Ambulance Market Outlook:

Ambulance Market size was over USD 11.74 billion in 2025 and is anticipated to cross USD 21.02 billion by 2035, growing at more than 6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ambulance is assessed at USD 12.37 billion.

The rising cases of road accidents, cardiac diseases, and emergency cases are fueling a high demand for ambulance services. According to the World Health Organization (WHO) report around 20 to 50 million people worldwide witness road non-fatal injuries, leading to permanent bed rest orthopedic issues. Quick access to medical treatment in emergency medical service (EMS) vehicles can lead to better outcomes. Thus, the rise in rapid medical intervention cases is driving high demand for specialized ambulances with neonatal, bariatric, and intensive care. These ambulances meet the specific needs of different patient demographics and medical conditions. Furthermore, this trend addressing the growing need for tailored emergency care is set to significantly augment the ambulance market growth in the coming years.

The EMS Data Report 2021 by the National Emergency Medical Services Information System (NEMSIS) reveals that the total number of EMS activations in the U.S. was around 47,488,767. Falls and motor vehicle crashes were the major causes of injury, which led to emergency medical service requirements. The falls accounted for a major share of around 51.5% (2,667,567 count of events) and motor vehicle crashes for 29.5% (1,525,903). For typical and pediatric patient demographics the EMS transport method was the ground ambulance. Thus, from these statistics, it can be understood that the injury cases directly rely on EMS for help. The growth in such cases is set to augment the adoption of advanced ambulances in the coming years.

Key Ambulance Market Insights Summary:

Regional Highlights:

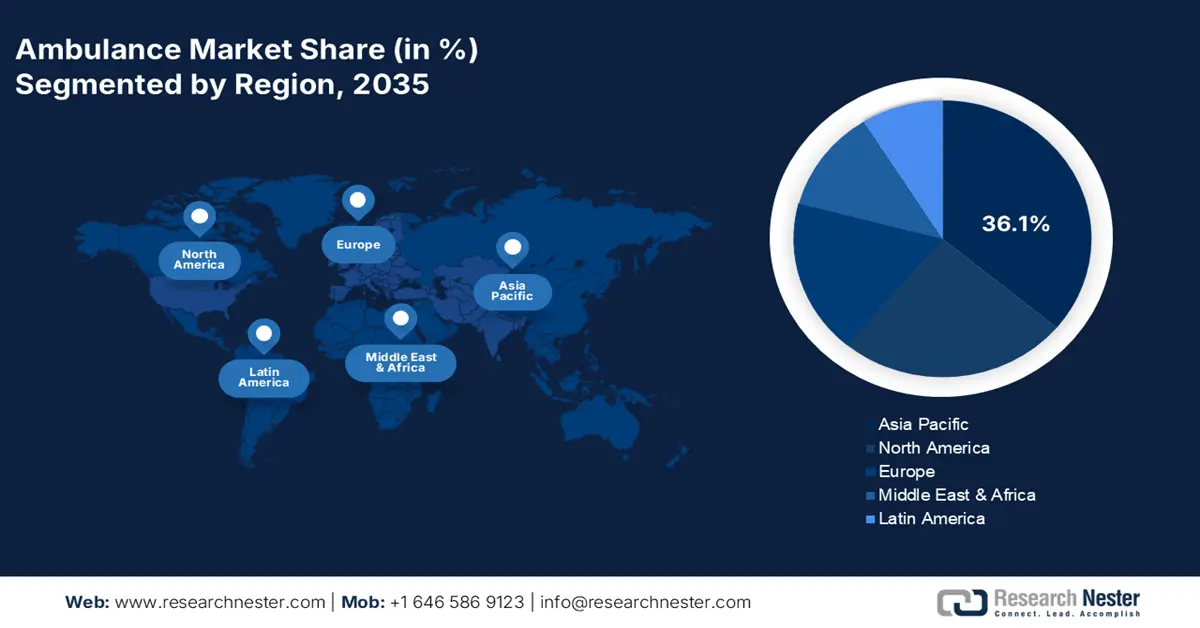

- Asia Pacific commands a 36.1% share in the ambulance market, fueled by high healthcare expenditure, ensuring dominance through 2026–2035.

Segment Insights:

- The Type 1 ambulance segment is expected to see significant growth through 2035, propelled by the integration of advanced medical technologies in emergency vehicles.

- The Diesel segment of the Ambulance Market is expected to capture around 59.5% share by 2035, fueled by diesel engines’ high performance and reliability for emergency response.

