Alpha-glucosidase Inhibitors Market Outlook:

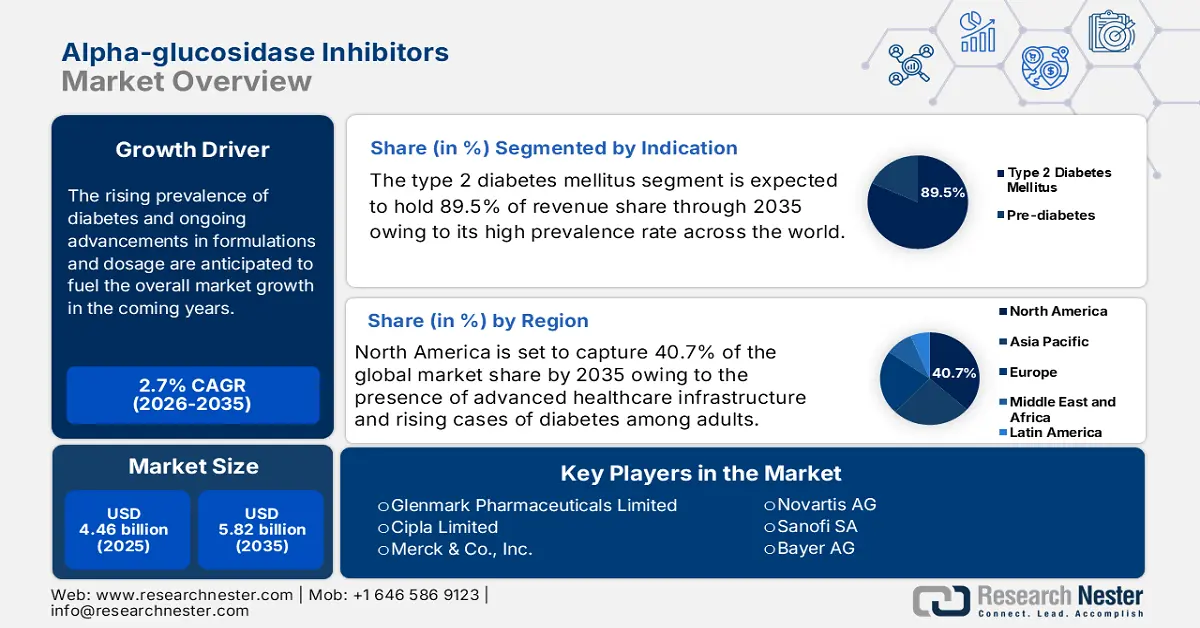

Alpha-glucosidase Inhibitors Market size was valued at USD 4.46 billion in 2025 and is expected to reach USD 5.82 billion by 2035, expanding at around 2.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of alpha-glucosidase inhibitors is evaluated at USD 4.57 billion.

One of the major factors boosting the alpha-glucosidase inhibitors market is the increasing prevalence of diabetes across the world. For instance, according to a 2023 published report by the Institute for Health Metrics and Evaluation (IHME), , states that more than half a billion people are living with diabetes around the globe. The worldwide prevalence rate of diabetes is 6.1%, whereas North America and the Middle East hold 9.3% and is predicted to reach 16.8% by 2050. Furthermore, based on demographics, people 65 and older age are capturing more than 20% of the diabetes prevalence rate. The rising risk of diabetes drives demand for effective glucose management therapies and is generating profitable opportunities for anti-diabetic drug producers. Moreover, the key market players are investing heavily in research and development activities to introduce advanced and effective solutions such as alpha-glucosidase inhibitors.

Key Alpha-glucosidase Inhibitors Market Insights Summary:

Regional Highlights:

