Global Market Size, Forecast, and Trend Highlights Over 2025-2037

Aluminum Extruded Products Market size was valued at USD 90.2 billion in 2024 and is projected to reach a valuation of USD 292.1 billion by the end of 2037, rising at a CAGR of 9.4% during the forecast period, i.e., 2025-2037. In 2025, the industry size of aluminum extruded products will be valued at USD 98.4 billion.

Expansion of the aluminum extruded products market is being driven by demand for the product across the construction, automotive, and clean energy sectors. In April 2025, Alcoa established a joint venture with IGNIS EQT, supporting the San Ciprian plant in Spain. Alcoa committed to providing up to USD 108 million in operations funding. This will guarantee a continued supply of high-quality billets. In addition, manufacturers are increasingly using recycled content and automated extrusion lines to be more sustainable and efficient. Market expansion is supported by government-backed green building initiatives and evolving global trade standards. These trends further support the role of aluminum extrusions in next-gen architecture and lightweight transport.

The global aluminum extruded products market is being shaped by emerging standards and international collaborations. The global adoption of ISO 6361-2:2014 in January 2024 harmonizes mechanical property standards for extruded aluminum profiles. This makes the product more reliable and easier to comply with cross-border for suppliers. At the same time, powder coating and anodizing methods are advancing to higher quality standards. Additionally, countries such as China and India are increasing their domestic capacity to reduce import dependence. These indications show a movement towards standardization of quality and energy-efficient aluminum extrusion practices. Players in the sector are becoming more innovation-driven and globally integrated.

Aluminum Extruded Products Market: Growth Drivers and Challenges

Growth Drivers

-

Global EV production rise: The rise in global EV production is one key growth driver that has intensified the need for high precision extruded profiles. In April 2023, Gloria Aluminum increased EV enclosure production to accommodate thermal management and safety needs. Lightweight aluminum helps to reduce vehicle mass and increases efficiency and range. Consistent extrudability and corrosion resistance are required for battery enclosures and structural components. The large-format profile investments are being driven by the EV boom globally. OEM specifications are catered to suppliers and receive higher recurring contracts. This further enhances extrusion’s status as a critical component of future mobility platforms.

-

Renewable energy infrastructure surges: Another major driver for aluminum extruded products is the surge in renewable energy infrastructure. In March of 2023, Array Technologies expanded its partnership with EAC to scale local extrusion of solar systems in the U.S., where using recycled aluminum in solar frames lowers lifecycle emissions while retaining strength. As climate targets become binding, countries are looking to use durable and modular construction materials. Due to its lightweight and corrosion resistance, aluminum is well-suited for PV racking, wind turbine frames, and substation structures. Energy transitions are expected to accelerate, and this demand tailwind is expected to continue through 2037.

-

Modernization of construction and real estate: The third key growth factor is construction and real estate modernization. In April 2024, Capral Aluminium launched its VOC-minimizing CUBE Plus powder coating line in Australia. Now, developers who are looking to build ESG-compliant buildings are drawn to green-certified profiles. Extrusions are increasingly being mandated in facades, curtain walls, and cladding systems as these projects become more urban. Aluminum is flexible in shaping, and design-grade finishing adds aesthetic and functional value. Procurement strategies are being influenced by regulatory focus on low-carbon building materials. As a result, extruded aluminum is seen as a preferred option for next-generation construction solutions.

Challenges

-

Regulatory fragmentation across markets: Another challenge is regulatory fragmentation across markets, making compliance for global suppliers difficult. The Aluminum Association in the U.S. requested adherence to ASTM B308/B308M-02 for structural profiles in April 2024. In order to remain competitive, suppliers have to align with local codes, which is increasing certification costs. However, these discrepancies result in longer time-to-market and more operational complexity. Although policymakers are pushing for regional harmonization, there are gaps across Asia, Europe, and North America.

-

Production processes with high levels of energy consumption: The production processes are becoming increasingly energy-intensive owing to the growing demand for carbon neutrality. Smelters and extrusion plants are in the process of converting to renewable power. Smaller players, on the other hand, find it difficult to adjust to new energy benchmarks and risk losing market share. However, the cost of transitioning to cleaner energy sources can also be a barrier for these smaller enterprises. This is anticipated to result in more consolidation in the aluminum extrusion market.

