Aluminum Die Casting Market Outlook:

Aluminum Die Casting Market size was valued at USD 84.9 billion in 2025 and is set to exceed USD 147.79 billion by 2035, registering over 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aluminum die casting is estimated at USD 89.26 billion.

The aluminum die casting market is undergoing major transformation owing to the integration of automation, robotics, and AI-based quality control methods. The die casting industry is becoming more competitive, as these technologies achieve better product consistency, along with lower defect rates and better operational effectiveness. The aluminum casting and forging industry is witnessing growth with automation, as combining robots allows more efficiency and lower expenses. For the forging process, automated systems execute the functions of die lubrication while also handling parts as well as performing quality checks, resulting in increased efficiency and enhanced operational safety.

Major companies are joining forces to introduce cutting-edge solutions in this sector. Toyota Industries Corporation formed an alliance with Siemens in April 2021, to create an artificial intelligence system that detects product issues in aluminum die casting. Through their collaborative effort, both organizations aim to improve productivity and quality results by utilizing AI, that performs real-time data analysis and monitoring to enable quick corrective measures for defect reduction. The aluminum die casting market is expected to witness new investments directed towards robotic die casting machines along with AI-powered process optimization tools, promoting improved efficiency including enhanced quality control.

The demand for the aluminum die casting industry is also rising with the increase in the production of aluminum around the globe. As reported by the U.S. Geological Survey (2021), China dominated the global primary aluminum manufacturing, by producing an amount of 38.5 million metric tons that sustained 58% of global aluminum output. India secured the second position as a primary aluminum producer with 3.9 million metric tons of production that amounted to 6.0% of global output. The combined contribution of Russia and Canada amounted to 5.0 each, percent of total production, through their output of 3.7 million metric tons and 3.1 million metric tons. The following table highlights the primary aluminum production by country.

Global Primary Aluminum Production by Country (2021)

|

Country |

Production (Million Metric Tons) |

Percentage (Global Production) |

|

China |

38.5 |

58% |

|

India |

3.9 |

6.0% |

|

Russia |

3.7 |

5.0% |

|

U.S. |

0.8 |

1.3% |

|

Canada |

3.1 |

5.0% |

Source: The U.S. Geological Survey

Key Aluminum Die Casting Market Insights Summary:

Regional Highlights:

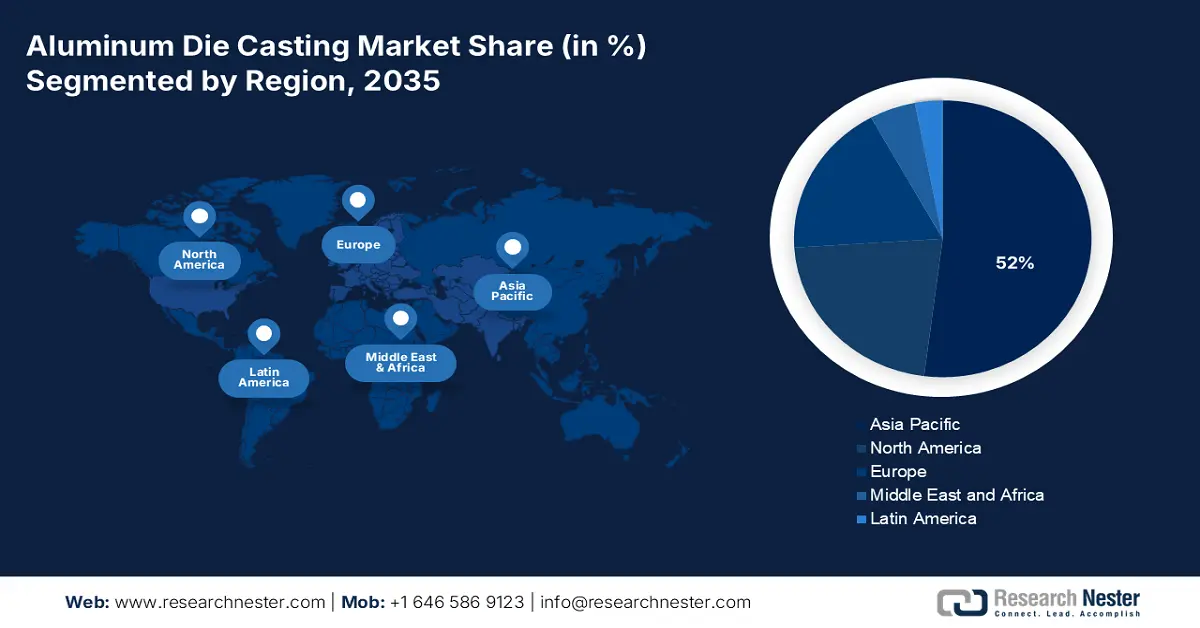

- Asia Pacific commands the Aluminum Die Casting Market with a 52% share, propelled by rising automotive and construction industry operations in the region, fostering growth through 2026–2035.

- North America's Aluminum Die Casting Market is anticipated to grow rapidly by 2035, driven by the need for lighter vehicles and strict regulations for fuel economy and emissions.

Segment Insights:

- The Pressure Die Casting segment is expected to account for over 54.4% market share by 2035, propelled by advancements in smart manufacturing with Industry 4.0 technologies.

Key Growth Trends:

- Expansion of electricals and electronics

- Innovations in die casting technologies

Major Challenges:

- Energy-intensive production process

- Limited adoption in certain sectors

- Key Players: GF Casting Solutions, Dynacast Deutschland GmbH, Consolidated Metco Inc., and Shiloh Industries Ltd.

Global Aluminum Die Casting Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 84.9 billion

- 2026 Market Size: USD 89.26 billion

- Projected Market Size: USD 147.79 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (52% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, Italy

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Aluminum Die Casting Market Growth Drivers and Challenges:

Growth Drivers

- Expansion of electricals and electronics: The aluminum die casting market benefits substantially from the growth of the electronics and electrical industries as the die casting is extensively used in consumer electronics, communication devices, and power distribution components. These devices and components require high-precision aluminum die-cast parts, owing to expanding smartphone production, together with 5G infrastructure development and rising electric power tool consumption. Electronic goods benefit from efficient heat dispersion due to the superior thermal conductive properties in aluminum die cast, promoting the device's performance and operational lifespan. The combination of aluminum's corrosion protection together with its durability enables the material to serve perfectly as components in situations with changing environmental exposures while bringing reliability along with longevity benefits.

- Innovations in die casting technologies: Die casting technologies, including high-pressure die casting, vacuum die casting and squeeze casting have improved the efficiency and precision of aluminum die-cast products. The combination of advanced die casting technologies with automation and Industry 4.0 intelligent systems delivers better production velocity and lower expenses together with diminished material waste, which strengthens the aluminum die casting market. The combination of digital twins and Industrial 4.0 technology has led to a revolutionary transformation of aluminum die casting operations in recent times.

Challenges

- Energy-intensive production process: The processing energy requirements during aluminum die casting reach high levels due to the need for hot temperatures to fuse aluminum materials along with the operation of casting equipment. The high levels of electricity consumption and fuel requirements result in production expenses, that rise due to global power price changes. Governments implement stronger energy efficiency and carbon emission regulations, forcing the manufacturers to spend on energy-efficient systems. The implementation of regenerative burners and electric furnaces produces cost reduction outcomes but the casting companies struggle with the expenses needed to meet compliance requirements as well as address their infrastructure update needs.

- Limited adoption in certain sectors: The application of aluminum die casting remains restricted in medical devices and aerospace markets due to regulatory constraints. These sectors need high-precision elements, biocompatibility as well as resistance to high temperatures, that can be better fulfilled by the methods such as CNC machining and additive manufacturing. Die-cast aluminum components confront difficulties when subject to the rigorous requirements of FDA medical device regulations as well as AS9100 aerospace standards. Extended material testing requirements alongside compliance processes act as barriers for die casting to gain widespread adoption in specialized applications.

Aluminum Die Casting Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 84.9 billion |

|

Forecast Year Market Size (2035) |

USD 147.79 billion |

|

Regional Scope |

|

Aluminum Die Casting Market Segmentation:

Production Process (Pressure Die Casting, Others)

Pressure die casting segment is anticipated to capture aluminum die casting market share of over 54.4% by 2035, owing to the advancements in smart manufacturing with Industry 4.0 technologies. The die casting enhances the process efficiency and product quality, due to their capability of providing exact temporal management that result from sensor and IoT device input data during the casting production. Data analytics paired with automated inspection techniques create high-quality standards that support automotive and electronic industries. The market expansion of pressure die casting depends heavily on the development of strategic alliances between manufacturers as well as enhancements in die casting machines. For instance, in June 2022, Italpresse Gauss announced its plan to launch a new generation of toggle free high pressure die casting machines, aimed at meeting the exact requirements of users.

Application (Transportation, Industrial, Building and Construction, Telecommunication, Consumer Durables, Energy)

The above 10 tons segment in aluminum die casting market is expected to register significant CAGR during the forecast period, attributed to the increasing adoption of lightweight materials by manufacturers for their designs. For instance, the automotive industry utilizes aluminum die casting to reduce vehicle weight levels, comply with strict emissions standards, and improve fuel economy measures. The growing electric vehicle market increases this demand as aluminum die-cast components extend EV battery range and enhance overall vehicle performance.

Manufacturers are using aluminum die-cast components throughout their vehicle structures due to worldwide government standards that aim to ensure vehicle fuel efficiency compliance. The automotive industry benefits from high-pressure die casting technology, to scale the manufacturing of durable aluminum components, enhancing their value for transportation applications. For instance, in January 2024, Nemak announced its plans to invest USD 18 million, to expand its die casting operations in the U.S. automotive industry. These developments highlight that modern transportation systems rely increasingly on aluminum die casting technologies.

