Aluminum Honeycomb Market Outlook:

Aluminum Honeycomb Market size was over USD 3.71 billion in 2025 and is anticipated to cross USD 6.71 billion by 2035, witnessing more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aluminum honeycomb is assessed at USD 3.91 billion.

Superior corrosion and fire resistance qualities are primarily boosting the demand for aluminum honeycombs. The lightweight nature and durability are fueling innovations in the production of aluminum honeycombs. Construction, aerospace, marine, and automotive sectors are making wide demand for aluminum honeycombs. Continuous innovations in the production of aluminum honeycombs are anticipated to lead to better bonding techniques and cost-effective manufacturing processes. The integration of nanotechnology and composite materials is further backing the sales of aluminum honeycombs. AI in the mining process is also expected to aid in ore production and supply. A seamless and adequate supply of aluminum ore leads to a high trade of aluminum honeycombs.

|

Aluminum Ore |

|||

|

Country |

Export Value in USD Million |

Country |

Import Value in USD Million |

|

Guinea |

4650 |

China |

5440 |

|

Australia |

865.0 |

India |

269.0 |

|

Indonesia |

675.0 |

Spain |

224.0 |

|

China |

207.0 |

U.S. |

202.0 |

|

Guyana |

192.0 |

Germany |

190.0 |

Source: OEC

The study by the International Aluminium Institute states that in December 2024, the total aluminum production was estimated at 6,236 thousand metric tonnes. China was leading with 3726 thousand metric tonnes followed by Gulf Cooperation Council (531 thousand metric tonnes) and Asia excluding China (409 thousand metric tonnes). Furthermore, the report by the Observatory for Economic Complexity (OEC) reveals that aluminum ore was the 462nd most traded product across the world. The total aluminum ore trade surpassed USD 7.24 billion in 2022, registering a CAGR of 23.0%. The export and import activities were saturated across Guinea and China. The export dominance of 4 countries represents a market concentration of 2.03 measured using Shannon Entropy.

Key Aluminum Honeycomb Market Insights Summary:

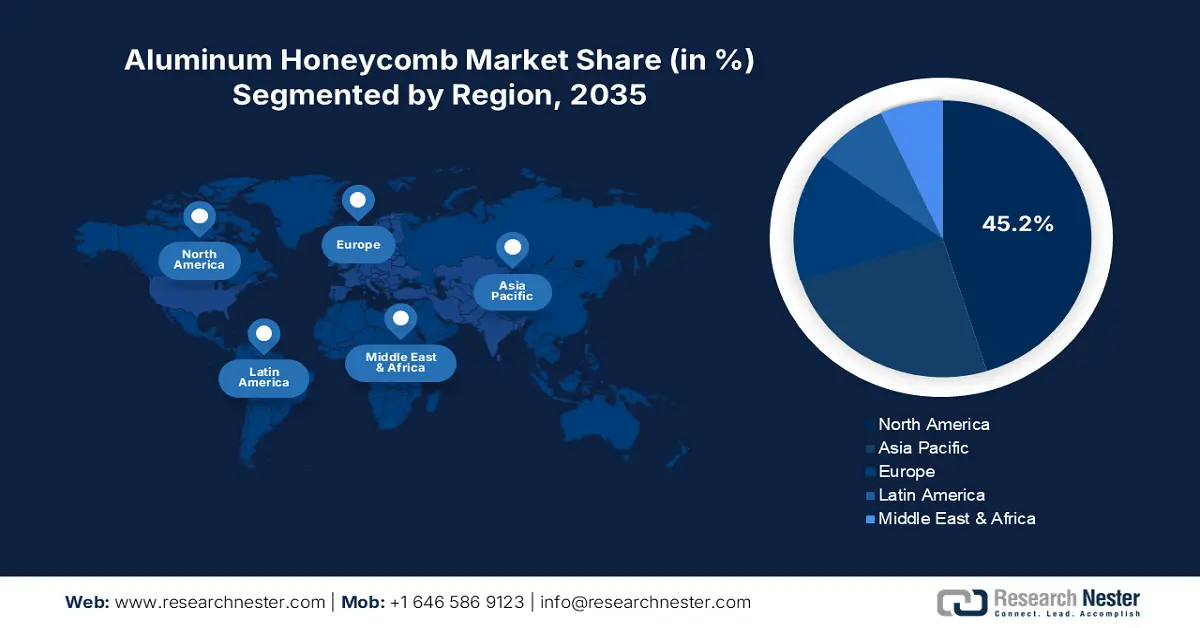

Regional Highlights:

- North America dominates the Aluminum Honeycomb Market with a 45.2% share, driven by technological innovations, infrastructure investment, and aerospace & defense market expansion, ensuring robust growth through 2035.

