Amblyopia Treatment Market Outlook:

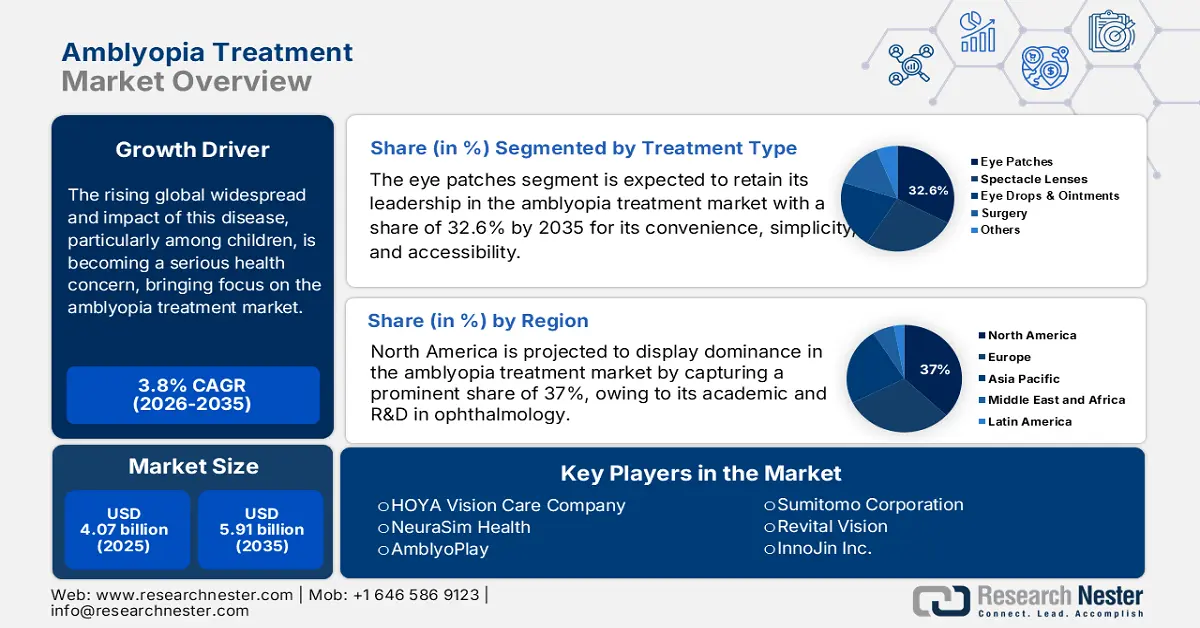

Amblyopia Treatment Market size was valued at USD 4.07 billion in 2025 and is set to exceed USD 5.91 billion by 2035, registering over 3.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of amblyopia treatment is estimated at USD 4.21 billion.

The rising global widespread and impact of this disease, particularly among children, is becoming a serious health concern, bringing focus on the amblyopia treatment market. According to an NLM study, published in May 2022, the patient pool of lazy eye witnesses a prevalence of 1.3%. The results also revealed variability in this across different regions. As a result, the need for early diagnosis and intervention has become a primary motive for several international ophthalmology organizations. Their efforts to improve outcomes and longevity of treatments through rigorous R&D in identifying the root cause and most effective technique is further boosting exposure for this sector.

Region-wise Prevalence of Amblyopia (2022)

|

Continent |

Prevalence (%) |

|

Europe |

2.6 |

|

North America |

1.9 |

|

Oceania |

1.8 |

|

Asia |

1.1 |

|

South America |

0.4 |

|

Africa |

0.3 |

|

Mixed Countries |

0.7 |

Source: NLM Study

The amblyopia treatment market is expanding with the rise in MedTech discoveries and government-issued promotional initiatives. Their focus is also set on mitigating the economic barrier by setting a standardization in payers’ pricing for diagnosis. On this note, a review on probabilistic sensitivity analysis from the Preventive Medicine Reports was released in March 2024, evaluating the budget efficiency and health benefits of screening. It concluded the likelihood of cost-effectiveness of screening in pediatric amblyopia treatment to be 92.5% in comparison to non-screening, with a comparative incremental cost-effectiveness ratio (ICER) of USD 17,466/quality-adjusted life year (QALY). Such studies have shown promising results by penetrating early detection into the conventional method.