Our in-depth analysis of the global aluminum die casting market includes the following segments:

|

Production Process |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aluminum Die Casting Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific aluminum die casting market is likely to dominate revenue share of over 52% by 2035, owing to rising automotive and construction industry operations in these regions. China, Japan, and India are presently boosting their investments in infrastructure development and advancement of manufacturing processes. The rapid development requires lightweight strong corrosion-resistant materials, and aluminum die casting has proven to be an optimal solution. The region strengthens its demand for electric vehicles and implements government programs that support energy efficiency standards.

The China aluminum die casting market is expected to propel due to the fast-paced industrial development across the country. The construction industry's expansion together with rising infrastructure projects creates a significant requirement for aluminum components due to their lightweight yet durable quality. The aluminum die casting industry in the country experiences improved production capabilities and technological enhancements through foreign investments that come, owing to its position as a global manufacturing hub.

The aluminum die casting market in India is growing rapidly, due to the rising demand for electric vehicles coupled with the rising number of locally-produced automotive components. The Faster Adoption and Manufacturing of Electric Vehicles (FAME) initiative is leveraging automakers to select aluminum die-cast components for EV efficiency improvement and range enhancement. The growing demand has prompted organizations to build new manufacturing facilities combined with partnership agreements and acquisitions. For instance, the acquisition of Unicast Autotech aluminum die casting business by Sandhar Technologies through a Memorandum of Understanding, in March 2021, is expected to enhance its India market reach.

North America Market

The North America aluminum die casting market is expected to witness a rapid expansion between 2025 and 2035 owing to the increasing need for vehicles with reduced weight and improved fuel efficiency. Auto manufacturers have been adopting aluminum die casting components due to their ability to offer reduced vehicle mass, resulting in better fuel economy together with emission reduction. Moreover, the market is witnessing rapid growth owing to the stringent regulations set by the government, regarding fuel economy performance as well as greenhouse gas emission reductions. The increasing number of electric vehicles in the market creates a significant requirement for lightweight materials to enhance driving range, propelling the market growth in the region.

The U.S. aluminum die casting market is increasing owing to the attributed to manufacturers’ requirement for lightweight materials for electric vehicle development along with aerospace applications. Die casting technology has been evolving, as the automakers are adopting aluminum components, that improve energy efficiency and dependability for batteries. Aerospace manufacturers are expanding their adoption of aluminum, due to its benefits in structural and non-structural applications, driving the aluminum die casting market growth. Through sustainable manufacturing support and fuel efficiency regulations, the local government motivates manufacturers to purchase high-performance aluminum die-cast components. The market also experiences development in AI-driven quality control systems alongside automation, leading to better precision while eliminating material waste. The integration of IoT-based monitoring systems by companies also improves production efficiency and minimizes defects, resulting in more cost-effective aluminum die casting.

The aluminum die casting market in Canada is expected to experience significant growth, with the increasing demand for lightweight and high-performance components, for industries including automotive, aerospace, and industrial manufacturing. Manufacturers prefer aluminum die-cast components for automotive applications, as they create more fuel-efficient vehicles and help businesses meet their emission targets. The aerospace industry uses die-cast aluminum for structural elements to obtain stronger parts with reduced weight. The increasing need for electric vehicle components leads to higher demand, as aluminum die casting provides essential functions for battery enclosures together with motor housings and chassis components that require low weight.

The local manufacturers are implementing advanced die-casting methods such as high-pressure die casting to achieve sustainability and performance improvements of manufactured products under the country’s environmental initiatives. The market growth is also receiving additional impetus from the government’s support for domestic production and valuable investments in modern die-casting infrastructure. Industrial manufacturers in the country have been implementing automation alongside Industry 4.0 technologies, for better quality control measures and waste reduction while attaining higher casting accuracy. Foundries implement robotics and AI-driven quality assurance to become more efficient, which is expected to promote long-term aluminum die casting industry development.

Key Aluminum Die Casting Market Players:

- GF Casting Solutions

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dynacast Deutschland GmbH

- Consolidated Metco Inc.

- MartinreaHonsel Germany GmbH

- Shiloh Industries Inc.

- Alcoa Corporation

- Alcast Technologies Ltd.

- Gibbs Die Casting Corporation

- Ryobi Die Casting Dalian Co.

- Walbro LLC

The competitive landscape of the aluminum die casting market is rapidly evolving, attributed to the integration of advanced technologies in energy management systems by key players. They are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global aluminum die casting market:

Recent Developments

- In December 2024, the Jaya Hind Industries installed a 4400-ton high-pressure aluminum die casting machine, that allows for the production of complex aluminum structural components.

- In March 2023, GF Casting Solutions announced to collaborate with Bocar Group develop and invest in new technologies and services, and to leverage their strong R&D, production facilities around the world.

- Report ID: 7257

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aluminum Die Casting Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.