- The Aluminum Honeycomb Market in Asia Pacific is forecasted to grow rapidly through 2026–2035, fueled by urbanization, infrastructure investments, and adoption of innovative automotive materials.

Segment Insights:

- Aerospace & Defense segment is forecasted to hold a dominant share by 2035, driven by lightweight and high-strength demands supported by government investments.

- Architectural & Building Panels segment are expected to secure over a 67.1% share by 2035, fueled by the increasing adoption of renewable energy sources and modern architectural trends.

Key Growth Trends:

- Boasting construction industry

- Rising innovations in automotive manufacturing

Major Challenges:

- Competition from alternative materials

- Supply chain vulnerabilities

- Key Players: Hexcel Corporation, Argosy International Inc., Plascore, Corex Honeycomb, Coach Line Industries, and Euro-Composites Group.

Global Aluminum Honeycomb Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.71 billion

- 2026 Market Size: USD 3.91 billion

- Projected Market Size: USD 6.71 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, Japan, India, South Korea, Brazil

Last updated on : 13 August, 2025

Aluminum Honeycomb Market Growth Drivers and Challenges:

Growth Drivers

- Boasting construction industry: The boom in the construction sector is generating profitable opportunities for aluminum honeycomb manufacturers. Innovations in infrastructure designs are fueling the use of aluminum honeycomb products. The push towards renewable energy and sustainable structures is also accelerating the sales of aluminum honeycombs. Aluminum honeycombs offer high-performance and superior properties for solar energy panels and wind turbine blades. According to the World Economic Forum (WEF), the infrastructure development project contributes around 79.0% of total greenhouse gas emissions. Aluminum honeycombs are an effective and sustainable product that aids in carbon emissions as they are made from recycled aluminum, which uses around 95.0% less energy than direct production from raw ore.

- Rising innovations in automotive manufacturing: The lightweight trend in the automotive sector aimed at meeting strict fuel efficiency standards and mitigating carbon emissions is boosting the adoption of aluminum honeycombs for the production of light vehicle body structures, bumpers, and doors. The increasing adoption of electric vehicles is also fueling the sales of aluminum honeycombs to improve the range and performance of vehicles. For instance, in April 2023, the Aluminum Association survey estimated a surge in aluminum in the EV market from leading vehicle manufacturers and Tier 1 suppliers. Aggressive CO2 and Miles Per Gallon (MPG) regulatory standards are augmenting the adoption of electric vehicles and aluminum sales. Furthermore, the same source anticipates that the battery electric light trucks are projected to average 644.0 pounds of aluminum content by 2030. Thus, aluminum honeycomb sales are directly influenced by EV and other propulsion-type vehicle adoption.

Challenges

- Competition from alternative materials: The aluminum honeycomb manufacturers are facing high competition from alternative solutions, which is hindering the overall market growth to some extent. Foam panels, plastic honeycombs, and lightweight wood structures are some of the competitive materials creating a competitive threat to key players. The major competition is observed in industries such as packaging and automotive, where cost efficiency is vital.

- Supply chain vulnerabilities: The supply chain vulnerabilities have the capability to potentially hamper the production of aluminum honeycombs. Restrictions on mining and scarcity of metals uplift the process of aluminum. In such cases, competitive pricing strategies do not perform well due to low to zero profit margins. Overall, the disruptions in the raw material supply chains hinder the aluminum honeycomb market growth to some extent.

Aluminum Honeycomb Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 3.71 billion |

|

Forecast Year Market Size (2035) |

USD 6.71 billion |

|

Regional Scope |

|

Aluminum Honeycomb Market Segmentation:

Application (Architectural & Building Panels, Floor Structures & Stairways, Energy Absorption, Others)

The architectural & building panels segment is poised to capture over 67.1% aluminum honeycomb market share by 2035. The increasing adoption of renewable energy sources such as solar panels in modern homes is augmenting the use of aluminum honeycombs in architectural and building panels. The formation of modern structures aesthetically better is the latest trend fueling the sales of aluminum honeycombs. The versatility and flexibility of aluminum honeycombs allow for creative and aesthetically pleasing facades, cladding, and interior applications, making them popular for modern architectural designs. Furthermore, thermal and acoustic insulation properties, durability, corrosion resistance, and recyclability are some of the other characteristics fueling the sales of aluminum honeycombs.

End use Industry (Aerospace & Defense, Marine, Automotive, Transportation, Building & Construction, Energy, Others)

The aerospace & defense segment is forecast to account for a dominant aluminum honeycomb market share throughout the study period. The lightweight and high strength are prime factors fueling the adoption of aluminum honeycombs in the aerospace & defense sectors. The need for specialized materials that offer superior performance is augmenting the use of aluminum honeycombs in aerospace & defense settings. Furthermore, high investments by the governments in advancing their aerospace & defense segments are creating high-earning opportunities for aluminum honeycomb product producers. For instance, the Aluminum Association states that aluminum is a vital component in aerospace manufacturing owing to its lightweight, durability, and flexibility. The same source also estimates that the USD 2.5 billion Mars Curiosity Rover mission would not have been possible without aluminum.