Aluminum Extruded Products Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

9.4% |

|

Base Year Market Size (2024) |

USD 90.2 billion |

|

Forecast Year Market Size (2037) |

USD 292.1 billion |

|

Regional Scope |

|

Aluminum Extruded Products Segmentation

Product Type (Mill-Finished, Powder-Coated, Anodized)

The mill-finished segment is anticipated to account for the largest 42.5% aluminum extruded products market share during the forecast period. The mill-finished type provide cost-effective and versatile products across the transport and industrial sectors. To meet aerospace demand, SNALCO expanded automated profile machining capacity in March 2024. Additional surface treatments can be performed on mill-finished profiles, which are a starting point for customization. They are used for their strength-to-weight advantages in structural frames and platforms. Demand is also driven by rapid availability and broad alloy compatibility. The core output of the extrusion industry remains mill-finished products as applications diversify.

Alloy Type (1000 Series, 2000 Series, 3000 Series, 5000 Series, 6000 Series, 7000 Series, Others)

The 6000 series alloy segment of aluminum extruded products market is expected to hold around 60.4% through 2037. This alloy is known for its excellent extrudability and corrosion resistance, along with its strength-to-weight ratio, for supporting demanding sectors. In March 2024, CHAL Precision Aluminum began production on 6000 series tubes for global EV and electronics clients. The mechanical performance of the alloy is improved due to its compatibility with T6 heat treatment. It is versatile enough to fit into aerospace, automotive, and construction markets. With further demand for higher tolerance and higher strength profiles, 6000 series alloys is anticipated to be an important part of premium grade extrusions.

Our in-depth analysis of the global aluminum extruded products market includes the following segments:

|

Product Type |

|

|

Alloy Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

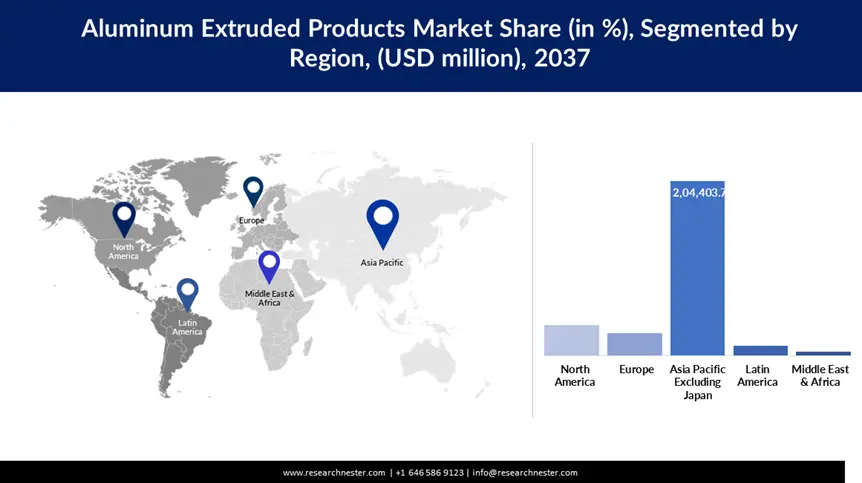

Aluminum Extruded Products Industry - Regional Synopsis

APEJ Market Statistics

Asia Pacific excluding Japan (APEJ) is anticipated to dominate the aluminum extruded products market with a 69.9% share during the forecast period. China and India are both scaling capacity and automation to meet their local demand as well as the demand for export. In March 2024, Padmawati Extrusion introduced 2000 and 7000 series profiles to reduce import dependence. This step makes India more self-reliant in precision manufacturing. Cost efficiencies and rising domestic consumption are also good for regional suppliers. Additionally, exports to Africa, the Middle East, and Southeast Asia are supported by trade agreements.

In terms of production scale and downstream integration, China is anticipated to remains dominant. JMA Aluminum expanded operations in March 2024 with 50 active extrusion machines. With large-format profiles, the company aims for global construction markets. Government subsidies for smart cities and solar infrastructure fuel long-term extrusion demand. China has a structural advantage in terms of midstream capacity and tooling access. The rising ESG scrutiny, however, propels firms to source greener inputs.

