Alopecia Drugs Market Outlook:

Alopecia Drugs Market size was valued at USD 11.44 billion in 2025 and is expected to reach USD 33.07 billion by 2035, expanding at around 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of alopecia drugs is assessed at USD 12.59 billion.

A major driver of the global alopecia drugs market is the rising prevalence of alopecia. For instance, in July 2022, research published in the National Library of Medicine (NLM) indicated a 49.14% increase in alopecia areata between 1990 and 2019. The incidents of flare-ups of alopecia areata are projected to spike after the COVID-19 pandemic with the American Institute of Dermatology reporting 42.5% of cases of people contracting COVID-19 leading to flare-ups. Additionally, factors such as stress, genetic predispositions, pollution, hormonal changes, etc., are driving the increase in cases of alopecia. The sector is poised to benefit from increasing investments in targeted therapeutics, such as 5-alpha-reductase inhibitors and corticosteroids. For instance, in July 2022, the Food & Drug Administration (FDA) of the U.S., approved OLUMIANT (baricitinib) of Eli Lilly & Company and Incyte as a first-in-disease systemic treatment for adults with severe alopecia areata.

The market’s growth is also attributed to advancements in alopecia treatment and rising awareness of hair loss causes. The surging demand for non-invasive treatments is poised to drive the market’s robust growth. A key factor of the market’s growth is the surging promotions on social media regarding alopecia awareness and alopecia drugs. For instance, in January 2023, research published in Wiley investigated the Google trends search volume for alopecia and public interest trends on hair loss in YouTube and TikTok to find high search volumes and engagement for videos related to alopecia, and for keywords related to hair loss.

With the rising demand for effective, long-term hair loss solutions, the global alopecia drugs market is projected to provide ample opportunities for companies to provide targeted alopecia drugs. The global market is projected to find profitable opportunities in emerging economies with favorable information dissemination by social media driving demands in these regions. Key market players are positioned to benefit from the surging demands by providing specialized treatments addressing various alopecia types. Additionally, the emergence of biologics CDMO and Janus kinase inhibitors offer promising prospects in autoimmune and genetic alopecia conditions. The alopecia drugs market is poised to leverage the increasing consumer demands and drug advancements to maintain a profitable growth surge by the end of the forecast period.

Key Alopecia Drugs Market Insights Summary:

Regional Highlights:

