Allogeneic Cell Therapy Devices Market Outlook:

Allogeneic Cell Therapy Devices Market size was over USD 494.62 million in 2025 and is projected to reach USD 4.91 billion by 2035, growing at around 25.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of allogeneic cell therapy devices is evaluated at USD 609.47 million.

The allogeneic cell therapy devices market is gaining momentum within the medical field, particularly in the treatment of cancer, autoimmune diseases, and degenerative conditions. In addition, advancements in regenerative medicine, the funding of more clinical trials, and an increased prevalence of chronic diseases require novel therapeutic approaches. For instance, in March 2023, TCR Therapeutics Inc. and Adaptimmune Therapeutics plc announced the signing of a final agreement that will see Adaptimmune merge with TCR² in an all-stock transaction to form a leading cell therapy business specializing in solid tumor treatment.

In addition, collaborations by the biotech companies with other research organizations will enhance innovation about cell sourcing and processing as well as delivery mechanisms further fueling demand for these products. With these advancements and growing awareness of the therapeutic potential of allogeneic cell-based interventions, the market for an allogeneic cell therapy device is expected to grow in the future. For instance, in June 2023, Lonza and Vertex Pharmaceuticals Incorporated announced a joint venture to support the production of Vertex's line of experimental stem cell treatments. In particular, the VX-880 and VX-264 programs that are presently undergoing clinical trials are intended to help people with Type 1 Diabetes (T1D).

Moreover, advancements in regulations and the establishment of good manufacturing facilities and practices for these treatments place them into the safety and quality standards are contributing to this market growth. For instance, in December 2024, BioCentriq signed a long-term lease with National Business Parks for a cutting-edge cell therapy manufacturing facility. It will feature a USD 12 million capital investment in equipment, business system enhancements, and facility upgrades. It will solidify BioCentriq's position in the quickly expanding cell therapy industry and bolster its capacity to offer comprehensive development, manufacturing, and quality control service solutions.

Key Allogeneic Cell Therapy Devices Market Insights Summary:

Regional Highlights:

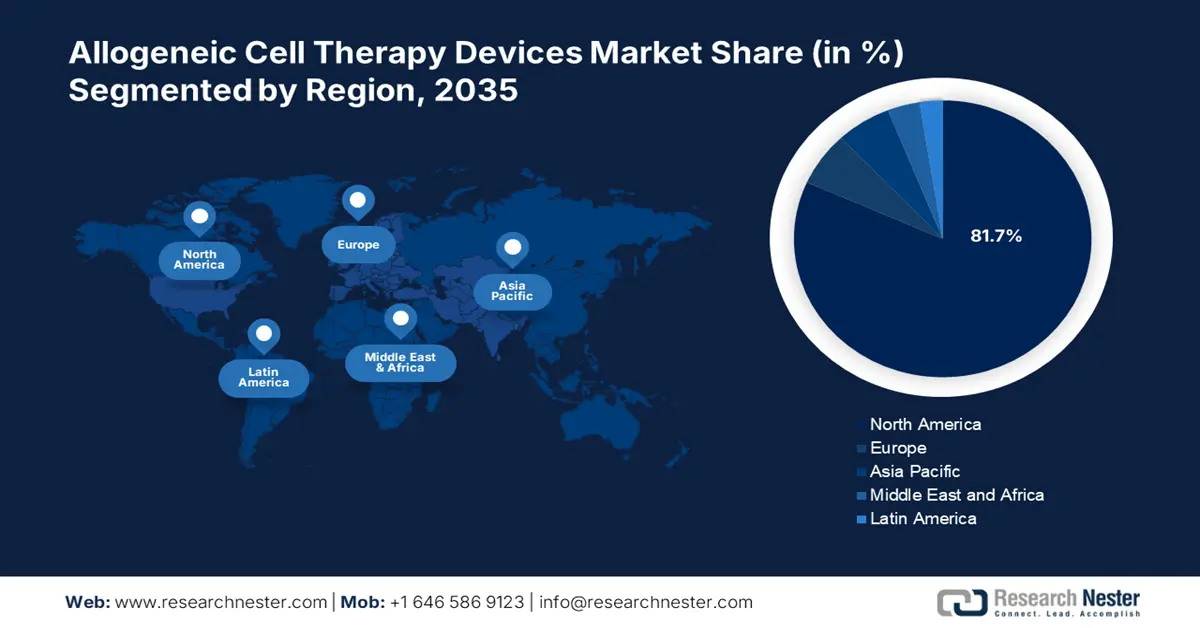

- North America allogeneic cell therapy devices market will account forn 81.70% share by 2035, driven by the presence of major pharmaceutical players and innovations in cell therapies.

- Asia Pacific market will register lucrative growth during the forecast period 2026-2035, attributed to the increasing development of personalized medicine and cell therapies in the region.

Segment Insights:

- The stem-cell therapies segment in the allogeneic cell therapy devices market is projected to secure a 51.20% share by 2035, driven by advancements in manufacturing and processing technology improving scalability.