Key Growth Trends:

- Ambulance digitalization

- Integration of telematics & telehealth

Major Challenges:

- High operational costs and service charges

- Stringent regulatory procedures

- Key Players: Road Rescue, DocGo, Acetech, and Falck A/S.

Global Ambulance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.74 billion

- 2026 Market Size: USD 12.37 billion

- Projected Market Size: USD 21.02 billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, Japan, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Ambulance Market Growth Drivers and Challenges:

Growth Drivers

- Ambulance digitalization: The digitalization trend is aggressively leading to the development of next-gen ambulance vehicles. Ambulance fleets are increasingly adopting software solutions for fleet management, real-time tracking, and route optimization. GPS systems, automatic vehicle location (AVL), and real-time data analytics are improving efficiency in dispatching, reducing response time, and ensuring better coordination with hospitals. For instance, in September 2023, the Erie County Department of Health (ECDOH) announced the launch of a country-run ambulance service. The ECDOH has the possession of 2 ambulances and 2 fly cars, wherein 3 more ambulances are in dispatch. These ambulances are set to be equipped with GPS locators, making emergency medical series (EMS) more digitalized. Thus, the increasing adoption of digital ambulances is set to boost the revenue shares of key manufacturers in the coming years.

- Integration of telematics & telehealth: The growing integration of telemedicine and telematics into ambulances is also a significant ambulance market trend, which allows paramedics to communicate directly with healthcare providers in real time. This improves the patient care provided during transport, especially in remote areas where access to medical professionals may be limited. To grab opportunities from this trend many advanced fleet manufacturers are investing in R&D activities to develop ambulances with telehealth and telematic features. For instance, in October 2022, Acetech announced the launch of HAAS Alert’s Safety Cloud digital alerting features through ACETECH CONNECT. The ambulances with Acetech-powered Traumahawk Telematics subscriptions are now equipped with HAAS Alert’s Responder-to-Vehicle (R2V) an advanced collision prevention safety service. Thus, the ambulances with these advanced features are able to send alerts to navigation and in-vehicle infotainment systems of passing by motorists.

- Electrification trend: The electric and green ambulance trend is boosting the adoption of electric and hybrid emergency medical service vehicles. These sustainable fuel-type vehicles effectively aid in reducing the environmental impact, lower operating costs, and offer quieter operations. Furthermore, to align with the net-zero carbon emission goals, many healthcare service providers are adopting these sustainable engine-type ambulance vehicles. The EMS automobile manufacturers are also launching electric ambulances to earn high profits from this trending opportunity. For instance, in February 2023, Falck A/S introduced its first electric ambulance vehicle in Denmark. Under the long-term strategy to convert ambulances to EVs and other renewable energy sources, Falck is advancing its position in the green conversion trend.

Challenges

- High operational costs and service charges: Ambulance service is often associated with high operational costs, particularly in terms of vehicle maintenance, fuel, medical equipment, and staffing. These high costs create financial pressure on emergency medical service providers and patients, especially in regions where funding for public services is limited. Thus, high operational costs and service charges are hampering the ambulance market growth to some extent.

- Stringent regulatory procedures: Ambulances being a part of emergency medical service are often associated with strict regulatory policies. The stringent regulations regarding vehicle specifications, safety standards, and medical certifications act as a barrier for smaller or new companies trying to enter the market. The new companies often invest in R&D activities to introduce innovative products/services and stand out in the crowd, but if the innovations don’t meet the regulatory standards can significantly hamper the company in both terms of financial and market position.

Ambulance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 11.74 billion |

|

Forecast Year Market Size (2035) |

USD 21.02 billion |

|

Regional Scope |

|

Ambulance Market Segmentation:

Vehicle Type (Type 1, Type 2, Type 3, and Medium-duty Ambulances)

The type 1 segment is projected to hold over 45% ambulance market share by the end of 2035. Type 1 ambulances are often equipped with advanced medical technologies, mobile diagnostic tools, and communication equipment, which aid in enhancing patient care. With a continuous rise in investments in advanced healthcare services, the sales of type 1 ambulances are set to rise. Manufacturers are concentrated on developing advanced type 1 ambulances owing to high demand. For instance, in August 2024, Road Rescue announced the launch of type 1 and type 3 redimedic ambulances. These easy-to-spec and pre-configured ambulances are well-equipped with advanced medical technologies. With these new vehicle launches, the company estimates to earn profitable revenue shares in the coming years.

Fuel Type (Diesel, Gasoline, Electric)

By the end of 2035, diesel segment is expected to dominate around 59.5% ambulance market share. The high performance, durability, and long life are major factors influencing diesel-based ambulance sales. Diesel vehicles have robust engines and high torque, which are vital for ambulances, especially in emergencies. Ambulances often need to travel at high speed over long distances, navigate through traffic, or climb steep roads, the diesel engines effectively aid in carrying out these tasks. Furthermore, the ambulances are equipped with various technologies, tools, and machines, which increase the overall weight of the vehicle. Diesel-based engines with high power efficiently aid in carrying high-weight loads at maximum speeds.

Our in-depth analysis of the global ambulance market includes the following segments

|

Vehicle Type |

|

|

Application |

|

|

Distribution Channel |

|

|

Fuel Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ambulance Market Regional Analysis:

Asia Pacific Market Forecast

By the end of 2035, Asia Pacific ambulance market is projected to account for more than 36.1% revenue share. The high healthcare expenditure, quick adoption of advanced medical technologies, and rapid digitalization are significantly contributing to the regional market growth. The strong presence of vehicle assistance technologic producers and advanced automobile manufacturers is aiding Asia Pacific to stand firm in the global ambulance market. The existence of potential economies such as India, China, Japan, and South Korea is further augmenting the sales of advanced ambulances.

In China, the supportive regulations on EMS vehicle manufacturing and the high focus on the digitalization of healthcare facilities are driving the ambulance market growth. The county’s 13th Five Year Plan is further augmenting the adoption of electric ambulances. China is ahead in the adoption of electric vehicles, according to the International Energy Agency (IEA) report over 1 in 3 vehicles registered in the country are electric. This electrification trend is set to significantly fuel the adoption of electric ambulances in the country.

In India, the government’s focus on advancing healthcare services is anticipated to drive the demand for advanced ambulances. The continuous investments in healthcare infrastructure expansion and increasing involvement of private healthcare facilities are creating a lucrative environment for ambulance manufacturers. The India Brand Equity Foundation (IBEF) reveals that the country’s public expenditure on healthcare reached 2.1 % of GDP in FY 2023 the government expects it to touch 2.5% by FY 2025. The government allocated around USD 10.70 billion in the Union budget 2024-2025 for advancing healthcare services. Such investments are set to augment the sales of ambulances in the country.

North America Market Statistics

The North America ambulance market is expected to increase at the fastest pace from 2026 to 2035. The strong presence of advanced facilities, supportive government investment plans, and the presence of advanced EMS vehicle manufacturers is fueling the sales of advanced ambulances. Both the U.S. and Canada are win-win marketplaces for ambulance manufacturers as these countries are at the forefront of the adoption of advanced healthcare technologies and services.

In the U.S., state-funded emergency medical services programs are positively influencing the ambulance market growth. The EMS policies ensure greater access to advanced emergency services encouraging the public healthcare facilities to invest in modern ambulance fleets. Furthermore, the strong presence of top ambulance manufacturers is aiding the U.S. market growth.

In Canada, the government’s support in the form of high investment and strict EMS policies is increasing the adoption of advanced ambulances. Public safety-first motives are set to boost the profits of advanced ambulance fleet manufacturers in the country. The Paramedic Academy estimates that driverless cars, drones, to artificial intelligence are some of the latest trends expected to enhance the emergency medical services in the country. Technological advancements are set to be a prime factor augmenting the ambulance market growth.

Key Ambulance Market Players:

- Road Rescue

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DocGo

- Acetech

- Falck A/S

- Auto Ribeiro

- Bollanti

- Braun Industries, Inc.

- Crestline Ambulance

- Demers Ambulances

- Excellence, Inc.

- Frazer Ltd

- Global Medical Response Company

- JCBL Group

- MEDICOP d.o.o.

Key players in the ambulance market are employing several strategies to boost their revenue shares such as new product launches, technological innovations, mergers, strategic collaborations, and acquisitions. They are continuously investing in research and development activities to improve the features of ambulances. Industry giants are also collaborating with other players and vehicle assistance technology producers to develop ambulances with cutting-edge technologies. Furthermore, merger and acquisition tactics are aiding them to boost their product offerings.

Some of the key players include:

Recent Developments

- In December 2024, the Emergency Medical Services Authority (EMSA) announced the launch of the organization’s first Gen2 Ambulance in Oklahoma City. With improved exterior and interior ambulance layout, this reconfigured EMS vehicle is set to offer better care to patients.

- In March 2022, DocGo revealed the launch of the country's first all-electric, zero-emission ambulance. More eco-friendly than the standard ambulance, this electric vehicle is the first of its kind registered in the U.S.

- Report ID: 6858

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ambulance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.