Aluminium-ion Battery Market Outlook:

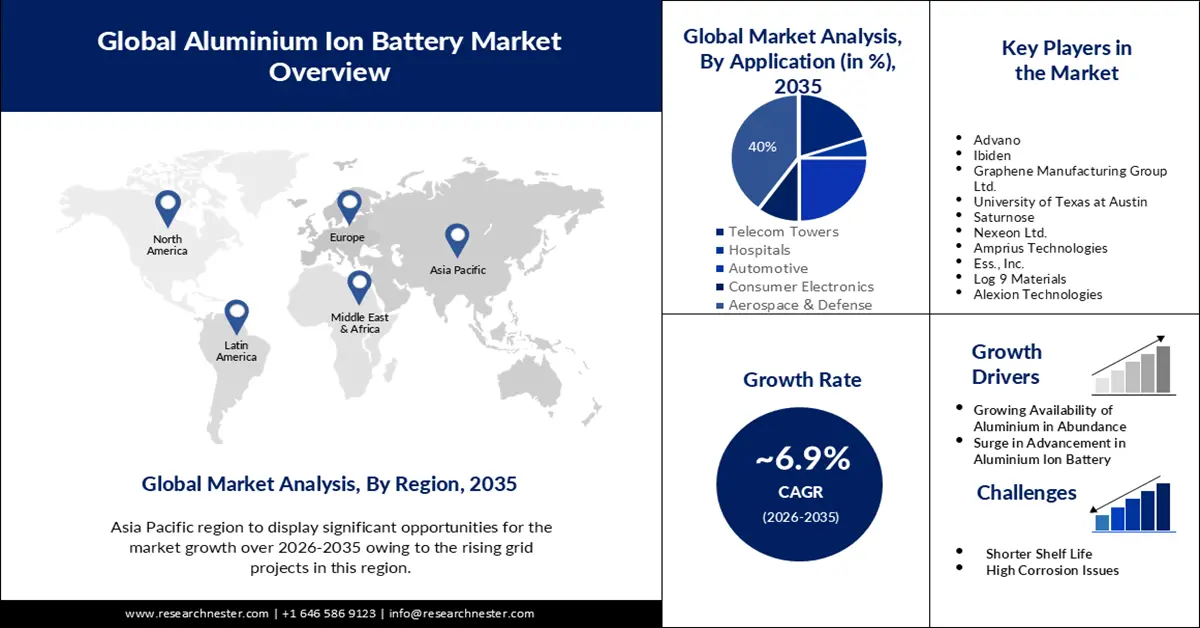

Aluminium-ion Battery Market size was over USD 7.63 billion in 2025 and is poised to exceed USD 14.87 billion by 2035, witnessing over 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aluminium-ion battery is estimated at USD 8.1 billion.

The growth of the sector is set to be dominated by the growing demand for renewable energy. For instance, over the years 2023 to 2025, worldwide demand for electricity is anticipated to expand by about 4% annually, outpacing the rate of 2022 growth. Hence, the demand for aluminium-ion battery is growing since it is used in storing energy. Aluminium-ion battery has the capacity of storing large amount of energy as compared to any other batteries.

Moreover, aluminium-ion batteries have an extended lifespan in terms of comes to holding energy. After 500–1000 charging and discharging cycles, lithium-ion batteries generally lose about 79% of their capacity. A prototype aluminium-ion battery from Stanford University withstood a total of approximately 7,499 cycles without losing any capacity.