Key Growth Trends:

- Streamlined approval process

- Investments and research consortia

Major Challenges:

- Competitive landscape

Key Players: Atara Biotherapeutics, Mallinckrodt Pharmaceuticals, STEMPEUTICS RESEARCH PVT LTD, Biosolution Co., Ltd., MEDIPOST Co., Ltd., and more.

Global Allogeneic Cell Therapy Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 494.62 million

- 2026 Market Size: USD 609.47 million

- Projected Market Size: USD 4.91 billion by 2035

- Growth Forecasts: 25.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (81.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Allogeneic Cell Therapy Devices Market Growth Drivers and Challenges:

Growth Drivers

- Streamlined approval process: It is improving the pathway for innovative therapies to reach the clinical setting. The regulatory agencies, including the U.S. FDA open doors to faster review of products demonstrating significant clinical potential in allogeneic products. These streamlined mechanisms reduce the time-to-market of the advanced therapies while lowering associated developmental costs. The table below presents the:

Approved Cellular and Gene Therapy Products

|

Approved Products & Trade Name |

Manufacturer |

Year |

|

ABECMA (idecabtagene vicleucel) |

Celgene Corporation, a Bristol-Myers Squibb Company |

2024 |

|

ADSTILADRIN (nadofaragene firadenovecvcng) |

Ferring Pharmaceuticals A/S |

2024 |

|

ALLOCORD (HPC, Cord Blood) |

SSM Cardinal Glennon Children's Medical Center |

2019 |

|

AMTAGVI (lifileucel) |

Iovance Biotherapeutics, Inc. |

2024 |

|

BEQVEZ (fidanacogene elaparvovec-dzkt) |

Pfizer, Inc. |

2024 |

|

BREYANZI (lisocabtagene maraleucel) |

Juno Therapeutics, Inc., a Bristol-Myers Squibb Company |

2024 |

|

CARVYKTI (ciltacabtagene autoleucel) |

Janssen Biotech, Inc. |

2024 |

|

CASGEVY (exagamglogene autotemcel [exacel]) |

Vertex Pharmaceuticals Incorporated |

|

|

Ducord, HPC Cord Blood |

Duke University School of Medicine |

|

|

ELEVIDYS (delandistrogene moxeparvovec-rokl) |

Sarapeta Therapeutics, Inc. |

|

Source: U.S. Food & Drug Administration

- Investments and research consortia: This is significantly enhancing the capacity for innovation and development. Further, research consortia also promote interdisciplinarity in the collaboration among academia, industry players, and healthcare institutions by sharing knowledge, resources, and expertise. For instance, in December 2024, to expedite the clinical development of its differentiated allogeneic Natural Killer (NK) cell therapy, Indapta Therapeutics, Inc., announced that it has closed a USD 22.5 million round of new financing. Thus, the added impetus of increased investment and research collaboration shifts the allogeneic cell therapy devices market toward better patient outcomes.

Challenges

- Immune rejection and graft-versus-host disease: A challenge that continues to impact patient outcomes and effectiveness in the allogeneic cell therapy devices market is the graft-versus-host disease. The incidence of these immune-mediated reactions calls for careful matching of donors and recipients as well as detailed pre-treatment protocols to reduce risks. Furthermore, these challenges will also impact clinician confidence and patient acceptance, thus impacting market penetration as well as the wider adoption of allogeneic therapies. To ensure sustainable growth in allogeneic cell therapy devices, overcome these immunological barriers, and bring improvement in clinical outcomes.

- Competitive landscape: In the allogeneic cell therapy devices market an overwhelming challenge is rising competition since the field is so dynamic, with a large number of players competing for market share and clinical acceptance. This explosion of allogeneic and autologous therapies fosters stiff competition among companies that can lead to price-cutting and shrink profit margins limiting the potential of profitable innovative programs. A saturated market environment is likely to create difficulties in differentiating the value proposition to seek regulatory approval and clinical validation, as companies have to face strong competition in their path. Thus, strategic positioning and strong partnerships become the necessity to drive these competitive dynamics successfully

Allogeneic Cell Therapy Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

25.8% |

|

Base Year Market Size (2025) |

USD 494.62 million |

|

Forecast Year Market Size (2035) |

USD 4.91 billion |

|

Regional Scope |

|

Allogeneic Cell Therapy Devices Market Segmentation:

Therapy

Based on the therapy, allogeneic cell therapy devices market, stem-cell therapies segment is set to capture revenue share of over 51.2% by 2035. The use of stem cell therapy offers flexibility in treatment protocols, thereby improving patient outcomes and increasing clinical utility. Advancements in manufacturing and processing technology have made further streamlining stem cell therapies easier, making the practices scalable and consistent while alleviating safety concerns. For instance, in December 2024, The U.S. FDA approved Ryoncil, an allogeneic (donor) mesenchymal stromal cell (MSC) therapy. It is designed to treat children two months of age and older who have steroid-refractory acute graft-versus-host disease (SR-aGVHD). Ryoncil is the first MSC treatment approved by the FDA.

