Ambient Light Sensor Market Outlook:

Ambient Light Sensor Market size was valued at USD 3.31 billion in 2025 and is set to exceed USD 8.66 billion by 2035, registering over 10.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ambient light sensor is evaluated at USD 3.61 billion.

The growth in this sector is driven by the rise in demand for smart devices such as smartphones, tablets, laptops, televisions, and other electronic devices. Ambient light sensors are increasingly being used to deploy auto-screen adjustment facilities in these devices. Thus, the growth in the smart electronics industry is propelling the demand for such sensors.

The expansion in the IoT ecosystem has also impacted the progress of the ambient light sensor market. As the demand for automation and smart home applications increases, the rate of integrating these sensors into connected devices has multiplied. These sensors are aimed to enable auto-management in operations based on environmental conditions. This has further influenced manufacturers including automakers to implement such sensors to elevate performance. For instance, in October 2021, Vishay launched the AEC-Q100 Qualified Ambient Light Sensor for automotive and consumer applications. The compact 2.67 mm x 2.45 mm x 0.6 mm package offers a high dynamic range of 228 klux and a resolution of 0.0034 lx/ct for dark lens designs.

Key Ambient Light Sensor Market Market Insights Summary:

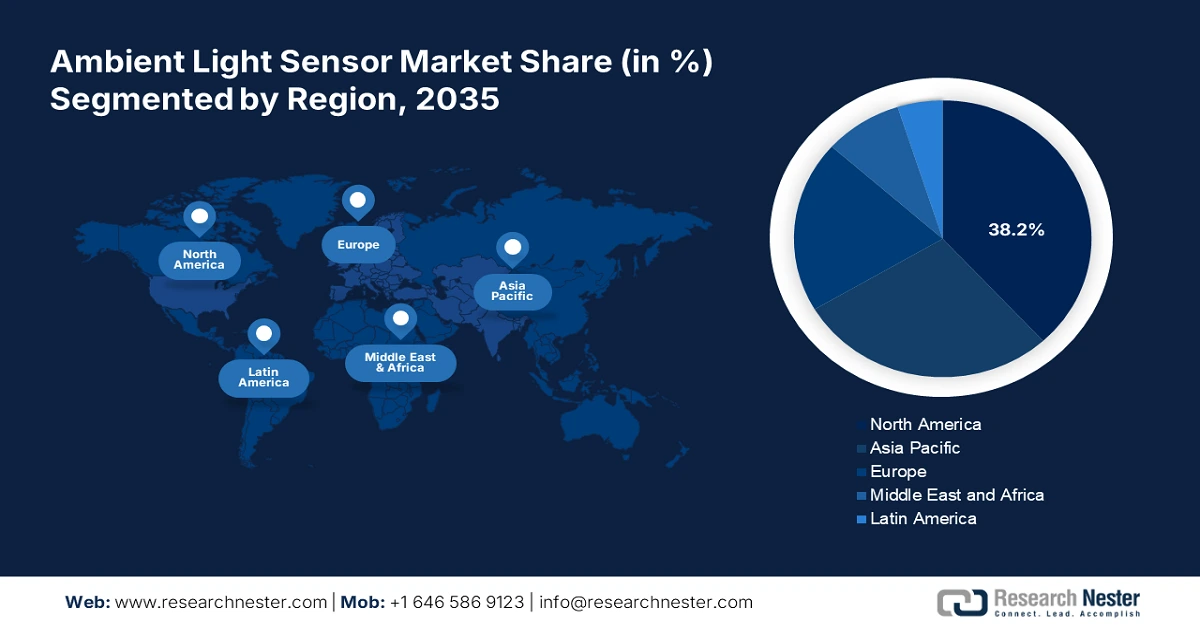

Regional Highlights:

- North America leads the Ambient Light Sensor Market with a 38.2% share, driven by the adoption of smart lighting and homes, fostering strong growth prospects through 2026–2035.

Segment Insights:

- The Automotive segment is projected to capture a 44.7% share by 2035, fueled by the growing automotive industry's adoption of sensor technologies.

Key Growth Trends:

- Diverse application of sensors

- Advancement in technology

Major Challenges:

- Concern about energy efficiency

- Lack of adoption due to cost sensitivity

- Key Players: Ams-OSRAM AG, Acuity Brands, Inc., Broadcom Ltd., ON Semiconductor Corporation, Panasonic Corporation, Renesas Electronics Corporation, ROHM Co., Ltd., STMicroelectronics N.V., Texas Instruments Incorporated, and Vishay Intertechnology, Inc.