Comparative Presentation on the Cost of Available Therapeutics (2025)

|

Treatment |

Duration (Weeks) |

Total Cost (USD) |

Cost per QALY (USD) |

|

Glasses |

12 |

514.0 |

427.0 |

|

Patches |

12 |

540.0 |

101.0 |

|

Atropine |

16 |

652.0 |

151.0 |

|

Luminopia |

12 |

1951.0 |

618.0 |

|

CureSight |

12 |

1564.0-1814.0 |

368.0-427.0 |

Source: American Academy of Ophthalmology (AAO) Journal

Key Amblyopia Treatment Market Insights Summary:

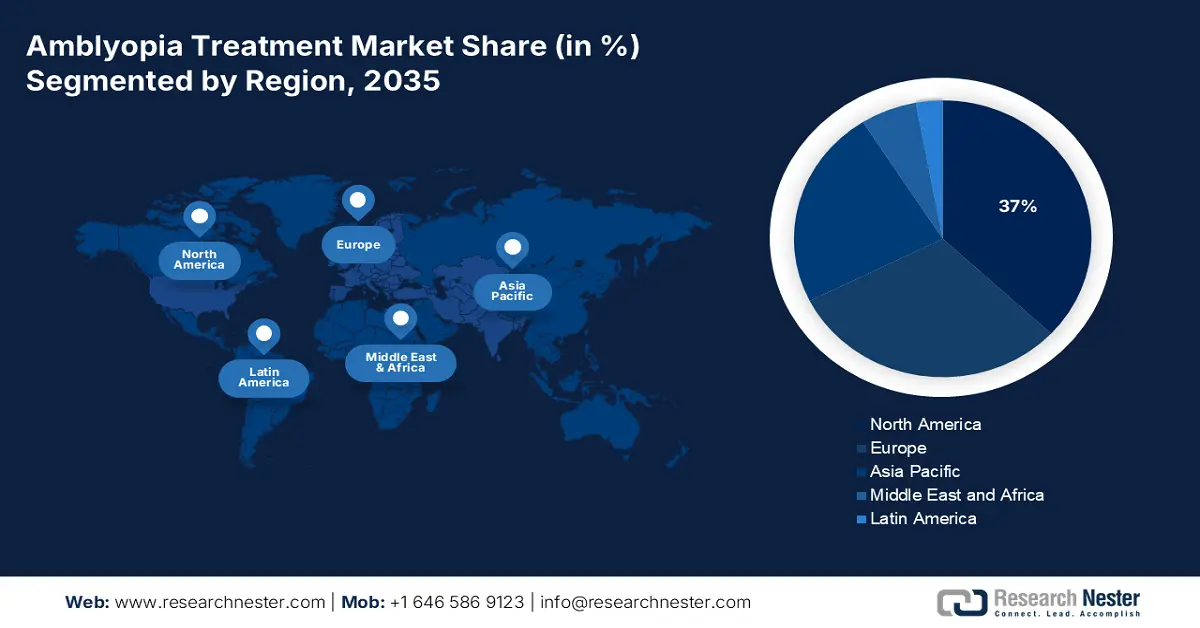

Regional Highlights:

- North America dominates the Amblyopia Treatment Market with a 37% share, driven by academic and R&D excellence in ophthalmology, alongside clinical discoveries, supporting strong growth through 2026–2035.

- Asia Pacific's Amblyopia Treatment Market is witnessing notable growth through 2026–2035, fueled by a high incidence rate of myopia, increasing the consumer base for amblyopia treatments.

Segment Insights:

- The Pharmacies segment is projected to hold a significant market share through 2026-2035, fueled by the expanding global pharmacy industry supporting prescription-based treatments.

- The Eye Patches segment of the Amblyopia Treatment Market is expected to hold a 32.6% share by 2035, propelled by the simplicity, accessibility, and proven efficacy of eye patches in early-stage amblyopia treatment.

Key Growth Trends:

- Growing focus on ophthalmic innovations

- Continuous improvement in treatment outcomes

Major Challenges:

- Lack of awareness about disease and therapeutics

- Financial barriers and limited reimbursements

- Key Players: Revital Vision, NovaSight, HOYA Vision Care Company, NeuraSim Health, AmblyoPlay.

Global Amblyopia Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.07 billion

- 2026 Market Size: USD 4.21 billion

- Projected Market Size: USD 5.91 billion by 2035

- Growth Forecasts: 3.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Amblyopia Treatment Market Growth Drivers and Challenges:

Growth Drivers

- Growing focus on ophthalmic innovations: Technological advancements are remarkably diversifying the amblyopia treatment market. As more companies and institutions invest and engage in meticulous R&D, the range of options for effective and affordable curatives is expanding. For instance, in May 2023, a consortium of eye specialists, mathematicians, and game designers at the University of Southampton was formed to develop a new mobile phone application. The app was specifically crafted to improve visual impairment among children with amblyopia. Such innovations, combined with other existing digital solutions, such as wearables and brain training protocols, are fostering a broad consumer base for this field.

- Continuous improvement in treatment outcomes: As the volume and variability in patients increase, global players in the amblyopia treatment market keep evolving their product line. For instance, in September 2024, NovaSight presented enhanced visual acuity gain by its recently developed product, CureSight, in a 16-week evaluation. The per-protocol conclusion showcased a higher mean augmentation from baseline by 0.05 logMAR and patient-adherence by 10.1% in CureSight than patching. This is evidence of continuous improvement in effectiveness and compliance. Thus, the sector subsequently expands its boundaries with new possibilities of greater profit margin and patient engagement.

Challenges

- Lack of awareness about disease and therapeutics: Although lazy eye is common in children, the knowledge about offerings from the amblyopia treatment market is still limited. Despite growing investments from higher income regions such as Europe and North America, lower- and middle-income continents (LMICs) are lagging due to the absence of an adequate medical system. In addition, the rare occurrence of this condition in these territories often results in a pool of unaware patients and disparity in market accessibility and availability.

- Financial barriers and limited reimbursements: Integration of next-generation technologies in the amblyopia treatment market brings higher pricing, which makes it difficult for patients to purchase. The heavy burden of out-of-pocket healthcare expenses on people from a weaker economic background is a major hurdle in the wide adoption. Thus, lower sales figures in budget-constrained regions may discourage companies from globalizing, shrinking the exposure and reach of this field. Moreover, this gap neutralizes the advantages of innovative solutions, restricting future progress.

Amblyopia Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.8% |

|

Base Year Market Size (2025) |

USD 4.07 billion |

|

Forecast Year Market Size (2035) |

USD 5.91 billion |

|

Regional Scope |

|

Amblyopia Treatment Market Segmentation:

Treatment Type (Eye Patches, Spectacle Lenses, Eye Drops & Ointments, Surgery, Others)

Based on treatment type, the eye patches segment is projected to dominate amblyopia treatment market share of around 32.6% by the end of 2035. Despite recent advances in this field, this option is still being preferred for its convenience, simplicity, and accessibility. The efficacy of this method has been proven by various clinical studies, particularly in the developing stage of the brain (less than 7 years of age). Thus, it is utilized widely across the globe. For instance, a randomized controlled trial on patching was published by the NLM, in May 2024, on 334 residents from Europe. In this study, a higher success rate of treatment, 67.0%, was observed in the early group, compared to a 54.0% in extended optical treatment (EOT). This segment is predominantly present in initial stage interventions.

Distribution Channel (Pharmacies, Drug Stores, Hypermarkets and Supermarkets, E-Commerce)

In terms of distribution channel, the pharmacies segment is predicted to hold a significant revenue share in the amblyopia treatment market throughout the assessed timeline. The reliability and awareness of these distributors are the key growth factors of this segment. The expanding territory of this industry is also evidence of its prophecy. According to IQVIA statistics, the number of prescriptions dispensed in the U.S. was 6.7 billion in 2022, with a 2.5% annual increment in prescription volume. This implies a steady progress in this segment.

Our in-depth analysis of the global amblyopia treatment market includes the following segments:

|

Treatment Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Amblyopia Treatment Market Regional Analysis:

North America Market Analysis

North America amblyopia treatment market is projected to dominate revenue share of around 37% by the end of 2035. The academic and R&D excellence of this region in ophthalmology is propelling significant growth in this field. The ongoing clinical discoveries and meticulous efforts to retain the highest standard of medical care are further fueling progression in this landscape. For instance, in February 2025, a team of researchers at the University of North Dakota commenced a nationwide clinical trial, proving the efficacy of VR headsets in treating lazy eye in pediatric residents. The study was conducted on 250 children, administered under 400 ophthalmic facilities in North America, promoting the use of tech-based solutions such as Luminopia and Vivid Vision wearables.

