Aluminum Extrusion Market Outlook:

Aluminum Extrusion Market size was over USD 101.82 billion in 2025 and is anticipated to cross USD 219.82 billion by 2035, growing at more than 8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aluminum extrusion is assessed at USD 109.15 billion.

The aerospace sector is anticipated to substantially boost aluminum extrusion sales in the coming years due to the high demand for innovative and lightweight materials. The increasing use of aluminum extrusions in aircraft, helicopters, or other military vehicles to replace heavier materials such as steel to improve performance and fuel efficacy is set to propel the overall aluminum extrusion market growth in the years ahead. The report by Secure Energy reveals that the military of the U.S. heavily relies on aluminum to enhance its national security. Aircraft structural components and parts, space and missile-related components, naval vessels, and propellants all make high use of aluminum alloys, representing nearly 40.0% of the U.S. aerospace material market. The demand for aluminum alloys in U.S. aerospace is poised to expand at a growth rate of 3.5% each year till 2028 owing to net zero emission commitments adopted by around 290 airlines.

The aluminum scrap trade is potentially influencing the revenues of aluminum extrusion manufacturers. For instance, the U.S. Geological Survey (USGS) unveiled that the aluminum recovered from purchased scrap totaled 3.3 million tons, 55.0% from new manufacturing scrap, and 45.0% from old discarded products. The major import sources were Canada (52.0%), United Arab Emirates (8.0%), Bahrain (4.0%), Russia (4.0%), and others (32.0%). This highlights that the recyclable characteristics of aluminum without losing quality uplifts its use in extrusion products.

Key Aluminum Extrusion Market Insights Summary:

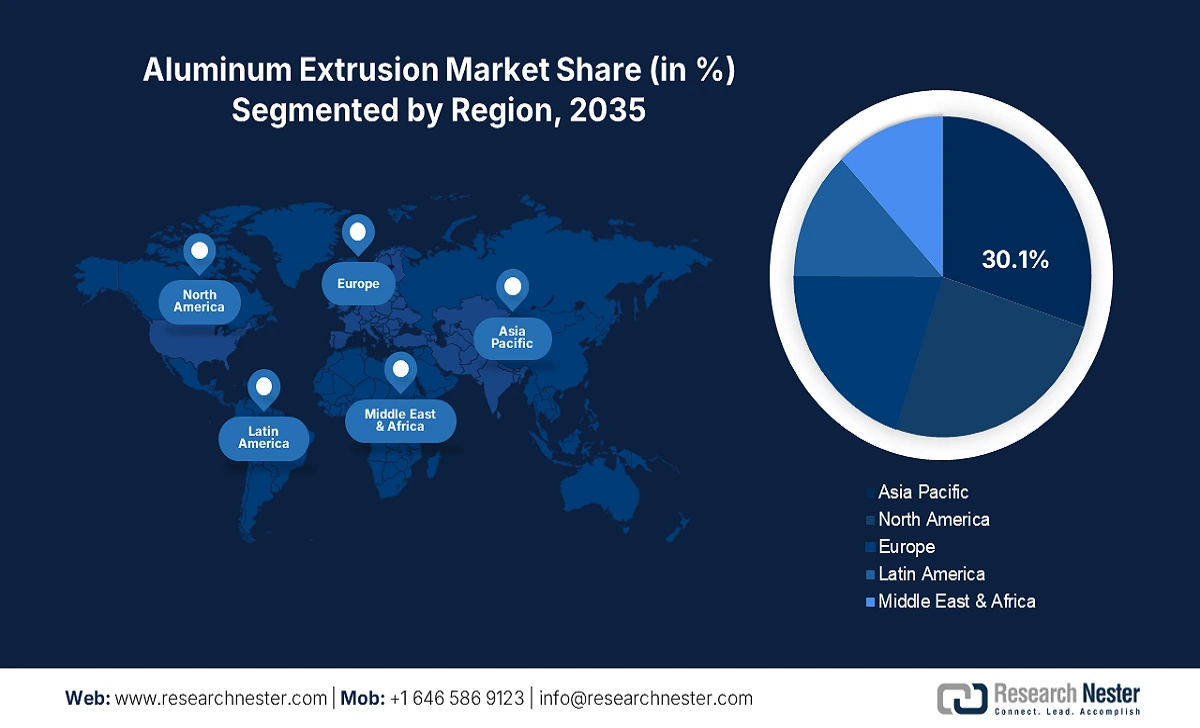

Regional Highlights:

- Asia Pacific dominates the Aluminum Extrusion Market with a 30.1% share, driven by increasing construction activities and infrastructure development, ensuring robust growth through 2026–2035.