Key Aluminium-ion Battery Market Insights Summary:

Regional Highlights:

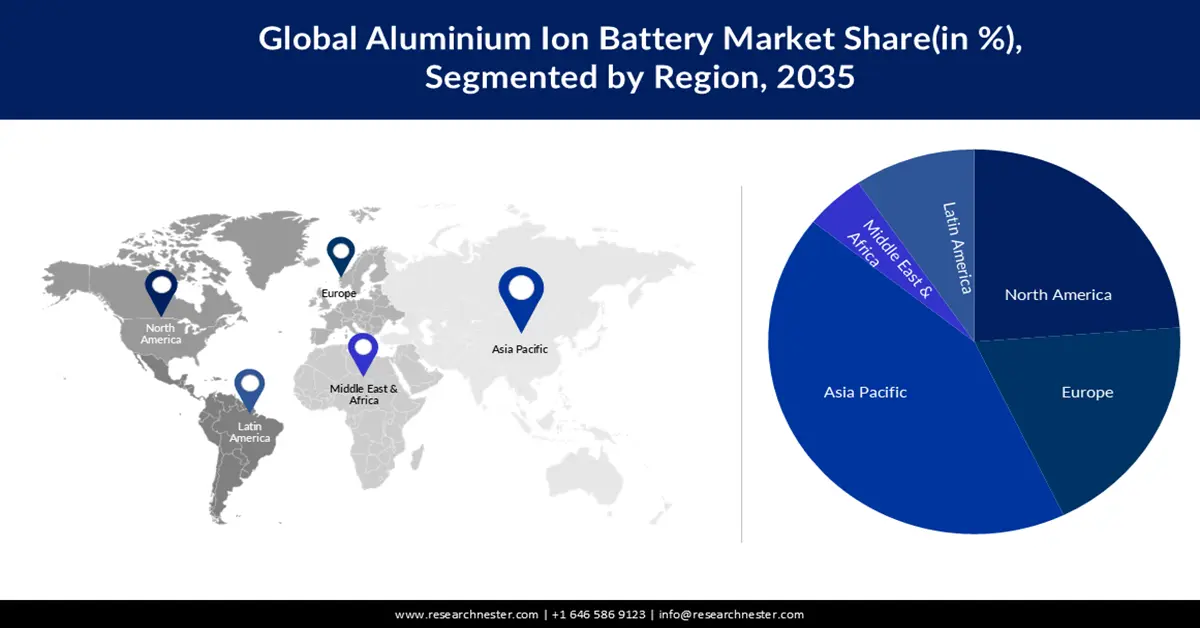

- By 2035, Asia Pacific is anticipated to secure a 45% share of the aluminium-ion battery market, spurred by expanding grid projects and increased aluminium extraction.

- North America is projected to witness notable advancement through 2026–2035, propelled by rising aircraft manufacturing and growing research into lightweight aluminium-ion battery integration.

Segment Insights:

- The aerospace & defense segment in the aluminium-ion battery market is set to command a 40% share by 2035, supported by the shift toward lighter, higher-density power solutions for military machinery and aerospace systems.

- The industrial segment is expected to capture nearly 70% share by 2035, underpinned by escalating demand for portable electronics across automotive and defense applications.

Key Growth Trends:

- Growing Availability of Aluminium in Abundance

- Surge in Advancement in Aluminium ion Battery

Major Challenges:

- Shorter Shelf Life

- High Corrosion Issues

Key Players: Advano, Ibiden, Graphene Manufacturing Group Ltd., University of Texas at Austin, Saturnose, Nexeon Ltd., Amprius Technologies, Ess., Inc., Log 9 Materials, Alexion Technologies.

Global Aluminium-ion Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.63 billion

- 2026 Market Size: USD 8.1 billion

- Projected Market Size: USD 14.87 billion by 2035

- Growth Forecasts: 6.9%

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Australia, Canada, United Kingdom, France

Last updated on : 25 November, 2025

Aluminium-ion Battery Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Availability of Aluminium in Abundance: Aluminium is estimated to be one of the most frequently available minerals in the earth's crust. Due to its strong affinity for oxygen, aluminium frequently coexists alongside oxygen in nature in the form of oxide. Hence, the price of aluminium is also low. Therefore, the manufacturing and sale of aluminium-ion batteries is expected to grow over the coming years.

