Allergic Rhinitis Market Outlook:

Allergic Rhinitis Market size was over USD 13.08 billion in 2025 and is anticipated to cross USD 18.81 billion by 2035, witnessing more than 3.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of allergic rhinitis is estimated at USD 13.52 billion.

The allergic rhinitis industry is fostering significantly owing to the rising global incidences of allergic conditions. For instance, in April 2020, it was published in The LANCET Global Health that the cases of allergic rhinitis among children aged between 6-7 years were 11.3% and 24.4% in children aged between 13-14 years. In addition, there are rising environmental pollution, climate change, and increasing incidences of urbanization factors that raise the exposure levels to allergen agents and, therefore, to allergic rhinitis cases.

Increasing awareness of symptoms and treatment options has led to more individuals seeking to be diagnosed and treated. New pharmaceutical formulations such as novel antihistamines, intranasal corticosteroids, and biologic therapies that provide potentially better and safer profiles are responsible for fueling the market. For instance, in October 2024, GSK plc reported positive results from the phase III clinical trials ANCHOR-1 and ANCHOR-2. In this trial, depemokimab showed efficacy as well as safety in comparison to placebo in adults with CRSwNP. Furthermore, improved medical care accessibility in developing economies is also contributing to further expansion in the market.

Key Allergic Rhinitis Market Insights Summary:

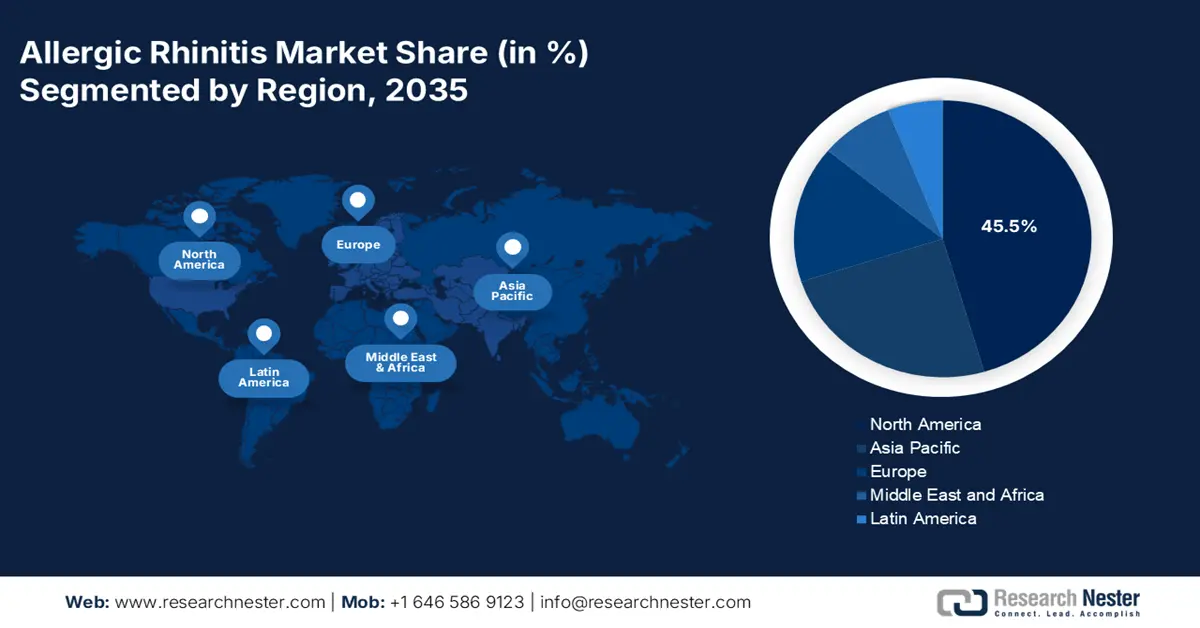

Regional Highlights:

- North America’s 45.5% share in the allergic rhinitis market is driven by increased indoor living, sustaining growth through 2026–2035.

Segment Insights:

- The Nasal & Others segment is anticipated to hold over 55.3% market share by 2035, propelled by fast symptom relief, patient preference, and low cost of nasal delivery.