- North America's Aluminum Extrusion Market is projected for rapid growth through 2026–2035, driven by investments in green building structures and increasing demand for EVs.

Segment Insights:

- Building & Construction segment is forecasted to hold over 56.8% share by 2035, propelled by rapid urbanization driving demand for residential and commercial structures.

- Mill-finished Product segment is projected to hold over a 55% share by 2035, driven by high demand in construction and automotive sectors fueled by urbanization, infrastructure development, and electric vehicle adoption.

Key Growth Trends:

- Increasing applications in automobile manufacturing

- Emerging applications in electrical and electronics solutions

Major Challenges:

- Aluminum extrusion is a costly and energy-intensive process

- Intense competition lowering revenue growth

- Key Players: LoadLok, Alumex PLC, Hydro Aluminium (Suzhou) Co., Ltd, and Jiangsu Gongchang Precision Aluminum Co., Ltd.

Global Aluminum Extrusion Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 101.82 billion

- 2026 Market Size: USD 109.15 billion

- Projected Market Size: USD 219.82 billion by 2035

- Growth Forecasts: 8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (30.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Aluminum Extrusion Market Growth Drivers and Challenges:

Growth Drivers

- Increasing applications in automobile manufacturing: The push towards fuel-efficient vehicles is driving the sales of aluminum extrusion solutions in the automotive industry. Aluminum extrusions find wide application in heat exchangers, structural components, and various parts of vehicles. The demand is majorly backed by the need for lighter and more durable materials to meet emission regulations and fuel economy. The Aluminum Association study highlights that by 2030, the use of aluminum is forecast to increase to content levels of 556 pounds per vehicle (PPV), whereas battery electric light trucks are anticipated to average 644 pounds. Both internal combustion engines (ICE) and electric vehicles (EV) are set to drive lucrative opportunities for aluminum extrusion manufacturers in the coming years.

- Emerging applications in electrical and electronics solutions: Being a good conductor, extruded aluminum is finding emerging applications in electrical and electronics. Photovoltaic (solar) panel support structures, picture frames & display cabinets, and point-of-sale displays are major application areas for aluminum extrusions. The rise in electrical and electronics sector growth is poised to push the sales of extruded aluminum solutions in the years ahead. For instance, the Aluminum Association study estimates that aluminum use in the electrical market is expected to increase at a high growth rate in the years ahead.

Challenges

- Aluminum extrusion is a costly and energy-intensive process: Aluminum extrusion is a capital-intensive business, and start-ups or small-scale companies are expected to invest a huge amount in manufacturing infrastructure. Businesses with low budgets often hesitate to enter into aluminum extrusion market leading to low trade activities and high product costs. Aluminum extrusion requires high use of electricity due to its complex Bayer process. This acts as a hurdle in meeting zero emission goals and ultimately aluminum extrusion sales.

- Intense competition lowering revenue growth: Apart from substantial capital, entering the aluminum extrusion business is most challenging due to the strong presence of existing gigantic players. Both domestic and international market players are major competitors for revenue growth. High price sensitivity drives manufacturers to focus on innovation and cost-effectiveness to stay competitive in the landscape. Strong competition leads to pressure on profitability and shut down of small businesses, hampering the overall market growth.

Aluminum Extrusion Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8% |

|

Base Year Market Size (2025) |

USD 101.82 billion |

|

Forecast Year Market Size (2035) |

USD 219.82 billion |

|

Regional Scope |

|

Aluminum Extrusion Market Segmentation:

Product (Mill-finished, Anodized, Powder Coated)

The mill-finished segment is anticipated to capture aluminum extrusion market share of over 55% by 2035. The mill-finished extruded aluminum is finding high application in the construction and automotive sectors owing to its durability, strength, and high performance. The mill-finished extruded aluminum demand is majorly driven by the urbanization and the ongoing infrastructure development projects. Asia Pacific is the most lucrative marketplace for mill-finished aluminum extrusion companies. The increasing adoption of electric vehicles is further poised to fuel the consumption of aluminum extrusion products.

End use (Building & Construction, Automotive & Transportation, Electrical & Electronics, Consumer Goods, Electrical & Energy, Ohers)

In aluminum extrusion market, building and construction segment is poised to capture revenue share of over 56.8% by 2035. The increasing demand for residential and commercial structures in both developed and developing regions particularly due to the swift rise in migration of people towards urban areas. The World Health Organization (WHO) reveals that more than 55.0% of the global population resides in urban areas and this is expected to rise to 68.0% by 2050.