Global Ambient Light Sensor Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.31 billion

- 2026 Market Size: USD 3.61 billion

- Projected Market Size: USD 8.66 billion by 2035

- Growth Forecasts: 10.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 14 August, 2025

Ambient Light Sensor Market Growth Drivers and Challenges:

Growth Drivers

- Diverse application of sensors: The versatile usage of these devices has propelled the demand in the ambient light sensor market. Various industries and product categories are contributing to the surge due to multiple applications of these sensors in their businesses. Manufacturing smart appliances such as smartphones and wearables is one of the major fields of users, driving demand in this sector. For instance, in January 2019, Ams-OSRAM launched TCS3701, an RGB light, and IR proximity sensor IC to measure the intensity of ambient light from behind an OLED screen. The optical sensor is built to support the maximized use of smartphone display area by eliminating front-facing bezels.

- Advancement in technology: The ongoing development in technology is propelling the growth of the ambient light sensor market. Continuous improvements are being made by leaders to deliver more compact and energy-efficient sensors. For instance, in October 2021, Ams-OSRAM launched an ultra-small ambient light sensor, TSL2585 for wearable and mobile devices. The compact model supports UV-A radiation detection and accurate ambient light sensing by utilizing its high-sensitivity photopic and IR channels. Such innovative features in devices due to integrating these sensors are now making them more attractive for a variety of applications.

Challenges

- Concern about energy efficiency: High power consumption may become a critical issue in optimum implementation in the ambient light sensor market. Though these devices are made for optimizing energy usage, their operation still consumes power. This further pushes the manufacturers to develop sensors with more energy efficiency to prevent power loss. Designing such tools without compromising their accuracy and performance may become a challenge for companies.

- Lack of adoption due to cost sensitivity: The cost of deploying these tools may raise difficulty for small-sized industries to invest in the ambient light sensor market. The production of sensors with advanced features is expensive, limiting the adoption in low-cost devices. In addition, the complexity of integrating these devices requires skilled professionals to obtain optimum effectiveness. This may result in additional expenses in the budget for manufacturing in the consumer electronics and automotive sectors.

Ambient Light Sensor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.1% |

|

Base Year Market Size (2025) |

USD 3.31 billion |

|

Forecast Year Market Size (2035) |

USD 8.66 billion |

|

Regional Scope |

|

Ambient Light Sensor Market Segmentation:

Application (Consumer Electronics, Automotive, Healthcare, Industrial, Home Automation, Others)

Automotive segment is poised to dominate around 44.7% ambient light sensor market share by the end of 2035. The growing automotive industry is highly influencing the adoption of these sensors to support automation in vehicles. The detecting devices are used in automatic headlight control, dashboard lighting adjustments, and cabin comfort enhancements. Such diverse applications are driving the demand for these tools to elevate the driver and passenger experience, inspiring leaders to introduce more solutions for the automobile industry. For instance, in April 2024, Ams-OSRAM collaborated with DOMINANT Opto Technologies to integrate its Open System Protocol into Opto's intelligent RGB LEDs, enabling smart automotive ambient lighting.

Output Type (Analog, Digital)

In terms of output type, the digital segment is predicted to garner significant value in the ambient light sensor market by the end of 2035. These sensors can convert analog signals into digital data to provide more accurate, noise-resistant, and easy-to-integrate outputs for devices. Due to using advanced protocols such as 12C or SPI for communication, these sensors can be seamlessly penetrated with modern electronic devices. For instance, in September 2022, Onsemi launched a customized high-end CMOS sensor for ARRI’s ALEXA 35 camera. The ALEV 4 Super 35 4.6K CMOS image sensor can enhance the outputs of digital cinematography. The segment is also preferable for industries due to its less power consumption feature, helping them to make their operations energy-efficient.

Our in-depth analysis of the global ambient light sensor market includes the following segments:

|

Application |

|

|

Output Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ambient Light Sensor Market Regional Analysis:

North America Market Analysis

North America ambient light sensor market is expected to hold revenue share of more than 38.2% by 2035. The growth in adoption of smart lighting and homes has driven demand for these sensors in the region. The concept of energy conservation and a secure living environment is greatly supported by innovation in this sector. For instance, in December 2022, Texas Instruments launched OPT3005, an ambient light sensor to enhance the ability of video surveillance cameras to measure light intensity. The extreme IR rejection of these tools can sense lights as a human eye. Additionally, the introduction of advanced driver-assistance systems in the automotive industry has inflated the demand. Such technological development has boosted the application of these tools in various industries.