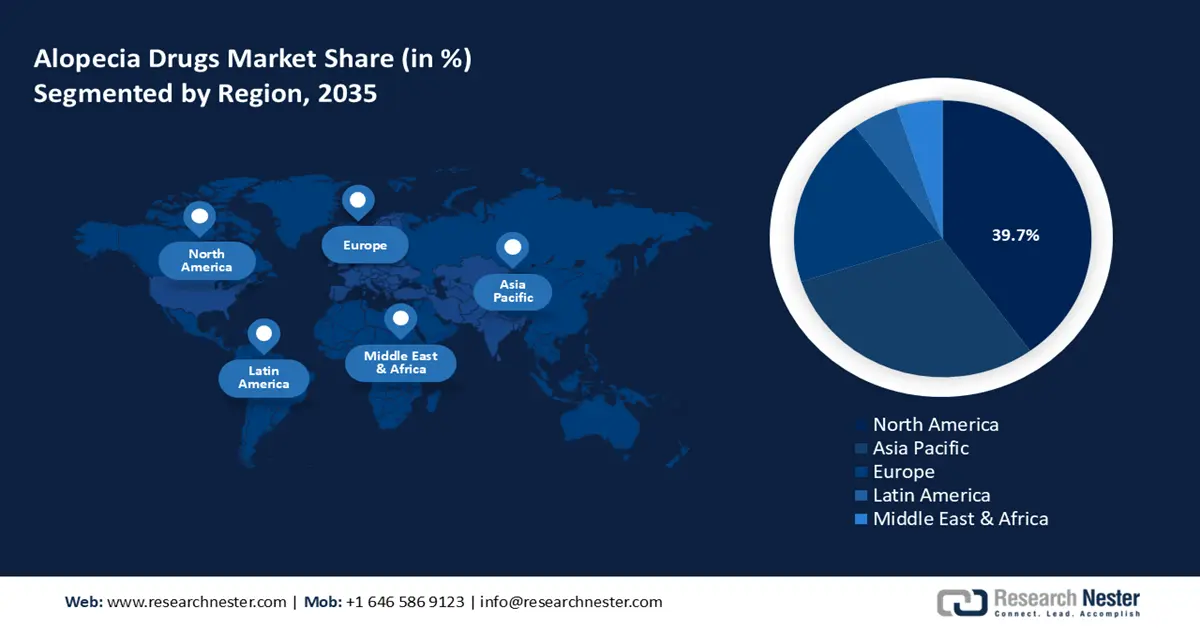

- North America dominates the Alopecia Drugs Market with a 39.7% share, propelled by advanced healthcare infrastructure and increasing prevalence of alopecia cases, sustaining its leadership through 2026–2035.

Segment Insights:

- The Androgenetic Alopecia segment is set for the fastest CAGR growth from 2026 to 2035, attributed to high prevalence and growing clinical trials for drug development.

- The Male segment is anticipated to achieve a profitable revenue share from 2026-2035, driven by high incidence of male pattern baldness and demand for effective treatments.

Key Growth Trends:

- Growth in regenerative medicine techniques

- Rising demand for combined cosmetic and pharmaceutical benefits

Major Challenges:

- Consumer skepticism towards pharmaceutical solutions

- Stiff competition from alternative treatments

- Key Players: Pfizer Inc., Eli Lilly, Dr. Reddy’s Laboratories, Janssen Global Services Inc., Sun Pharmaceuticals Industries Ltd., Revian Inc., Lutronic, Freedom Laser Therapy, Apira Science Inc., Theradome, Glaxo Smith Kline, EVA Pharma.

Global Alopecia Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.44 billion

- 2026 Market Size: USD 12.59 billion

- Projected Market Size: USD 33.07 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Alopecia Drugs Market Growth Drivers and Challenges:

Growth Drivers

- Growth in regenerative medicine techniques: The global alopecia drugs market is projected to benefit from innovations in regenerative medicine, such as advancements in stem cell treatment. Advancements in regenerative medicine offer non-invasive treatment options complementing existing drug treatments. Rising demands for natural hair regrowth and reduced reliance can lead to favorable integration in clinical practice creating additional value for the global market. For instance, in April 2024, Pelage Pharmaceuticals announced that the first patients have been dosed in its Phase 2a clinical trial to evaluate the efficacy of PP405 for androgenetic alopecia treatment, and the clinical trial is led by USD 14 million financing by Google Ventures (GV).

- Rising demand for combined cosmetic and pharmaceutical benefits: The global alopecia drugs market is poised to benefit from the increasing consumer demands for hair loss treatments with therapeutic and aesthetic advantages. Key market players are poised to benefit from the rising demands by providing solutions that stimulate hair regrowth and improve hair density. The growth of the cosmetics industry boosts the demand for effective alopecia drugs. For instance, in March 2022, Eli Lilly reported that adults with severe alopecia areata who took Olumiant exhibited positive results of scalp, eyebrow, and eyelash hair growth with around 75% of responders achieving 90% scalp coverage. The dual approach to hair regrowth and aesthetics positions alopecia drugs as a part of the beauty and personal care products sector, boosting investments from consumers.

- Influence of social media on consumer awareness: The global alopecia drugs market is poised to benefit from social media trends. Various social media platforms play a significant role in raising awareness of alopecia and highlighting emerging treatments. Companies are increasingly investing in ad campaigns on social media platforms to spread awareness of their alopecia care solutions and raise further awareness. Major businesses are expanding to emerging markets owing to the proliferation of social media trends driving demands for effective therapeutic drugs.

A recent indicator is the viral popularity of Adivasi hair oil in India, driven by social media trends. Additionally, social media trends have led to surging interest in herbal beauty products positioning companies to provide herbal therapeutic solutions for alopecia care. For instance, in October 2023, a study on herbal medications for alopecia treatment indicated hyllanthus Emblica, Oscimum sanctum, allium cepa, allium sativum, etc., as herbal medications for alopecia treatment. Companies can leverage the trends to provide effective alopecia drugs with herbal formulations.