Extrusion is being rapidly adopted in India transport, infrastructure, and renewable energy sectors. In April 2025, Hindalco announced a commitment to spend USD 5 billion to expand its aluminum operations. High precision engineered extrusions are the focus of investment for global aluminum extruded products markets. There is a rising demand from India’s PLI schemes, rail modernization, and EV policies. Additionally, domestic producers are also investing in alloy diversification and recycling. Lightweight engineered aluminum profiles are emerging as an important supply base for India.

North America Market Analysis

The aluminum extruded products market in North America is projected to expand at a CAGR of 9.5% through 2037. Federal investments in green infrastructure and domestic supply chain resilience support this growth. In April 2024, Kaiser Aluminum modernized its Tennessee facility with automated casting lines. This move is beneficial for aerospace and defense applications where consistent mechanical properties are required. Buy American policies and inflation reduction acts favor U.S.-based extruders. The domestic use of aluminum is expected to surge as infrastructure bills unlock new projects.

Aluminum extrusions play a central role in energy and transport initiatives in the U.S. According to the Aerospace Industries Association, in March 2023, aerospace contributed 1.6% to GDP, and aluminum is a structural part of it. Wings, landing gear bays, and interior framing are made of mill-finished and 6000 series profiles. Global supply chain disruptions are prompting U.S. OEMs to source more domestically. These fuels localized extrusion investments. Also, producers with high precision and certified facilities are favored by the U.S. aluminum extruded products market.

Canada is integrating hydropower to focus on green aluminum output. In April 2024, Rio Tinto started producing billet with clean energy at its Canada site. This supports national decarbonization targets and expanding demand from EV and construction clients. Due to their proximity to the U.S. and Europe markets, Canada manufacturers are well-positioned to serve them. Low-carbon metal sourcing has been favored by export incentives and ESG reporting mandates. Canada’s market share is expected to rise as global buyers seek out sustainable aluminum.

Companies Dominating the Aluminum Extruded Products Landscape

- Alcoa Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aluminum Bahrain (Alba) B.S.C.

- Al Ghurair Group

- CHAL Precision Aluminium

- Hindalco Industries Ltd.

- JM Aluminum

- Kaiser Aluminum

- Norsk Hydro ASA

- Padmawati Extrusion

- RusAL

- Rio Tinto

- SNALCO

The aluminum extruded products market is extremely competitive on a global scale, with regional leaders competing for scale, precision, and sustainability. Chongqing Chal Precision Aluminium Co., Ltd., Hindalco Industries Ltd., JM Aluminium, Kaiser Aluminium, Padmawati Extrusion, Rio Tinto, SNALCO, Alcoa Corporation, Aluminium Bahrain B.S.C., Al Ghurair Group, Norsk Hydro ASA, and RusAL are some of the key players in the global aluminium foam market. These companies utilize advanced extrusion presses, digital controls, and low-emission production lines.

Hydro's strategic partnerships with EV makers provide access to niche markets. In February 2024, Norsk Hydro acquired Hueck GmbH to add to its Europe profile portfolio. This acquisition adds to Hydro’s architectural and industrial offerings. This strengthens its presence in Germany and allows it to supply custom profile solutions. The move is in line with Hydro’s vision of reaching net-zero extrusions by 2030. Large players continue to utilize consolidation and cross-border M&A as core tactics to optimize distribution and specialty offerings. This development cements the trend towards greener, smarter aluminum extrusions globally.

Here are some leading companies in the aluminum extruded products market:

Recent Developments

-

In March 2025, Hydro announced an USD 85 million investment to build a casting line in Kentucky. The Henderson facility will supply recycled aluminum to U.S. automakers. Supported by Kentucky’s tax incentives, it will add 28,000 tonnes in annual capacity. Hydro reinforces its EV-aligned extrusion strategy.

-

In March 2025, RUSAL began using eco-friendly petroleum pitch for anode production in aluminum electrolysis. This innovation reduces toxic emissions compared to traditional coal-tar pitch. The shift follows a USD 1.1 million R&D initiative. RUSAL pioneers sustainable feedstock alternatives in smelting.

-

In April 2024, Al Ghurair Group increased powder coating capacity in the UAE for extruded profiles. The upgrade supports Gulf housing and commercial sectors. It ensures weather-resistant finishes for exposed structures. Al Ghurair expands architectural aluminum production capacity.

- Report ID: 4128

- Published Date: May 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aluminum Extruded Products Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert