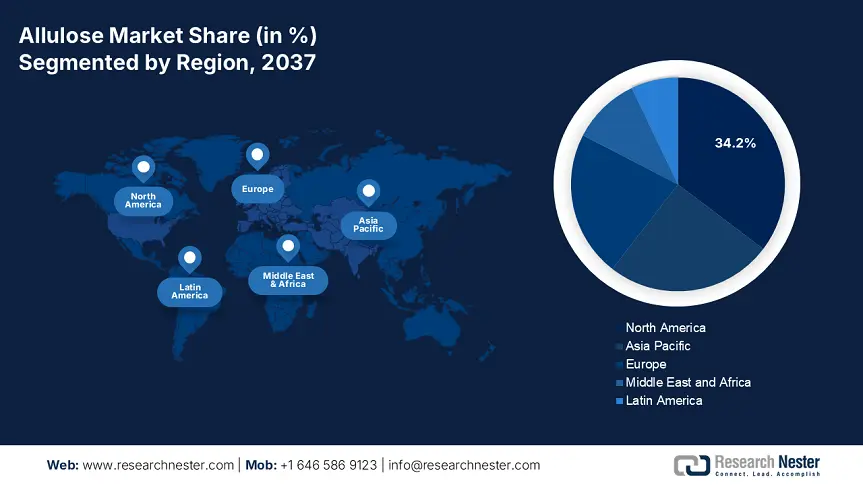

Allulose Market - Regional Analysis

North America Market Insights

By 2037, the North American market is expected to hold 34.2% of the market share due to end-user requirements for low-calorie sweeteners, as well as the FDA’s GRAS status approval. The region’s market forecast is expected to exceed USD 221 million by 2037, which represents a CAGR of 8.2% from 2025 to 2037. Innovation in natural sweetener applications has increased as a result of increased funding for R&D and regulatory support. Top manufacturers of allulose, like Tate & Lyle and Ingredion, have also expanded production plants in North America.

The U.S. is projected to dominate North America’s allulose market with a greater than 76% share by 2037. The U.S. Food and Drug Administration (FDA) ruling removing allulose from "added sugars" labelling has also prompted the food and beverage (F&B) industry to more broadly adopt allulose. The U.S. market of approximately USD 96 million in 2024 is expected to reach USD 181 million in 2037, growing at a CAGR of 7.8%. Consumer trends in the country for keto, diabetic-friendly, and plant-based foods and beverages continue to support the market.

In Canada, the allulose market is still growing, valued at an estimated USD 21 million in 2024, with a forecasted CAGR of 9.5% from 2025 to 2037, which will approach USD 59 million by 2037. Market demand for allulose is trending upward, primarily due to increasing rates of obesity, among other diabetes-related issues. Canadian manufacturers in the F&B space are investing significant resources into new sugar reduction technologies as their national health authorities and scientists identify sugar reduction targets for the population.

Asia Pacific Market Insights

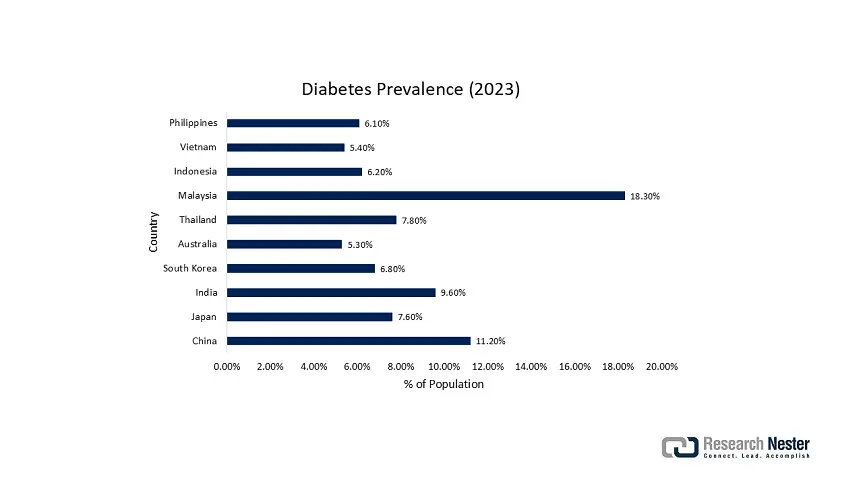

The Asia Pacific market is expected to hold 25.2% of the market share, and is projected to grow at a CAGR of 9.7% from 2025 to 2037. Changes in consumer preferences with regard to health, regulatory acceptance, and increasing populations with diabetes will increase demand for allulose in the region. The market size in Asia Pacific is expected to go from USD 62.2 million in 2025 to reach USD 162.5 million by 2037. Key local entities are increasing partnerships and investments in manufacturing capacity to meet the demand in the region. The below graph represents the prevalence of diabetes in the region in 2023.