Challenges

- Consumer skepticism towards pharmaceutical solutions: The alopecia drugs market can face challenges owing to consumer skepticism towards pharmaceutical solutions for hair loss. The potential side effects of pharmaceutical options can deter patients from adopting alopecia drugs. For instance, alopecia drugs such as Finasteride may exhibit side effects such as impotence, decreased libido, breast tenderness & enlargement, and testicular pain.

- Stiff competition from alternative treatments: The market can face challenges from alternative treatments and wellness products. Consumers may prefer herbal hair oils and homeopathic treatments, despite unproven benefits, over pharmaceutical drugs. The competition can limit the market’s growth. The surge in wellness-oriented health practices popularizes a non-pharmaceutical approach to hair loss management providing a challenge to the alopecia drugs market.

Alopecia Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 11.44 billion |

|

Forecast Year Market Size (2035) |

USD 33.07 billion |

|

Regional Scope |

|

Alopecia Drugs Market Segmentation:

Disease Type (Alopecia Areata, Androgenetic Alopecia, Cicatricial Alopecia, Traction Alopecia, Alopecia Totalis, Alopecia Universalis, Others)

By the end of 2035, alopecia areata segment is estimated to capture around 35.6% alopecia drugs market share. The National Alopecia Areata Foundation reported 160 million people globally to have alopecia areata creating significant opportunities for businesses to position effective alopecia drugs. For instance, in September 2023, the European Union approved the use of Pfizer’s LITFULO for adults and adolescents with severe alopecia areata as a once-daily oral capsule.

Advancements in immunotherapy, such as Janus Kinase (JAK) inhibitors exhibit promise in treating the condition. For instance, in June 2023, NLM published research on the use of tofacitinib as a selective JAK inhibitor to treat patients leading to reported eyelash and facial hair growth. Additionally, rising investments in research for safe and effective treatment are poised to benefit the continued profitable growth of the segment.

The androgenetic alopecia segment of the global alopecia drugs market is poised to register the fastest growth in its revenue share during the forecast period. The segment’s growth is owed to a high prevalence of the hereditary condition, also known as male or female pattern baldness. Androgenetic alopecia affects a significant percentage of the population worldwide, creating a large market of end-users for alopecia drugs. For instance, in December 2022, the Journal of Dermatology and Skin Science estimated androgenetic alopecia in around 50 million men and 30 million women in the U.S.

Owing to rising demand to combat male and female pattern baldness, therapeutic companies are investing in clinical trials for effective drug formulations. For instance, in December 2022, Dermaliq Therapeutics sponsored a new clinical trial for male androgenetic alopecia to test the topical medication DLQO1. The favorable developments are poised to benefit the profit surge of the segment in the global alopecia drugs market.

Gender (Male, Female)

By gender, the male segment of the global alopecia drugs market is poised to register a profitable revenue share during the forecast period. The growth of the segment is attributed to high incidences of hair loss conditions in males, especially androgenetic alopecia (male pattern baldness). As symptoms may develop in early adulthood and progress with age, it creates a large base of end-users for alopecia drugs to manage the condition. The demand for effective treatments to slow or reverse hair loss boosts sales of alopecia drugs such as finasteride and minoxidil amongst males.

Additionally, advancements in advanced therapies and rising awareness of the condition are projected to assist the continued growth of the segment. For instance, in June 2023, researchers from Northwestern University stated that MicroRNA can treat male pattern baldness by stimulating growth in aging hair follicles.

Our in-depth analysis of the alopecia drugs market includes the following segments:

|

Disease Type |

|

|

Gender |

|

|

Sales Channel |

|

|

Treatment |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Alopecia Drugs Market Regional Analysis:

North America Market Forecast

North America industry is likely to hold largest revenue share of 39.7% by 2035, due to advanced healthcare infrastructure and the increasing prevalence of alopecia cases. The regional market benefits from increasing awareness campaigns that are assisting in dispelling associated stigma with the condition, allowing people to actively seek treatment. The trends create a burgeoning market for alopecia drugs in the region. Additionally, the rising disposable income, growing drug approval by regulatory bodies, and increasing healthcare spending in the region are poised to benefit the market’s continued growth. For instance, in December 2023, LITFULO of Pfizer Inc. received approval from Health Canada as the first treatment in the country for cases of severe alopecia.