The U.S. amblyopia treatment market is enriched with the presence of a supportive regulatory framework and globally leading pioneers. Growing awareness and a wide network of the eye specialty medical facilities are attracting leaders in this field to be involved in this progressive cohort. For instance, in December 2022, NovaSight announced the commercial launch of its pediatric amblyopia therapeutic, CureSight, in the U.S. after getting the 510(K) clearances from the FDA for marketing and manufacturing. Previously, in October 2021, the FDA also granted the application of Lumiopia to serve the same purpose. This continuous allowance record is further solidifying the country’s position.

Canada consists of a large consumer pool and favorable government strategies on reducing vision impairment, which is feeding growth in the amblyopia treatment market. As per a survey by NLM, in July 2020, the overall availability of optometrists in Canada was 1.7 for every 10,000 citizens, where 32 health regions had high utilization of these services. Thus, the country is proactively investing and working to increase the availability of optometry services, which subsequently inflates the rate of early detection and intervention. Furthermore, Canada is suffering from an economic burden of vision loss, which is pushing it to accommodate high-end facilities across the nation, fueling demand in this field.

APAC Market Statistics

Asia Pacific is anticipated to witness a notable pace of progress in the amblyopia treatment market over the forecasted timeframe. High incidence rate of myopia, which can cause this condition at a younger age if not treated, in this region is a remarkable driver in this field. According to a report from AAO Journal, published in June 2021, the probability of myopia occurrence among school-aged children in East Asia was registered to be 90.0%, presenting a 10.0% increment from the past decade. The report also highlighted the prevalence of this eye disorder in South Korea, where 96.5% and 83.3% of the 19-year-old male conscripts were affected in Seoul and other rural areas of the country respectively. The figures signify a potentially larger consumer base for this sector, making it an attractive marketplace.

India is adopting and cultivating technological advancements from the amblyopia treatment market to equip the domestic ophthalmology industry with adequate solutions. The country is now highly focused on developing next-generation tools to revolutionize the approach of therapy administration and disease management. For instance, in February 2021, CureSee, previously gained popularity for its AI-based vision therapy, launched another virtual version, CureSee 2.0, for lazy eye patients. Such pioneers are helping this landscape attain traction in this field with innovations.

China is witnessing an increased incidence of high myopia in academically involved children. As the number of affected habitats increases in this country, the scope of investment and profit generation in the amblyopia treatment market heightens. According to a 2022 NLM article, high-myopia was highly prevalent among the elementary, middle, and high school students in China, accounting for 7.59% in girls and 6.43% in boys. The report further mentioned that the condition kept worsening and multiplying in prevalence with the progression in academic career. Thus, considering the close relation of high myopia with lazy eye, one can conclude that this marketplace is emphasizing.

Key Amblyopia Treatment Market Players:

- Vivid Vision

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M

- Lancastle International Ltd.

- Johnson and Johnson

- Trayner

- Good-Lite

- HOYA Vision Care Company

- Ortopad USA

- NovaSight

- Revital Vision

- NeuraSim Health

- AmblyoPlay

Global leaders in the amblyopia treatment market are creating a healthy and competitive atmosphere for attaining a well-balanced capital influx and profit generation. Their industry survival instincts push them to deliver betterment through every new launch, promoting globalization. For instance, in February 2025, RevitalVision debuted in the U.S. market with its groundbreaking pipeline of digital vision enhancement gadgets for ocular conditions including amblyopia. The company signed a partnership agreement with Launchpad Vision to expand the reach of its technology across the country, establishing a strong foundation for RevitalVision. Such key players are:

Recent Developments

- In February 2025, NeuraSim introduced an AI-driven VR therapy, BeeVee, in collaboration with QWR, for treating amblyopia. The wearable non-invasive alternative device is capable of offering remote disease management through adaptive exercises, retraining the brain to improve vision.

- In September 2024, AmblyoPlay launched a revolutionary technology, Active Peripheral Stimulation (APS), to treat amblyopia with better peripheral vision. The solution is engineered to generate controlled stimulation in the peripheral areas of the retina, increasing spatial awareness among patients.

- Report ID: 7288

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Amblyopia Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.