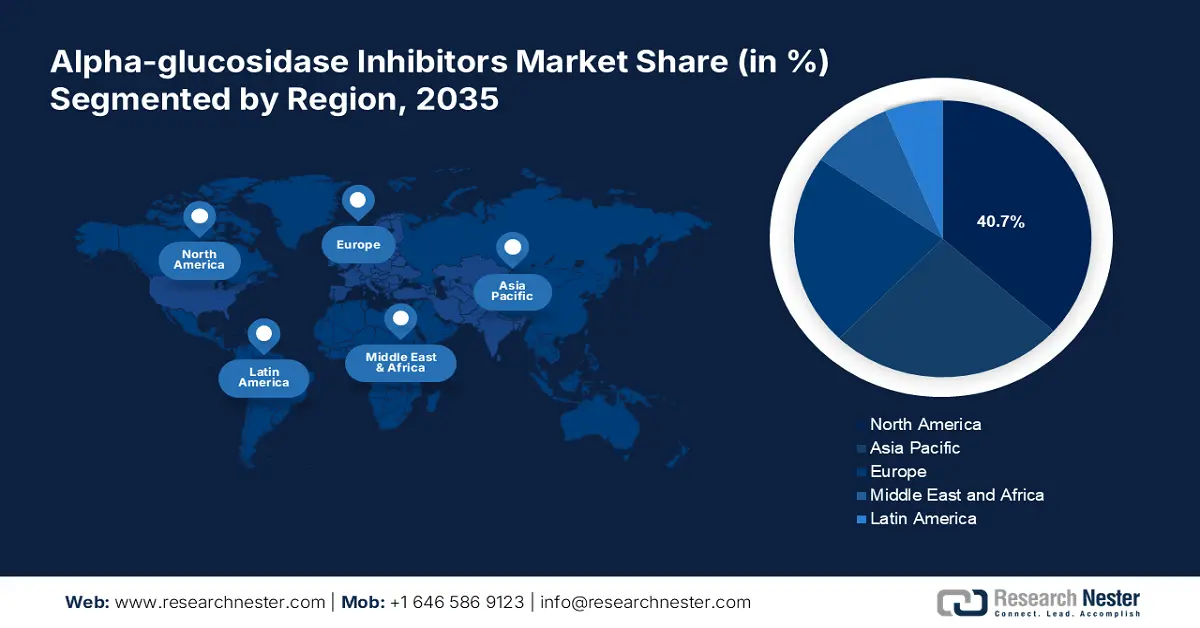

- North America alpha-glucosidase inhibitors market will account for 40.70% share by 2035, driven by the high prevalence of type 2 diabetes and advancements in drug production.

- Asia Pacific market will register significant growth during the forecast timeline, driven by increased healthcare expenditure and government investments in healthcare infrastructure.

Segment Insights:

- The type 2 diabetes mellitus segment in the alpha-glucosidase inhibitors market is projected to dominate by 2035, attributed to the global rise in type 2 diabetes prevalence and the need for effective blood sugar management.

Key Growth Trends:

- Introduction of combination therapies

- High prevalence of diabetes among older population

Major Challenges:

- Availability of alternatives

- Gastrointestinal side effects

Key Players: Takeda Pharmaceutical Company Limited, Pfizer Inc., Bayer AG, Sun Pharmaceutical Industries Ltd., Glenmark Pharmaceuticals Ltd., Torrent Pharmaceuticals Ltd., Cipla Limited, Lupin Limited, Blue Cross Laboratories Pvt. Ltd., Mylan N.V. (Viatris).

Global Alpha-glucosidase Inhibitors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.46 billion

- 2026 Market Size: USD 4.57 billion

- Projected Market Size: USD 5.82 billion by 2035

- Growth Forecasts: 2.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 18 September, 2025

Alpha-glucosidase Inhibitors Market Growth Drivers and Challenges:

Growth Drivers

- Introduction of combination therapies: The combination of alpha-glucosidase inhibitors with other antidiabetic drugs is anticipated to offer effective results by achieving better glycemic control and improving patient outcomes. The increasing importance of personalized treatments drives the use of combination therapies to meet individual patient needs. This multifaceted approach is becoming a cornerstone in modern diabetes management further augmenting the overall market growth.

Additionally, the focus on combination therapies in clinical trials is a key factor propelling growth in the alpha-glucosidase inhibitors market.Several trials are investigating novel pairings that can lead to synergistic effects, improving overall treatment efficacy. For instance, in 2019, a Novartis 5-year Phase IV clinical study, VERIFY, in type 2 diabetes compared the long-term efficacy and safety of an early combination treatment strategy with metformin plus vildagliptin (dipeptidyl peptidase-4 [DPP-4] inhibitor) to the traditional stepwise approach with metformin as initial therapy followed by vildagliptin and found positive results. The study's preliminary findings revealed that early intervention with a combination therapy strategy gives larger and longer-lasting benefits to patients. - High prevalence of diabetes among older population: Alpha-glucosidase inhibitors are well tolerated in the treatment of diabetes in the elderly. Older individuals are more prone to various chronic disorders including diabetes due to several physiological changes such as hormonal imbalance, metabolism, and body composition, which increases the risk of insulin resistance. For instance, the Institute for Health Metrics and Evaluation estimates that the high prevalence rate of diabetes of around 24.4% is among people aged between 75 and 79. As this prevalence rate increases the need for innovative diabetes treatment solutions including alpha-glucosidase inhibitors is expected to boost.

Challenges

- Availability of alternatives: There are numerous alternatives for managing diabetes, which may offer more convenient dosing regimens or broader mechanisms of action. The development of novel medications and therapies can overshadow the traditional use of alpha-glucosidase inhibitors, potentially leading to a decrease in market share.

- Gastrointestinal side effects: Patients often experience flatulence, diarrhea, and abdominal discomfort, which can lead to discontinuation of the medication. The unpleasant nature of these side effects may discourage adherence, causing patients to seek alternative therapies with better tolerability.