-

Surge in Advancement in Aluminium-ion Battery: Batteries have grown into a necessary component of everyday life, yet conventional disposable batteries compromise the environment significantly since they include dangerous compounds including lead, cadmium, and mercury that are very difficult to recycle. Therefore, there has been growing advancement in aluminium-ion batteries. For instance, scientists from Zhejiang Sci-Tech University in China and Flinders University in South Australia collaborated to conduct the study. The new batteries are constructed with unique materials described to be stable organic radicals, that comprise a critical element known as 2,2,6,6-tetramethylpiperidyl-1-oxy, or TEMPO. They employ fluids that are based on water rather than dangerous chemicals. Scientists claim that these water-based electrolytes contributed to the creation of the first air-stable and fire-retardant aluminium radical battery architecture.

-

Rise in Deployment of AI: With the deployment of AI, the monitoring of batteries could get easier. AI can increase battery efficiency and lifespan by tracking the battery's health and predicting when it will fail.

Challenges

-

Shorter Shelf Life - There is currently a limited lifespan for aluminium-ion batteries. Energy capacity may be significantly impacted by the interaction of heat, rate of charge, and cycle. A contributing factor is the graphite anode's fracture. Hence, this factor is projected to hinder the market revenue in the forecast period.

-

High Corrosion Issues

-

Stringent Government Regulations

Aluminium-ion Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 7.63 billion |

|

Forecast Year Market Size (2035) |

USD 14.87 billion |

|

Regional Scope |

|

Aluminium-ion Battery Market Segmentation:

Application Segment Analysis

The aerospace & defense segment is poised to hold 40% share of the global aluminium-ion battery market during the projected period. These batteries could be employed by the military to power machinery, lowering battery weight and boosting energy density, enabling longer missions between battery replacements. Additionally, aluminium-ion batteries could power spacecraft and satellites in the aerospace sector, where weight is a key factor.

End-User Segment Analysis

The industrial segment in the aluminium-ion battery market is projected to garner the highest share of approximately 70% by the end of 2035. This is owing to the growing demand for portable electronics in the automotive and defense sectors. Therefore, even manufacturers of aluminium-ion batteries are focusing more on these sectors to supply this battery. Hence, this factor is expected to dominate the market growth.

Our in-depth analysis of the global aluminium-ion battery market includes the following segments:

|

Application |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aluminium-ion Battery Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 45% by 2035. This growth in the market in this region could be owing to rising grid projects in this region. The board of the Power Grid Corporation authorized an investment worth more than USD 8 billion for a number of energy transmission projects across India this year. Additionally, there has been a growing extraction of aluminium in this region which is also a major factor for the growth in market share.

North American Market Insights

The aluminium-ion battery market in North America is expected to also have significant growth over the coming years. The major for this growth in this region is backed by the growing manufacturing of aircraft. There has been growing research on the utilization of these batteries in aircraft owing to their lightweight nature. Also, it ensures the safety of aircraft and limits the prevalence of thermal runways and fires.

Aluminium-ion Battery Market Players:

- Advano

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ibiden

- Graphene Manufacturing Group Ltd.

- University of Texas at Austin

- Saturnose

- Nexeon Ltd.

- Amprius Technologies

- Ess., Inc.

- Log 9 Materials

- Alexion Technologies

Recent Developments

- December 22, 2021: A number of potential clients from all over the world have received prototypes of Graphene Manufacturing Group Ltd.'s graphene aluminum-ion batteries ("G+AI Battery") 2032 type coin cells. Coin cell testing to date has shown that the GMG 2032 type G+AI Battery prototype coin cells are fully rechargeable in a few seconds, maintain capacity for a few thousand charge and discharge cycles, are non-flammable, are reasonably non-toxic, and are practically entirely recyclable.

- November 30, 2021: The independent evaluation of Saturnose's Enhanced Altered Aluminium-ion(Ea2I) battery chemistry was anticipated to be made public, and the company also intends to introduce a solid-state, rechargeable aluminium battery. Asian company Saturnose was anticipated to be the first to commercialize lithium-ion batteries.

- Report ID: 5205

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aluminium-ion Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.