Our in-depth analysis of the global aluminum extrusion market includes the following segments:

|

Product |

|

|

End use |

|

|

Alloy Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aluminum Extrusion Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific aluminum extrusion market is anticipated to capture revenue share of over 30.1% by 2035. The increasing construction activities and infrastructure development projects are opening profitable doors for aluminum extrusion companies. The boasting automobile and electronics market is also poised to double the revenues of aluminum extrusion manufacturers. China and India are the most opportunistic marketplaces owing to rapid urbanization and industrialization activities. The innovations and smart city initiatives are fueling the sales of aluminum extrusions in Japan and South Korea.

China being the leading producer of aluminum is emerging as the most profitable for aluminum extrusion market producers. The country captures nearly 60.0% of the global aluminum production share. The swiftly expanding automobile production and supply of both ICE and EV are further propelling the sales of extruded aluminum. For instance, the International Energy Agency (IEA) study reveals that in 2023, approx. 4.0 million cars were exported by China, with 1.2 million units of electric propulsion systems.

India’s rising construction and infra-development projects are positively fueling the consumption of aluminum. Lightweight and durable extruded aluminum enhances the aesthetic look of the buildings. For instance, the India Brand Equity Foundation (IBEF) states that international companies particularly engineering, aviation, and construction are rapidly increasing their operation in the country with over 50 registered companies in 2024. Further, around USD 1.8 billion worth of various connectivity projects were inaugurated in March 2024.

North America Market Statistics

The North America aluminum extrusion market is expected to increase at the fastest pace during the forecast period. The aerospace & defense sector is poised to propel the sales of aluminum extrusion products in the coming years. The emission goals and fuel economy trend are backing the trade of extruded aluminum. The EV trend and investments in green building structures are expected to uplift the demand for aluminum extrusion solutions.

The energy efficiency and climatic commitments are driving the demand for recyclable extruded aluminum products in the U.S. construction sector. For instance, the Aluminum Extruders Council (AEC) states that by winning tariff protection, aluminum extrusion companies are achieving a level of competition. The offset unfair trade practices of extruders/importers of aluminum products produced in China are aiding American companies to earn more. Around 1.2 billion pounds of extrusion is generated in the country annually. Positive trade practices are set to augment the extruded aluminum sales in the country.

Canada’s robust investment in infrastructure development activities is fueling the sales of extruded aluminum products. The increasing demand for both commercial and residential structures is also estimated to fuel the sales of aluminum extrusion products. In 2022, the government invested over USD 33.0 billion in the Infrastructure Program. Nearly 1.1 billion was funded by the Government of Newfoundland and Labrador, Canada, in infra-development in 2023. Continuous construction actions are poised to double the revenues of aluminum extrusion companies in the coming years.

Key Aluminum Extrusion Market Players:

- LoadLok

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alumex PLC

- Hydro Aluminium (Suzhou) Co., Ltd

- Jiangsu Gongchang Precision Aluminum Co., Ltd

- Shandong Hongyuan Metal Materials Co., Ltd

- Alom Extrusions Limited

- Global Aluminium Private Limited

- Jindal Aluminium, Ltd.

- Mittal Extrusions

- Estral S.p.A.

- Pasturi S.r.l.

- Hindalco Industries Limited,

- Aluminium Products Company (ALUPCO)

- Arconic Corporation,

- Bahrain Aluminium Extrusion Co. (BALEXCO)

- China Zhongwang, Constellium N. V.

- Gulf Extrusion Co. LLC.

Leading companies are investing in several organic and inorganic marketing strategies such as new product launches, technological innovations, mergers & acquisitions, partnerships and collaborations, and global expansion to maintain their positions and earn high profits in the competitive landscape. Consistent introduction of new products attracts a wider consumer base, aiding to stand out of the crowd. Strategic collaborations and partnerships with other players help to expand the product folio and market reach. Key players also enter emerging markets to grab untapped opportunities.

Some of the key players include aluminum extrusion market:

Recent Developments

- In November 2024, Alumex PLC a leading player in the aluminum extrusion sector announced the inauguration of its Ascend facility in Sri Lanka. Through this move, the company is strengthening its market presence and product folio with innovation, high quality, and sustainability.

- In June 2024, LoadLok introduced IsoLok 3073 Alu RS Track an advanced aluminum extrusion track system to enhance payload and production efficiency for refrigerated trailers. The solution is estimated to save users over 40% on energy consumption and CO2 emissions.

- Report ID: 7191

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aluminum Extrusion Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.