The rising awareness about sustainability in the U.S. has created new growth possibilities for the ambient light sensor market. The strict regulations on maintaining energy efficiency in buildings, consumer electronics, and the automotive sector have driven the demand for such sensors. This further influences companies to innovate more effective technologies to reduce power consumption in operation. For instance, in October 2023, Onsemi launched a new image sensor family, Hyperlux LP for smart doorbells, security cameras, AR/VR/XR headsets, machine vision, and video conferencing. The 1.4 µm pixel sensors can extend battery life up to 40% while capturing crisp and vibrant images even in difficult lighting conditions.

Canada is expected to create great opportunities for the global ambient light sensor market to grab the enlarging consumer base of this country. The initiatives taken by the government to promote digitalization and automation of industries have greatly inflated the adoption of these sensors. According to a report published by the International Trade Administration, in October 2024, the AI landscape of Canada was estimated to be USD 4.1 billion in 2024. The report further states the efforts made by the government to secure the industry by implementing laws such as AIDA as part of Bill C-27 and the Digital Charter and Implementation Act. Such growing AI industry in this country is increasing the usage of advanced sensing technology for better results.

APAC Market Statistics

The Asia Pacific ambient light sensor market is projected to garner significant revenue by the end of 2035 due to the growing industries such as consumer electronics and automotive. This raises concerns about energy efficiency, creating great business opportunities for energy-saving leaders. According to a report published by the World Economic Forum, in June 2024, Asia Pacific garners the potential to generate USD 10.1 trillion in revenue by 2030 through promoting sustainability. The expansion includes industries such as renewable power, energy efficiency, transportation, agriculture, and the producing sector. The sensors are proven to reduce the consumption of power in the operational field of many industries, promoting the adoption.

India fosters the scope of profitable business for the global leaders in the ambient light sensor market due to increasing demand for consumer electronics. The country is focusing on emphasizing the domestic production of electronics to support its economic growth. According to the PIB report published in July 2024, the electronics manufacturing sector in India is expected to reach USD 500 billion by 2030. It further states that the industry accounted for USD 155 billion in 2023 and plans to incorporate modern manufacturing methods to enhance its participation in global trade. This further creates a surge in sensing technologies to cope with the demand.

China is predicted to experience remarkable growth in the ambient light sensor market due to its enlarging industry of smart devices and wearables. This has propelled the adoption of advanced technologies including these sensors. As the growth of this country highly depends on the manufacturing sector, the need for factory automation to increase production has surged. This also contributed to the implementation of advanced detecting systems in the production facilities to ensure product quality. In addition, the increasing demand for energy efficiency and smart devices presents a promising growth in this sector.

Key Ambient Light Sensor Market Players:

- Ams-OSRAM AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Acuity Brands, Inc.

- Broadcom Ltd.

- ON Semiconductor Corporation

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Vishay Intertechnology, Inc.

- Cosmicnode

- Haisen

The current ambient light sensor market is progressing toward integrating advanced technologies in product development. Many companies are introducing methods to accelerate innovation in this sector. For instance, in November 2024, Onsemi launched an analog and mixed-signal platform, Treo Platform, offering a foundation for a wide range of power and sensing solutions. It is built with bipolar-CMOS-DMOS (BCD) process technology on an advanced 65nm node to feature a modular architecture for the development of intelligent power management, sensor interface, and communications solutions. The innovative solutions are further inspiring other global leaders to invest in R&D. Such key players include:

Recent Developments

- In December 2023, STMicroelectronics launched a multizone time-of-flight sensor, VL53L8CX for industries. The next-generation ranging sensor is capable of delivering greater ambient-light immunity, lower power consumption, and enhanced optics, suitable for human-presence sensing, gesture recognition, robotics, and other industrial uses.

- In September 2023, Cosmicnode partnered with Haisen to integrate advanced sensors with its wireless mesh platform. The collaboration will help the company deliver a smart lighting experience by incorporating Haisen’s cutting-edge sensors for auto ambient light management.

- Report ID: 6779

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ambient Light Sensor Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.