Key Growth Trends:

- Advancements in treatment options

- Rising healthcare investments

Major Challenges:

- Variability in environmental allergens

- Regulatory obstacles

- Key Players: Bayer AG, Sanofi, Merck & Co., Novartis AG, AstraZeneca, Johnson & Johnson Services.

Global Allergic Rhinitis Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.08 billion

- 2026 Market Size: USD 13.52 billion

- Projected Market Size: USD 18.81 billion by 2035

- Growth Forecasts: 3.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, Japan, India, South Korea, Singapore

Last updated on : 14 August, 2025

Allergic Rhinitis Market Growth Drivers and Challenges:

Growth Drivers

- Advancements in treatment options: Innovative treatment options have been the greatest catalyst for growth in allergic rhinitis, as developing pharmaceutical therapies can better ensure efficacy, safety, and compliance. For instance, in February 2021, it was published that Tezspire (Tezepelumab), developed by Amgen and AstraZeneca is the first biologic to significantly reduce exacerbations in a broad population of patients with severe, uncontrolled asthma. The availability of newer, much safer antihistamines and intranasal corticosteroids has maximally expanded the treatment options and increased the levels of patient satisfaction and compliance.

- Rising healthcare investments: The growth of allergic rhinitis market is mainly driven by increased access to medical care and greater investment in more advanced treatments. For instance, in January 2021, Neurent Medical announced the closing of a USD 25 million Series B financing in innovative solutions for treating chronic inflammatory sino-nasal disease. The proceeds of the financing were utilized to support the expansion of the company's clinical and commercial operations. It has led to a higher rate of diagnosis and treatment of allergic rhinitis. Thus, fueling up the demand for a line of treatments ranging from over-the-counter antihistamines to biologics.

Challenges

- Variability in environmental allergens: The concern over significant variability in environmental allergens makes allergic rhinitis a challenging market. It is due to the constant fluctuation of the levels of pollen, dust mites, and mold that creates inconsistent symptom control and treatment efficacy. Such variability creates confusion for healthcare providers regarding uniform management as patients have varied triggers, dependent on regional exposure and seasonal and climatic factors. Therefore, the patients will need to be managed through a plan tailored to each patient, which becomes complicated and affects the therapy currently in place. This, in turn, limits the growth of the allergic rhinitis market as a whole.

- Regulatory obstacles: The most significant hindrance to market growth for allergic rhinitis is the regulatory framework and rules. The protracted and technical process of drug development for new drugs delays the appearance of new treatments. These regulatory requirements are particularly lengthy when it comes to clinical trials, safety and efficacy assessments, and product approvals concerning new drugs such as biologics and advanced immunotherapies. This makes the potential drugs inaccessible to patients more often than otherwise but adds cost and risks to pharmaceutical companies, thus slowing the speed of innovation and market expansion.

Allergic Rhinitis Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.7% |

|

Base Year Market Size (2025) |

USD 13.08 billion |

|

Forecast Year Market Size (2035) |

USD 18.81 billion |

|

Regional Scope |

|

Allergic Rhinitis Market Segmentation:

Route of Administration (Nasal & Others, Oral)

By 2035, nasal & others segment is expected to dominate over 55.3% allergic rhinitis market share. The growth is fostered by direct, local drug delivery, thus imparting a fast onset of action and greater efficacy in symptom control. For instance, in September 2022, Hikma Pharmaceuticals PLC and Glenmark Pharmaceuticals Ltd. collaboratively produced a nasal spray, Ryaltris. This is approved by the FDA and is effective for children aged between 12 years and over and acts within 15 minutes of the nasal problems. Ease of use, convenience, and relatively low-cost add to the dominance of the nasal route. Moreover, patient preference for self-administration through nasal sprays further propels higher adoption in the market.

Type (Seasonal Allergic Rhinitis, Perennial Allergic Rhinitis, Occupational Allergic Rhinitis)

The seasonal allergic rhinitis segment gains a significant proportion of the allergic rhinitis market due to the immense prevalence of pollen-related allergies, mostly during certain seasons, including spring and fall. Being seasonal, the disease causes episodic attacks resulting in a relatively frequent visit by the patients to their treating physicians, therefore supporting continuous demand in the market. For instance, in February 2024, Novartis announced that the US FDA has approved Xolair (omalizumab) for reducing allergic reactions, including anaphylaxis with IgE-mediated food allergy. Over-the-counter and prescription drugs differentiated strictly based on seasonal symptoms enhance the dominance of the segment.

