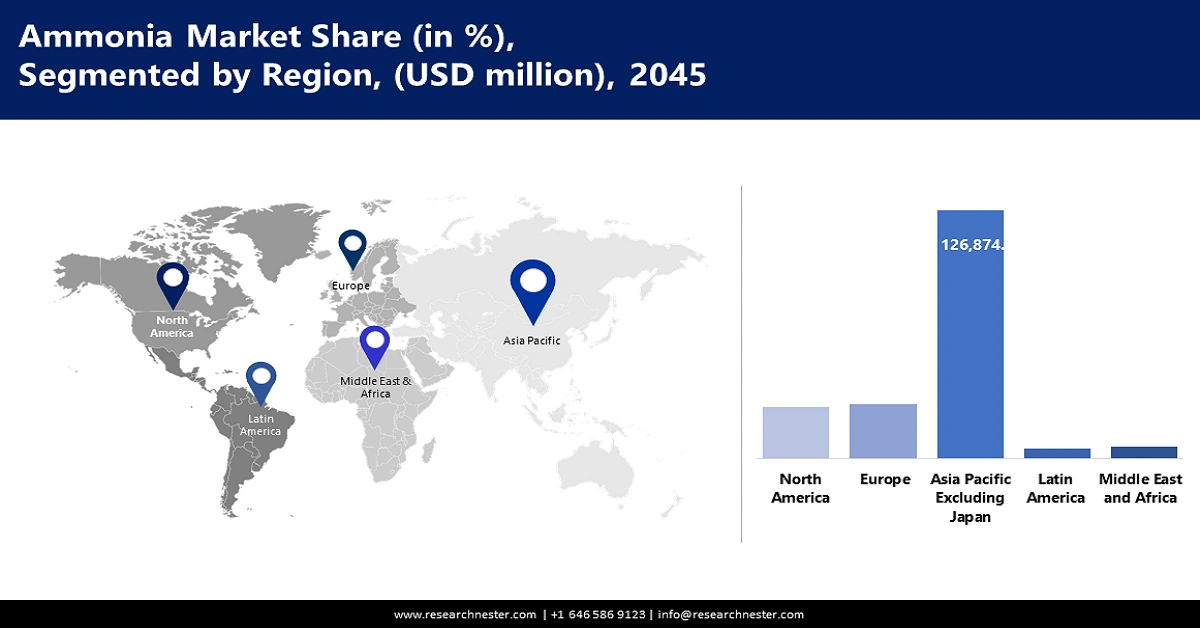

Ammonia Market - Regional Analysis

Asia Pacific Excluding Japan Market Insights

Asia Pacific excluding Japan ammonia market is expected to dominate with a share of 64.2% during the forecast period. This is attributed to the high consumption of fertilizer and industrial uses of ammonia and ammonia in clean energy technologies. The population of Asia is expected to reach more than 4.8 billion people in 2024, and therefore, the demand for food and energy in the region will be the key factors that are likely to spur the ammonia market growth. Governments across Asia are also increasing their investments in ammonia production facilities owing to their importance in decreasing the reliance on imported energy and increasing crop yields.

India ammonia market is experiencing a rise in green ammonia investments due to the country’s focus on renewable energy and eco-friendly fertilizers. In November 2024, Topsoe signed a deal with Hygenco to provide its dynamic ammonia technology for Hygenco’s green ammonia plant in Gopalpur, Odisha. This fits well with India’s efforts to transition to carbon-free fertilizers to cut the use of fossil fuels in ammonia production. Moreover, India’s National Green Hydrogen Mission is also promoting ammonia as a hydrogen carrier and making the country an important player in the transition to a cleaner economy.

China is the largest producer of ammonia globally, accounting for 30% of global production, as reported by the International Energy Agency. The country also consumes one-third of the global nitrogenous fertilizers and has been the largest consumer for the past three consecutive years. As a country that pays significant attention to food security and self-sufficiency, China has been increasing its ammonia production capacity while also taking efforts in low-carbon and hydrogen-based ammonia production in line with its carbon-neutrality goals. To enhance its ammonia production chain, China is incorporating more CCUS technologies to minimize emissions while retaining its ammonia production dominance globally.

North America Market Insights

The ammonia market in North America is expected to rise at a 5.9% CAGR between 2026 and 2045, attributed to rising demand in agriculture, hydrogen storage, and industries. The region is experiencing a transition towards low-carbon and green ammonia production through government policies and private investments. Carbon capture utilization and storage, or CCUS, is a relatively new innovation that is being implemented to minimize the emission of carbon from the production of ammonia.

The U.S. is a significant importer and consumer of ammonia, specifically for fertilizer and energy uses. The World Integrated Trade Solution (WITS) reported that in 2023, the U.S. imported anhydrous ammonia worth USD 1,345.8 million. Furthermore, the main suppliers were Canada (USD 788.75 million) and Trinidad and Tobago (USD 511.7 million). The rising dependence on imported ammonia also highlights the necessity to increase the production capacity of this important chemical in the country, especially green ammonia. These projects are aimed at reducing carbon emissions in industrial ammonia production and contributing to the development of hydrogen economy which also requires ammonia as a hydrogen vector. The increasing adoption of renewable energy sources is also expected to increase the use of ammonia in future energy storage and transportation systems.

Canada is also witnessing stable growth in the market. Ammonia production in Canada is mainly influenced by the strong fertilizer industry as agriculture is a major user of ammonia-based nitrogen fertilizers. Also, the country is progressing toward more sustainable ammonia production with CCUS technologies to decrease the emission of greenhouse gases. In August 2023, Nutrien announced that its Redwater facility in Alberta, Canada, had received a Certified Clean Ammonia certification from the Ammonia Energy Association (AEA). This extension is consistent with the nation’s dedication to reducing emissions to net zero by 2050, as ammonia that is green is expected to be a key input in the process of decarbonizing agriculture and industrial uses.