Alpha-glucosidase Inhibitors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

2.7% |

|

Base Year Market Size (2025) |

USD 4.46 billion |

|

Forecast Year Market Size (2035) |

USD 5.82 billion |

|

Regional Scope |

|

Alpha-glucosidase Inhibitors Market Segmentation:

Indication Segment Analysis

Type 2 diabetes mellitus segment is estimated to account for more than 89.5% alpha-glucosidase inhibitors market share by the end of 2035. The increasing prevalence of type 2 diabetes mellitus globally creates a substantial population in need of effective management solutions. For instance, the prevalence of type 2 diabetes mellitus among older adults accounted for 96% in 2021. As per the analysis by the World Health Organization (WHO), around 95% of people living with diabetes have type 2 diabetes. Alpha-glucosidase inhibitors specifically target postprandial blood sugar levels, making them valuable for managing the unique challenges faced by type 2 diabetes patients.

Drug Type Segment Analysis

The acarbose drug type segment in alpha-glucosidase inhibitors market is foreseen to hold a dominant revenue share through 2035 owing to its effectiveness in the treatment of diabetes. Acarbose has a proven track record in effectively managing postprandial blood glucose levels, making it a trusted choice among healthcare providers. The drug is often included in diabetes management guidelines, which supports its continued use in clinical practice and drives demand.

Acarbose has strong brand recognition and is marketed under various names, such as Glucobay in Europe and Asia, Precose in the U.S., and Prandase in Canada. Moreover, Acarbose is frequently used in combination with other antidiabetic medications, further enhancing its effectiveness and broadening its use among patients.

Our in-depth analysis of the global market includes the following segments:

|

Drug Type

|

|

|

Indication |

|

|

Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Alpha-glucosidase Inhibitors Market Regional Analysis:

North America Market Insights

North America industry is expected to dominate majority revenue share of 40.7% by 2035, owing to the high prevalence of type 2 diabetes and advancements in drug production. The region has a strong presence of antidiabetic drug producers and advanced research and treatment organizations, which is positively influencing the sales of alpha-glucosidase inhibitors.

The U.S. market for alpha-glucosidase inhibitors was valued at USD 1.2 billion in 2023 and is expected to expand at a steady CAGR during the forecasted period. According to a 2024 report published by the Centers for Disease Control and Prevention (CDC) states that more than 38 million individuals have diabetes with type 2 diabetes accounting for 90% to 95% of the total. Although type 2 diabetes primarily affects those 45 years of age and older, it is also increasingly occurring in children, teenagers, and young adults.

Improved patient education about diabetes management options and access to healthcare services in the country enhances the likelihood of prescribing alpha-glucosidase inhibitors.

Canada is witnessing a rising prevalence of diabetes that is augmenting the need for advanced therapeutics such as alpha-glucosidase inhibitors. For instance, according to Diabetes Canada, 30% of the individuals in the country are living with diabetes. Moreover, rise in clinical research in Canada is crucial for validating and enhancing the role of alpha-glucosidase inhibitors in diabetes management, ultimately driving market growth and adoption.

APAC Market Insights

Asia Pacific region is expected to register significant growth till 2035, owing to the increased healthcare expenditure. Several governments in the region are highly investing in advancing their healthcare infrastructure, which is set to drive the sales of antidiabetic drugs including alpha-glucosidase inhibitors. India, Japan, South Korea, and China are some of the top markets for alpha-glucosidase inhibitors in the region.

India is foreseen to witness high sales of alpha-glucosidase inhibitors owing to the growing cases of diabetes and rising government initiatives. India is home to the world's second highest number of diabetic patients. According to the National Center for Disease Control, Government of India, the country is projected to have 1.09 billion diabetes cases by 2035. Non-communicable diseases cause 9.8 million fatalities in the country, with diabetes accounting for 2% of total deaths each year.

Additionally, government health programs such as National Diabetes Control Program aims at managing diabetes and promoting preventive healthcare thus, contributing to the increased use of diabetes medications such as alpha-glucosidase inhibitors.

Alpha-glucosidase Inhibitors Market Players:

- Glenmark Pharmaceuticals Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck & Co., Inc.

- Novartis AG

- Sanofi SA

- Bayer AG

- Cipla Limited

- Dr. Reddy's Laboratories Ltd.

- Emcure Pharmaceuticals Ltd.

- Lupin Ltd.

- Alkem Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- Torrent Pharmaceuticals Ltd.

- Unichem Laboratories Ltd

The key players in the alpha-glucosidase inhibitors market are employing strategies such as the introduction of innovative drug solutions, strategic partnerships, mergers & acquisitions, and regional expansions. Leading companies are collaborating with research organizations and other players to develop advanced alpha-glucosidase inhibitors formulations and earn high profits. They are also acquiring other companies to expand their portfolio and reach a wider consumer base. Furthermore, regional expansion strategies are aiding them to tap into emerging marketplaces.

Some of the key players include:

Recent Developments

- In April 2023, Sanofi SA announced the successful acquisition of Provention Bio, Inc. This move by Sanofi SA is aiding it in expanding its diabetes drug product portfolio.

- In October 2021, Glenmark Pharmaceuticals Limited launched the first combination drug for the treatment of type 2 diabetes in India. This fixed dose combination consists of Remogliflozin, Vildagliptin, and Metformin, and is marketed under two brand names Remo MV and Remozen MV.

- Report ID: 6473

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Alpha-glucosidase Inhibitors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.