China's market for allulose is growing rapidly due to a strong consumer preference for sugar alternatives and a very large population suffering from diabetes (129mn in 2024). There is government support promoting the consumption of functional foods under the "Healthy China 2030" program, which assists the projected growth to reach USD 56.9 million in 2037 at a CAGR of 10.3% for the allulose market. There was previously little domestic production of allulose, but with support and interest, and investments from manufacturers, there are gradual increases in the local production of allulose. The Chinese government has recently approved allulose as a novel food ingredient.

India is also experiencing an upward trend in demand for low-calorie sweeteners among consumers who are increasingly urban and health aware. The allulose market is forecast to grow at a CAGR of 11.4% from 2025 to 2037 and is expected to grow from USD 9.2 million in 2025 to USD 26.8 million by 2037. Government regulations in support of both the Food Safety and Standards Authority of India (FSSAI) and investments in Research and Development (R&D) have been major contributors to growth in the market, especially demand in the food & beverage and pharmaceutical sectors.

Allulose Market Insights in APAC (2023-2024)

|

Country |

Diabetes Prevalence (% of Population) |

Consumer Awareness of Sugar-Related Health Risks (High/Medium/Low) |

Key Government Initiatives Promoting Healthier Lifestyles |

|

China |

11.2% (2023) |

High |

"Healthy China 2030" campaign; sugar reduction guidelines for packaged foods |

|

Japan |

7.6% (2023) |

Very High |

Tax incentives for low-sugar product innovation; FOSHU (Functional Food) certifications |

|

India |

9.6% (2023) |

Medium (urban), Low (rural) |

FSSAI’s "Eat Right India" movement; proposed sugar taxes |

|

South Korea |

6.8% (2023) |

Very High |

Mandatory "high-sugar" warning labels; subsidies for diabetic-friendly foods |

|

Australia |

5.3% (2023) |

High |

Health Star Rating system; restrictions on junk food ads to children |

|

Thailand |

7.8% (2023) |

Medium |

Sugar tax on beverages since 2017; public education on diabetes prevention |

|

Malaysia |

18.3% (highest in APAC) |

Medium |

"Malaysia Healthier Options" program; sugar tax on sweetened drinks |

|

Indonesia |

6.2% (2023) |

Low (rising in urban areas) |

Pilot programs for sugar-free school meals; public health campaigns |

|

Vietnam |

5.4% (2023) |

Low |

Proposed sugar tax (2025); partnerships with NGOs for diabetes education |

|

Philippines |

6.1% (2023) |

Medium |

"Pinggang Pinoy" dietary guidelines; stricter food labeling proposals |

Europe Market Insights

The European market is expected to hold 22.1% of the market share due to ramped-up demand for low-calorie sweeteners within functional food and beverages. The market is expected to be worth over USD 130 million by 2037, growing at a CAGR of 7.8% (2025 - 2037). There is an enabling environment for allulose and similar sweeteners, as regulatory guidance regarding reducing sugar consumption (such as the EU Sugar Reduction Strategy) and an increasing consumer preference for clean-label, natural products are causing allulose consumption to rise. There is evidence that innovation and product launches, where companies are incorporating rare sugars like allulose into energy bars, beverages, and baked goods, are increasing.

Allulose Market Insights in Europe (2024)

|

Country |

Health Consciousness Index (1-10) |

Search Interest for Sugar Alternatives (High/Medium/Low) |

Key Trends Driving Allulose Demand |

|

Germany |

8.5 |

High |

Strong demand for clean-label, diabetic-friendly products; strict sugar reduction policies |

|

France |

8.2 |

High |

Rising keto/low-carb diets; government anti-obesity campaigns |

|

UK |

8.0 |

Very High |

Sugar tax (Soft Drinks Industry Levy) pushing reformulation with alternatives like allulose |

|

Italy |

7.6 |

Medium |

Growing interest in "natural" sweeteners; Mediterranean diet adaptations |

|

Spain |

7.4 |

Medium |

Increasing diabetes awareness; demand for reduced-sugar bakery/confectionery |

|

Netherlands |

8.1 |

High |

Innovation hub for sugar-free products; high consumer literacy on metabolic health |

|

Sweden |

8.3 |

High |

"Less Sugar" national initiative; popularity of low-glycemic diets |

|

Poland |

6.8 |

Low (but rising) |

Emerging health trends in urban areas; EU-driven food labeling changes |

|

Belgium |

7.5 |

Medium |

Corporate shifts toward sugar-free snacks; retail demand for "better-for-you" options |

|

Switzerland |

8.4 |

High |

Premium health-food market; strict regulations on added sugars |