Our in-depth analysis of the global aluminum honeycomb market includes the following segments:

|

Application |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aluminum Honeycomb Market Regional Analysis:

North America Market Forecast

North America aluminum honeycomb market is expected to capture revenue share of over 45.2% by 2035. Technological innovations, the green building trend, increasing investments in infrastructure development projects, and expanding aerospace and defense markets are fueling the sales of aluminum honeycombs. The strong existence of automotive manufacturing companies and increasing integration of renewable energy sources is propelling the sales of aluminum honeycombs in both the U.S. and Canada.

In the U.S., the increasing demand for lightweight and durable materials in the automotive and aerospace sectors is augmenting the growth of the aluminum honeycomb market. The strict carbon emission regulations and sustainability goals are driving manufacturers to invest in aluminum materials to improve fuel efficiency and operational costs. The growth in these sectors is set to directly augment the sales of aluminum honeycombs. According to Aerospace Industries Association (AIA) states that in 2023, the aerospace & defense sector calculated over USD 955.0 billion in sales, a 7.1% hike from the previous year. The industry also generated an employment opportunity for around 2.21 million individuals in 2023.

In Canada, the rise in infrastructure development programs and renewable energy trends are propelling the sales of aluminum honeycombs. The green building trends and sustainable construction practices are further creating lucrative opportunities for aluminum honeycomb producers in the country. For instance, in the 2022 budget, the Government of Canada allotted over USD 33.0 billion to the Infrastructure Program. Also, the Government of Newfoundland and Labrador, Canada, disclosed that in 2023 it has spent nearly USD 767.0 million (around Canadian 1.1 billion dollars) for infrastructure development.

Asia Pacific Market Statistics

The Asia Pacific aluminum honeycomb market is set to rise at the fastest CAGR from 2026 to 2035. The swift urban and industrial activities are propelling the sales of aluminum honeycombs. The growing investments in infrastructure development and upgrade projects, high mining activities, and increasing adoption of innovative materials in the automotive sector are fueling the sales of aluminum honeycombs. India and China are long-term return marketplaces for aluminum honeycomb manufacturers. Forefront at innovations, Japan and South Korea are set to witness high trade of advanced aluminum honeycombs.

In India, high infrastructure development investments by the government are attracting numerous international aluminum honeycomb manufacturers. For instance, the India Brand Equity Foundation (IBEF) report reveals that the PM of India inaugurated multiple connectivity projects of around USD 1.8 billion in Kolkata. In the interim budget 2024-25, the capital investments for infrastructure development surpassed by 11.1% to USD 133.86 billion, around 3.4% of the economy. The rapid urban activities are propelling the sales of aluminum honeycombs.

China is the largest producer of aluminum in the world and accounts for 60.0% of total production share. The rapidly expanding automobile ownership rates in the country are further highlighting a high adoption of aluminum honeycombs. The International Energy Agency (IEA) states that around 4.0 million cars were exported by China in 2023 out of which 1.2 million were of electric propulsion systems. The high automobile trade activities are swiftly promoting the sales of aluminum honeycombs in the country.

Key Aluminum Honeycomb Market Players:

- Hexcel Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Argosy International Inc.

- Plascore

- Corex Honeycomb

- Coach Line Industries

- Euro-Composites Group

- Benecor, Inc.

- Strata Manufacturing

- Aludecor

- Bostik

- Alucoil

- Universal Metaltek

- Motonity Private Limited

- Covestro

- EconCore

The leading companies in the aluminum honeycomb market are employing several organic and inorganic strategies to earn high profits and maximize their reach. Technological advancements, investments in research and development activities, strategic collaborations and partnerships, mergers and acquisitions, and global expansion are some of the marketing tactics used by industry giants to stand out from the crowd. Key players are forming strategic collaborations to introduce innovative solutions and earn high profits. By entering untapped markets, the industry giants are grabbing high-earning opportunities.

Some of the key players include:

Recent Developments

- In May 2023, Strata Manufacturing (Strata) in strategic collaboration with Mohammed Bin Rashid Space Centre (MBRSC) established local satellite component manufacturing of aluminum honeycomb panels. This collaboration is anticipated to drive technological advancements in the UAE’s space industry.

- In July 2023, Aludecor announced the launch of the next-generation aluminum honeycomb Nexcomb. These solutions are finding widespread applications in construction, transportation, aeronautics, and aviation.

- Report ID: 7058

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aluminum Honeycomb Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.