Our in-depth analysis of the allergic rhinitis market includes the following segments:

|

Route of Administration |

|

|

Treatment |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Allergic Rhinitis Market Regional Analysis:

North America Market Statistics

North America industry is expected to dominate majority revenue share of 45.5% by 2035,The growth is stimulated owing to the increased indoor living and exposure to dust mites, pet dander, and other allergens. In addition, the in-built air conditioning systems with heating systems stimulate the circulation of allergens resulting in increased prevalence.

Canada allergic rhinitis market is anticipated to register considerable growth during the forecast period. The major characteristic of the Canada landscape for the allergic rhinitis market is the emerging demand for effective treatments as air pollution surges and climate change advances, coupled with a heightened awareness of environmental allergens more than ever. For instance, in August 2024, it was published that up to 20% of the general population in Canada is estimated to have a diagnosis of allergic rhinitis due to rising air pollution and changing environmental conditions.

The U.S. landscape is transforming through a shift towards even more personalized and convenient treatment options, such as SLIT and improved nasal sprays, further fueling the growth in the sector. In addition, the regulatory structure boosts the development of treatment options for allergic rhinitis. For instance, in March 2023, the U.S. FDA approved the ZAVZPRET, a nasal spray developed by Pfizer. This spray is the first and only calcitonin gene-related peptide (CGRP) receptor antagonist nasal spray for the acute treatment of migraine with or without aura in adults.

Asia Pacific Market Analysis

Asia Pacific is the most rapidly growing region in the allergic rhinitis market, driven by the increasing pollutants in the air such as particulate matter and vehicular emissions. It fuels the cases of allergic rhinitis amongst the population thus increasing the need for timely diagnosis. In addition, the majority of the population in this region is inclusive middle-class which seeks affordable treatment options for allergic rhinitis.

The primary growth driver for the allergic rhinitis market in India is fueled by the all-around increasing urbanization, gradual aggravation of air pollution, and lifestyle changes that trigger a higher incidence of allergic conditions. For instance, in October 2024, it was published in the Economic Times that Bengaluru, with rapid urbanization and huge high-rise construction, has faced an all-year-long pollination allergy that has posed a health threat to its citizens. Environmental reduction in air quality and sudden climate changes have been separately aggravating this issue present at this point.

The allergic rhinitis market in China is evolving at a steady pace attributable to rising activities toward research into the root cause of allergic rhinitis and its treatments. For instance, in October 2024, it was published that researchers in China found that a change in the morphology of an immune receptor plays a significant role in allergic reactions. Such a discovery may bring new, useful insight into the development of allergy medicines. Moreover, the market is witnessing both expansion in treatment options and increasing demand for customized therapies with greater efficacy and fewer side effects.

Key Allergic Rhinitis Market Players:

- Bayer AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GlaxoSmithKline plc

- Sanofi

- Glenmark Pharmaceuticals Limited

- AstraZeneca

- Merck & Co.,

- Novartis AG

- Meda Pharmaceuticals

The allergic rhinitis market is driven by a competitive landscape curated by the presence of well-established and emerging key players. The major participants in the market are diversifying their portfolios and focusing on innovating biological therapies for treating allergic rhinitis. In addition, the trend of treatments using advanced technologies and growing emphasis on personalized healthcare solutions is fueling the allergic rhinitis market expansion.

Here’s the list of some key players:

Recent Developments

- In November 2024, ARS Pharmaceuticals, Inc. announced a licensing agreement with ALK-Abelló A/S. In this agreement, ALK has gained the exclusive rights to commercialize neffy (epinephrine nasal spray), EURneffy in Europe as the first and only needle-free emergency treatment for Type I allergic reactions including anaphylaxis.

- In March 2024, Entod Pharmaceuticals announced the launch of a state-of-the-art novel probiotic, Lactoshield RH. This treatment is effective for treating nasal allergies and managing other allergies rhinitis.

- Report ID: 6711

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Allergic Rhinitis Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.