Therapeutic Areas

Based on therapeutic areas, the hematological disorders segment in the allogeneic cell therapy devices market is likely to unfold remarkable growth opportunities by 2035. It is mainly because these conditions, including leukemia, lymphoma, and several anemias, are highly prevalent and require innovative treatments. Allogeneic hematopoietic stem cell transplantation (HSCT) has now become a mainstream treatment that promises a cure for these malignancies by replacing diseased blood cells with healthy donor cells using effective devices. For instance, in October 2024, Agappe unveiled the Mispa i200 series, an AE-powered Immunology CLIA analyzer, and its first-of-its-kind in-house manufactured HX series hematology equipment. This device was intended to improve the speed and accuracy of blood tests.

Our in-depth analysis of the global allogeneic cell therapy devices market includes the following segments:

|

Therapy |

|

|

Therapeutic Areas |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Allogeneic Cell Therapy Devices Market Regional Analysis:

North America Market Insights

By 2035, North America allogeneic cell therapy devices market is set to capture over 81.7% revenue share. The strong presence of major pharmaceutical players are enabling precise genetic modifications in the donor cells to improve their therapeutic properties and lower the risk of immune rejection. Furthermore, recent developments in gene editing technologies, such as CRISPR/Cas9, have created new opportunities for allogeneic cell therapies.

The factors propelling the U.S. allogeneic cell therapy devices market for its profitable growth are innovations in drug development and furthering nvel treatments using cell therapy to combat chronic diseases. For instance, in August 2022, Global Blood Therapeutics, Inc. and Pfizer Inc. announced that they reached a final agreement for Pfizer to purchase GBT. This acquisition led to the discovery, development, and distribution of life-altering treatments that give underprivileged patient communities hope, beginning with sickle cell disease (SCD).

The Allogeneic cell therapy devices market in Canada is witnessing significant growth due to investments and effortless regulatory ecosystem. For instance, in July 2024, The Canada government is making investments in a strong, resilient, and dynamic life sciences ecosystem that can handle present and upcoming medical crises. To guarantee that Canadians have access to the newest medical technologies, more than USD 2.2 billion has been invested since March 2020 to bolster our nation's domestic biomanufacturing and life sciences capabilities.

Asia Pacific Market Insights

The Allogeneic cell therapy devices market in Asia Pacific is gaining traction and is expected to witness lucrative growth during the forecast timeline i.e. 2026-2035. Clinical studies have increased as a result of the growth of personalized medicine. Furthermore, customized treatments that target each patient's distinct genetic composition are possible with cellular therapies, particularly those involving genetically modified cells. This individualized analysis changes the way healthcare is provided by increasing treatment efficacy and reducing side effects.

The allogeneic cell therapy devices market in India is expanding as a result of the regulations receiving more attention as a result of the growing accessibility of sophisticated cell engineering technologies and instruments. For instance, in July 2024, Bioserve India is announced the launch of its state-of-the-art stem cell products in India. The Indian market will benefit from advancements in therapeutic discovery and regenerative medicine, as well as from new developments in scientific research and drug development, attributed to these new REPROCELL products.

The Allogeneic cell therapy devices market in China is gaining noteworthy traction owing to the strategic collaborations between companies to push expertise and leverage proficiency. For instance, in January 2025, Terumo Blood and Cell Technologies and the Shandong Institute of Medical Devices and Pharmaceutical Packaging Inspection signed a MoU on a strategic partnership. The partnership aims to establish a comprehensive platform that integrates production, academia, research, and application to enhance communication and collaboration within the medical device industry.

Allogeneic Cell Therapy Devices Market Players:

- Tego Science Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SSM Cardinal Glennon Children's Medical Center

- Cleveland Cord Blood Center

- Duke University School of Medicine

- New York Blood Center

- Clinimmune Labs, University of Colorado Cord Blood Bank

- MD Anderson Cord Blood Bank

- LifeSouth Community Blood Centers, Inc.

- Bloodworks Northwest

- Atara Biotherapeutics

- Mallinckrodt Pharmaceuticals

- STEMPEUTICS RESEARCH PVT LTD

- Biosolution Co., Ltd.

- MEDIPOST Co., Ltd.

Leading businesses in the allogeneic cell therapy devices market are now putting in more effort to create and launch novel cell therapies for a range of cell therapy indications. Companies with strong pipelines and resources are competing for product approvals to gain a first-mover advantage in specific applications. Moreover, they are also forming alliances and licensing agreements to preserve their place in the very competitive market. For instance, in May 2023, Johnson & Johnson and Cellular Biomedicine Group inked a worldwide partnership and licensing deal in May 2023 to develop next-generation CAR-T treatments.

Here's the list of some key players in allogeneic cell therapy devices market:

Recent Developments

- In February 2024, Atara Biotherapeutics, Inc., developed revolutionary treatments for autoimmune diseases and cancer patients by utilizing its novel allogeneic Epstein-Barr virus (EBV) T-cell platform.

- In November 2023, BioCardia, Inc. announced that the FDA approved the CardiAMP autologous cell therapy Phase III clinical trial for the treatment of patients with ischemic heart failure.

- In October 2023, Nkarta, Inc. reported that the FDA had approved an IND application to study NKX019, its allogeneic, CD19-directed CAR NK cell therapy candidate, to treat lupus nephritis.

- Report ID: 7161

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.