The U.S. is projected to register the largest market share in the alopecia drugs market of North America. The market’s growth in the country is attributed to a large population affected by various alopecia types driving demands for alopecia drugs. For instance, the National Alopecia Areata Foundation estimated around 7 million people in the U.S. are afflicted with the condition. Advancements in novel therapeutics are poised to boost demands for alopecia drugs in the country benefiting the growth of the sector.

Additionally, the surging influence of social media platforms such as Reddit, X (formerly Twitter), Instagram, Facebook, etc., benefits rising awareness of alopecia drugs. With surging cases of male and female pattern baldness in the country, reported to be afflicting 50 million men and 30 million women as per the Journal of Dermatology and Skin Science, is poised to create a large market for alopecia drugs end-users in the country.

Canada is poised to increase its revenue share in the alopecia drugs market of North America. The growth of the market in Canada is attributed to rising awareness of alopecia and a burgeoning focus on proactive treatment. The favorable regulatory ecosystem of Canada benefits the growth of the market by quick approval of alopecia drugs. For instance, in January 2024, Eli Lilly Canada Inc. announced that OLUMIANT received regulatory approval for the treatment of severe alopecia areata from Health Canada.

APAC Market Analysis

The APAC for alopecia drugs market is projected to register the fastest revenue growth during the forecast period. The growth is owed to rising awareness of alopecia drugs in the region coupled with an increasing prevalence of alopecia. Densely populated countries of APAC, such as China, and India, are at risk of increased alopecia cases due to increasing pollution and stress levels. China, India, Japan, and South Korea lead the revenue share in the region. Investments in awareness drives and the large-scale population in APAC provide additional opportunities for companies to market alopecia drugs to a larger section of end users. For instance, in October 2024, AesMed Co., Ltd., announced plans to participate in the World Congress for Hair Research 2026 to showcase their new hair loss treatment technology.

India is projected to lead the revenue share of the alopecia drugs market of APAC. The market’s growth is attributed to surging male pattern baldness in the country. Young men in India are facing chronic hair loss issues, creating a burgeoning market for alopecia drugs. For instance, the Indian Journal of Dermatology, Venereology, and Leprology found a 58% prevalence of androgenetic alopecia in males aged 30-50 years in the country.

The market may face challenges from herbal treatments that are popular in the country but businesses can invest in ad campaigns via social media or awareness campaigns to increase awareness of various types of alopecia and their therapeutics to increase adoption. Businesses are identifying the potential of the alopecia drugs market in India and expanding to the domestic market. For instance, in October 2024, Triple Hair Group entered into a licensing agreement with Akums Drugs and Pharmaceuticals Ltd., for the licensing of the Therapy-07 prescription drug in India.

China is poised to increase its revenue share in the alopecia drugs market of APAC. The growth in China is owed to rising awareness of alopecia boosting demands for alopecia treatment drugs. Advancements in formulations for alopecia treatment are poised to benefit the growth of the sector in China. For instance, in July 2023, Kintor Pharmaceuticals Ltd. announced the phase 2 clinical trial of Pyrilutamide for the treatment of male androgenetic alopecia in China and the United States. Additionally, the popularity of e-commerce platforms in the country has created a burgeoning market for alopecia treatment products that businesses can further leverage.

Key Alopecia Drugs Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eli Lilly

- Dr. Reddy’s Laboratories

- Janssen Global Services Inc.

- Sun Pharmaceuticals Industries Ltd.

- Revian Inc.

- Lutronic

- Freedom Laser Therapy

- Apira Science Inc.

- Theradome

- Glaxo Smith Kline

- EVA Pharma

The global alopecia drugs market is poised for a profitable growth curve during the forecast period. Key players in the sector are investing to improve drug formulations for alopecia treatment and in clinical trials to improve safety and efficacy. Rising partnerships between global and local players are opening access to emerging markets for alopecia drugs.

Here are some key players in the market:

Recent Developments

- In September 2024, Eli Lilly and EVA Pharma announced an agreement to expand access to baricitinib to an estimated 20 thousand people in 49 low-to-middle-income countries in Africa by 2030. Baricitinib will be used for the treatment of alopecia areata and the collaboration is a part of Eli Lilly’s initiative to provide quality healthcare in resource-limited settings.

- Report ID: 6729

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Alopecia Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.